Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

|

Amendment No. 2

(Mark one)

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2019

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

Commission file number 001-39043

BROADWAY FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

|

|

95-4547287

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

|

(I.R.S. Employer

Identification No.)

|

|

5055 Wilshire Boulevard, Suite 500

Los Angeles, California

|

|

|

|

90036

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

|

|

|

(323) 634-1700

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

|

|

Securities registered under Section 12(b) of the Act:

|

|

|

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Common Stock, par value $0.01 per share (including attached preferred stock purchase rights)

|

|

BYFC

|

|

The Nasdaq Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

|

Accelerated filer o

|

|

|

|

|

|

Non-accelerated filer x

|

|

Smaller reporting company x

Emerging growth companyo

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $36,244,000.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of March 18, 2020, 19,282,571 shares of the Registrant’s voting common stock and 8,756,396 shares of the Registrant’s non-voting common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Not applicable

Table of Contents

EXPLANATORY NOTE

This amendment is being filed to provide the information required by Part III of Form 10-K because Broadway Financial Corporation’s (the “Company”) proxy statement for the 2020 Annual Meeting of Stockholders will not be filed within 120 days after the end of the Company’s 2019 fiscal year. Unless otherwise expressly stated herein, this amendment does not reflect any events occurring after the filing of the Company’s original Annual Report on Form 10-K for the year ended December 31, 2019.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The Company’s certificate of incorporation provides that the Board shall be divided into three classes of directors, with the term of one class of directors to expire each year. Two directors are to be elected at the Annual Meeting.

Information Concerning Nominees and Directors

The following table sets forth the names and information regarding the persons who are currently members of the Board, including those nominated by the Board for election at the Annual Meeting. If elected, Mr. Virgil Roberts and Mr. Daniel A. Medina will each serve for a term of three years or until their respective successors are elected and qualified. Each has consented to be named in the Proxy Statement and has indicated his intention to serve if elected. If any of the nominees becomes unable to serve as a director for any reason, the shares represented by the proxies solicited hereby may be voted for a replacement nominee selected by the Board.

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

Age at

|

|

Director

|

|

Term

|

|

Positions Currently Held with

|

|

Name

|

|

December 31 2019

|

|

Since

|

|

Expires

|

|

the Company and the Bank

|

|

NOMINEES:

|

|

|

|

|

|

|

|

|

|

Virgil Roberts

|

|

72

|

|

2002

|

|

2020

|

|

Director and Chairman of the Board

|

|

Daniel A. Medina

|

|

62

|

|

1997

|

|

2020

|

|

Director

|

|

CONTINUING DIRECTORS:

|

|

|

|

|

|

|

|

|

|

Wayne-Kent A. Bradshaw

|

|

72

|

|

2012

|

|

2021

|

|

President, Chief Executive Officer and Director

|

|

Erin Selleck

|

|

63

|

|

2015

|

|

2021

|

|

Director

|

|

Robert C. Davidson, Jr.

|

|

74

|

|

2003

|

|

2022

|

|

Director

|

|

Dutch C. Ross III

|

|

73

|

|

2016

|

|

2022

|

|

Director

|

|

Jack T. Thompson

|

|

48

|

|

2019

|

|

2022

|

|

Director

|

The following is a brief description of the business experience of the nominees and continuing directors and their respective directorships, if any, with other public companies that are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Also set forth below for each nominee and continuing director is a description of the specific experience, qualifications, attributes or skills that led to the Board’s conclusion that such person should serve as a director of the Company.

1

Table of Contents

Director Nominees

Virgil Roberts has been the Managing Partner of Bobbitt & Roberts, a law firm representing clients in the entertainment industry, since 1996. Prior to forming Bobbitt & Roberts, Mr. Roberts was President of Solar Records from 1990 to 1996. He currently serves on the boards of directors of Community Build, Inc., Families in Schools, the Alliance for College Ready Public Schools, Southern California Public Radio and the James Irvine Foundation.

Mr. Roberts is the Chairman of the Board of Directors of the Company and the Bank. Mr. Roberts’ qualifications to serve on the Board include his extensive legal and business experience and community leadership. Mr. Roberts serves on a number of local community boards and provides leadership to local community groups. He brings leadership, management, and regulatory experience to the Board.

Daniel A. Medina has been a research analyst for Needham & Company, LLC, a New York based investment bank since October 2009. Mr. Medina has also been a Managing Director of Capital Knowledge, LLC, a consulting firm that provides financial advisory services, since 2000. Mr. Medina has been involved in the financial services industry for over 36 years, including work at major investment banking firms, Union Bank of California, and Avco Financial.

Mr. Medina has extensive experience in analyzing and valuing financial institutions and assessing their strengths and weaknesses. He also has extensive knowledge of the capital markets, mergers and acquisitions, specifically within the financial services industry, and loan underwriting processes and decisions. Mr. Medina has invaluable knowledge of the Company’s history, its mission, and the markets and communities that the Company serves.

Continuing Directors

Wayne-Kent A. Bradshaw is the President and Chief Executive Officer of the Company and the Bank. Mr. Bradshaw joined the Company in February of 2009 as the President and Chief Operating Officer, and was appointed Chief Executive Officer in January 2012. He was elected to serve as a director of both the Company and the Bank in September 2012. Prior to joining the Company, Mr. Bradshaw was the Regional President for Community and External Affairs of Washington Mutual Bank from 2003 to 2009. He was President and Chief Executive Officer of the Los Angeles-based Family Savings Bank from 1989 until 2002 and Chief Deputy Superintendent for the California State Banking Department from 1981 to 1983. Mr. Bradshaw has served on many community and educational boards. He most recently served on the boards of directors of California State University Northridge, Northridge Hospital Medical Center, and California Community Reinvestment Corporation. He currently serves on the boards of Western Bankers Association and Louisville High School.

Mr. Bradshaw has over 45 years of experience in financial management and banking. Mr. Bradshaw has the proven ability to plan and implement programs that optimize opportunities to accelerate profitable growth in highly competitive environments. He has extensive experience in community banking, commercial banking and as a bank regulator.

Erin Selleck served as Senior Executive Vice President and Treasurer of Union Bank until her retirement in 2014. In addition to her role as Union Bank’s Treasurer, she served as a Policy Making Officer and Executive Committee member. Prior to joining Union Bank in 2002, she held a variety of positions within the Corporate Treasury department at Bank of America. She is currently serving on the Advisory Board of an early stage fintech company. She has served on the Board of Directors for numerous non-profit organizations and currently is a member of the Board of Directors for the National Association of Corporate Directors, Pacific Southwest Chapter.

Ms. Selleck has extensive experience in finance and in banking. She has comprehensive expertise in all treasury functions including investments, funding and liquidity, interest rate risk, capital management, and

2

Table of Contents

investor relations. As a banker for more than 25 years, she has deep knowledge of the capital markets and of the regulatory landscape in banking. Ms. Selleck also has extensive executive management experience with driving growth and profitability, guiding strategy including mergers and acquisitions, and providing effective oversight of all enterprise risks, including cyber-security.

Robert C. Davidson, Jr. served, until his retirement in 2007, in the position of Chairman and Chief Executive Officer of Surface Protection Industries, a paint and specialty coatings manufacturing company he founded in 1978, that became one of the leading African American-owned manufacturing companies in California. Previously, from 1972 to 1974, he co-founded and served as Vice President of Urban National Corporation, a private venture capital corporation that was focused specifically on investing in minority-controlled businesses. Mr. Davidson currently also serves on the boards of directors of Morehouse College (Chairman Emeritus), Art Center College of Design (Chairman), Jacobs Engineering Group, Inc. (a publicly traded professional service company), Smithsonian American Art Museum, Ray Charles Foundation, Cedars-Sinai Medical Center (Emeritus Member) and the University Of Chicago Graduate School Of Business Advisory Council.

Mr. Davidson has extensive entrepreneurial experience in developing and managing small and medium-sized businesses. He has hands-on experience in marketing and sales, human resources and strategic planning and implementation. He has a long history with, and extensive knowledge of the Company and of the markets and communities in which the Company operates. We believe that this knowledge and experience qualifies him to serve on our Board.

Dutch C. Ross III is President and Chief Executive Officer of Economic Resources Corporation (‘‘ERC”), a non-profit corporation with a mission of promoting economic development and job creation in underserved neighborhoods. Mr. Ross has served in that capacity since 1996. Prior to joining ERC, Mr. Ross held a variety of managerial, financial and planning positions in the corporate headquarters, divisional, and subsidiary operations of Atlantic Richfield Company (‘‘ARCO”) from January 1975 to December 1995. Over the years, Mr. Ross has been active in a number of community organizations and has served on the boards of directors of several such organizations, including the Downtown Long Beach YMCA, where he served as Chairman, Genesis L.A. Economic Growth Corporation, where he currently chairs the Audit Committee and also serves on the Executive Committee, and The Valley Economic Development Center, where he formerly served as a board member, and Chairman of the Finance Committee.

Mr. Ross is a financial executive with over 40 years of business experience with a Fortune 500 company and non-profit economic development organizations. We believe that this knowledge and experience qualifies him to serve on our Board.

Jack T. Thompson is the Chief Executive Officer of Pawson Capital Management, an investment firm focused on community banks based in Greenwich, Connecticut. From 2010 to 2018, Mr. Thompson was the Head of Financial Services Investments at Gapstow Capital Partners, an alternative investment firm based in New York City. Prior to joining Gapstow Capital Partners, Mr. Thompson held positions at Deutsche Bank Securities, Goldman Sachs & Co., Novantas, LLC, and Booz Allen & Hamilton. He is a Director on the Boards of ETHIC Bank in Boston, Massachusetts and Seaside National Bank & Trust, Inc. in Orlando, Florida. He graduated from Yale University with a B.A. in History and he received his M.B.A. with honors from the University of Chicago with concentrations in Finance and Accounting. Mr. Thompson is also a former 1st Lieutenant in the Armor Branch of the U.S. Army Reserve.

Mr. Thompson provides the Board with important experience and insight into the financial services industry. Mr. Thompson is the nominee of CJA Private Equity Financial Restructuring Master Fund I, L.P. (‘‘CJA’’), an institutional stockholder that elected to exercise its right to nominate a candidate to the Board of Directors of the Company. In connection with CJA’s purchase of our capital stock in 2013, we agreed to use our reasonable best efforts to cause one person nominated by CJA to be elected to serve on our Board of Directors so long as it, together with its affiliates, beneficially owns at least four percent (4%) of our total outstanding capital stock.

3

Table of Contents

Executive Officers

The following table sets forth information with respect to current executive officers of the Company and the Bank who are not directors. Officers of the Company and the Bank serve at the discretion of, and are elected annually, by the respective Boards of Directors.

|

Name

|

|

Age(1)

|

|

Principal Occupation during the Past Five Years

|

|

Brenda Battey

|

|

62

|

|

Executive Vice President and Chief Financial Officer of the Company since June 2013 and the Bank since April 2013. Senior Vice President and Senior Controller of Bank of Manhattan from September 2011 to June 2012. Senior Vice President and Controller of Community Bank from February 2010 to September 2010. Senior Vice President and Controller of First Federal Bank of California from 1997 to 2009.

|

|

|

|

|

|

|

|

Norman Bellefeuille

|

|

67

|

|

Executive Vice President and Chief Loan Officer of the Bank since July 2012. Lending Division Manager of Luther Burbank Savings from 2005 to July 2012.

|

|

|

|

|

|

|

|

Ruth McCloud

|

|

71

|

|

Executive Vice President / Chief Retail Banking Officer of the Bank since July 2014. Senior Vice President / Divisional Sales Manager of OneWest Bank from January of 2010 to June 2014. Senior Vice President / Sales Manager of First Federal Bank of California from January 2004 to December 2009.

|

(1) As of March 31, 2020

Delinquent Section 16(A) Reports

Section 16(a) of the Exchange Act requires the Company’s executive officers and directors, and persons who own more than 10% of the Company’s Common Stock, to report to the SEC their initial ownership of shares of the Company’s common stock and any subsequent changes in that ownership. Specific due dates for these reports have been established by the SEC and any late filings or failures to file are to be disclosed in the Proxy Statement. Officers, directors and greater than 10% stockholders are required by SEC rules to furnish the Company with copies of all forms that they file pursuant to Section 16(a) of the Exchange Act. On March 5, 2019, Mr. Bradshaw, Ms. Battey, Ms. McCloud, and Mr. Bellefeuille each filed a Form 4 regarding the issuance of shares of our common stock to them (in the form of restricted stock awards described above) on February 27, 2019, which filings were required under applicable regulations to have been made by the end of the second business day after the issuance.

Code of Ethics

The Board has adopted a Code of Conduct for the Company’s directors and a Code of Conduct for all employees, including the executive officers. Our directors and executive officers are expected to adhere to these policies at all times. Stockholders may obtain copies, free of charge, upon written request to: Broadway Financial Corporation, 5055 Wilshire Boulevard, Suite 500, Los Angeles, California 90036, Attention: Brenda Battey.

Company Committees

The Audit Committee consists of Ms. Selleck (Chairwoman) and Messrs. Roberts and Ross. This committee is responsible for the engagement and oversight of the Company’s independent registered public accounting firm. The Audit Committee, together with the corresponding committee of the Bank’s Board of Directors, is also responsible for oversight of the internal audit function of the Company, assessment of accounting and internal control policies, and monitoring of regulatory compliance. The Audit Committee held fourteen meetings during 2019. The Audit Committee has a written charter, which is available on the Company’s website at www.broadwayfederalbank.com. All of the members of the Audit Committee are independent directors as defined under the Nasdaq listing standards. In addition, Ms. Selleck meets the definition of “audit committee financial expert,” as defined by the SEC.

The Compensation and Benefits Committee consists of Messrs. Davidson (Chairman), Medina, Roberts, and Thompson. This committee, together with the corresponding committee of the Bank’s Board of Directors, is responsible for the oversight of salary and wage administration and various employee benefits policies and incentive compensation matters at the Company level. The Compensation and Benefits Committee has a written charter, which is available on the Company’s website at www.broadwayfederalbank.com The Compensation and Benefits Committee held six meetings during 2019.

The Compensation and Benefits Committee is authorized to engage its own outside experts for advice. The Compensation and Benefits Committee engaged EW Business Partners, Inc. to provide advice in connection with the compensation of the Company’s executives, directors and other employees and to review the Broadway Financial Corporation 2018 Long-Term Incentive Plan.

The Corporate Governance Committee consists of Messrs. Roberts (Chairman), Davidson, and Medina. This committee is designated as the Nominating Committee of the Board and is responsible for the review of the qualifications of persons being considered for election as directors, including existing directors, and for recommending candidates for election to the Board. The Corporate Governance Committee held four meetings in 2019. Nominees for the 2020 Annual Meeting were recommended by the Corporate Governance Committee and approved by the Board. The Corporate Governance Committee’s duties and responsibilities and the qualifications for director nominees are described in the Corporate Governance Committee Charter, which is available on the Company’s website at www.broadwayfederalbank.com. All of the members of the Corporate Governance Committee are independent directors as defined under the Nasdaq listing standards.

4

Table of Contents

AUDIT COMMITTEE REPORT

The following Audit Committee Report does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filings by the Company under the Securities Act of 1933, as amended, or under the Exchange Act, except to the extent we specifically incorporate this Report by reference.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the consolidated financial statements and the reporting process, including the Company’s systems of internal controls. The Company’s independent registered public accounting firm, Moss Adams LLP, is responsible for auditing the Company’s consolidated financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States.

The Audit Committee operates under a written charter approved by the Board. The Charter provides, among other things, that the Audit Committee has full authority to engage the independent auditor, independent advisors, and consultants.

In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited consolidated financial statements in the Annual Report with management and the independent auditors, Moss Adams LLP, including a discussion of the quality, not just the acceptability, of the accounting principles applied, the reasonableness of significant judgments, and the clarity of disclosures in the consolidated financial statements.

The Audit Committee reviewed with the independent registered public accounting firm such matters as are required to be discussed with the Committee under the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), including PCAOB Auditing Standard 1301, “Communications with Audit Committees”. In addition, the Audit Committee has discussed with the independent registered public accounting firm the auditors’ independence from management and the Company, including the matters in the written disclosures received by the Committee as required by the rules of the PCAOB regarding the independence of such auditors, and has considered the compatibility of non-audit services provided by the auditors with the auditors’ independence.

The Audit Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations or audits, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2019.

|

|

Audit Committee

|

|

|

|

|

|

Ms. Erin Selleck, Chairwoman

|

|

|

Mr. Virgil Roberts

|

|

|

Mr. Dutch C. Ross III

|

5

Table of Contents

ITEM 11. EXECUTIVE COMPENSATION

Summary Compensation Table

The Summary Compensation Table includes information concerning the compensation paid to or earned by our Chief Executive Officer (‘CEO”) and our three other most highly compensated executive officers. Each executive is referred to herein as a named executive officer (“NEO”).

|

Name and Principal Position

|

|

Year

|

|

Salary(1)

|

|

Stock

Awards(2)

|

|

Non-Equity

Incentive Plan

Compensation(3)

|

|

All Other

Compensation(4)

|

|

Total

($)

|

|

|

Wayne-Kent A. Bradshaw Chief Executive Officer

|

|

2019

|

|

$

|

435,000

|

|

$

|

239,100

|

|

—

|

|

$

|

70,963

|

|

$

|

745,063

|

|

|

|

2018

|

|

$

|

435,000

|

|

$

|

240,072

|

|

—

|

|

$

|

71,515

|

|

$

|

746,587

|

|

|

|

2017

|

|

$

|

435,000

|

|

$

|

230,101

|

|

—

|

|

$

|

70,299

|

|

$

|

735,400

|

|

|

Brenda J. Battey Chief Financial Officer

|

|

2019

|

|

$

|

235,323

|

|

$

|

47,065

|

|

—

|

|

$

|

34,032

|

|

$

|

316,420

|

|

|

|

2018

|

|

$

|

235,323

|

|

—

|

|

—

|

|

$

|

32,271

|

|

$

|

267,594

|

|

|

|

2017

|

|

$

|

235,323

|

|

—

|

|

$

|

47,065

|

|

$

|

33,427

|

|

$

|

315,815

|

|

|

Norman Bellefeuille Chief Loan Officer

|

|

2019

|

|

$

|

248,044

|

|

$

|

49,609

|

|

—

|

|

$

|

46,701

|

|

$

|

344,354

|

|

|

|

2018

|

|

$

|

248,044

|

|

—

|

|

—

|

|

$

|

46,669

|

|

$

|

294,713

|

|

|

|

2017

|

|

$

|

248,044

|

|

—

|

|

$

|

49,609

|

|

$

|

49,129

|

|

$

|

346,782

|

|

|

Ruth McCloud Chief Retail Banking Officer

|

|

2019

|

|

$

|

200,510

|

|

$

|

40,102

|

|

—

|

|

$

|

29,387

|

|

$

|

269,999

|

|

|

|

2018

|

|

$

|

200,510

|

|

—

|

|

—

|

|

$

|

27,788

|

|

$

|

228,298

|

|

|

|

2017

|

|

$

|

200,510

|

|

—

|

|

$

|

40,102

|

|

$

|

28,963

|

|

$

|

269,575

|

|

(1) Includes amounts deferred and contributed to the 401(k) Plan by the NEO.

(2) Relates to RSU awards covering 129,270 shares and 97,195 shares of Common Stock in 2017 and 2018, respectively, in lieu of cash bonuses due to restrictions applicable to companies that participated in the U.S. Treasury Department’s Capital Assistance Program, and awards of 194,390 shares, 38,264 shares, 40,332 shares, and 32,603 shares of restricted stock awarded to Mr. Bradshaw, Ms. Battey, Mr. Bellefeuille, and Mrs. McCloud, respectively, pursuant to the LTIP in 2019. The restricted stock awards granted in 2019 vest two years after the grant date.

(3) The amounts shown represent the cash incentive compensation awards earned by the NEO under the Bank’s Incentive Plan for Management (“Incentive Plan”), based on the objective criteria established by the Board pursuant to the Incentive Plan at the beginning of each year. The Compensation and Benefits Committee evaluates the performance results at the beginning of the following year and approves the amounts of bonuses to be paid under the Incentive Plan.

(4) Includes amounts paid by the Company to the 401(k) account of the NEO and allocations under our Employee Stock Ownership Plan. Also includes perquisites and other benefits consisting of automobile and telephone allowances, health benefits and life insurance premiums. The amount shown for our CEO includes country club dues.

Employment Agreements

Mr. Bradshaw and each of the other NEOs serve in their current positions pursuant to Employment Agreements entered into by the Company and the Bank with the respective NEOs effective in March and May 2017, respectively. The Employment Agreements provided for initial terms of employment of three years, subject to annual one-year extensions by mutual agreement of the parties. The Employment Agreements initially provided for the payment of annual base salaries in the following amounts, subject in each case to annual review and possible increase by the Board of the Company: Mr. Bradshaw $435,000; Ms. Battey $235,323; Mr. Bellefeuille $248,044; and Ms. McCloud $200,510. The Employment Agreements also provide for the NEOs’ participation in the Bank’s Employee Stock Ownership Plan, eligibility to receive equity-based awards pursuant to the Company’s Long Term Incentive Plan of such types and in such amounts as are determined by the Board and eligibility to participate in all employee benefit plans applicable to senior executive officers, including the Bank’s annual cash incentive compensation plan, the Company’s 401(k) plan (with continuation of the Company’s employee contribution matching policy as of the effective date of the Employment Agreements), and medical, dental, life and long-term disability programs.

The Employment Agreements may be terminated by the Company with or without Cause, may be terminated by the NEO with or without Good Reason, and will also terminate in the event of the death or Disability (as defined in the Employment Agreements) of an NEO. “Cause” is defined in the Employment

6

Table of Contents

Agreements to include, among other reasons: failure substantially to perform the NEO’s duties, or material breach by the NEO of the Employment Agreement or any material written policy of the Company, in each case if not cured within 30 days after notice from the Board requiring such cure; willful violation of any law, rule or regulation (excluding traffic violations and similar offenses); entry of a final regulatory cease and desist order against the NEO; and other offenses involving fraud, moral turpitude, or dishonesty involving personal profit. “Good Reason” is defined in the Employment Agreements to mean, among other events: demotion, or loss of title or authority, of an NEO; reduction of an NEO’s base salary; relocation of an NEO’s primary work location by more than 20 miles; or material breach of an NEO’s Employment Agreement by the Company.

In the event of termination of an Employment Agreement by the Company due to Disability or without Cause, or by the NEO for Good Reason, the NEO would be entitled to receive all amounts accrued for payment to the NEO to the date of termination and not previously paid, including base salary, unreimbursed business expenses, vested amounts under the Company’s 401(k) Plan and other employee benefit plans (collectively, the ‘‘Accrued Obligations”). The NEO would also be entitled to continue to receive an amount equal to the NEO’s monthly base salary for a specified period (the “Severance Period”) and would continue during the Severance Period to be entitled to receive the NEO’s automobile allowance and payment by the Company of the NEO’s life, long-term disability, medical and dental insurance premiums provided for in the NEO’s Employment Agreement (such payments during the Severance Period being collectively referred to as the “Severance Payments”). The Severance Periods specified in the Employment Agreements for the respective NEOs are: Mr. Bradshaw 36 months; Ms. Battey 24 months; Mr. Bellefeuille 30 months; and Ms. McCloud 18 months. In the event of termination of an Employment Agreement for Cause, or due to death or voluntary termination by an NEO without Good Reason, the NEO or the NEO’s estate would only be entitled to receive payment of the Accrued Obligations for such NEO.

The Employment Agreements provide that if the employment of an NEO is terminated by the Company without Cause or by the NEO for Good Reason within two years after a Change in Control of the Company has occurred, the NEO will be entitled to receive a single lump sum payment equal to the present value of the Severance Payments described above. The present value of the Severance Payments would be calculated using the Applicable Federal Rate published by the Internal Revenue Service from time to time. “Change in Control” is defined in the Employment Agreements to include: events that would be required to be reported as such pursuant to the Exchange Act or federal banking laws and regulations; any person or entity acquiring beneficial ownership of 50% or more of the Company’s outstanding securities; and changes in the composition of the Board of the Company that result, with certain exceptions, in directors who were members of the Board as of the effective date of the Employment Agreements ceasing to constitute a majority of the Board.

Incentive Compensation

The Bank’s Incentive Plan for Management (“Incentive Plan”) is designed to reward management for productivity, high performance, and implementing the business plan and vision of the Bank. The Compensation and Benefits Committee establishes performance objectives in advance of each year. These performance objectives are derived from the Strategic Plan, which is reviewed and approved by the Board annually, and typically covers the ensuing three years. The compensation payable under the Incentive Plan is tied directly to the attainment of the pre-established performance objectives. The Incentive Plan provides for a minimum, target and maximum incentive opportunity equal to 25%, 40%, and 65%, respectively, of base salary for the CEO, and 20%, 35%, and 50%, respectively, of base salary for the other senior executive officers, and lower percentages of base salary for other managers.

In order for the Incentive Plan participants to receive any form of payout, a minimum financial threshold of 80% of the Board approved consolidated net earnings for the Incentive Plan year must be achieved. For each year, the Board establishes specific objectives in the following areas:

7

Table of Contents

· Net Earnings

· Capital

· Compliance

· Net Loan Growth

· Asset Quality

· Core Deposit Growth

At the end of the Incentive Plan year, each goal is assessed and results calculated. The Compensation and Benefits Committee, pursuant to the terms of the Incentive Plan, determined that the pre-established objectives for 2018 and 2019 were achieved at least in part, and those achievements were used by the Committee to determine the restricted stock awards that were granted in early 2019 and 2020. No cash bonuses were paid for 2018 and 2019 performance.

Grants of Plan-Based Awards in 2019

Restricted stock awards totaling 305,589 were granted to the NEOs for the year ended December 31, 2019 as follows: 194,390 shares, 38,264 shares, 40,332 shares, and 32,603 shares were granted to Mr. Bradshaw, Ms. Battey, Mr. Bellefeuille, and Mrs. McCloud, respectively. The restricted stock awards granted in 2019 vest two years from the date of grant and are subject to forfeiture until vested. There were no grants of restricted stock units or stock options to the NEOs for the year ended December 31, 2019.

8

Table of Contents

Outstanding Equity Awards at December 31, 2019

The following table sets forth information concerning outstanding equity awards held by each NEO as of December 31, 2019.

|

|

|

Option Awards

|

|

Restricted Stock Awards

|

|

|

|

|

Number of

|

|

Number of

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities

|

|

Securities

|

|

|

|

|

|

Number of

|

|

Market

|

|

|

|

|

Underlying

|

|

Underlying

|

|

|

|

|

|

Shares

|

|

Value of

|

|

|

|

|

Unexercised

|

|

Unexercised

|

|

Option

|

|

Option

|

|

That Have

|

|

Shares That

|

|

|

|

|

Options

|

|

Options

|

|

Exercise

|

|

Expiration

|

|

Not

|

|

Have Not

|

|

|

Name

|

|

(Exercisable)

|

|

(Unexercisable)(1)

|

|

Price(2)

|

|

Date(3)

|

|

Vested(4)

|

|

Vested(5)

|

|

|

Wayne K. Bradshaw

|

|

—

|

|

—

|

|

—

|

|

—

|

|

194,390

|

|

$

|

299,361

|

|

|

Brenda J. Battey

|

|

90,000

|

|

60,000

|

|

$

|

1.62

|

|

02/24/26

|

|

38,264

|

|

$

|

58,927

|

|

|

Norman Bellefeuille

|

|

120,000

|

|

80,000

|

|

$

|

1.62

|

|

02/24/26

|

|

40,332

|

|

$

|

62,111

|

|

|

Ruth McCloud

|

|

60,000

|

|

40,000

|

|

$

|

1.62

|

|

02/24/26

|

|

32,603

|

|

$

|

50,209

|

|

(1) Options vest in equal annual installments on each anniversary date over a period of five years commencing on the date of grant.

(2) Based upon the fair market value of a share of Company common stock on the date of grant.

(3) Terms of outstanding stock options are for a period of ten years from the date the option is granted.

(4) There were no vested restricted stock awards as of December 31, 2019.

(5) Based upon a market value of $1.54 per share for the Company’s common stock as of December 31, 2019.

Director Compensation

Members of the Board of Directors of Broadway Financial Corporation do not receive separate compensation for their service on the Board of Directors of Broadway Federal Bank.

For the year ended December 31, 2019, each member of the Board received $1,000 per meeting for attending monthly and special board meetings. The Chairman of the Board received an additional annual retainer of $10,000. Committee members received an additional annual retainer of $8,000 and Committee Chairpersons received an additional annual retainer of $6,000 for such service, except for the Corporate Governance Committee Chair, who received an additional annual retainer of $4,000.

The following table summarizes the compensation paid to non-employee directors for the year ended December 31, 2019.

|

Name

|

|

Fees Earned

or Paid in

Cash(1)

|

|

Stock Awards(2)

|

|

All Other

Compensation(3)

|

|

Total

|

|

|

Robert C. Davidson

|

|

$

|

34,000

|

|

$

|

7,500

|

|

$

|

516

|

|

$

|

42,016

|

|

|

Daniel Medina

|

|

$

|

27,000

|

|

$

|

7,500

|

|

—

|

|

$

|

34,500

|

|

|

Virgil Roberts

|

|

$

|

36,000

|

|

$

|

7,500

|

|

—

|

|

$

|

43,500

|

|

|

Dutch C. Ross III

|

|

$

|

28,000

|

|

$

|

7,500

|

|

—

|

|

$

|

35,500

|

|

|

Erin Selleck

|

|

$

|

27,000

|

|

$

|

7,500

|

|

—

|

|

$

|

34,500

|

|

|

Jack Thompson

|

|

$

|

22,000

|

|

$

|

7,500

|

|

—

|

|

$

|

29,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes payments of annual retainer fees, fees paid to chairmen and members of Board committees, and meeting attendance fees.

(2) The amounts shown reflect the aggregate fair value of stock awards on the grant date, as determined in accordance with FASB ASC Topic 718.

(3) Includes premiums paid for dental and vision insurance.

9

Table of Contents

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information as of March 31, 2020 concerning the shares of the Company’s Common Stock owned by each person known to the Company to be a beneficial owner of more than 5% of the Company’s Common Stock, each director, each Named Executive Officer, and all current directors and executive officers as a group.

|

Beneficial Owner

|

|

Number of

Shares of

Voting

Common

Stock

Beneficially

Owned

|

|

Percent

of Voting

Common

Stock

|

|

Number of

Shares of

Non-Voting

Common

Stock

Beneficially

Owned(1)

|

|

Percent of

Total

Common

Stock

Outstanding(2)

|

|

|

CJA Private Equity Financial Restructuring Master Fund I L.P.(3)

|

|

1,845,141

|

|

9.57

|

%

|

6,453,995

|

|

29.60

|

%

|

|

Steven A. Sugarman(4)

|

|

1,846,154

|

|

9.57

|

%

|

—

|

|

6.58

|

%

|

|

Broadway Federal Bank f.s.b. Employee Stock Ownership Plan(5)

|

|

1,638,721

|

|

8.50

|

%

|

—

|

|

5.84

|

%

|

|

Grace & White, Inc.(6)

|

|

1,599,673

|

|

8.30

|

%

|

—

|

|

5.71

|

%

|

|

National Community Investment Fund(7)

|

|

818,748

|

|

4.25

|

%

|

1,564,540

|

|

8.50

|

%

|

|

First Republic Bank(8)

|

|

834,465

|

|

4.33

|

%

|

737,861

|

|

5.61

|

%

|

|

Directors and Executive Officers(5)

|

|

|

|

|

|

|

|

|

|

|

Wayne-Kent A. Bradshaw(9)

|

|

346,508

|

|

1.80

|

%

|

—

|

|

1.24

|

%

|

|

Robert C. Davidson, Jr.(10)

|

|

85,134

|

|

0.44

|

%

|

—

|

|

0.30

|

%

|

|

Daniel A. Medina(11)

|

|

67,490

|

|

0.35

|

%

|

—

|

|

0.24

|

%

|

|

Virgil Roberts(12)

|

|

39,457

|

|

0.20

|

%

|

—

|

|

0.14

|

%

|

|

Dutch C. Ross III

|

|

28,616

|

|

0.15

|

%

|

—

|

|

0.10

|

%

|

|

Erin Selleck(13)

|

|

20,878

|

|

0.11

|

%

|

—

|

|

0.07

|

%

|

|

Jack T. Thompson

|

|

11,179

|

|

0.06

|

%

|

—

|

|

0.04

|

%

|

|

Brenda J. Battey(14)

|

|

201,313

|

|

1.04

|

%

|

—

|

|

0.71

|

%

|

|

Norman Bellefeuille(15)

|

|

296,624

|

|

1.53

|

%

|

—

|

|

1.05

|

%

|

|

Ruth McCloud(16)

|

|

151,026

|

|

0.78

|

%

|

—

|

|

0.54

|

%

|

|

All current directors and executive officers as a group (10 persons)

|

|

1,248,225

|

|

6.35

|

%

|

—

|

|

4.40

|

%

|

(1) The non-voting common stock may be converted to common stock only upon certain prescribed forms of sales to third parties that are not affiliated with the holders thereof.

(2) Percentages are based on the total of voting and non-voting common stock held by the respective

stockholders shown in the table.

(3) Christopher J. Acito, managing member of Christopher J. Acito (“CJA’’) & Associates LLC, has sole investment and voting power with respect to these shares. CJA & Associates LLC is the managing member of CJA Private Equity Financial Restructuring GP I Ltd., which is the general partner of CJA Private Equity Financial Restructuring Master Fund I LP. The address for CJA & Associates LLC is 654 Madison Avenue, Suite 601, New York, NY 10065. CJA & Associates LLC is an affiliate of Gapstow Capital Partners located at 654 Madison Avenue, Suite 601, New York, NY 10065.

(4) Mr. Sugarman directly owns no shares of the Company; however, as a result of wholly-owning Sugarman Enterprises, Inc., which controls TCC Manager, LLC, which wholly owns The Capital Corps, LLC (“Capital”), which wholly owns Commerce Home Mortgage, LLC (“Commerce”), Mr. Sugarman may be deemed to have shared voting power over, and thus beneficial ownership of, the shares owned by Commerce. Mr. Sugarman has an indirect interest in the same shares by virtue of an indirect ownership

10

Table of Contents

interest in Capital. The address for Mr. Sugarman and his related entities is 16845 Von Karman Avenue, Suite 200, Irvine, CA 92606. Information based upon Schedule 13D, filed by Mr. Sugarman on February 10, 2020 with the SEC. The 13D filing indicates that the shares reported in the table for Mr. Sugarman are held directly by Commerce.

(5) The address for each of the directors and named executive officers and the Broadway Federal Bank f.s.b. Employee Stock Ownership Plan (“ESOP”) is 5055 Wilshire Boulevard, Suite 500, Los Angeles, CA 90036.

(6) Information based upon Schedule 13G/A, filed on January 31, 2020 with the SEC by Grace & White, Inc., which is an investment adviser. The address for Grace & White, Inc. is 515 Madison Avenue, Suite 1700, New York, NY 10022.

(7) The address for National Community Investment Fund (“NCIF”) is 135 South LaSalle Street, Suite 3025, Chicago, IL 60603.

(8) The address for First Republic Bank is 111 Pine Street, 2nd Floor, San Francisco, CA 94111.

(9) Includes 36,271 allocated shares under the ESOP and 231,761 shares of restricted stock.

(10) Includes 70,000 shares that are held by the Robert and Alice Davidson Trust, dated August 11, 1982. Robert Davidson and Alice Davidson share investment and voting power with respect to the shares held by the Robert and Alice Davidson Trust in their capacities as trustees of the trust.

(11) Includes 48,068 shares that are held by the Martin Medina Family Trust. Mr. Medina and his wife share investment and voting power with respect to the shares held by the Martin Medina Family Trust in their capacities as trustees of the trust.

(12) Includes 20,037 shares held jointly with his spouse with whom voting and investment power are shared.

(13) Includes 2,262 shares held jointly with her spouse with whom voting and investment power are shared.

(14) Includes 26,876 allocated shares under the ESOP, 54,437 shares of restricted stock, and 120,000 shares subject to options granted under the LTIP, which options are all currently exercisable as of March 31, 2020.

(15) Includes 26,744 allocated shares under the ESOP, 57,380 shares of restricted stock, and 160,000 shares subject to options granted under the LTIP, which options are all currently exercisable as of March 31, 2020, and 52,500 shares held jointly with his spouse with whom voting and investment power are shared.

(16) Includes 24,642 allocated shares under the ESOP, 46,384 shares of restricted stock and 80,000 shares subject to options granted under the LTIP, which options are all currently exercisable as of March 31, 2020.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Certain Relationships and Related Transactions

The Company’s current loan policy provides that all loans made by the Company or its subsidiary to its directors and executive officers or their associates must be made on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with other persons of similar creditworthiness who are not related to the Company and must not involve more than the normal risk of collectability or present other unfavorable features. As of December 31, 2019, the Company did not have any loans to related parties or affiliates.

Director Independence

We have adopted standards for director independence pursuant to the Nasdaq Stock Market (“Nasdaq”) listing standards. The Board has considered relationships, transactions and/or arrangements with each of its directors, and has determined that all of the Company’s non-employee directors are “independent” under applicable Nasdaq listing standards and Securities and Exchange Commission (“SEC”) rules.

11

Table of Contents

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Principal Accountant Fees and Services

The Audit Committee approves each engagement before the Company’s independent accountants, Moss Adams LLP, are engaged to render non-audit services for the Company or the Bank. No non-audit services were provided by Moss Adams LLP for the years indicated, except as indicated in the table below. The Audit Committee also preapproved all of the audit and audit-related services provided by Moss Adams LLP for the years ended December 31, 2019 and 2018.

The following table sets forth the aggregate fees billed to us by Moss Adams LLP for the years indicated, inclusive of out of pocket expenses.

|

|

|

2019

|

|

2018

|

|

|

|

|

(In thousands)

|

|

|

Audit fees(1)

|

|

$

|

197

|

|

$

|

192

|

|

|

Audit-related fees(2)

|

|

12

|

|

7

|

|

|

Total fees

|

|

$

|

209

|

|

$

|

199

|

|

(1) Aggregate fees billed for professional services rendered for the audit of the Company’s consolidated annual financial statements included in the Company’s Annual Report on Form 10-K and for the reviews of the Company’s consolidated financial statements included in the Company’s Quarterly Reports on Form 10-Q.

(2) Consultation fees billed for professional services rendered for the 2019 and 2018 reviews of the Company’s deferred tax assets valuation, and a Registration Statement on Form S-8 filed with the SEC by the Company, respectively.

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(b) List of Exhibits

12

Table of Contents

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

BROADWAY FINANCIAL CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Brenda J. Battey

|

|

|

|

Brenda J. Battey

|

|

|

|

Chief Financial Officer

|

|

|

Date:

|

April 29, 2020

|

13

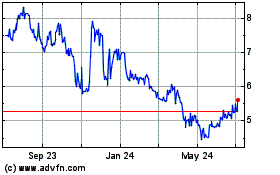

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

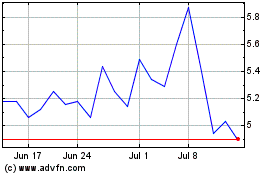

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Apr 2023 to Apr 2024