UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the

Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use

of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

x

|

Soliciting Material Pursuant

to §240.14a-12

|

BIOSCRIP,

INC.

(Name of the Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below

per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate

value of transaction:

|

|

|

|

|

|

|

¨

|

Fee paid previously with

preliminary materials.

|

|

|

¨

|

Check box if any part of

the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

A LEADING PROVIDER OF HOME INFUSION AND ALTERNATE SITE INFUSION THERAPY

INVESTOR PRESENTATION // 2 DISCLAIMER This communication, in addition to historical information, contains “forward - looking statements” (as defined in the Private Secu rities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of BioScrip and Option Care. All statements other than statements of historical facts are forward - looking statements. In addition, words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “i nte nd,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words, and words and terms of similar substance used in co nnection with any discussion of future plans, actions or events identify forward - looking statements. Forward - looking statements relating to the proposed transaction include, but are not limited to: statements about the benefits of the proposed transaction between BioScrip and Option Care, including future financial and operating results; expected synergies; BioScrip’s and Option Cares plans, objectives, expectations and intentions; the expected timing of completion of the proposed transaction; and other statements relating to the acquisition that are not historical facts. Forward - looking statements are based on information currently available to BioScrip and Option Care and involve estimates, expectations and projections. Investors are cautioned that all such forward - looking statements are subject to risks and uncertainties (both known and unknown), and many factors could cause ac tual events or results to differ materially from those indicated by such forward - looking statements. With respect to the proposed transaction between BioScrip and Option Care, these factors could include, but are not limited to: the risk that BioScrip or Option Care may be unable to obtain governmental and regulatory approvals required for the transaction, or that required g ov ernmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from th e proposed transaction or cause the parties to abandon the proposed transaction; the risk that a condition to closing of the transaction may not be satisfied; the length of ti me necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated su cce ssfully; the risk that the cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected; the diversion of man agement time on transaction - related issues; the effect of future regulatory or legislative actions on the companies or the industries in which they operate; the risk that th e c redit ratings of the combined company or its subsidiaries may be different from what the companies expect; economic and foreign exchange rate volatility; and the other risks contained in BioScrip’s most recently filed Annual Report on Form 10 - K. Many of these risks, uncertainties and assumptions are beyond BioScrip’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward - looking statements. Furthermore, forward - looking statements speak only as of the information cur rently available to the parties on the date they are made, and neither BioScrip nor Option Care undertakes any obligation to update publicly or revise any forward - looking statements to reflect events or circ umstances that may arise after the date of this communication. Nothing in this communication is intended, or is to be construed, as a profit for eca st or to be interpreted to mean that earnings per BioScrip share for the current or any future financial years or those of the combined company, will necessarily match or exceed the hi st orical published earnings per BioScrip share, as applicable. Neither BioScrip nor Option Care gives any assurance (1) that either BioScrip or Option Care will achieve its expectations, or (2) concerning any result or the timing thereof, in each case, with respect to any regulatory action, administrative proceedings, government investigations, litigati on, warning letters, consent decrees, cost reductions, business strategies, earnings or revenue trends or future financial results. All subsequent written and oral forward - looking sta tements concerning BioScrip, Option Care, the proposed transaction, the combined company or other matters and attributable to BioScrip or Option Care or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. ADDITIONAL INFORMATION AND WHERE TO FIND IT BioScrip , Inc. (“ BioScrip ” or the “Company”) will file with the Securities and Exchange Commission (“SEC”) a proxy statement in connection with the pr opo sed transaction. The proxy statement will contain important information about the proposed transaction and related matters. INVESTORS AND SECURITY HOLD ERS ARE URGED AND ADVISED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. The proxy statement and other relev ant materials (when they become available) and any other documents filed by the Company with the SEC may be obtained free of charge at the SEC’s website, at www .sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement and other relevant materials from the Company by contacting Investor Relati ons by mail at 1600 Broadway, Suite 700, Denver, CO 80202, Attn: Investor Relations, by telephone at (720) 697 - 5200, or by going to the Company’s Investor Relations page on its cor porate web site at https://investors.bioscrip.com. PARTICIPANTS IN THE SOLICITATION The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from sto ckh olders in connection with the matters discussed above. Information about the Company’s directors and executive officers is set forth in the Proxy Statement on Schedule 14A f or the Company’s 2018 annual meeting of stockholders, which was filed with the SEC on April 4, 2018. This document can be obtained free of charge from the sources i ndi cated above. Information regarding the ownership of the Company’s directors and executive officers in the Company’s securities is included in the Company’s SEC filings on For ms 3, 4, and 5, which can be found through the SEC’s website at www.sec.gov. Other information regarding the participants in the proxy solicitation and a description of their di rec t and indirect interests, by security holdings or otherwise, will be contained in the preliminary proxy statement and the definitive proxy statement and other relevant materia ls to be filed with the SEC when they become available.

INVESTOR PRESENTATION // 3 PRESENTERS John Rademacher CEO Option Care Mike Shapiro CFO Option Care Dan Greenleaf CEO BioScrip Steve Deitsch CFO BioScrip

INVESTOR PRESENTATION // 4 COMBINING TWO LEADERS IN HOME INFUSION Headquar te r s: Denver , Colorado Headquar te r s: Bannockburn , Illinois Significant Scale 2018 Metrics Expansive and Complementary Footprints Therapeutic Solutions • 76 full service pharmacies • 90 ambulatory infusion suites • Locations in 42 states • 53 full service pharmacies • 66 ambulatory infusion suites • Locations in 27 states • Anti - infectives • Nutrition support • Revenue: $1,942mm • Adj. EBITDA: $95mm • Employees: ~4,500 • Clinicians: ~1,800 • 87% commercial payors 2 • 2016 - 2018 Revenue CAGR: 8.6% 4 • Revenue: $709mm • Adj. EBITDA: $45mm • Employees: ~2,100 • Clinicians: ~1,100 1 • 81% commercial payors 2 • 2016 - 2018 Revenue CAGR: 2.7% 3 • Autoimmune • Bleeding disorders • Immunoglobin • Heart failure 1. Includes pharmacy technicians. 2. Commercial includes Managed Medicaid and Medicare Advantage. 3. Pro forma for the impact of the UnitedHealthcare contract transition, Cures Act, Company’s exit from the Hepatitis C marke t a nd including a reduction in revenue due to bad debt expense. 4. Adjusted for impact of Cures Act.

INVESTOR PRESENTATION // 5 COMBINATION CREATES PROVIDER WITH NATIONAL REACH AND COMPREHENSIVE SOLUTIONS 1. Includes pharmacy technicians. $2.6bn+ combined 2018 revenue 46 states 96% of U.S. population covered 2,900+ skilled clinicians 1 Top 10 payors all in network Highly complementary footprint expected to make the combined company a preferred partner to payors Option Care locations BioScrip locations 600+ frontline selling resources

INVESTOR PRESENTATION // 6 OPTION CARE OVERVIEW • 76 full service pharmacies • 50 state dispensing capabilities • 90 ambulatory infusion suites • Contracted with all 10 of the top 10 national payors • Contracted as a provider of Medicare and Medicaid in all 50 states • >750 payor relationships and >1,200 payor contracts • 1,800 multi - disciplinary clinicians • 1,000 employed IV nurses • 1,500 subcontracted, credentialed HHA partners • >45,000 patient census • 131,000 unique patients served in 2018 • 40+ Limited Distribution Drugs, with many exclusive to Option Care Broad Footprint and Reach Broad Payor Access Significant Clinical Competencies Unique Product Portfolio

OPTION CARE HISTORICAL PERFORMANCE 1. Adj. EBITDA includes adjustments related to stock - based compensation, loss on dispositions, non - cash portion of debt extingui shment, management fees, and restructuring and other charges. In the past three years , Option Care generated ~$150mm in operating cash flow ~$90 million has been invested in IT and facilities Established a foundation for enhanced revenue growth and margin expansion Free Cash Flow Reinvestment Despite investment in corporate infrastructure, Option Care generated high single digit revenue and low double digit Adj. EBITDA 1 growth per annum In 2018 revenue was up ~9% and Adj. EBITDA 1 was up ~14% vs. 2017 Strong Historical Performance MDP acquired a majority stake in Option Care (formerly Walgreens Infusion Services) in 2015 Post separation, Option Care aggressively invested in a standalone corporate infrastructure, quality and clinical excellence and industry - leading information technology Option Care has a national team of sales account managers and clinical transition specialists Option Care established a unique business development function focused on developing relationships with biopharmaceutical and pharmaceutical manufacturers to commercialize new therapies Scaling Infrastructure for Growth INVESTOR PRESENTATION // 7

CORE OPTION CARE GROWTH HAS BEEN STRONG Note: Represents performance from 2016 - 2018 excluding impact of CURES Act. 1. Adj. EBITDA includes adjustments related to stock - based compensation, loss on dispositions, non - cash portion of debt extingui shment, management fees, and restructuring and other charges. 8.6% CAGR 15.2% CAGR Revenue Adjusted EBITDA 1 INVESTOR PRESENTATION // 8

OPTION CARE’S UNIQUE POSITION TO CAPITALIZE ON THERAPY TRENDS 1. Adj. EBITDA includes adjustments related to stock - based compensation, loss on dispositions, non - cash portion of debt extingui shment, management fees, and restructuring and other charges. Key therapies include anti - infectives, total parental nutrition and enteral nutrition Shorter duration therapy regiments Higher gross margins Requires significant sales & marketing and clinical expertise Key therapies include IVIG, TNF (ex: Remicade) and Factor products Longer duration therapies Lower gross margins but significant Adj. EBITDA 1 dollars Payor strategies for site of care redirection Pharma manufacturer partnerships for limited distribution of innovative therapies; robust large molecule pipeline Drive above - market revenue growth and Adj. EBITDA 1 margin expansion Acute Therapies (30% of Revenue) Chronic Therapies (70% of Revenue) Focus on therapies that require HCP oversight, allowing Option Care to leverage clinical competencies and drive meaningful EBITDA Broad Product Portfolio In Network Payor Base Unique Referral Management Strong Drug Pipeline INVESTOR PRESENTATION // 9

96% INVESTOR PRESENTATION // 10 OPTION CARE’S INDUSTRY LEADING QUALITY METRICS AND ACCREDITATIONS 1. Review of Option Care patient data on file April 2017 – June 2017. Data may include some injectable drugs. 2. Review of Optio n Care patient data therapy related admission rates April 2017 – June 2017. 3. Review of Option Care nurse managed central lines patient data April 2017 – June 2017; incident rate per 1,000 catheter days. 4. Review of Option Care patient data on file April 2017 – June 2017. 5. Luszcz N, O’Neill M, Siddiqui T. Home nutrition support team interventions demonstrate improved clinical and financial outcomes. Poster presented at: Clinical Nutrition Week 2013; F ebr uary 9 - 12, 2013; Phoenix, AZ. 6. PharmaceuticalCommerce.com. Shelley, S. “Home infusion providers struggle with unfriendly reimbursement policies.” October 10, 2009. 7. Based on a 7 year average of patient satisfaction data 20 10 – 2017 of more than 30,000 patients surveyed. .003% rate of infusion - related adverse drug reactions 1 <1% rate of unplanned hospital readmissions 2 .02 rate of bloodstream infections 3 99.9% clinician - reported patient adherence rate 4 Avoiding hospitalization saves about $2,000 per day 5,6 Overall satisfaction among patients receiving infusion therapy 7

INVESTOR PRESENTATION // 11 PARTNERING WITH WORLD - CLASS SHAREHOLDERS AND BOARD MEMBERS Over 30 years of experience with completed investments in over 140 companies Supportive partnership One of the world’s leading investment firms with approximately $23 billion AUM One of the leading investors in the healthcare sector Strong track record of creating public shareholder value in comparable transactions One of the world’s largest pharmaceutical retail networks Full - scale provider across the continuum of care

12% 20% 28% 40% Home Skilled Nursing Facility Physician Office Outpatient Hospital INVESTOR PRESENTATION // 12 U.S. INFUSION INDUSTRY OVERVIEW LARGE AND GROWING INDUSTRY OPPORTUNITY Top 6 providers account for <50% of U.S. industry The combined company market share is 21% Highly fragmented industry 800+ infusion companies in the U.S. Large and Growing Industry Opportunity U.S. Infusion Industry U.S. Competitive Landscape – Home ~$100bn U.S. Infusion industry Includes: hospitals, physician outpatient offices, SNFs and home infusion ~$12bn U.S. Home Infusion industry Lowest - cost setting; growing penetration of overall industry $2.6bn+ Option Care + BioScrip One of the largest providers of infusion solutions $100bn

x The combination creates a leading independent provider of home infusion x Merger of two best - in - breed platforms in a large and growing industry x Diversified payor mix, in network with top 10 payors x $60+ million of run - rate cost synergies identified x Expected to be realized on a run - rate basis within 24 months x Partnership with two world - class shareholders with a long - standing track record of success x Addition of industry leaders to the Board of Directors including Harry Kraemer, Jr., John Arlotta and Nitin Sahney x Enhanced and simplified capital structure provides flexibility and access to liquidity INVESTOR PRESENTATION // 13 TRANSFORMATIONAL TRANSACTION CREATING MEANINGFUL SHAREHOLDER VALUE Significant Synergy Potential Transformational Strategic Combination Support by Leading Investors Financial Flexibility

• BioScrip to issue common stock to Option Care in an all - stock transaction • $60+ million of run - rate cost synergies identified • BioScrip shareholders: 20.5% • Option Care shareholders: 79.5% • Chief Executive Officer: John Rademacher • Chief Financial Officer: Mike Shapiro • Draw on best talent from both organizations • 10 member Board to be comprised of 8 directors from Option Care’s Board and 2 directors from BioScrip’s Board (Carter Pate and David Golding) • Dan Greenleaf to serve as strategic advisor to the Board of Directors • Pro Forma Debt / Combined Credit Adj. EBITDA of ~6x 1 • Committed financing in place to refinance and optimize capital structure • Subject to BioScrip shareholder approval, regulatory approval and customary closing conditions • Transaction expected to close in second half of 2019 INVESTOR PRESENTATION // 14 KEY TRANSACTION TERMS 1. Reflects Pro Forma Combined 2018 Credit Adj. EBITDA of $210mm and $1,325mm of debt based on committed financing at time of tr ansaction announcement. Approximate Ownership Financing Management Board of Directors Transaction Structure Timing Synergy Potential

SYNERGY POTENTIAL IN ORDER OF MAGNITUDE Streamline corporate and administrative functions including labor and non - labor costs SG&A Optimize assets where applicable to best serve the market Includes associated costs Network Optimization Purchasing at the “best of” price where overlap exists Purchasing done independently of WBA today Procurement Opportunities to partner with payors to drive more favorable relationships and support their efforts to manage appropriate site of care redirection through our greater ambulatory infusion suite network Additional Opportunities INVESTOR PRESENTATION // 15 $60+ million of run - rate cost synergies identified Synergies expected within 24 months post - closing

INVESTOR PRESENTATION // 16 CHALLENGING BIOSCRIP CAPITAL STRUCTURE Near - term leverage levels are expected to remain high Narrow window to address current capital structure — 1L and 2L debt becomes current in August 2019; 1L and 2L have a springing maturity in August 2020 — Senior Secured Notes due in February 2021 Meaningful EBITDA uplift required to arrive at 6.0x standalone leverage Debt and Preferred Equity Historical Cash Flow $mm 2017 2018 2 Operating Cash Flow 1 45 21 Cash Interest Expense (45) (41) 3 CapEx (9) (14) Operating Cash Flow less Interest less CapEx (9) (34) Cash and Cash Equivalents at 12/31 39 15 200 198 193 118 135 155 200 200 200 98 110 123 1 1 1 $617 $643 $672 0 100 200 300 400 500 600 700 800 12/31/2018 12/31/2019 12/31/2020 First Lien Second Lien Senior Secured Notes Preferred Stock Capital Leases EBITDA to Achieve 6.0x Leverage ($mm) $103 $107 $112 4 4, 5 $mm Sources: Capital IQ and Company filings as of March 17, 2019. 1. Represents Net Cash Used in Operating Activities excluding cash interest expense. 2. BioScrip drew down its $10 million Second Lien Delayed Draw Senior Secured Notes in June 2018. 3. Does not include $7.8 million of paid - in - kind interest capitalized as principal on Second Lien Note Facility. 4. Assumes First Lien and Second Lien remain outstanding at December 31, 2020. 5. Assumes Second Lien capitalizes all interest accrued.

BIOSCRIP, INC. INVESTOR PRESENTATION // 17 SIGNIFICANTLY IMPROVED PRO FORMA CAPITAL STRUCTURE Significant deleveraging No near - term maturities Lower cost of capital No preferred equity Covenant - lite Significant additional liquidity ABL revolver for additional capital flexibility Pro Forma Capitalization Key Highlights Pro Forma Capitalization Amount $150mm ABL Revolver - First Lien Term Loan 925 Second Lien 400 Total Debt $1,325 Credit Statistics Total First Lien Debt / PF Adj. EBITDA ~4x 1 Total Debt / PF Adj. EBITDA ~6x 1 1. Reflects Pro Forma Combined 2018 Credit Adj. EBITDA of $210mm.

90% 50% BioScrip 2018A Pro Forma Expected INVESTOR PRESENTATION // 18 IMPROVED ABILITY TO INVEST AND DELEVER Improved capital flexibility Increased ability to invest in and enhance patient experience Continued investment in quality management system (USP800) Fund growth initiatives Paydown debt 1. Reflects Adj. EBITDA of $45mm and actual cash interest costs of $41mm for 2018. 2. Reflects Pro Forma Combined 2018 Credit Adj. EBITDA of $210mm and $1,325mm of debt based on committed financing at time of tr ansaction announcement. % of Pro Forma Credit Adj. EBITDA Used for Debt Service Key Highlights ~ 1 ~ BioScrip 2018 1 Pro Forma Expected 2

INVESTOR PRESENTATION // 19 PRO FORMA COMBINED 2018 FINANCIAL SNAPSHOT 1. Includes identified run - rate cost synergies of ~$60mm. 2. Balances at December 31, 2018. $709 $1,942 $2,651 $45 $95 $200 1 $602 $514 Combined with Run - Rate Cost Synergies Revenue ($mm) Adj. EBITDA ($mm) The combined Company will be poised to grow revenue in - line with or faster than market growth, with EBITDA expected to grow faster than revenue Net Debt + Preferred 2

INVESTOR PRESENTATION // 20 THE POWER OF THE COMBINATION Leading home infusion platform with national reach and scale Right side of healthcare – independent, low cost care setting, patient centric Enhanced product and payor diversity Sizable and actionable synergies expected Improved capital structure and liquidity Limited risk of government rate reset, limited exposure to PBM Seasoned management team and Board of Directors x x x x x x x

BioPlus Acquisition (NASDAQ:BIOS)

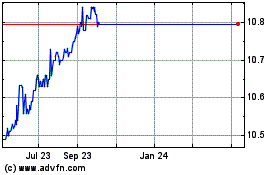

Historical Stock Chart

From Mar 2024 to Apr 2024

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024