Slack, Broadcom Among Tech Companies Seeing Mixed Coronavirus Impact

March 12 2020 - 7:17PM

Dow Jones News

By Aaron Tilley and Asa Fitch

The spreading coronavirus is shaping up to deliver mixed

fortunes for tech companies.

Slack Technologies Inc. said the global fallout from the

pandemic is resulting in a surge of interest in its

workplace-collaboration software, though the impact isn't reflected

in its fiscal 2020 earnings posted Thursday.

Chief Financial Officer Allen Shim told analysts that Slack was

seeing a surge in free use of its service. However, he said, a

global slowdown in travel over virus concerns could make it harder

to close new deals.

Slack's earnings outlook reflected that uncertainty, he said.

The company's sales forecast of $185 million to $188 million for

the current quarter, and $842 million to $862 million for this

fiscal year, both fell slightly short of Wall Street projections,

according to FactSet. Shares plunged more than 18% in after-hours

trading.

Infrastructure-software and chip-making giant Broadcom Inc.

withdrew its annual revenue guidance on Thursday, saying sales were

too difficult to predict this year, given the uncertainty around

the coronavirus. Instead, the company gave a revenue forecast for

its current quarter of between $5.55 billion and $5.85 billion --

lower than the $5.94 billion analysts surveyed by FactSet had

forecast.

"Visibility in our global markets is lacking and demand

uncertainty is intensifying," chief executive Hock Tan said. The

company said the global health crisis didn't have an immediate

impact on earnings in the quarter that ended Feb. 2.

The crisis could have a positive impact on some hardware and

software providers, Mr. Tan said, as a greater number of people

work from home and use internet and cloud-computing services more

heavily. Spending on cloud infrastructure probably wouldn't be

pulled back because of the crisis and might even improve, he said

on a call with analysts Thursday.

Broadcom, long a hardware provider, is increasingly betting also

on software to serve enterprises and industry through a spate of

acquisitions and asset sales. As part of the shift it also is

exploring the sale of its radio-frequency chip business. But Mr.

Tan said Thursday that the company had concluded that continuing to

invest in and operate the business was in the best interest of

shareholders.

Chief Financial Officer Tom Krause signaled Broadcom's

acquisition plans were on hold because of coronavirus uncertainty.

"We're focused on liquidity; we're focused on capital returns," he

said on the call with analysts. "At least for the time being,

M&A is off the table, at least until visibility improves."

Publishing software provider Adobe Inc. Thursday said the spread

of the novel coronavirus was affecting spending, particularly in

areas hit by the pandemic. Because of the health crisis, "we expect

some enterprises will delay bookings, postpone services

implementation and reduce expenses," Adobe Chief Executive Shantanu

Narayen told analysts after the company posted first-quarter

results. "The situation is concerning" in the short-term, he said,

with "tremendous uncertainty."

The company also said spending on its products from consumers

could be dented in markets most affected by the virus as it issued

a muted outlook for the current quarter. It forecast sales of $3.18

billion and adjusted earnings per share of $2.35, both trailing

Wall Street expectations. The company, among many to encourage

employees to work from home during the outbreak, reported $3.09

billion in sales in the most recent quarter with adjusted earnings

of $2.27 per share.

Safra Catz, chief executive of database vendor Oracle Corp.,

Thursday said on an earnings call that "it's not yet clear" what

effect the virus will have on "our customers and suppliers," as she

gave a wider-than-typical sales outlook for the current

quarter.

Oracle also said it was increasing a share repurchase program by

$15 billion, helping boost shares in aftermarket trading. Shares

rose more than 4% after falling 11% during regular trading before

the earnings announcement. Sales could retreat or rise 2%, she told

analysts.

Apple Inc. and Microsoft Corp., the world's two largest tech

companies, last month already warned their earnings could be

affected by the outbreak, then still principally confined to

China.

"Across the board, no one is immune, but some are better

positioned," said Jefferies analyst Brent Thill. "If you're Zoom,

Slack or another collaboration app, you're going to have a stronger

tailwind given this environment."

Zoom Video Communications Inc. last week said it had seen a rise

in use of its videoconferencing systems, though many of those users

were opting for free services. The San Jose, Calif.-based company

said it wasn't clear how many of those customers would eventually

become paying customers.

Write to Aaron Tilley at aaron.tilley@wsj.com and Asa Fitch at

asa.fitch@wsj.com

(END) Dow Jones Newswires

March 12, 2020 19:02 ET (23:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

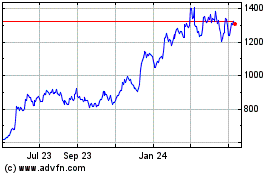

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

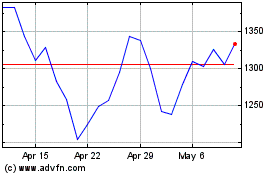

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Apr 2023 to Apr 2024