Current Report Filing (8-k)

December 22 2021 - 11:21AM

Edgar (US Regulatory)

0001213660

false

CN

0001213660

2021-12-20

2021-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): December

20, 2021

|

BIMI International Medical Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

001-34890

|

|

02-0563302

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

9th Floor, Building 2, Chongqing Corporation Avenue,

Yuzhong District, Chongqing, P. R. China

|

|

116000

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area

code: (8604) 1182209211

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value

|

|

BIMI

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 20, 2021,

the Company entered into a stock purchase agreement (the “Mali Hospital SPA”) to acquire Bengbu Mali OB-GYN Hospital Co.,

Ltd. (“Mali Hospital”), a private OB-GYN specialty hospital with 199 beds located in Bengbu city in the southeast region

of the People’s Republic of China.

Pursuant

to the Mali Hospital SPA, the Company will purchase all the issued and outstanding equity interests in Mali Hospital in consideration

of US$16,750,000. At the closing, $2,800,000 in cash and 3,000,000 shares of the Company’s common stock (the “Common Stock”)

valued at US$ 9,000,000, or $3.00 per share will be delivered as partial consideration for the purchase of Mali Hospital. The remainder

of the purchase price of 1,650,000 shares of Common Stock valued at US$4,950,000, or $3.00 per share (the “Earnout Amount”),

is subject to post-closing adjustments based on the performance of Mali Hospital in 2022 and 2023.

If the net profit of Mali

Hospital in 2022 equals or exceeds the net profit target, which is RMB 5,000,000 (approximately US $770,000), approximately 50% of the

Earnout Amount will be paid to the sellers or their designees by the issuance of 800,000 shares of Common Stock. If the net profit target

is not met, a reduced number of shares of Common Stock will be issuable based on the ratio of the actual net profit to the net profit

target. The sellers or their designees will receive about 50% (or a smaller portion) of the Earnout Amount (850,000 shares of Common

Stock), subject to Mali Hospital reaching a similar performance target in 2023.

The Mali Hospital SPA

also sets forth circumstances where the Company may elect, in its sole discretion, to pay the entire Earnout Amount to the sellers or

their designees on an earlier date if the 2022 net profit target is met or exceeded (the “Accelerated Earnout Payment”).

In the event an Accelerated Earnout Payment is made, the sellers will not be eligible to receive any additional payment under the Mali

Hospital SPA.

The closing of the Mali

Hospital SPA is expected to take place in January 2022, subject to necessary regulatory approvals.

The foregoing description

of the Mali Hospital SPA does not purport to be complete and is qualified in its entirety by reference to the Mali Hospital SPA, which

is filed as Exhibit 4.1 hereto, and is incorporated herein by reference.

Item 8.01 Other Events

On December 21, 2021,

the Company issued a press release announcing the entry into of the Mali Hospital SPA.

A copy of the press release

is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information under

this Item 8.01, including Exhibit 99.1, is deemed “furnished” and not “filed” under Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not

be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The information in this

Current Report on Form 8-K, including Exhibit 99.1, may contain forward-looking statements based on management’s current expectations

and projections, which are intended to qualify for the safe harbor of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The statements contained herein that are not historical facts are considered

“forward-looking statements.” Such forward-looking statements may be identified by, among other things, the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,” or “anticipates”

or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks and uncertainties.

In particular, statements regarding the efficacy of investment in research and development are examples of such forward-looking statements.

The forward-looking statements include risks and uncertainties, including, but not limited to, the effect of political, economic, and

market conditions and geopolitical events; legislative and regulatory changes that affect our business; the availability of funds and

working capital; the actions and initiatives of current and potential competitors; investor sentiment; and our reputation. The Company

not undertake any responsibility to publicly release any revisions to these forward-looking statements to take into account events or

circumstances that occur after the date of this report. The factors discussed herein are expressed from time to time in the Company’s

filings with the Securities and Exchange Commission available at http://www.sec.gov.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: December 21, 2021

|

BIMI International Medical Inc.

|

|

|

|

|

|

|

By:

|

/s/ Tiewei Song

|

|

|

Name:

|

Tiewei Song

|

|

|

Title:

|

Chief Executive Officer

|

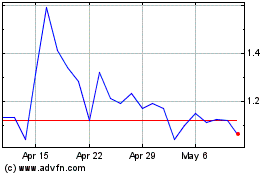

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

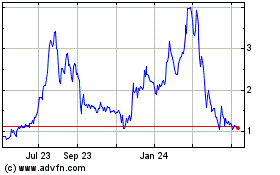

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Apr 2023 to Apr 2024