Securities Registration: Employee Benefit Plan (s-8)

December 23 2020 - 4:04PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on December 23, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Caesarstone Ltd.

(Exact name of registrant as specified in its charter)

|

Israel

|

|

Not Applicable

|

|

(State or Other Jurisdiction of

|

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Identification Number)

|

Kibbutz Sdot Yam

MP Menashe

Israel 3780400

(Address of Principal Executive Offices) (Zip Code)

Caesarstone Ltd. 2020 Share Incentive Plan

(Full Title of the Plan)

Caesarstone USA Inc.

1401 W Morehead St, Charlotte,

NC 28208, United States

Charlotte, NC 28208

(Name and Address of Agent for Service)

(818) 779-0999

(Telephone Number, Including Area Code, of Agent for Service)

|

Colin J. Diamond, Esq.

White & Case LLP

1155 Avenue of the Americas

New York, NY 10036

Tel: (212) 819-8200

Fax: (212) 354-8113

|

Ron Mosberg, Adv.

General Counsel and Corporate Secretary

Caesarstone Ltd.

Kibbutz Sdot-Yam

MP Menashe, 37804 Israel

Tel: +972 (4) 610-9239

Fax: +972 (4) 636-4400

|

Shachar Hadar, Adv.

Meitar | Law Offices

16 Abba Hillel Silver Rd.

Ramat Gan 52506, Israel

Tel: (+972) (3) 610-3100

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the

definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act of 1934.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☒

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be Registered

|

|

Amount to be

Registered (1) (2)

|

|

|

Proposed Maximum Offering Price per Share

|

|

|

Proposed Maximum Aggregate Offering Price

|

|

|

Amount of Registration Fee

|

|

|

Ordinary shares, par value New Israeli Shekel (“NIS”) 0.04 per share (“Ordinary Shares”)

|

|

|

3,500,000

|

|

|

$

|

10.67

|

(3)

|

|

$

|

37,345,000

|

(3)

|

|

$

|

4,074

|

|

|

(1)

|

This registration statement on Form S-8 (the “Registration Statement”) registers the offer, issuance and sale of 3,500,000 Ordinary Shares of the

Company pursuant to equity awards that may be granted under the Caesarstone Ltd. 2020 Share Incentive Plan (the “2020 Plan”). The 3,500,000 Ordinary Shares consist of: (i) 2,500,000 Ordinary Shares,

not previously registered, reserved for issuance under the 2020 Plan and (ii) an additional number of shares (up to 1,000,000 Ordinary Shares), which includes (A) Ordinary Shares that remained available for issuance under the Caesarstone

Ltd. 2011 Incentive Compensation Plan (the “2011 Plan”) as of the date the Company’s shareholders approved the 2020 Plan at the Company’s 2020 annual general meeting of shareholders and (B) Ordinary

Shares underlying outstanding awards granted pursuant to the 2011 Plan if expired, cancelled, terminated, forfeited or settled in cash in lieu of issuance of shares.

|

|

(2)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall also cover any

additional Ordinary Shares of Caesarstone Ltd. (the “Registrant”) that become issuable under the 2020 Plan by reason of any stock dividend, stock split, recapitalization, or any other similar

transaction without receipt of consideration which results in an increase in the number of outstanding Ordinary Shares.

|

|

(3)

|

Calculated in accordance with Rules 457(h)(1) and 457(c) promulgated under the Securities Act, based on the average of the high and low prices of the Registrant’s Ordinary Shares on the

Nasdaq Global Select Market on December 22, 2020.

|

This registration statement on Form S-8 (this “Registration Statement”) is being filed with the Securities and Exchange Commission (the

“Commission”) to register 3,500,000 Ordinary Shares, par value NIS 0.04 per share (“Ordinary Shares”) of Caesarstone Ltd. (the “Company,”

the “Registrant,” “we” or “us”) issuable by the Registrant to its and/or its subsidiaries’ officers, employees, directors and

consultants, pursuant to the Caesarstone Ltd. 2020 Share Incentive Plan (the “2020 Plan”), which was approved by shareholders on November 10, 2020 (the “Effective Date”).

The Ordinary Shares registered hereby are the maximum number of shares issuable pursuant to the 2020 Plan, consisting of (i) 2,500,000 Ordinary Shares reserved for issuance

thereunder and (ii) up to 1,000,000 Ordinary Shares, including Ordinary Shares that remained available for issuance under the Caesarstone Ltd. 2011 Incentive Compensation Plan (the “2011 Plan”) as of the Effective Date and Ordinary Shares underlying outstanding awards granted pursuant to the 2011 Plan if expired, cancelled, terminated, forfeited or settled in cash in lieu of issuance of

Ordinary Shares, which will be available for grant of awards pursuant to the 2020 Plan (the “Carryover Shares”). The Carryover Shares were previously registered on the Company’s registration statements on

Form S-8 filed with the Commission on March 23, 2012 and March 29, 2016 (File Nos. 333-180313 and 333-210444).

PART I

INFORMATION REQUIRED IN

THE SECTION 10(A) PROSPECTUS

Item 1. Plan Information. *

Item 2. Registrant Information and Employee Plan Annual Information. *

|

*

|

The documents containing the information specified in this Part I of Form S-8 (Plan Information and Registration Information and Employee Plan Annual Information) will be sent or given to

employees as specified by the Commission pursuant to Rule 428(b)(1) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Such documents are not required to be and are not

filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 promulgated under the Securities Act. These documents and the documents incorporated by reference in

this Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. The Registrant will provide a written statement to participants

advising them of the availability without charge, upon written or oral request, of the documents incorporated by reference in Item 3 of Part II hereof and including the statement in the preceding sentence. The written statement to all

participants will indicate the availability without charge, upon written or oral request, of other documents required to be delivered pursuant to Rule 428(b), and will include the address and telephone number to which the request is to be

directed.

|

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

We hereby incorporate by reference herein the following documents (or portions thereof) that we have filed with or furnished to the Commission:

|

(a)

|

Our Annual Report on Form 20-F for the fiscal year ended December 31, 2019, filed with the Commission on March 23, 2020 (the “ Annual Report”);

|

|

|

|

|

(b)

|

|

|

(b)

|

The description of our Ordinary Shares which is contained in Item 1 of our Registration Statement on Form 8-A filed with the Commission on March 20, 2012 (Commission File No. 001-35464), as updated by Exhibit 2.1 to the Annual Report (Description of the Registrant’s Securities) and any other amendment or report filed for the purpose of

updating such description.

|

All other documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) and, to the extent designated therein, Reports of Foreign Private Issuer on Form 6-K furnished by us to the Commission, in each case, subsequent to the effective date of this Registration Statement and prior to the filing of a

post-effective amendment to this Registration Statement indicating that all securities offered under the Registration Statement have been sold, or deregistering all securities then remaining unsold, are also incorporated herein by reference and

shall be a part hereof from the date of the filing or furnishing of such documents.

Any statement contained in a document all or a portion of which is incorporated or deemed incorporated by reference herein shall be deemed to be modified or superseded for

purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any

statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

|

Item 4.

|

Description of Securities.

|

|

Item 5.

|

Interests of Named Experts and Counsel

|

Item 6. Indemnification of Directors and Officers.

Consistent with the provisions of the Israeli Companies Law, 5759–1999 (the “Companies Law”), our articles of association include

provisions permitting us to procure insurance coverage for our office holders (which is defined in the Companies Law as including directors and certain officers), exculpate them from certain liabilities and indemnify them, to the maximum extent

permitted by law. Under the Companies Law, exculpation from liability, indemnification of, and procurement of insurance coverage for, our office holders must be approved by our compensation committee and our board of directors and, in specified

circumstances, by our shareholders.

Insurance

Under the Companies Law and the Securities Law 5738-1968 (the “Securities Law”), an Israeli company may obtain insurance for any of its

office holders against the following liabilities incurred for acts performed by him or her as an office holder if and to the extent provided for in, or permitted under, the company’s articles of association:

|

|

|

a breach of a fiduciary duty to the company, provided that the office holder acted in good faith and had a reasonable basis to believe that the act would not harm the

company;

|

|

|

|

a breach of duty of care to the company or to a third party, to the extent such a breach arises out of the negligent conduct of the office holder;

|

|

|

|

a monetary liability imposed on the office holder in favor of a third party;

|

|

|

|

a monetary liability imposed on the office holder in favor of an injured party at an administrative procedure pursuant to Section 52(54)(a)(1)(a) of the Securities Law;

and

|

|

|

|

expenses incurred by an office holder in connection with an administrative procedure, including reasonable litigation expenses and reasonable attorneys’ fees.

|

An “administrative procedure” is defined as a procedure pursuant to chapters H3 (Monetary Sanction by the Israeli Securities Authority), H4 (Administrative Enforcement

Procedures of the Administrative Enforcement Committee) or I1 (Arrangement to prevent Procedures or Interruption of procedures subject to conditions) to the Securities Law.

Indemnification

Under the Companies Law and the Securities Law, an Israeli company may indemnify an office holder in respect of the following liabilities, payments and expenses incurred for

acts performed by him as an office holder, either in advance of an event or following an event, provided its articles of association include a provision authorizing such indemnification:

|

|

|

a monetary liability incurred by or imposed on him or her in favor of another person pursuant to a judgment, including a settlement or arbitrator’s award approved by a

court. However, if an undertaking to indemnify an office holder with respect to such liability is provided in advance, then such an undertaking must be limited to events which, in the opinion of the board of directors, can be foreseen

based on the company’s activities when the undertaking to indemnify is given, and to an amount or according to criteria determined by the board of directors as reasonable under the circumstances, and such undertaking shall detail the

foreseen events described above and amount or criteria;

|

|

|

|

reasonable litigation expenses, including reasonable attorneys’ fees, incurred by the office holder as a result of an investigation or proceeding instituted against him

or her by an authority authorized to conduct such investigation or proceeding, provided that (i) no indictment was filed against such office holder as a result of such investigation or proceeding; and (ii) no financial liability, was

imposed upon him or her as a substitute for the criminal proceeding as a result of such investigation or proceeding or, if such financial liability was imposed, it was imposed with respect to an offense that does not require proof of

criminal intent or in connection with a monetary sanction;

|

|

|

|

a monetary liability imposed on him or her in favor of an injured party at an Administrative Procedure (as defined below) pursuant to Section 52(54)(a)(1)(a) of the

Securities Law;

|

|

|

|

expenses incurred by an office holder in connection with an Administrative Procedure under the Securities Law, including reasonable litigation expenses and reasonable

attorneys’ fees; and

|

|

|

|

reasonable litigation expenses, including attorneys’ fees, incurred by the office holder or imposed by a court in proceedings instituted against him or her by the

company, on its behalf, or by a third party, or in connection with criminal proceedings in which the office holder was acquitted, or as a result of a conviction for an offense that does not require proof of criminal intent.

|

Under the Companies Law, exculpation, indemnification and insurance of office holders must be approved by the compensation committee and the board of directors and, with

respect to directors or controlling shareholders, their relatives and third parties in which such controlling shareholders have a personal interest, also by the shareholders.

Our articles of association permit us to exculpate, indemnify and insure our office holders to the fullest extent permitted or to be permitted by law. Our office holders are

currently covered by a directors and officers liability insurance policy. We have agreements with each of our current office holders exculpating them from a breach of their duty of care to us to the fullest extent permitted by law, subject to

limited exceptions, and undertaking to indemnify them to the fullest extent permitted by law, subject to limited exceptions, including with respect to liabilities resulting from our IPO to the extent that these liabilities are not covered by

insurance. This indemnification is limited to events determined as foreseeable by the board of directors based on our activities, and to an amount or according to criteria determined by the board of directors as reasonable under the

circumstances. The maximum aggregate amount of indemnification that we may pay to our office holders based on such indemnification agreement is the greater of (1) with respect to indemnification in connection with a public offering of our

securities, the gross proceeds raised by us and any selling shareholder in such public offering, and (2) with respect to all permitted indemnification, including in connection with a public offering of our securities, an amount equal to the

greater of 50% of our shareholders’ equity on a consolidated basis, based on our most recent financial statements made publicly available before the date on which the indemnification payment was made, and $30.0 million. Such indemnification

amounts are in addition to any insurance amounts.

Exculpation

Under the Companies Law, a company may not exculpate an office holder from liability for a breach of the duty of loyalty. An Israeli company may exculpate an office holder in

advance from liability to the company, in whole or in part, for damages caused to the company as a result of a breach of duty of care but only if a provision authorizing such exculpation is included in its articles of association. Our articles of

association include such a provision. The company may not exculpate in advance a director from liability arising out of a prohibited dividend or distribution to shareholders.

Limitations

Under the Companies Law, a company may not indemnify, exculpate or insure an office holder against any of the following:

|

|

|

a breach of fiduciary duty, except for indemnification and insurance for a breach of the fiduciary duty to the company to the extent that the office holder acted in

good faith and had a reasonable basis to believe that the act would not prejudice the company;

|

|

|

|

a breach of duty of care committed intentionally or recklessly, excluding a breach arising out of the negligent conduct of the office holder;

|

|

|

|

an act or omission committed with intent to derive illegal personal benefit; or

|

|

|

|

a fine or forfeit levied against the office holder.

|

|

Item 7.

|

Exemption from Registration Claimed

|

Item 8. Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

The undersigned Registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or

in the aggregate, represent a fundamental change in the information set forth in the Registration Statement Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the

aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this

Registration Statement.

|

Provided, however, that paragraphs

(a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the Registrant

pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(b)

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to

Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing

provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a

court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8, and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in MP Menashe, State of Israel, on this 23rd day of December, 2020.

|

CAESARSTONE LTD.

|

|

|

|

|

|

|

By:

|

/s/ Yuval Dagim

|

|

|

|

Name: Yuval Dagim

|

|

|

|

Title: Chief Executive Officer

|

|

KNOW ALL PERSONS BY THESE PRESENTS that the undersigned officers and directors

of Caesarstone Ltd., an Israeli corporation, do hereby constitute and appoint Yuval Dagim, Chief Executive Officer, and Ophir Yakovian, Chief Financial Officer, and each of them, their lawful attorneys-in-fact and agents with full power and

authority to do any and all acts and things and to execute any and all instruments which said attorneys and agents, and any one of them, determine may be necessary or advisable or required to enable said corporation to comply with the

Securities Act of 1933, as amended, and any rules or regulations or requirements of the Securities and Exchange Commission in connection with this Registration Statement. Without limiting the generality of the foregoing power and authority,

the powers granted include the power and authority to sign the names of the undersigned officers and directors in the capacities indicated below to this Registration Statement, to any and all amendments, both pre-effective and post-effective,

and supplements to this Registration Statement, and to any and all instruments or documents filed as part of or in conjunction with such registration statements or amendments or supplements thereof and to file the same, with all exhibits

thereto, and other documents in connection therewith, with the Securities and Exchange Commission, and each of the undersigned hereby ratifies and confirms that all said attorneys and agents, or any one of them, shall do or cause to be done by

virtue hereof. This Power of Attorney may be signed in several counterparts.

IN WITNESS WHEREOF, each of the undersigned has executed this Power of Attorney as of the date indicated.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

Title

|

Date

|

|

|

|

|

|

/s/ Yuval Dagim

Yuval Dagim

|

Chief Executive Officer (Principal Executive Officer)

|

December 23, 2020

|

|

|

|

|

|

/s/ Ophir Yakovian

Ophir Yakovian

|

Chief Financial Officer (Principal Financial and Principal Accounting Officer)

|

December 23, 2020

|

|

|

|

|

|

/s/ Dr. Ariel Halperin

Dr. Ariel Halperin

|

Chairman of the Board

|

December 23, 2020

|

|

|

|

|

|

/s/ Ofer Borovsky

Ofer Borovsky

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Irit Ben-Dov

Irit Ben-Dov

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Nurit Benjamini

Nurit Benjamini

|

Director

|

December 23, 2020

|

|

/s/ Lily Ayalon

Lily Ayalon

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Roger Abravanel

Roger Abravanel

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Ofer Tsimchi

Ofer Tsimchi

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Ronald Kaplan

Ronald Kaplan

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Dori Brown

Dori Brown

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Shai Bober

Shai Bober

|

Director

|

December 23, 2020

|

|

|

|

|

|

/s/ Tom Pardo Izhaki

Tom Pardo Izhaki

|

Director

|

December 23, 2020

|

AUTHORIZED REPRESENTATIVE IN

THE UNITED STATES:

CAESARSTONE USA, INC.

|

By:

|

/s/ Yuval Dagim

|

|

December 23, 2020

|

|

Name:

|

Yuval Dagim

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ophir Yakovian

|

|

December 23, 2020

|

|

Name:

|

Ophir Yakovian

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

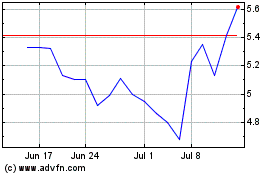

Caesarstone (NASDAQ:CSTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

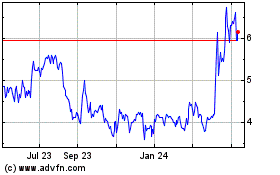

Caesarstone (NASDAQ:CSTE)

Historical Stock Chart

From Apr 2023 to Apr 2024