As filed with the Securities and Exchange

Commission on December 17, 2021

Registration 333-259856

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment No. 3 to

Form

F-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BORQS

TECHNOLOGIES, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

British

Virgin Islands

|

|

7373

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

Not

Applicable

|

|

(I.R.S.

Employer Identification Number)

|

Office B, 21/F, Legend Tower

7 Shing Yip Street, Kwun Tong

Kowloon, Hong Kong

Tel: +852 5188 1864

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Pat

Sek Yuen Chan, Chairman & Chief Executive Officer

Office B, 21/F, Legend Tower

7 Shing Yip Street, Kwun Tong

Kowloon, Hong Kong

Telephone: +852 5188 1864

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

to:

Darrin

M. Ocasio, Esq.

Avital

Perlman, Esq.

Sichenzia

Ross Ference LLP

31st

Floor

New

York, NY 10036

Telephone:

(212) 930-9700

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

†

|

The term

“new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board

to its Accounting Standards Codification after April 5, 2012.

|

CALCULATION

OF REGISTRATION FEE

|

each class of securities to be registered

|

|

Amount

to be

registered(1)(2)

|

|

|

Proposed

maximum

aggregate

price per

common

share(3)

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount

of

registration

fee(4)

|

|

|

Ordinary shares, no par value

|

|

|

814,140

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares, no par value, underlying Convertible Notes

|

|

|

54,936,997

|

|

|

$

|

0.61

|

|

|

$

|

33,511,568.17

|

|

|

$

|

3,106.52

|

|

|

Ordinary shares, no par value, underlying Warrants

|

|

|

45,931,726

|

|

|

$

|

0.61

|

|

|

$

|

28,018,352.86

|

|

|

$

|

2,597.30

|

|

|

Total:

|

|

|

101,682,863

|

|

|

|

|

|

|

$

|

61,529,921.03

|

|

|

$

|

5,703.82

|

|

(1)

Under the terms of the registration rights agreement with the Company, the Company is contractually required to register 125% of the

number of common shares issuable under the 8% Convertible Notes (“Notes”) as of the filing of this Registration Statement

and the number of common shares issuable upon the exercise of outstanding warrants to purchase ordinary shares (the “Warrants”).

(2)

Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of securities

as may be issued with respect to the securities being registered hereunder as a result of stock splits, stock dividends or similar transactions.

(3) Estimated solely

for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. The price per share and

aggregate offering price are based on the average of the high and low prices of the registrant’s ordinary shares on December ___,

2021, as reported on the Nasdaq Capital Market.

(4) Previously paid.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor does it

seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December __,

2021

Preliminary

Prospectus

Borqs

Technologies, Inc.

101,682,863

ORDINARY SHARES

This prospectus relates

to the sale or other disposition from time to time by the selling shareholders identified in this prospectus of up to 101,682,863 ordinary

shares, including up to 54,936,997 ordinary shares which may be issued upon the conversion of outstanding convertible notes (the “Notes”)

and up to ______ ordinary shares which may be issued upon the exercise of outstanding warrants (the “Warrants”). All

of the ordinary shares, when sold, will be sold by the selling shareholders. We are not selling any ordinary shares under this

prospectus and will not receive any of the proceeds from the sale or other disposition of the ordinary shares by the selling shareholders.

We will, however, receive the net proceeds of any Warrants exercised for cash, if any. The selling shareholders became entitled

to receive the ordinary shares (some of which are upon their conversion of Notes or exercise of Warrants) offered by this prospectus

in private placements completed in May 2021 and September 2021 in reliance on exemptions from registration under the Securities Act.

The selling shareholders

may sell or otherwise dispose of some or all the ordinary shares covered by this prospectus in a number of different ways and at varying

prices. We provide more information about how the selling shareholders may sell or otherwise dispose of their ordinary shares in

the section entitled “Plan of Distribution” on page 21. Discounts, concessions, commissions and similar selling expenses

attributable to the sale of ordinary shares covered by this prospectus will be borne by the selling shareholders. We will pay the

expenses incurred in registering the ordinary shares covered by this prospectus, including legal and accounting fees. We will not

be paying any underwriting discounts or commissions in this offering.

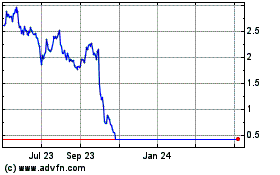

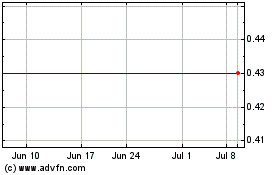

Our ordinary shares are

listed on the Nasdaq Capital Market under the symbol BRQS. On December ___, 2021, the closing price for an ordinary share on the

Nasdaq Capital Market was $______.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus for a discussion of

information that should be considered before making a decision to purchase our ordinary shares.

We are a British Virgin

Islands holding company without any operations, and we conduct most of our sales to customers through

our wholly-owned subsidiaries and consolidated affiliated entities in the U.S., Europe and India while sourcing and manufacturing substantially

all of our hardware products through our wholly-owned subsidiaries and consolidated affiliated entities in China. This structure involves

unique risks to investors. See “Risk Factors – Risks Related to Our Business Operations and Doing Business in China

-- The Chinese government exerts substantial influence over the manner in which we may conduct our business activities, and if

we are unable to substantially comply with any PRC rules and regulations, our financial condition and results of operations may be materially

adversely affected; – Substantial uncertainties exist with respect to the interpretation and implementation of any new PRC laws,

rules and regulations relating to foreign investment and how it may impact the viability of our current corporate structure, corporate

governance and our business operation; and – Our shares may be delisted under the Holding Foreign Companies Accountable Act if

the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021. The delisting of our shares, or the threat

of their being delisted, may materially and adversely affect the value of your investment.”

There are legal

and operational risks associated with being based in Hong Kong and having substantial operations in Hong Kong and China. The Chinese

government recently took regulatory actions on certain U.S. listed Chinese companies and made statements that it will exert more oversight

and control over offerings and listings by Chinese companies that are conducted overseas. Any change in foreign investment regulations,

and other policies in China or related enforcement actions by China

government could result in a material change in our operations and the value of our ordinary

shares and warrants and could significantly limit or completely hinder our ability to offer

our ordinary shares and warrants to investors or cause the value of our ordinary shares and warrants to significantly decline

or be worthless.

Recently, the PRC government

initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with

little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based

companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews,

and expanding efforts in anti-monopoly enforcement. We do not believe that we are directly subject to these regulatory actions or statements,

as we do not have a variable interest entity structure and our business does not involve the collection of user data, implicate cybersecurity,

or involve any other type of restricted industry. Because these statements and regulatory actions are new, however, it is highly uncertain

how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations

will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business

operations or our ability to accept foreign investments and list on an U.S. exchange.

We do not believe we

are required to obtain any permission from any PRC governmental authorities to offer securities to foreign investors. We have been closely

monitoring regulatory developments in China regarding any necessary approvals from the CSRC or other PRC governmental authorities required

for overseas listings, on the U.S. exchanges or on a foreign exchange other than the U.S., including this offering. As of the date of

this prospectus, we have not received any inquiry, notice, warning, sanctions or regulatory objection to this offering from the CSRC

or other PRC governmental authorities. However, there remains significant uncertainty as to the enactment, interpretation and implementation

of regulatory requirements related to overseas securities offerings and other capital markets activities. If it is determined in the

future that the approval of the CSRC, The Cyberspace Administration of China or any other regulatory authority is required for this offering,

we may face sanctions by the CSRC, the Cyberspace Administration of China or other PRC regulatory agencies. These regulatory agencies

may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations

in China, delay or restrict the repatriation of the proceeds from this offering into China or take other actions that could have a material

adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities.

The CSRC, the Cyberspace Administration of China or other PRC regulatory agencies also may take actions requiring us, or making it advisable

for us, to halt this offering before settlement and delivery of our ordinary shares. Consequently, if you engage in market trading or

other activities in anticipation of and prior to settlement and delivery, you do so at the risk that settlement and delivery may not

occur. In addition, if the CSRC, the Cyberspace Administration of China or other regulatory PRC agencies later promulgate new rules requiring

that we obtain their approvals for this offering, we may be unable to obtain a waiver of such approval requirements, if and when procedures

are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding such an approval requirement could have

a material adverse effect on the trading price of our securities. See “Risk Factors – Risks Related to Doing Business

in China – Risks Related to Our Business Operations and Doing Business in China”

The “Company,”

“we,” “us,” and “our,” refer to BORQS Technologies, Inc., a holding company incorporated under the

laws of the British Virgin Islands, and its subsidiaries. We currently conduct our business through BORQS International Holding Corp,

a holding company incorporated under the laws of the Cayman Islands (“BHolding”) and its subsidiaries: (i) Holu Hou Energy

LLC a limited liability company organized under the laws of Delaware (HHE) which is a solar energy and storage provider for the residential,

multi-family residential and commercial building markets and 51% owned by BORQS Technologies, Inc.; (ii) Borqs Technologies USA, Inc.,

a corporation incorporated under the laws of the U.S. (BTUSA) which engages in sales of our software and hardware products and is wholly

owned by BORQS International Holding Corp.; (iii) BORQS Technology (HK) Limited, a company incorporated under the laws of Hong Kong (BTHK)

which engaged in sales of our software and hardware products, but is currently idle and is 100% owned by BORQS International Holding

Corp.; (iv) BORQS Hong Kong Limited, a company incorporated under the laws of Hong Kong (BHK) which engages in the software and services

business and is 100% owned by Borqs International Holding Corp; (v) BORQS Software Solutions Private Limited, a company established under

the laws of India (BIN) which engages in the R&D for software and is 99.99% owned by Borqs International Holding Corp and 0.01% owned

by Borqs Hong Kong; (vi) Borqs Technologies, LTD, a Sino-foreign joint venture incorporated under the laws of China (BTCHN) which engages

in manufacturing of hardware products and is 60% owned by BORQS Hong Kong Limited; (vii) BORQS KK, a company incorporated under the laws

of Japan (BKK) which engages in business development and is 100% owned by Borqs Hong Kong; (viii) BORQS Chongqing Ltd., a company incorporated

under the laws of China (BCQ) which engages in manufacturing of hardware products and is 100% owned by BORQS Hong Kong Limited; (ix)

BORQS Beijing Ltd, a company incorporated under the laws of China (BBJ) which engages in design of hardware products and is 100% owned

by BORQS Hong Kong Limited; (x) Beijing Big Cloud Century Technology Limited, a company incorporated under the laws of China (BC-Tech)

which is currently idle and is 100% owned by BORQS Chongqing Ltd; (xi) BORQS Huzhou Ltd., a company incorporated under the laws of China

(BHZ) which engages in manufacturing of hardware products and is 100% owned by Borqs Technologies LTD; (xii) Beijing Big Cloud Network

Technology Co., Ltd, a company incorporated under the laws of China (BC-NW) which is currently idle and is 100% owned by Beijing Big

Cloud Century Technology Limited; and (xiii) Beijing BORQS Software Technology Co., Ltd., a company incorporated under the laws of China

(BSW) which engages in government subsidized software development and engineering projects as well as other software and services business

and is 100% owned by Beijing Big Cloud Century Technology Limited (“BC-Tech”), which is 100% owned by Borqs Beijing.

The structure of cash

flows within our organization, and as summary of the applicable regulations is as follows:

The parent and listing

company Borqs Technologies, Inc. raises funds from the capital markets and transfers cash to all its subsidiaries for operations, such

as Borqs Hong Kong Limited (BHK) in Hong Kong and Borqs Software Solutions Private Limited (BIN) in India.

|

|

●

|

Borqs

Hong Kong Ltd (BHK) transfer cash to its China entities for company operations. For instance,

Borqs Chongqing Ltd will use the cash to purchase components for manufacturing. Borqs Beijing

Ltd will use the cash to pay employee salaries in China.

|

|

|

●

|

The

Borqs entities in China have been costs centers engaged in hardware design, supply chain

management and contract manufacturing.

|

|

|

●

|

The

Company historically has not distributed any earnings or settlement amounts from its China

subsidiaries, nor have paid dividends or made distribution to its shareholders.

|

|

|

●

|

The

Company’s profits have been booked in Borqs Hong Kong Ltd (BHK) and there is no restriction

to distribute the capital from Hong Kong.

|

|

|

●

|

We have not been notified from any Chinese government authorities

of any restriction on foreign exchange which limits our ability to transfer cash between entities, across borders, and to U.S. investors.

|

|

|

●

|

We have not been notified from any Chinese government

authorities of any restriction which can limit our ability to distribute earning from our business, including subsidiaries, to the

apparent company and U.S. investors.

|

The following tabulation provides

a summary of the funds transferred between the Borqs entities.

|

|

1)

|

our accounts of BRQS and

BHolding in the U.S. (“Parent Company US Accounts”) received $6.4 million from

fundraising, and our Parent Company US Accounts together with the BHK accounts in Hong Kong

and the BIN accounts in India, we received $23.4 million from sales activities;

|

|

|

2)

|

for operational

purposes, from the Parent Company US Accounts, we transferred,

|

2.1) $5.7 million to BHK;

2.2) $0.4 million to BIN;

|

|

3)

|

for operational purposes,

from BHK, we transferred,

|

3.1) $1.2

million to BIN;

3.2) $0.5

million to BBJ;

3.3) $0.2

million to BHZ.

|

|

Ø

|

In

the year 2021 up to November 30, 2021:

|

|

|

1)

|

our Parent Company US Accounts received $38.8 million

from fundraising, and our Parent Company US Accounts together with the BHK accounts in Hong

Kong and the BIN accounts in India, we received $15.3 million from sales activities;

|

|

|

2)

|

for operational purposes, from the Parent Company US

Accounts, we transferred,

|

2.1) $22.9 million to BHK;

2.2) $3.3 million to BIN;

2.3) $3.3 million to HHE for

the acquisition of HHE;

|

|

3)

|

for operational purposes,

from the BHK, we transferred,

|

3.1) $1.6

million to BIN;

3.2) $1.6

million to BBJ;

3.3) $1.3

million to BCQ;

3.4) $2.0

million to BHZ.

Since the inception

of the Company in 2017, no transfers, dividends, or distributions to U.S. investors have been made to date.

We have not been notified

from any Chinese government authorities of any restriction on foreign exchange which limits our ability to transfer cash between entities,

across borders, and to U.S. investors.

To address persistent

capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China

and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the subsequent months,

including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments

and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends

and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion

of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing

the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore,

if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to

pay dividends or make other payments.

In addition, the Enterprise

Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by

Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and

the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement

between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends

by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities

determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities

may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will

apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will reduce the amount of dividends

we may receive from our PRC subsidiaries.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November

, 2021.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some

of the statements in this prospectus may constitute “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended (“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended

(“Exchange Act”). These statements relate to future events concerning our business and to our future revenues, operating

results and financial condition. In some cases, you can identify forward-looking statements by terminology such as “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,”

“potential” or “continue,” or the negative of those terms or other comparable terminology.

Any

forward looking statements contained in this prospectus are only estimates or predictions of future events based on information currently

available to our management and management’s current beliefs about the potential outcome of future events. Whether these future

events will occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating results

or financial condition will improve in future periods are subject to numerous risks. There are a number of important factors that could

cause actual results to differ materially from the results anticipated by these forward-looking statements. These important factors include

those that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form 20-F for the year

ended December 31, 2020, including all amendments thereto, as filed with the Securities and Exchange Commission (SEC), as well as in

our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus. You should read these

factors and the other cautionary statements made in this prospectus and in the documents we incorporate by reference into this prospectus

as being applicable to all related forward-looking statements wherever they appear in this prospectus or the documents we incorporate

by reference into this prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our

actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied

by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required by law.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-1 that we filed with the SEC using a continuous offering process.

You

should read this prospectus, exhibits filed as part of the registration statement and the information and documents incorporated by reference

carefully. Such documents contain important information you should consider when making your investment decision. See “Where You

Can Find Additional Information” and “Incorporation of Information by Reference” in this prospectus.

You

should rely only on the information provided in this prospectus, exhibits filed as part of the registration statement or documents incorporated

by reference into this prospectus. We have not authorized anyone to provide you with different information. This prospectus covers offers

and sales of our ordinary shares only in jurisdictions in which such offers and sales are permitted. The information contained in this

prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of

our ordinary shares. You should not assume that the information contained in this prospectus is accurate as of any date other than the

date on the front cover of this prospectus, or that the information contained in any document incorporated by reference is accurate as

of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any

sale of a security.

In

this prospectus, we refer to Borqs Technologies, Inc. as “we,” “us,” “our,” the “Company”

or “Borqs.” You should rely only on the information we have provided or incorporated by reference in this prospectus, exhibits

filed as part of the registration statement, any applicable prospectus supplement and any related free writing prospectus. We have not

authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus.

BORQS

TECHNOLOGIES, INC.

Borqs

Technologies, Inc. (formerly known as “Pacific Special Acquisition Corp.”, and hereinafter referred to as the “Company”

“Borqs Technologies”, “Borqs” or “we”) was incorporated in the British Virgin Islands on July 1,

2015. The Company was formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, purchasing

all or substantially all of the assets of, entering into contractual arrangements, or engaging in any other similar business combination

with one or more businesses or entities.

On

August 18, 2017, the Company acquired 100% of the equity interest of BORQS International Holding Corp. (“Borqs International”)

and its subsidiaries, variable interest entities (the “VIE”) and the VIE’s subsidiaries (collectively referred to as

“Borqs Group” hereinafter) (the Company and Borqs Group collectively referred to as the “Group”) in an all-stock

merger transaction. Concurrent with the completion of the acquisition of Borqs International, the Company changed its name from Pacific

Special Acquisition Corp., to Borqs Technologies, Inc.

Our principal place of

business is located at Office B, 21/F, Legend Tower, 7 Shing Yip Street, Kwun Tong, Kowloon, Hong Kong. Our telephone number is +852

5188 1864. Our agent in the BVI is Kingston Chambers and their address is P.O. Box 173, Road Town, Tortola, British Virgin Islands.

We

are a global leader in software, development services and products providing customizable, differentiated and scalable Android-based

smart connected devices and cloud service solutions. We are a leading provider of commercial grade Android platform software for mobile

chipset manufacturers, mobile device OEMs and mobile operators, as well as complete product solutions of mobile connected devices for

enterprise and consumer applications.

Our

Connected Solutions business unit (the “Connected Solutions BU”) works closely with chipset partners to develop new connected

devices. Borqs developed the reference Android software platform and hardware platform for Intel and Qualcomm phones and tablets. We

provide Connected Solutions customers with customized, integrated, commercial grade Android platform software and service solutions to

address vertical market segment needs through the targeted BorqsWare software platform solutions. The BorqsWare software platform consists

of BorqsWare Client Software and BorqsWare Server Software. The BorqsWare Client Software platform has been used in Android phones, tablets,

watches and various Internet-of-things (“IoT”) devices. The BorqsWare Server Software platform consists of back-end server

software that allows customers to develop their own mobile end-to-end services for their devices.

Prior to its sale in October

2020, our mobile virtual network operator, or MVNO, business unit, consisted of the following Consolidated VIEs.

MVNO BU

We define “Consolidated

VIEs” as our entities previously set up as variable interest entities in China for the purpose of conducting the MVNO business

activities due to the laws of China prohibited direct foreign investment into such business activities, and that the financial results

of these entities are consolidated into the reporting parent company of Borqs. These Consolidated VIEs provided a full range 2G/3G/4G

voice and data services for general consumer usage and IoT devices, as well as traditional telecom services such as voice conferencing.

We decided to sell the MVNO BU in October 2020 in order to focus on the growing IoT industry via our Connected Solutions BU, especially

with the coming of 5G.

After the sale of the

MVNO business, both Yuantel (Beijing) Investment Management Co. Ltd and the YuanTel (Beijing) Telecommunication Technology Co. Ltd were

no longer any part of Beijing Big Cloud Network Technology Co. Ltd (BC-NW). Beijing Big Cloud Network Technology Co. Ltd. is still within

our organizational structure because Beijing Big Cloud Network Technology Co. Ltd is required to pay China capital gains tax for the

sale of YuanTel (Beijing) Investment Management Co. Ltd which owned YuanTel (Beijing) Telecommunication Technology Co. Ltd. We anticipate

to close Beijing Big Cloud Network Technology Co. Ltd once the tax settlement with the local tax authority is completed.

Operations of Our Entities:

Below are descriptions

of each entity within our organization.

|

|

●

|

Borqs

Technologies, Inc. (BRQS) – the BVI parent holding company and the listing company.

|

|

|

●

|

Borqs

International Hold Corp (BHolding) – the Cayman Island holding company that was the

parent company prior to our listing on NASDAQ in August 2017.

|

|

|

●

|

Holu

Hou Energy LLC (HHE) – a US company we acquired controlling interests in October 2021

that engages in the businesses of solar energy storage solutions.

|

|

|

●

|

Borqs

Technologies USA, Inc. (BTUSA) – a US entity responsible for commercial contracts with

customers that require a US entity for contractual basis.

|

|

|

●

|

Borqs

Technologies (HK) Limited (BTHK)–

a Hong Kong entity responsible for signing commercial contracts that do not use Chinese RMB

or Indian Rupee. This entity is currently idle.

|

|

|

●

|

Borqs

Hong Kong Limited (BHK) – a Hong Kong entity that holds 60% of the shares of Borqs

Technologies Ltd (BTCHN), holds 60% of the shares of Borqs KK (BKK), and holds 100% of Borqs

Chongqing Ltd (BCQ) and 100% of Borqs Beijing Ltd (BBJ). This entity signs a majority of

our commercial contracts with international customers.

|

|

|

●

|

Borqs

Software Solutions Private Ltd (BIN) – an Indian entity responsible for our software

engineering R&D and for signing commercial contracts that require the Indian Rupee currency.

|

|

|

●

|

Borqs

Beijing Ltd. (BBJ) – a wholly owned foreign enterprise, a “WOFE” as it

is called, in China. This entity is responsible for the general administration and hardware

R&D purposes.

|

|

|

●

|

Borqs

Chongqing Ltd. (BCQ) – a wholly owned foreign enterprise in China that is a holding

company for Beijing Big Cloud Century Technology Ltd, and it is responsible for the purchasing

and management of the component supplies for the manufacturing of our products.

|

|

|

●

|

Beijing

Big Cloud Century Technology Ltd. (BC-Tech) – an entity in China and is a holding company

for Beijing Big Cloud Network Technology Co. Ltd and Beijing Borqs Software Technology Co.

Ltd.

|

|

|

●

|

Beijing

Borqs Software Technology Co. Ltd. (BSW) – an entity in China and is responsible for our software R&D.

|

|

|

●

|

Beijing

Big Cloud Network Technology Co. Ltd (BC-NW) – an entity in China that was formerly the holding company of our VIE entities

engaged in the business of mobile virtual network operator (“MVNO”). The VIE entities and the MVNO business was sold

as of October 2020.

|

|

|

●

|

Borqs

Technologies Ltd. (BTCHN) – a Sino-foreign entity is in China for setting up a manufacturing facility in Huzhou, China, and

is a holding company for Borqs Huzhou Ltd (BHZ).

|

|

|

●

|

Borqs

Huzhou Ltd. (BHZ) – an entity is in China and is responsible for operations of our hardware manufacturing activities in Huzhou,

China.

|

|

|

●

|

Borqs

KK (BKK) – an entity is in Japan and is responsible for sales activities in Japan.

|

In

November 2018, the Company’s board of directors approved the plan to dispose all of its tangible and intangibles assets related

to Yuantel, our MVNO BU, the Consolidated VIEs through a series of agreements, signed in November 2018 and February 2019, with Jinan

Yuantel Communication Technology LLP (“Jinan Yuantel”) and Jinggangshan Leiyi Venture Capital LLP (“JGS Venture”).

According to the agreements, all of the Company’s 75% equity interest in Yuantel would be disposed at a consideration of RMB108.7

million. The Company received only $5.98 million from the buyers within the year ended December 31, 2019, so the Company, then amended

the agreement with other third-party buyers (the “New Buyers”) of Yuantel as of September 1, 2020 to sell the remaining percentage

of Yuantel owned by the Company for $4.54 million, of which approximately $0.4 million were received and the balance of $4.14 million

was to be received by September 30, 2020, which was later postponed to October 2020 by both parties. The Company received the last payment

of $1.2 million on October 27, 2020, and completed the disposition of Yuantel on October 29, 2020. The New Buyers also purchased the

ownership of Yuantel that was first sold to other purchasers in 2019. The disposal of the Consolidated VIEs represents a strategic shift

for the Company and has a major effect on the Company’s results of operations. Accordingly, assets and liabilities related to the

Consolidated VIEs were reclassified as held for sale as the carrying amounts would be recovered principally through the sale and revenues,

and expenses related to the Consolidated VIEs were reclassified in the accompanying consolidated financial statements as discontinued

operations for all periods presented. The consolidated balance sheets as of December 31, 2019 and 2020 and consolidated statements of

operations for the years ended December 31, 2018, 2019 and 2020 were adjusted to reflect this change. There was no gain or loss recognized

on the reclassification of the discontinued operations as held for sale. The sale of the MVNO business unit was finally completed as

of October 29, 2020, and since then the Company no longer had a VIE within its operating structure.

In

the years ended December 31, 2018, 2019 and 2020, Borqs generated 96.7%, 98.3% and 98.4% of its Connected Solutions BU revenues from

customers headquartered outside of China and 3.3%, 1.7% and 1.6% from customers headquartered in China. As of December 31,

2020, Borqs had collaborated with six mobile chipset manufacturers and 29 mobile device OEMs to commercially launch Android based connected

devices in 11 countries, and sales of connected devices with the BorqsWare software platform solutions are embedded in more than 17 million

units worldwide. The discontinued MVNO BU generated all of its revenue from China.

We

have dedicated significant resources to research and development, and have research and development centers in Beijing, China and Bangalore,

India. As of December 31, 2020, 234 out of the 286 persons under our employ were technical professionals dedicated to platform research

and development and product specific customization.

Summary of Risks Associated with Our Business

Our business is subject to a number of risks,

including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition,

results of operations, cash flows and prospects that you should consider before making a decision to invest in our ordinary share and

warrants, including risks and uncertainties, among others, the following:

|

|

●

|

The

Chinese government exerts substantial influence over the manner in which we may conduct our

business activities, and if we are unable to substantially comply with any PRC rules and

regulations, our financial condition and results of operations may be materially adversely

affected.

|

|

|

●

|

Changes

in China’s economic, political or social conditions or government policies could have

a material adverse effect on our business and results of operations..

|

|

|

●

|

Uncertainties

and quick change in the interpretation and enforcement of Chinese laws and regulations with

little advance notice could result in a material and negative impact on our business operation,

decrease the value of our ordinary shares and warrants and limit the legal protections available

to us.

|

|

|

●

|

Any

change of regulations and rules by Chinese government may intervene or influence our operations

at any time and any additional control over offerings conducted overseas and/or foreign investment

in China- based issuers could result in a material change in our operations and/or the value

of our ordinary shares and could significantly limit or completely hinder our ability to

offer our ordinary shares to investors and cause the value of such securities to significantly

decline or be worthless.

|

|

|

●

|

Recent

joint statement by the SEC and the Public Company Accounting Oversight Board (United States),

or the “PCAOB,” proposed rule changes submitted by Nasdaq, the newly enacted

Holding Foreign Companies Accountable Act all call for additional and more stringent criteria

to be applied to emerging market companies upon assessing the qualification of their auditors,

especially the non-U.S. auditors who are not inspected by the PCAOB. If the PCAOB determines

that it cannot inspect or fully investigate our auditor, the trading in our securities may

be prohibited under the Holding Foreign Companies Accountable Act, and as a result Nasdaq

may delist our securities.

|

|

|

●

|

Any

failure to comply with PRC regulations regarding the registration requirements for employee

stock incentive plans may subject the PRC plan participants or us to fines and other legal

or administrative sanctions.

|

|

|

●

|

If

we are classified as a PRC resident enterprise for PRC income tax purposes, such classification

could result in unfavorable tax consequences to us and our non-PRC shareholders.

|

|

|

●

|

Regulatory

bodies of the United States may be limited in their ability to conduct investigations or

inspections of our operations in China.

|

|

|

●

|

Substantial

uncertainties exist with respect to the interpretation and implementation of the newly enacted

PRC Foreign Investment Law and how it may impact the viability of our current corporate structure,

corporate governance, business operations and financial results.

|

|

|

●

|

It

will be difficult to acquire jurisdiction and enforce liabilities against our officers, directors

and assets based in Hong Kong.

|

|

|

●

|

The

Hong Kong legal system embodies uncertainties which could negatively affect our listing on

Nasdaq and limit the legal protections available to you and us.

|

The

following customers accounted for near 10% or more of our total revenues, not including discontinued operations, for the years indicated:

|

2020

|

GreatCall, Inc.

|

41.9%

|

|

|

|

ECOM Instruments

|

23.1%

|

|

|

|

Qualcomm India Ltd.

|

14.4%

|

|

|

|

|

|

|

|

2019

|

Reliance Retail Limited

|

63.9%

|

|

|

|

GreatCall, Inc.

|

7.8%

|

|

|

|

|

|

|

|

2018

|

Reliance Retail Limited

|

59.6%

|

|

|

|

E La Carte, Inc.

|

8.0%

|

|

Since

2020 and continuing into 2021, the Chinese government has been implementing increasingly stringent rules and regulations on its domestic

business activities, particularly for companies whose shares are listed on U.S. exchanges. Such policy changes have caused profound impact

on the value of the affected companies’ equities and resulted in significant drop in market valuation for their shareholders. The

recent regulatory changes in China have focused on the following industries:

|

|

1)

|

Cryptocurrency

mining and coin offerings

|

|

|

2)

|

Social

media and cyber security

|

|

|

5)

|

Extra-curriculum

education and tutoring

|

|

|

6)

|

Variable

interest entity structures

|

The

Company does not participate in any of the above six categories, and particularly our division that operated a MVNO business under a

variable interest entity structure in China was sold as of October 29, 2020. Also, as indicated in our 2020 Annual Report filed on Form

20-F, our revenues recognized from activities in China represent only 1.6%, 1.7% and 3.3% of our total net revenues for the years 2020,

2019 and 2018, respectively. However, as the rules and regulations in China continue to evolve, the Company may become affected in future

periods causing the public market valuation of our shares to decline.

We are a global leader

in software, development services and products providing customizable, differentiated and scalable Android-based smart connected devices

and cloud service solutions. We are also a leading provider of commercial grade Android platform software for mobile chipset manufacturers,

mobile device OEMs and mobile operators, as well as complete product solutions of mobile connected devices for enterprise and consumer

applications We are not a Critical Information Infrastructure Operator (“CIIO”) or a Data Processing Operator (“DPO”)

as defined in Cybersecurity Review Measures (Revised Draft for Public Comments) published by Cyberspace Administration of China or the

CAC on July 10, 2021. As we explained in our response to Staff comment no. 5, the subsidiary Beijing Big Cloud Century Technology Ltd

(“BC-Tech”) used to operate a mobile virtual network operator (“MVNO”) business in China with a VIE structure.

The VIE entity was a holding company known as Beijing Big Cloud Network Technology Co. Ltd (“BC-NW”) which owned the operating

company known as Yuantel (Beijing) Telecommunications Technology Co., Ltd (“Yuantel”). Yuantel was sold as of October 29,

2020. BC-NW was re-organized with the VIE structure dismantled and became directly owned by BC-Tech, and therefore BC-NW remains on the

Company’s organization chart. Therefore, we are not covered by the permission and requirements from the China Securities Regulatory

Commission (“CSRC”), CAC or any other entity that is required to approve of the VIE’s operations, and we have received

all requisite permissions to operate our business in China and no permission has been denied.

Corporate

Organizational Chart

The following diagram

illustrates our current corporate structure and the place of formation, ownership interest and affiliation of each of our subsidiaries

and un-consolidated minority interests in certain entities as of December __, 2021. The corporate organization chart reflects our completed

sale of the MVNO BU which removed the VIE structure by which it was held.

RISK

FACTORS

An investment in our ordinary

shares involves risks. Prior to making a decision about investing in our ordinary shares, you should consider carefully all of the information

contained or incorporated by reference in this prospectus, including any risks in the section entitled “Risk Factors” contained

in any supplements to this prospectus and in our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, as amended to

date, and in our subsequent filings with the SEC. Each of the referenced risks and uncertainties could adversely affect our business,

operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks

not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and

the value of an investment in our securities.

Risks

Related to Our Business Operations and Doing Business in China

The

Chinese government exerts substantial influence over the manner in which we may conduct our business activities, and if we are unable

to substantially comply with any PRC rules and regulations, our financial condition and results of operations may be materially adversely

affected.

The

Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through

regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those

relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of these

jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures

and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future,

including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional

or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular

regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As

such, our business operations of and the industries we operate in may be subject to various government and regulatory interference in

the provinces in which they operate. We could be subject to regulation by various political and regulatory entities, including various

local and municipal agencies and government sub-divisions. We may incur increased costs necessary to comply with existing and newly adopted

laws and regulations or penalties for any failure to comply. In the event that we are not able to substantially comply with any existing

or newly adopted laws and regulations, our business operations may be materially adversely affected and the value of our ordinary shares

may significantly decrease.

Furthermore,

the PRC government authorities may strengthen oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers like us. Such actions taken by the PRC government authorities may intervene or influence our operations at any

time, which are beyond our control. Therefore, any such action may adversely affect our operations and significantly limit or hinder

our ability to offer or continue to offer securities to you and reduce the value of such securities.

Changes in China’s economic, political

or social conditions or government policies could have a material adverse effect on our business and results of operations.

All of our manufacturing operations are located

in China. Accordingly, our business, prospects, financial condition and results of operations may be influenced to a significant degree

by political, economic and social conditions in China generally and by continued economic growth in China as a whole.

The Chinese economy differs from the economies

of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control

of foreign exchange and allocation of resources. Although the Chinese government has implemented measures emphasizing the utilization

of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of improved corporate

governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition,

the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies and change

of enforcement practice of such rules and policies can change quickly with little advance notice. The Chinese government also exercises

significant control over China’s economic growth through allocating resources, controlling payment of foreign currency-denominated

obligations, setting monetary policy, and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced

significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy. The Chinese

government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures

may benefit the overall Chinese economy but may have a negative effect on us. For example, our financial condition and results of operations

may be adversely affected by government control over capital investments or changes in tax regulations. Since 2012, China’s economic

growth has slowed down. Any prolonged slowdown in the Chinese economy may reduce the demand for our products and materially and adversely

affect our business and results of operations.

Uncertainties and quick change in the

interpretation and enforcement of Chinese laws and regulations with little advance notice could result in a material and negative impact

our business operation, decrease the value of our ordinary shares and limit the legal protections available to us.

The PRC legal system is

based on written statutes, and prior court decisions have limited value as precedents. Since these laws and regulations are relatively

new and the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform

and enforcement of these laws, regulations and rules involves uncertainties. The enforcement of laws and that rules and regulations in

China can change quickly with little advance notice and the risk that the Chinese government may intervene or influence our operations

at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China- based issuers, could result

in a material change in our operations and/or the value of our ordinary shares.

We cannot rule out the possibility

that the PRC government will institute a licensing regime or pre-approval requirement covering our industry at some point in the future.

If such a licensing regime or approval requirement were introduced, we cannot assure you that we would be able to obtain any newly required

license in a timely manner, or at all, which could materially and adversely affect our business and impede our ability to continue our

operations.

From

time to time, we may have to resort to administrative and court proceedings to enforce our legal rights. However, since PRC administrative

and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult

to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal

systems. Furthermore, the PRC legal system is based in part on government policies and internal rules (some of which are not published

in a timely manner or at all) that may have retroactive effect. As a result, we may not be aware of our violation of these policies and

rules until sometime after the violation. Such uncertainties, including uncertainty over the scope and effect of our contractual, property

(including intellectual property) and procedural rights, could materially and adversely affect our business and impede our ability to

continue our operations.

Substantial

uncertainties exist with respect to the interpretation and implementation of any new PRC laws, rules and regulations relating to foreign

investment and how it may impact the viability of our current corporate structure, corporate governance and our business operations.

On

March 15, 2019, the National People’s Congress promulgated the Foreign Investment Law, which came into effect on January 1,

2020 and replaced the three existing laws regulating foreign investment in China, namely, the Sino-foreign Equity Joint Venture

Enterprise Law, the Sino-foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-invested Enterprise Law, together

with their implementation rules and ancillary regulations. The existing foreign-invested enterprises, or FIEs, established prior

to the effectiveness of the Foreign Investment Law may keep their corporate forms within five years. The Foreign Investment Law stipulates

that China implements the management system of pre-establishment national treatment plus a negative list to foreign investment,

and the government generally will not expropriate foreign investment, except under certain special circumstances, in which case it will

provide fair and reasonable compensation to foreign investors. Foreign investors are barred from investing in prohibited industries on

the negative list and must comply with the specified requirements when investing in restricted industries on such list. On December 26,

2019, the State Council promulgated the Implementing Regulations of the Foreign Investment Law, which came into effect on January 1,

2020 and further requires that FIEs and domestic enterprises be treated equally with respect to policy making and implementation.

Pursuant

to the Foreign Investment Law, “foreign investment” means any foreign investor’s direct or indirect investment in the

PRC, including: (i) establishing FIEs in the PRC either individually or jointly with other investors; (ii) obtaining stock shares, stock

equity, property shares, other similar interests in Chinese domestic enterprises; (iii) investing in new project in the PRC either

individually or jointly with other investors; and (iv) making investment through other means provided by laws, administrative regulations

or State Council provisions. Although the Foreign Investment Law does not explicitly classify the contractual arrangements, as a form

of foreign investment, it contains a catch-all provision under the definition of “foreign investment,” which includes

investments made by foreign investors in China through other means stipulated by laws or administrative regulations or other methods

prescribed by the State Council without elaboration on the meaning of “other means.” However, the Implementing Regulations

of the Foreign Investment Law still does not specify whether foreign investment includes contractual arrangements.

If the Chinese government were to impose

new requirements for permission or approval from the PRC Authorities including China Securities Regulatory Commission (“CSRC”)

or CAC, or any other entity that is required to approve this offering, to issue our ordinary shares to foreign investors or list on a

foreign exchange, such action could significantly limit or completely hinder our ability to offer or continue to offer securities to

investors and cause the value of such securities to significantly decline or be worthless.

As of the date of this prospectus,

we and our PRC subsidiaries, (1) are not required to obtain permissions from any PRC authorities to operate or issue our Ordinary Shares

to foreign investors, (2) are not subject to permission requirements from the CSRC, CAC or any other entity that is required to approve

of our PRC subsidiaries’ operations, and (3) have not received or were denied such permissions by any PRC authorities. Nevertheless,

the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued

the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions, which were made

available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities,

and the need to strengthen the supervision over overseas listings by Chinese companies. Given the current PRC regulatory environment,

it is uncertain when and whether we or our PRC subsidiaries, will be required to obtain permission from the PRC government to list on

U.S. exchanges in the future, and even when such permission is obtained, whether it will be denied or rescinded.

Further, since these statements

and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and

what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and

the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign

investments and list on an U.S. exchange. If, (i) we inadvertently conclude that such approvals or permissions are not required, or (ii)

applicable laws, regulations, or interpretations change and we are required to obtain such approvals and permissions in the future, and

we are unable to obtain such approvals and permissions, Borqs will not be able to perform R&D and manufacturing in China, our revenues

will be adversely affected and we will have to expand our R&D activities in India and relocate our manufacturing activities outside

China to India or other Asian countries. Also, if applicable laws, regulations, or interpretations change, and we are required to obtain

permission or approval from the PRC authority for the offering of our Ordinary Shares in the U.S. in the future, and if any of such permission

or approval were not received maintained, or subsequently rescinded, it may significantly limit or completely hinder our ability to complete

this offering or cause the value of our Ordinary Shares to significantly decline or become worthless.

Risks related to a future determination

that the Public Company Accounting Oversight Board (the “PCAOB”) is unable to inspect or investigate our auditor completely.

The audit report included

in this prospectus, and our annual report on Form 20-F for the year ended December 31, 2020, was issued by Yu Certified Public Accountant

P.C. (“Yu CPA”), a U.S.-based accounting firm that is registered with the PCAOB and can be inspected by the PCAOB. We have

no intention of dismissing YU CPA in the future or of engaging any auditor not based in the U.S. and not subject to regular inspection

by the PCAOB. There is no guarantee, however, that any future auditor engaged by the Company would remain subject to full PCAOB inspection

during the entire term of our engagement. The PCAOB is currently unable to conduct inspections in China without the approval of Chinese

government authorities. If it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors

may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB,

or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors' audits

and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate

and accurate. In addition, under the Holding Foreign Companies Accountable Act (the “HFCAA”), our securities may be prohibited

from trading on the Nasdaq or other U.S. stock exchanges or in the over the counter trading market in the U.S. if our auditor is not

inspected by the PCAOB for three consecutive years, and this ultimately could result in our Ordinary Shares being delisted. Furthermore,

on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), which, if

enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges

or in the over the counter trading market in the U.S. if its auditor is not subject to PCAOB inspections for two consecutive years instead

of three.

On December 2, 2021, SEC has announced the adoption of amendments to finalize rules

implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants the SEC identifies as having

filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and

that the PCAOB is unable to inspect or investigate (Commission-Identified Issuers). The final amendments require Commission-Identified

Issuers to submit documentation to the SEC establishing that, if true, it is not owned or controlled by a governmental entity in the

public accounting firm’s foreign jurisdiction. The amendments also require that a Commission-Identified Issuer that is a "foreign

issuer," as defined in Exchange Act Rule 3b-4, provide certain additional disclosures in its annual report for itself and any of

its consolidated foreign operating entities. Further, the adopting release provides notice regarding the procedures the SEC has established

to identify issuers and to impose trading prohibitions on the securities of certain Commission-Identified Issuers, as required by the

HFCAA. The SEC will identify Commission-Identified Issuers for fiscal years beginning after Dec. 18, 2020. A Commission-Identified Issuer

will be required to comply with the submission and disclosure requirements in the annual report for each year in which it was identified.

If a registrant is identified as a Commission-Identified Issuer based on its annual report for the fiscal year ended Dec. 31, 2021, the

registrant will be required to comply with the submission or disclosure requirements in its annual report filing covering the fiscal

year ended Dec. 31, 2022.

Risks

Related to Our Ordinary Shares

The

outstanding Notes and Warrants contain full-ratchet anti-dilution protection, which may cause significant dilution to our stockholders.

As

of December __, 2021, we had outstanding 162,111,146 ordinary

shares. As of that date we had outstanding Notes and Warrants issuable into an aggregate of 81,346,292 ordinary shares. The issuance

of ordinary shares upon the conversion or exercise of these securities would dilute the percentage ownership interest of all shareholders,

might dilute the book value per share of our ordinary shares and would increase the number of our publicly traded shares, which could

depress the market price of our ordinary shares. The Notes and Warrants contain full-ratchet anti-dilution provisions which, subject

to limited exceptions, would reduce the conversion price or exercise price of such securities (and increase the number of shares issuable)

in the event that we in the future issue ordinary shares, or securities convertible into or exercisable to purchase ordinary shares,

at price per share lower than the conversion price or exercise price then in effect, to such lower price. Our outstanding Notes convertible

into an aggregate of 43,949,597 shares at a conversion price equal to the lower of (i) $0.6534 per share, (ii) 90% of the closing price

of the ordinary shares on the date that the registration statement of which this prospectus forms a part is declared effective, or (iii)

in the event that the registration statement of which this prospectus form a part is not declared effective by the date that the shares

underlying the Notes are eligible to be sold, assigned or transferred under Rule 144, 90% of the closing price of the ordinary shares

on such date. Our outstanding Warrants are convertible into an aggregate of 37,396,694 shares at an exercise price of $0.8682 per share.

This full ratchet anti-dilution provision would be triggered by the future issuance by us of ordinary shares or ordinary share equivalents

at a price per share below the then-conversion price of all of our outstanding notes and Warrants, subject to limited exceptions

INCORPORATION

OF DOCUMENTS BY REFERENCE

The

SEC allows us to incorporate by reference the information we file with them. This means that we can disclose important information to

you by referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and

the incorporation by reference of such documents should not create any implication that there has been no change in our affairs since

such date. The information incorporated by reference is considered to be a part of this prospectus and should be read with the same care.

When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC,

the information incorporated by reference in this prospectus is considered to be automatically updated and superseded. In other words,

in the case of a conflict or inconsistency between information contained in this prospectus and information incorporated by reference

into this prospectus, you should rely on the information contained in the document that was filed later.

We

incorporate by reference the documents listed below:

|

|

●

|

Our annual report on Form 20-F for the fiscal year ended December 31, 2020 filed with the SEC on April 26, 2021;

|

|

|

●

|

Amendment No. 1 to our annual report

on Form 20-F/A for the

fiscal year ended December 31, 2020 filed with the SEC on June 14, 2021;

|

|

|

●

|

Amendment

No. 2 to our annual report on Form 20-F/A for the fiscal year ended December 31, 2020 filed with the SEC on September 13, 2021

|

|

|

●

|

Form 6-K filed with the SEC on February 22, 2021;

|

|

|

●

|

Form 6-K filed with the SEC on May 5, 2021;

|

|

|

●

|

Form 6-K filed with the SEC on May 7, 2021

|

|

|

●

|

Form 6-K filed with the SEC on June 7, 2021;

|

|

|

●

|

Form 6-K filed with the SEC on June 15, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on June 22, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on June 23, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 7, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 15, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 22, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 30, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on August 10, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on August 11, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on August 20, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on September 9, 2021;

|

|

|

|

|

|

|

●

|

Form

6-K filed with the SEC on September 17, 2021;

|

|

|

|

|

|

|

●

|

Form

6-K filed with the SEC on September 28, 2021;

|

|

|

|

|

|

|

●

|

Form

6-K filed with the SEC on October 6, 2021;

|

|

|

|

|

|

|

●

|

Form

6-K filed with the SEC on October 26, 2021;

|

|

|

●

|

Form 6-K filed with

the SEC on November 9, 2021; and

|

|

|

|

|

|

|

●

|

Form 6-K filed with

the SEC on December 1, 2021.

|

|

|

●

|

The description of our ordinary shares contained in our registration statement on Form 8-A filed on October 13, 2015 pursuant to Section 12 of the Exchange Act, together with all amendments and reports filed for the purpose of updating that description.

|

Unless expressly incorporated

by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the

SEC. We post our SEC filings on our website, www.borqs.com. We will also provide to you, upon your written or oral request, without

charge, a copy of any or all of the documents we refer to above which we have incorporated in this prospectus by reference, other than

exhibits to those documents unless such exhibits are specifically incorporated by reference in the documents. You should direct your

requests to Anthony Chan, our Chief Financial Officer, at Office B, 21/F, Legend Tower, 7 Shing Yip Street, Kwun Tong, Kowloon, Hong

Kong.. Our telephone number at this address is +852 5188 1864.

SELLING

SHAREHOLDERS

This prospectus relates

to the resale by the selling shareholders identified below of up to 101,682,863 ordinary shares, including 54,936,997 ordinary shares

that may be issued upon the conversion of $28,716,667 of Notes and 45,931,726 ordinary shares which may be issued upon the exercise

of outstanding Warrants. We are contractually required to register 125% of the number of ordinary shares issuable under the Notes

and the number of ordinary shares issuable upon the exercise of outstanding Warrants. The actual number of shares, if any, to be issued

may be more or less than such number, and any shares issued in excess of such number will not be eligible for sale under this prospectus,

unless amended.

Selling

Shareholders Table

The

table below sets forth:

|

|

●

|

the names and address of

the selling shareholders;

|

|

|

●

|

the

number of ordinary shares beneficially owned by the selling shareholders as of December __, 2021;

|

|

|

●

|

the