Broadcom Seeks Buyer for RF Wireless-Chip Unit

December 18 2019 - 1:54PM

Dow Jones News

By Cara Lombardo and Dana Cimilluca

Broadcom Inc. is looking to sell one of its wireless-chip units,

a move that would accelerate the company's shift away from its

roots as a semiconductor maker.

Broadcom is working with Credit Suisse Group AG to find a buyer

for its radio-frequency, or RF, unit, a segment of its

wireless-chip business that makes filters used in cellphones to

clarify signals, according to people familiar with the matter.

The unit had $2.2 billion in revenue in Broadcom's 2019 fiscal

year and is one of the original businesses of predecessor company

Avago. It could be worth $10 billion, some of the people said, but

it isn't clear if that's achievable and there may not be a deal.

The process is at an early stage, the people said.

Broadcom obliquely referred to the move when it reported results

last week, saying it was reclassifying its wireless units as

outside its core semiconductor business.

On a conference call to discuss results, Broadcom Chief

Executive Hock Tan called the wireless businesses "stand-alone

franchises" that don't fully mesh with the company's other

operations.

Broadcom, historically known for semiconductors that go into

cellphones and networking equipment, in recent years has pushed

into the more lucrative software business through two big

acquisitions. It paid $18.9 billion for CA Technologies Inc. in

2018 and recently closed a deal to buy Symantec Corp.'s corporate

business for $10.7 billion. The push into software came after the

company was thwarted in an effort to buy Qualcomm Inc. for more

than $100 billion.

--Asa Fitch contributed to this article.

Write to Cara Lombardo at cara.lombardo@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

December 18, 2019 13:39 ET (18:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

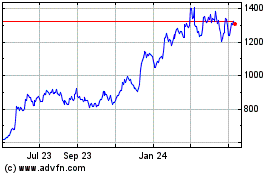

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

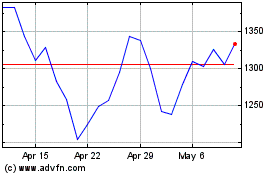

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Apr 2023 to Apr 2024