Broadwind Energy Announces $29 Million of New Tower Orders

June 17 2019 - 7:00AM

Broadwind Energy (NASDAQ:BWEN) today announced $29 million of new

tower orders from multiple customers for production scheduled in Q4

2019 through 2020.

Broadwind President and CEO Stephanie Kushner stated, “We are

excited to announce new tower orders and the expansion of our tower

customer base. We have made meaningful progress on our

diversification strategy, recording $32 million of diverse orders

in 2019 against our $60 million full year target. The US wind

turbine market continues to strengthen, we are in active

discussions to fill remaining open 2019 capacity and are encouraged

by 2020 demand discussions with our customers.”

About Broadwind Energy, Inc.Broadwind Energy

(NASDAQ:BWEN) applies decades of deep industrial expertise to

innovate integrated solutions for customers in the energy and

infrastructure markets. From gears and gearing systems for wind,

oil and gas and mining applications, to wind towers and industrial

weldments, we have solutions for the energy needs of the future.

With facilities throughout the central U.S., Broadwind Energy's

talented team is committed to helping customers maximize

performance of their investments—quicker, easier and smarter. Find

out more at www.bwen.com

Forward-Looking StatementsThis release contains

“forward looking statements”, as defined in Section 21E of the

Securities Exchange Act of 1934, as amended. Forward looking

statements include any statement that does not directly relate to a

current or historical fact. Our forward-looking statements may

include or relate to our beliefs, expectations, plans and/or

assumptions with respect to the following: (i) state, local and

federal regulatory frameworks affecting the industries in which we

compete, including the wind energy industry, and the related

extension, continuation or renewal of federal tax incentives and

grants and state renewable portfolio standards; (ii) our customer

relationships and efforts to diversify our customer base and sector

focus and leverage customer relationships across business units;

(iii) our ability to continue to grow our business organically;

(iv) the sufficiency of our liquidity and alternate sources of

funding, if necessary; (v) our restructuring efforts, including

estimated costs and saving opportunities; (vi) our ability to

realize revenue from customer orders and backlog; (vii) our ability

to operate our business efficiently, manage capital expenditures

and costs effectively, and generate cash flow; (viii) the economy

and the potential impact it may have on our business, including our

customers; (ix) the state of the wind energy market and other

energy and industrial markets generally and the impact of

competition and economic volatility in those markets; (x) the

effects of market disruptions and regular market volatility,

including fluctuations in the price of oil, gas and other

commodities; and (xi) the potential loss of tax benefits if we

experience an “ownership change” under Section 382 of the Internal

Revenue Code of 1986, as amended. These statements are based on

information currently available to us and are subject to various

risks, uncertainties and other factors. We are under no duty to

update any of these statements. You should not consider any list of

such factors to be an exhaustive statement of all of the risks,

uncertainties or other factors that could cause our current

beliefs, expectations, plans and/or assumptions to change.

BWEN INVESTOR CONTACT:

Jason Bonfigt

708.780.4821

jason.bonfigt@bwen.com

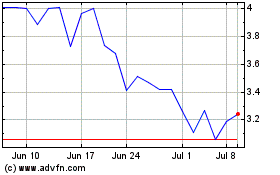

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

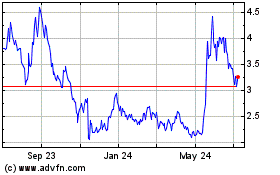

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Apr 2023 to Apr 2024