By Miriam Gottfried | Photographs by Jose A. Alvarado Jr. for The Wall Street Journal

Blackstone Group Inc. became an investing powerhouse by making

successful bets on undervalued companies. For the next leg of its

expansion, the firm is focused on companies with big growth

prospects, even if it has to pay up for them.

Since Jonathan Gray became Blackstone's day-to-day leader in

2018, he has encouraged the heads of its businesses, who

collectively manage $619 billion of assets, to develop big-picture

convictions and invest in companies or assets that stand to benefit

from those trends.

The new approach has led the New York firm to plow billions into

faster-growing companies -- including in the technology sector --

to which it previously paid less attention.

It has taken Blackstone out of its traditional comfort zone of

turning underperforming companies around through cost cuts and

efficiency improvements -- and juicing returns by employing ample

helpings of borrowed money.

The growth bug has bitten nearly every corner of the sprawling

firm, including its real-estate, credit and hedge-fund businesses.

Among the assets in its main buyout fund is a big stake in Bumble

Inc., which Blackstone acquired in 2019 in a deal that valued the

owner of the dating app at $3 billion. The stake has nearly

quintupled in value as the company's market capitalization shot to

about $14 billion following its February initial public

offering.

Mr. Gray's thematic approach and the growth orientation it has

spawned show how the 51-year-old heir-apparent to Chief Executive

Stephen Schwarzman is making his mark on the firm as it barrels

toward a goal of managing $1 trillion in assets by 2026.

"Investing is about looking forward, but the future is now

coming faster, " he said in an interview. "You want to be exposed

to businesses that benefit from this change."

A big goal of his is for employees in the firm's disparate

businesses to all think about the same themes and discuss them with

each other.

Blackstone has long been interested in identifying growing

industries, but under Mr. Gray has become more clear about what it

won't buy, said Joseph Baratta, global head of private equity at

the firm. In addition to brick-and-mortar retailers, that list

includes established media-and-telecommunications providers and

companies reliant on single-use plastics.

"There are certain types of companies that we're just not going

to invest in, no matter how cheap they are," Mr. Baratta said.

The strategy isn't without risk. The assets the firm is

collecting could be among the first to get hit if, for example, the

recent increase in interest rates continues as the economy emerges

from the pandemic-induced lockdown.

Rivals such as Apollo Global Management Inc. have largely

resisted the allure of the growth strategy, preferring instead to

put money into hard-hit areas like gaming and physical retail. But

even the historically value-focused Apollo has done more

technology-related deals in its most recent buyout funds. The firm

also raised two blank-check companies targeting growth-oriented

deals.

Among the themes that have guided recent Blackstone investments

are the ongoing shift to e-commerce and the technology-fueled

advancement of the life-sciences industry.

The firm has launched a new business dedicated to investing in

life sciences -- including by backing new drugs in the late stages

of development, the last thing a traditional leveraged buyout would

target. It hired Jon Korngold, a veteran of growth-investing

pioneer General Atlantic, to build a new business taking minority

stakes in growing companies.

Blackstone, which previously had virtually no West Coast

presence, has opened a San Francisco office and hired executives

and advisers from technology companies such as Amazon.com Inc. and

Snowflake Inc.

And in November, it hired Jennifer Morgan, former co-chief

executive of business-software giant SAP SE, to lead a team helping

the firm's 200-plus portfolio companies "drive growth through

digital transformation."

Blackstone isn't alone. An increasing number of its rivals and

stock investors have embraced growth as a decadelong bull market

pushes up the price of all manner of assets and leaves fewer and

fewer pockets of value. The two-year rolling average of

purchase-price multiples for U.S. buyouts reached a record 12.8

times earnings before interest, taxes, depreciation and

amortization in 2020, according to an analysis by McKinsey &

Co. That's up from 11.9 times in 2019 and 10.2 times in 2015.

Mr. Gray's thematic push was born from personal experience. He

led Blackstone's $26 billion deal to buy Hilton Hotels Corp. on the

eve of the financial crisis. As the hotel chain's business suffered

during the ensuing economic downturn, outsiders would often label

the deal a failure. Instead, Hilton became one of the most

successful private-equity investments of all time, ultimately

reaping more than $14 billion in profits, or more than three times

Blackstone's initial investment.

Mr. Gray said the experience taught him that the efforts of

Blackstone and Hilton's management may not have been enough if the

company weren't the beneficiary of a long-term growth trend in

global travel, the thesis that underpinned the investment.

"In the fullness of time, what mattered was you picked the right

neighborhood, not the right house," Mr. Gray said.

(Mr. Gray's fondness for hotels abides, witness Blackstone and

Starwood Capital Group's agreement this month to acquire Extended

Stay America Inc. in a bet that a rare bright spot for the lodging

industry during Covid-19 will continue to thrive.)

He also led the firm's first foray into industrial warehouses in

2010, betting on the ascendance of e-commerce around the world.

Blackstone is now the largest owner of warehouses used for

e-commerce, with a roughly $100 billion portfolio consisting of 880

million square feet of such properties around the world.

The two highly successful real-estate bets helped propel Mr.

Gray's rise at the private-equity giant.

One example of how his growth-related themes are being applied

across the firm is Blackstone's April 2020 investment in biotech

company Alnylam Pharmaceuticals Inc. The $2 billion deal consisted

of a $1 billion investment led by Blackstone Life Sciences in a

portion of the future total royalties of a cholesterol drug.

Its credit arm also provided Alnylam with a term loan of up to

$750 million, and Blackstone bought $100 million of the company's

stock. The firm's real-estate business also owns Alnylam's

landlord, BioMed Realty, which consists of 91 life-science

properties. Blackstone last year agreed to sell the company from

one of its funds to another in a deal that valued BioMed at $14.6

billion.

Write to Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

March 21, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

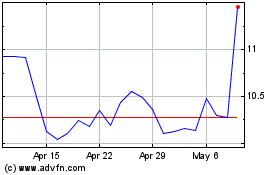

Bumble (NASDAQ:BMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

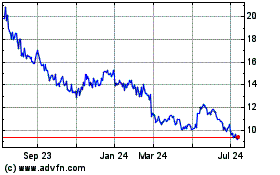

Bumble (NASDAQ:BMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024