Current Report Filing (8-k)

May 10 2019 - 7:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 9, 2019

BRUKER CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-30833

|

|

04-3110160

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

40 Manning Road

Billerica, MA 01821

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code:

(978) 663-3660

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the reporting obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 of the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value per share

|

|

BRKR

|

|

The Nasdaq Global Select Market

|

Section 8 — Other Events

Item 8.01. Other Events.

On May 9, 2019, the Board of Directors of Bruker Corporation (the “Company”) approved a share repurchase authorization authorizing the purchase of up to $300 million of the Company’s common stock over a two-year period commencing May 14, 2019 and declared a quarterly cash dividend in the amount of $0.04 per share on the Company’s common stock. The dividend will be paid on June 21, 2019 to stockholders of record as of June 3, 2019.

Under the share repurchase authorization, the Company may repurchase its common stock from time to time, in amounts, at prices, and at such times as the Company deems appropriate, subject to market conditions, legal requirements and other considerations. The Company’s repurchases may be executed using open market purchases, privately negotiated purchases or other transactions, including transactions that may be effected pursuant to trading plans intended to qualify under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, during the period from May 14, 2019 to May 13, 2021. The Company intends to fund repurchases under the share repurchase program from cash on hand and available borrowings under its existing credit facility. The share repurchase authorization does not obligate the Company to repurchase any specific number of shares and may be suspended, modified or terminated at any time without prior notice.

A copy of the Company’s press release announcing approval of the $300 million share repurchase authorization and the quarterly dividend payment is attached as Exhibit 99.1 to this Current Report on Form 8-K.

FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements, including but not limited to, statements regarding the Company’s commitment to repurchasing its shares at any level in the future, the anticipated value of shares to be repurchased by the Company, the expected timing of such repurchases and the availability of funds for the repurchase of shares. Any forward-looking statements contained herein are based on current expectations, but are subject to risks and uncertainties that could cause a change in the Company’s share repurchase authorization by the Company’s Board of Directors or management, including changes in the value of shares to be repurchased or the timing of such repurchases, and unanticipated material payment obligations incurred by the Company that decrease the Company’s willingness or ability to repurchase shares at the anticipated level and timing, or at all and other risk factors discussed from time to time in our filings with the Securities and Exchange Commission, or SEC. These and other factors are identified and described in more detail in our filings with the SEC, including, without limitation, our annual report on Form 10-K for the year ended December 31, 2018. These risks and uncertainties could cause actual results to differ materially from those referred to in these forward-looking statements. We expressly disclaim any intent or obligation to update these forward-looking statements other than as required by law.

Section 9 — Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

Number

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BRUKER CORPORATION

(Registrant)

|

|

|

|

|

|

|

|

Date: May 10, 2019

|

By:

|

/s/GERALD N. HERMAN

|

|

|

|

Gerald N. Herman

|

|

|

|

Chief Financial Officer

|

3

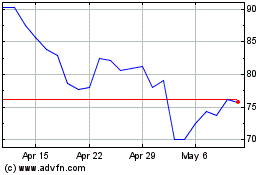

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

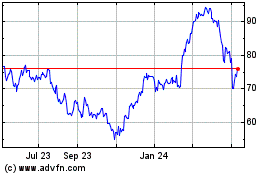

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Apr 2023 to Apr 2024