UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the

Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for

Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional

Materials

|

|

|

x

|

Soliciting Material Pursuant

to §240.14a-12

|

BIOSCRIP,

INC.

(Name of the Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table

below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

¨

Fee

paid previously with preliminary materials.

¨

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

CREATING THE LEADING HOME INFUSION COMPANY BIOSCRIP, INC. JEFFERIES HEALTHCARE CONFERENCE June 4, 2019 NASDAQ: BIOS

DISCLAIMER INVESTOR PRESENTATION // 2 This communication, in addition to historical information, contains “forward - looking statements” (as defined in the Private Securities Litigation Reform Act of 1995 ) regarding, among other things, future events or the future financial performance of BioScrip and Option Care . All statements other than statements of historical facts are forward - looking statements . In addition, words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words, and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward - looking statements . Forward - looking statements relating to the proposed transaction include, but are not limited to : statements about the benefits of the proposed transaction between BioScrip and Option Care, including future financial and operating results ; expected synergies ; BioScrip’s and Option Care’s plans, objectives, expectations and intentions ; the expected timing of completion of the proposed transaction ; and other statements relating to the acquisition that are not historical facts . Forward - looking statements are based on information currently available to BioScrip and Option Care and involve estimates, expectations and projections . Investors are cautioned that all such forward - looking statements are subject to risks and uncertainties (both known and unknown), and many factors could cause actual events or results to differ materially from those indicated by such forward - looking statements . With respect to the proposed transaction between BioScrip and Option Care, these factors could include, but are not limited to : the risk that BioScrip or Option Care may be unable to obtain governmental and regulatory approvals required for the transaction, or that required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction ; the risk that a condition to closing of the transaction may not be satisfied ; the length of time necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons ; the risk that the businesses will not be integrated successfully ; the risk that the cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected ; the diversion of management time on transaction - related issues ; the effect of future regulatory or legislative actions on the companies or the industries in which they operate ; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect ; economic and foreign exchange rate volatility ; and the other risks contained in BioScrip’s most recently filed Annual Report on Form 10 - K . Many of these risks, uncertainties and assumptions are beyond BioScrip’s ability to control or predict . Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward - looking statements . Furthermore, forward - looking statements speak only as of the information currently available to the parties on the date they are made, and neither BioScrip nor Option Care undertakes any obligation to update publicly or revise any forward - looking statements to reflect events or circumstances that may arise after the date of this communication . Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per BioScrip share for the current or any future financial years or those of the combined company, will necessarily match or exceed the historical published earnings per BioScrip share, as applicable . Neither BioScrip nor Option Care gives any assurance ( 1 ) that either BioScrip or Option Care will achieve its expectations, or ( 2 ) concerning any result or the timing thereof, in each case, with respect to any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decrees, cost reductions, business strategies, earnings or revenue trends or future financial results . All subsequent written and oral forward - looking statements concerning BioScrip, Option Care, the proposed transaction, the combined company or other matters and attributable to BioScrip or Option Care or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above . ADDITIONAL INFORMATION AND WHERE TO FIND IT On April 30 , 2019 , BioScrip, Inc . (“BioScrip” or the “Company”) filed with the Securities and Exchange Commission (“SEC”) a preliminary proxy statement in connection with the proposed transaction . The definitive proxy statement will be sent to the stockholders of BioScrip and will contain important information about the proposed transaction and related matters . INVESTORS AND SECURITY HOLDERS ARE URGED AND ADVISED TO READ THE PRELIMINARY PROXY STATEMENT AND THE DEFINITIVE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION . The proxy statement and other relevant materials (when they become available) and any other documents filed by the Company with the SEC may be obtained free of charge at the SEC’s website, at www . sec . gov . In addition, security holders will be able to obtain free copies of the proxy statement and other relevant materials from the Company by contacting Investor Relations by mail at 1600 Broadway, Suite 700 , Denver, CO 80202 , Attn : Investor Relations, by telephone at ( 720 ) 697 - 5200 , or by going to the Company’s Investor Relations page on its corporate web site at https : //investors . bioscrip . com . PARTICIPANTS IN THE SOLICITATION The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the matters discussed above . Information about the Company’s directors and executive officers is set forth in the Proxy Statement on Schedule 14 A for the Company’s 2019 annual meeting of stockholders, which was filed with the SEC on April 30 , 2019 . This document can be obtained free of charge from the sources indicated above . Information regarding the ownership of the Company’s directors and executive officers in the Company’s securities is included in the Company’s SEC filings on Forms 3 , 4 , and 5 , which can be found through the SEC’s website at www . sec . gov . Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the preliminary proxy statement and will be contained in the definitive proxy statement and other relevant materials to be filed with the SEC when they become available .

INVESTOR PRESENTATION // 3 • BioScrip and Option Care Merger Announced March 15, 2019 ‒ Creates the #1 provider of home and alternate site infusion therapy services 1 ‒ Powerful value creation potential, with cost synergies alone exceeding $60 million annualized ‒ The only pure - play, independent, publicly - traded home infusion company in an estimated ~$12 billion home infusion market growing 5 - 7% per year ‒ Strong historical growth profile at both BioScrip and Option Care, with pro forma combined 2016 - 2018 revenue and adjusted EBITDA CAGR of 7.0% and 23.6%, respectively 2 ‒ The total infusion market is estimated at ~$100 billion , and the combined company will continue to lead the shift in site of care from higher cost institutional settings such as hospitals, to the lower - cost home setting , with high quality patient outcomes BIOSCRIP + OPTION CARE: THE LEADING HOME INFUSION COMPANY 1 Market share in terms of revenue based on management estimates 2 Excludes approximately $ 24 million of Revenue and Adjusted EBITDA for BioScrip in 2016 to normalize 2016 results for the impact of 21 st Century Cures Act reimbursement reductions which became effective Jan . 1 , 2017 ; excludes approximately $ 212 million of Revenue in 2016 , and approximately $ 105 million of Revenue in 2017 , for BioScrip to normalize for the impact of the UnitedHealthcare exit and other exited products ; excludes approximately $ 26 million of Revenue and Adjusted EBITDA in 2016 for Option Care to normalize 2016 results for the impact of 21 st Century Cures Act reimbursement reductions which became effective Jan . 1 , 2017 .

BIOS Standalone Pro - Forma with Option Care U.S. Home Infusion Market Share 1 #4 #1 # of States with Service Locations 27 46 % of U.S. Population within Service Area 72% 96% # of Unique Patients Served (2018) ~200,000 ~375,000 # of Clinicians ~1,100 ~2,900 # of Full Service Pharmacies 52 128 # of Ambulatory Infusion Suites 66 156 INVESTOR PRESENTATION // 4 BIOSCRIP + OPTION CARE: COMBINATION AT A GLANCE 1 Market share in terms of revenue based on management estimates

INVESTOR PRESENTATION // 5 • Targeting 2020 pro forma Adjusted EBITDA of at least $250 million, including $60 million of pro forma run - rate synergies 1 • Mid - to high - single digit revenue growth profile • Organic Adjusted EBITDA growth of 1.5x to 2.0x top - line growth rate • Significantly improved free cash flow generation and leverage profile BIOSCRIP + OPTION CARE: ATTRACTIVE FUNDAMENTALS, DISCOUNT TO PEER GROUP 1 Actual 2020 synergy impact to be determined based of timing on merger close and implementation plan.

$100 B $12 B $2.6 B BIOSCRIP + OPTION CARE: #1 POSITION IN A LARGE AND GROWING MARKET 1 INVESTOR PRESENTATION // 6 BioScrip/Option Care Largest independent provider and only publicly - traded “pure play” U.S. Home Infusion Market Lowest - cost setting; growing penetration of overall market U.S. Infusion Market Incudes: hospitals, physician outpatient offices, SNFs and home infusion The U.S. Home Infusion Market is Growing by an Estimated 5 - 7% Per Year 1 Market share in terms of revenue based on management estimates

1% 6% 10% 17% 21% 45% U.S. INFUSION MARKET OVERVIEW 1 INVESTOR PRESENTATION // 7 U.S. Infusion Market U.S. Competitive Landscape – Home 12% 20% 28% 40% $100B Hospital Physician Office Outpatient Skilled Nursing Facility Home / $12B ; Top 5 providers account for approximately half of the U.S. market ; Highly fragmented market ; Significant consolidation opportunity with 800+ infusion companies in the U.S. / 1 Based on management estimates

…to the Home • Lowest cost site of care • Safest site of care; lower risk of infection • Patient preference, empowerment, quality of life • Healthcare reform moving from fee - for - service to fee - for - outcomes • The home is becoming the general ward • Democratization of healthcare (physical, mental and financial health of the patient) Care is moving from the Hospital … • Waste in healthcare system in large part driven by hospitals • Up to 1/3 of total healthcare spend is waste (est. $1 trillion) • Higher costs and worse outcomes , including death ( 440k preventable deaths each year in the hospital) • 50% of hospitals are not financially sound BIOSCRIP + OPTION CARE: ON THE RIGHT SIDE OF HEALTHCARE TRENDS INVESTOR PRESENTATION // 8 The right place , the right team , and the right time. The Home is the Disruptive Service Model within the Infusion Market ( think Amazon, Uber)

BIOSCRIP + OPTION CARE: PAYOR DIVERSITY AND LOW PEN - STROKE RISK INVESTOR PRESENTATION // 9 14% 86% Pro Forma Revenue By Payor Type 1 Commercial Government No Single Payor Relationship Accounts for >15% of Pro Forma Sales 1 Commercial includes Medicare Advantage, Managed Medicaid and Patient Pay

BIOSCRIP + OPTION CARE: COMPLEMENTARY FOOTPRINT INVESTOR PRESENTATION // 10 National Reach Makes the Combined Company a Logical Partner to Payors 1. Includes pharmacy technicians. $2.6bn+ combined 2018 revenue 46 states 96% of U.S. population covered 2,900+ skilled clinicians 1 Top 10 payors all in network Option Care locations BioScrip locations 600+ frontline selling resources

$5 $45 $45 2016 2017 2018 BIOSCRIP + OPTION CARE: COMBINING TWO STRONG BUSINESSES INVESTOR PRESENTATION // 11 $1,647 $1,782 $1,942 2016 2017 2018 Adjusted EBITDA (in mm) 3 $72 $84 $95 2016 2017 2018 1 Excludes approximately $24 million of Revenue and Adjusted EBITDA in 2016 to normalize 2016 results for the impact of 21 st Century Cures Act reimbursement reductions which became effective Jan. 1, 2017. 2 Excludes approximately $212 million of Revenue in 2016, and approximately $105 million of Revenue in 2017, to normalize for t he impact of the UnitedHealthcare exit and other exited products. 3Excludes approximately $26 million of Revenue and Adjusted EBITDA in 2016 to normalize 2016 results for the impact of 21st C ent ury Cures Act reimbursement reductions which became effective Jan. 1, 2017. Over last three years, Option Care generated $150mm in cash flow from operations, invested $90mm in technology and facilities, and improved leverage profile by 1x EBITDA Net Revenue (in mm) 1,2 Adjusted EBITDA (in mm) 1 BioScrip: Option Care: Net Revenue (in mm) 3 $673 $688 $709 2016 2017 2018

BIOSCRIP + OPTION CARE: POTENTIAL ADDITIONAL VALUE CREATION INVESTOR PRESENTATION // 12 • Potential revenue synergy upside through: ‒ 600 member sales force with optimized coverage by location; ‒ Cross - selling solution sets, such as Option Care’s broader portfolio sold through BIOS accounts; ‒ Optimization of payor relations and contracting ; ‒ Support payor redirection efforts with a larger ambulatory infusion suite network ; and ‒ Improve revenue cycle performance through strengthened processes.

BIOSCRIP + OPTION CARE: THE POWER OF THE COMBINATION INVESTOR PRESENTATION // 13 #1 home infusion company with national reach and scale Right side of healthcare – independent, low cost care setting, patient centric Enhanced product and payor diversity Sizable and actionable synergies expected Improved capital structure and liquidity Low “pen stroke” risk / limited government exposure; limited PBM exposure Seasoned management team and Board of Directors x x x x x x x

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

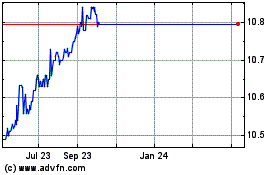

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024