BioCryst Pharmaceuticals, Inc. (Nasdaq:BCRX) today announced

financial results for the first quarter ended March 31, 2020, and

provided a corporate update.

“This is a transformational year for BioCryst as

we prepare to launch berotralstat in multiple territories to bring

our oral, once-daily prophylactic medicine to HAE patients, and

begin generating significant revenue,” said Jon Stonehouse,

president and chief executive officer of BioCryst.

“We are excited to see the clinical response in

treatment-naïve PNH patents at the 50 mg and 100 mg twice-daily

dose levels, and more than 98 percent suppression of complement in

both alternative pathway assays at the 200 mg and 400 mg

twice-daily levels in healthy volunteers,” said Dr. William

Sheridan, chief medical officer of BioCryst.

“This profile provides strong support for

BCX9930 as an oral monotherapy. We look forward to studying 200 mg

and 400 mg twice-daily in PNH patients and advancing this program

to treat multiple complement-mediated diseases,” Sheridan

added.

Program Updates and Key

Milestones

Hereditary Angioedema (HAE) Program –

Berotralstat (BCX7353): Oral, once-daily treatment for prevention

of HAE attacks

- BioCryst expects three regulatory

approvals for berotralstat in 2020 and early 2021. These timelines

remain on track.

- The U.S. Food and Drug Administration (FDA) is currently

reviewing a new drug application for berotralstat and has set an

action date of December 3, 2020, under the Prescription Drug User

Fee Act (PDUFA).

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA)

is reviewing a new drug application (JNDA) for berotralstat under

the Sakigake timeline, and the company expects approval in Japan in

the second half of 2020.

- On March 30, 2020, the company announced that the European

Medicines Agency (EMA) had validated its marketing authorization

application (MAA) submission for berotralstat and begun their

formal review of the MAA under the centralized procedure. An

opinion from the Committee for Medicinal Products for Human Use

(CHMP) is expected within approximately 12 months from MAA

validation.

- Ongoing commercial launch

preparations are on track in the U.S., EU and Japan. The

company does not expect delays due to

COVID-19.

- On May 5, 2020, the company

announced that the United States Patent and Trademark Office issued

a notice of allowance for a new composition of matter patent which

extends patent protection for berotralstat in the U.S. market by

four years through October 2039.

Complement Oral Factor D Inhibitor

Program – BCX9930

- Low dose cohort (50 mg and 100 mg

twice-daily) data in three treatment-naïve paroxysmal nocturnal

hemoglobinuria (PNH) patients who completed 28 days of therapy

shows BCX9930 inhibited complement and was safe and generally well

tolerated.

- Patients were severely ill with pre-treatment LDH from 3.7 to

11× the upper limit of normal (ULN) and low hemoglobin of 6.0 to

8.2 g/dL.

- All patients had dose-dependent reductions in LDH and increases

in hemoglobin.

- No drug-related serious adverse events were

observed.

- No PNH patients experienced rash.

- Based on the investigators’ assessment of clinical benefit, all

three patients continued on therapy with BCX9930 (100 mg

twice-daily) following the 28-day study window.

- With the recent enrollment of a

fourth patient with PNH, enrollment is now complete in

treatment-naïve cohort 1 (50 mg and 100 mg twice-daily).

Treatment-naïve cohort 2 (200 mg and 400 mg twice-daily) is

expected to begin enrollment upon completion of cohort 1, with data

expected in Q3 2020.

- The company plans to begin

enrolling PNH patients resistant to C5 inhibitors in Q3 2020 and

expects to report data from these treatment-resistant patients by

the end of 2020.

- Data from the 200 mg and 400 mg

twice-daily multiple ascending dose (MAD) cohorts in healthy

volunteers shows >98 percent suppression of the alternative

pathway beyond 12 hours and no dose-limiting adverse

events.

Given these data, the company expects to achieve

its goal of monotherapy for PNH patients in cohort 2 (200 mg and

400 mg

twice-daily). Additional

details can be found on slides, which can be accessed at the

Investors’ section of BioCryst’s website at

http://www.biocryst.com.

Coronavirus Antiviral Program –

Galidesivir (BCX4430)

- Patient dosing is underway in

Brazil in a randomized, double-blind, placebo-controlled clinical

trial to assess the safety, clinical impact and antiviral effects

of galidesivir in patients with COVID-19. The trial (NCT03891420)

is being funded by the National Institute of Allergy and Infectious

Diseases (NIAID), part of the National Institutes of Health.

- Part 1 of the trial is enrolling 24 hospitalized adults

diagnosed with moderate to severe COVID-19 confirmed by PCR. Three

cohorts of eight patients will be randomized to receive intravenous

(IV) galidesivir (n=6) or placebo (n=2) every 12 hours for seven

days. Upon completion of part 1 of the trial, an optimized dosing

regimen of galidesivir will be selected for part 2 of the trial,

based on part 1 results. In part 2 of the trial, up to 42

hospitalized patients with COVID-19 will be randomized 2:1 to

receive IV galidesivir or placebo.

- In vitro testing of galidesivir

against SARS-CoV-2, the virus that causes COVID-19, is underway.

Galidesivir has been shown to be active against more than 20 RNA

viruses in nine different families, including coronaviruses.

- The company also is working closely

with the government to increase the supply of galidesivir.

Additional Updates

- On April 2, 2020, the company

announced the appointment of Anthony Doyle as senior vice president

and chief financial officer.

- The company remains on track

to report data in 2H 2020 from its ongoing Phase 1 clinical trial

of BCX9250, an oral ALK-2 kinase inhibitor for treatment of

fibrodysplasia ossificans progressiva (FOP), in healthy

subjects.

First Quarter 2020 Financial

Results

For the three months ended March 31, 2020, total

revenues were $4.8 million, compared to $5.9 million in the first

quarter of 2019. The decrease was primarily due to reduced

peramivir product sales and lower royalty revenues, partially

offset by amortization of deferred revenue from the Torii

Pharmaceutical, Co. commercialization agreement.

Research and development (R&D) expenses for

the first quarter of 2020 increased to $29.9 million from

$27.5 million in the first quarter of 2019, primarily due to

due to increased spending on the company’s complement-mediated

diseases program and other preclinical development initiatives.

Selling, general and administrative (SG&A)

expenses for the first quarter of 2020 increased to $15.9 million,

compared to $6.2 million in the first quarter of 2019. The

increase was primarily due to increased spending on commercial

activities and medical affairs to support the U.S. commercial

launch of berotralstat in 2020 and contingent legal costs

associated with our Seqirus UK Limited (Seqirus) dispute.

Interest and other income were $6.4 million in

the first quarter of 2020, compared to $0.6 million in the first

quarter of 2019. The increase was primarily due to the partial

arbitration award related to our Seqirus dispute.

Interest expense was $3.0 million in the first

quarter of 2020, compared to $2.7 million in the first quarter

of 2019 and was associated with an increase in the outstanding

balance of the company’s secured credit facility in February 2019

and increased interest expense associated with the company’s

non-recourse notes payable.

Net loss for the first quarter of 2020 was

$37.6 million, or $0.24 per share, compared to a net loss of

$31.1 million, or $0.28 per share, for the first quarter of

2019.

Cash, cash equivalents and investments totaled

$114.6 million at March 31, 2020, and reflect a decrease from

$137.8 million at December 31, 2019. Operating cash use for the

first quarter of 2020 was $23.1 million.

Financial Outlook for

2020

BioCryst expects full year 2020 net operating

cash use to be in the range of $125 to $150 million, and its

operating expenses to be in the range of $135 to $160 million. The

company’s operating expense range excludes equity-based

compensation expense due to the difficulty in reliably projecting

this expense, as it is impacted by the volatility and price of the

company’s stock, as well as by the vesting of the company’s

outstanding performance-based stock options.

Conference Call and Webcast

BioCryst management will host a conference call

and webcast at 8:30 a.m. ET today to discuss the financial results

and provide a corporate update. The live call may be accessed by

dialing 877-303-8027 for domestic callers and 760-536-5165 for

international callers and using conference ID # 4679821. A live

webcast of the call and any slides will be available online at the

investors section of the company website at www.biocryst.com. A

telephone replay of the call will be available by dialing

855-859-2056 for domestic callers or 404-537-3406 for international

callers and entering the conference ID # 4679821.

About BioCryst

Pharmaceuticals

BioCryst Pharmaceuticals discovers novel, oral,

small-molecule medicines that treat rare diseases in which

significant unmet medical needs exist and an enzyme plays a key

role in the biological pathway of the disease. BioCryst has several

ongoing development programs including berotralstat (BCX7353), an

oral treatment for hereditary angioedema, BCX9930, an oral Factor D

inhibitor for the treatment of complement-mediated diseases,

galidesivir, a potential treatment for COVID-19, Marburg virus

disease and Yellow Fever, and BCX9250, an ALK-2 inhibitor for the

treatment of fibrodysplasia ossificans progressiva. RAPIVAB®

(peramivir injection), a viral neuraminidase inhibitor for the

treatment of influenza, is BioCryst's first approved product and

has received regulatory approval in the U.S., Canada, Australia,

Japan, Taiwan, Korea and the European Union. Post-marketing

commitments for RAPIVAB are ongoing. For more information, please

visit the Company's website at www.BioCryst.com.

Forward-Looking Statements

This press release contains forward-looking

statements, including statements regarding future results,

performance or achievements. These statements involve known and

unknown risks, uncertainties and other factors which may cause

BioCryst’s actual results, performance or achievements to be

materially different from any future results, performances or

achievements expressed or implied by the forward-looking

statements. These statements reflect our current views with respect

to future events and are based on assumptions and are subject to

risks and uncertainties. Given these uncertainties, you should not

place undue reliance on these forward-looking statements. Some of

the factors that could affect the forward-looking statements

contained herein include: that the ongoing COVID-19 pandemic could

create challenges in all aspects of our business, including without

limitation delays, stoppages, difficulties and increased expenses

with respect to our and our partners’ development, regulatory

processes and supply chains, could negatively impact our ability to

access the capital or credit markets to finance our operations, or

could have the effect of heightening many of the risks described

below or in the documents we file periodically with the Securities

and Exchange Commission; that developing any HAE product candidate

may take longer or may be more expensive than planned; that ongoing

and future preclinical and clinical development of BCX9930, BCX9250

and galidesivir may not have positive results; that BioCryst may

not be able to enroll the required number of subjects in planned

clinical trials of product candidates; that BioCryst may not

advance human clinical trials with product candidates as expected;

that the FDA, EMA, PMDA or other applicable regulatory agency may

require additional studies beyond the studies planned for product

candidates, or may not provide regulatory clearances which may

result in delay of planned clinical trials, or may impose a

clinical hold with respect to such product candidates, or withhold

market approval for product candidates; that actual financial

results may not be consistent with expectations, including that

2020 operating expenses and cash usage may not be within

management's expected ranges. Please refer to the documents

BioCryst files periodically with the Securities and Exchange

Commission, specifically BioCryst’s most recent Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on

Form 8-K, all of which identify important factors that could cause

the actual results to differ materially from those contained in

BioCryst’s projections and forward-looking statements.

BCRXW

Contact:John Bluth+1 919 859

7910jbluth@biocryst.com

| BIOCRYST

PHARMACEUTICALS, INC. |

| CONSOLIDATED

FINANCIAL SUMMARY |

| (in thousands,

except per share) |

|

|

|

|

|

|

|

Statements of Operations (Unaudited) |

|

|

|

|

| |

|

|

|

|

| |

Three Months

Ended |

| |

March 31, |

| |

|

2020 |

|

|

|

2019 |

|

|

Revenues: |

|

|

|

|

|

Product sales |

$ |

218 |

|

|

$ |

1,679 |

|

|

Royalty revenue |

|

1,945 |

|

|

|

2,322 |

|

|

Collaborative and other research and development |

|

2,660 |

|

|

|

1,886 |

|

| Total

revenues |

|

4,823 |

|

|

|

5,887 |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

Cost of product sales |

|

- |

|

|

|

1,399 |

|

|

Research and development |

|

29,867 |

|

|

|

27,493 |

|

|

Selling, general and administrative |

|

15,865 |

|

|

|

6,238 |

|

|

Royalty |

|

69 |

|

|

|

87 |

|

| Total

operating expenses |

|

45,801 |

|

|

|

35,217 |

|

|

|

|

|

|

|

| Loss from

operations |

|

(40,978 |

) |

|

|

(29,330 |

) |

|

|

|

|

|

|

| Interest and

other income |

|

6,446 |

|

|

|

596 |

|

| Interest

expense |

|

(3,047 |

) |

|

|

(2,726 |

) |

| (Loss) gain

on foreign currency derivative |

|

(20 |

) |

|

|

406 |

|

| |

|

|

|

|

| Net

loss |

$ |

(37,599 |

) |

|

$ |

(31,054 |

) |

|

|

|

|

|

|

| Basic and

diluted net loss per common share |

$ |

(0.24 |

) |

|

$ |

(0.28 |

) |

| |

|

|

|

|

| Weighted

average shares outstanding |

|

154,156 |

|

|

|

110,167 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data (in thousands) |

|

|

|

|

|

| |

March 31, 2020 |

|

December 31,

2019 |

| |

(Unaudited) |

|

(Note 1) |

|

Cash, cash equivalents and investments |

$ |

113,058 |

|

|

$ |

136,226 |

|

| Restricted

cash |

|

1,559 |

|

|

|

1,551 |

|

| Receivables

from collaborations |

|

5,642 |

|

|

|

22,146 |

|

| Total

assets |

|

136,589 |

|

|

|

175,282 |

|

| Non-recourse

notes payable |

|

29,671 |

|

|

|

29,561 |

|

| Senior

credit facility |

|

50,539 |

|

|

|

50,309 |

|

| Accumulated

deficit |

|

(878,227 |

) |

|

|

(840,628 |

) |

|

Stockholders’ equity |

|

3,648 |

|

|

|

38,252 |

|

| Shares of

common stock outstanding |

|

154,192 |

|

|

|

154,082 |

|

| |

|

|

|

|

|

|

Note 1: Derived from audited financial statements.

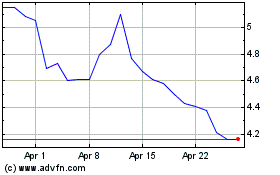

BioCryst Pharmaceuticals (NASDAQ:BCRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

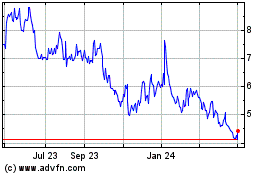

BioCryst Pharmaceuticals (NASDAQ:BCRX)

Historical Stock Chart

From Apr 2023 to Apr 2024