Broadcom Withdraws Annual Financial Guidance Over Coronavirus Uncertainty -- Update

March 12 2020 - 8:07PM

Dow Jones News

By Maria Armental

Chip maker Broadcom Inc. on Thursday pulled its financial

projections for the year, citing uncertainty around the coronavirus

pandemic, and said it would push debt payments to the second half

of the year or earlier if conditions improve.

The company, based in California, had projected about $25

billion in revenue for the year that ends Nov. 1 and pledged to pay

down about $4 billion in debt.

Instead, Broadcom offered a revenue forecast for the current

quarter, saying that with clear visibility of where business stood,

it expected revenue to come in at about $5.7 billion. That,

however, fell short of analysts' projected $5.94 billion, according

to FactSet.

Broadcom shares closed down 11% for the day at $218.78, and fell

9% to $200 in after-hours trading.

Apple Inc., Broadcom's largest customer accounting for roughly

20% of Broadcom's revenue last year, warned last month that it

would likely fall short of quarterly revenue projections due to the

coronavirus outbreak.

Wireless products, Chief Executive Hock Tan said in an earnings

call, were down sharply from a year earlier.

But the company, which fueled speculation of a possible sale of

the wireless business after saying in December that it considered

wireless as one of several noncore businesses and "more financial

assets, especially in terms of capital allocation," on Thursday

said it had decided to keep the operations.

Mr. Tan pointed to the supply agreements to provide wireless

components for Apple products through 2023. Broadcom estimated the

agreements, in addition to an agreement last year to supply Apple

with radio-frequency units, would generate about $15 billion in

revenue.

On Thursday, Broadcom reported a 19% drop in first-quarter

profit, before dividends on preferred stock, to $385 million, or 74

cents a share. On an adjusted basis, which excludes costs tied to

acquisitions and other items, profit fell to $5.25 a share from

$5.55 a share a year earlier.

Meanwhile, revenue from continuing operations rose to $5.86

billion from $5.79 billion a year earlier.

Analysts surveyed by FactSet expected a profit of $1.42 a share,

or $5.33 a share on an adjusted basis, and roughly $6 billion in

revenue.

Broadcom's semiconductor business, which accounts for the bulk

of revenue and has weighed on results in recent quarters, fell 4%

from a year earlier but was partially offset by a 19% revenue

growth in the infrastructure software segment.

Mr. Tan had said the core semiconductor business would return to

growth in the second half of the year, following the latest

cyclical downturn, and that Broadcom would also benefit from its

recent acquisition of Symantec's enterprise business.

On Thursday, Mr. Tan said in a conference call with analysts

that the semiconductor business has been improving and that he

hadn't seen any material impact in the most recent quarter from the

spreading coronavirus.

"But frankly, visibility is bad, and confidence continues to

erode. So as a result, we believe it is only prudent that we

withdraw our annual guidance until such time that visibility

returns to pre-Covid-19 levels, " Mr. Tan said, referring to the

disease caused by the virus.

Chief Financial Officer Tom Krause said in a statement that

Broadcom was "well positioned to continue to support our dividends

to stockholders despite the challenging market backdrop."

"Things would have to get a lot worse where we'd be looking at

changing our dividend policy," he said in the call. But "M&A is

off the table until visibility improves," he said.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

March 12, 2020 19:52 ET (23:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

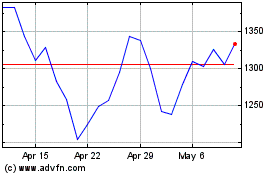

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

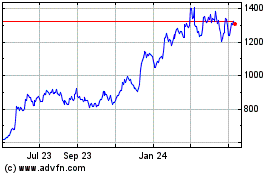

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Apr 2023 to Apr 2024