BIMI International Medical Inc. Announces Third Quarter 2021 Financial Results

November 15 2021 - 4:30PM

BIMI International Medical Inc. (NASDAQ: BIMI) (“BIMI” or the

“Company”), a leading healthcare products and services provider,

today announced its unaudited financial results for the third

quarter ended September 30, 2021.

Third Quarter 2021

Highlights:

- Revenues. Revenues for the three months ended

September 30, 2021 increased to $13,777,494 from $3,091,071 in the

comparable period in 2020, an increase of $10,686,423, or

345.7%.

- Gross profit. Gross profit

for the three months ended September 30, 2021 increased to

$2,029,109 from $257,278 in the comparable period in 2020, an

increase of $1,771,831, or 688.7%.

“We are glad to achieve significant revenue

growth in the third quarter. The growth was mainly driven by the

increase in sales of wholesale pharmaceuticals. Contributing to the

increase in revenues for the three months ended September 30, 2021,

was the operations of our recently-acquired five hospitals”, said

Mr. Tiewei Song, Chief Executive Officer and President of BIMI

International Medical Inc. “Looking ahead, we plan to form

partnerships with hospitals with regional reputations, with the

goal of making quality medical care more accessible to the wider

public, especially in less- developed areas, and to provide health

management and healthcare services for both urban and rural

residents in a more inclusive and coherent manner.”

Three and Nine Month Financial

Results

- Revenues. Revenues for the three months ended

September 30, 2021 and 2020 were $13,777,494 and $3,091,071,

respectively. Compared with the three months ended September 30,

2020, revenues increased by $10,686,423 in 2021. Revenues for the

nine months ended September 30, 2021 and 2020 were $25,202,485 and

$7,317,449, respectively. Compared with the same period in 2020,

revenues increased by $17,885,036 in 2021.Wholesale pharmaceuticals

segment. Revenues from the wholesale pharmaceuticals segment for

the three months ended September 30, 2021 and 2020 were $8,483,024

and $2,368,785, respectively. Revenues from the wholesale

pharmaceuticals segment for the nine months ended September 30,

2021 and 2020 were $14,978,955 and $4,698,985,

respectively.Wholesale medical devices segment. Revenues from the

wholesale medical devices segment for the three months ended

September 30, 2021 and 2020 were $1,608,584 and $669,276,

respectively. Revenues from the wholesale medical devices segment

for the nine months ended September 30, 2021 and 2020 was

$2,524,777 and 2,567,029, respectively.Medical services segment.

Revenues from the recently formed medical services segment for the

three months ended September 30,2021 were $2,961,536. Revenue from

the medical services segment for the nine months ended September

30, 2021 were $6,694,510.Retail pharmacy segment. Revenues from the

retail pharmacy segment for the three and nine months ended

September 30, 2021 were $133,815 and $375,045, respectively, which

were generated from 5 retail pharmacy stores in Chongqing. Revenues

from the retail pharmacy segment for the three and nine months

ended September 30, 2020, which related to stores in Dalian, were

negligible.

- Cost of revenues.

Cost of revenues for the three months ended September 30, 2021 and

2020 were $11,748,385 and $2,833,793, respectively. Cost of

revenues for the nine months ended September 30, 2021 and 2020 were

$20,616,279 and $6,240,962, respectively.Wholesale pharmaceuticals

segment. For the three months ended September 30, 2021 and 2020,

the cost of revenues of our wholesale pharmaceuticals segment were

$8,835,440 and $2,010,319, respectively. For the nine months ended

September 30, 2021 and 2020, the cost of revenues of our wholesale

pharmaceuticals segment were $14,598,512 and $3,759,707,

respectively.Wholesale medical devices segment. For the three

months ended September 30, 2021 and 2020, the cost of revenues of

our wholesale medical devices segment were $1,133,768 and $572,886,

respectively. For the nine months ended September 30, 2021 and

2020, the cost of revenues of the wholesale medical devices segment

were $1,831,089 and $2,051,563, respectively.Medical services

segment. For the three and nine months ended September 30, 2021,

the cost of revenues of the recently acquired medical services

segment were $1,240,773 and $3,334,306, respectively.Retail

pharmacy segment. For the three and nine months ended September 30,

2021, the cost of revenues of our retail pharmacy segment were

$99,477 and $295,059, respectively. For the three and nine months

ended September 30, 2020, the cost of revenues of our retail

pharmacy operations in Dalian were $227,883 and $426,293,

respectively, including an inventory impairment charge of $68,600

that resulted from the expiration of a large portion of our

products because of the local lockdown.

- Gross

margin. For the three months ended September 30, 2021 and

2020, BIMI had gross margins of 14.7% and 8.3%, respectively. For

the three months ended September 30, 2021 and 2020, the gross

profit margin of our: (i) wholesale pharmaceuticals segment were

(4.2%) and 15.1%, respectively; (ii) wholesale medical devices

segment were 29.5% and 14.4%, respectively; (iii) medical services

segment was 58.1% in 2021; and (iv) retail pharmacy segment was

25.7% in 2021.For the nine months ended September 30, 2021 and

2020, BIMI had gross margins of 18.0% and 14.7%, respectively. For

the nine months ended September 30, 2021 and 2020, the gross profit

margin of our: (i) wholesale pharmaceuticals segments were 2.5% and

20.0%, respectively; (ii) wholesale medical devices segment were

27.5% and 20.1%, respectively; (iii) medical services segment was

50.2% in 2021; and (iv) retail pharmacy segment was 21.3% in

2021.

- Operating

expenses. Operating expenses were $3,574,443 for the three

months ended September 30, 2021 as compared to $1,689,962 for the

same period in 2020, an increase of $1,884,481, or 111.5%.

Operating expenses were $ 9,522,372 for the nine months ended

September 30, 2021 as compared to $6,583,685 for the same period in

2020, an increase of $2,938,687, or 44.6%.Wholesale pharmaceuticals

segment. Operating expenses of the wholesale pharmaceuticals

segment for the three months ended September 30, 2021 and 2020 were

$269,425 and $33,419, respectively. Operating expenses of the

wholesale pharmaceuticals segment for the nine months ended

September 30, 2021 and 2020 were $750,023 and $497,103,

respectively.Wholesale medical devices segment. Operating expenses

of the wholesale medical devices segment for the three and nine

months ended September 30, 2021 were $243,117 and $469,644,

respectively. Operating expenses of the wholesale medical devices

segment for the three months and nine months ended September 30,

2020 were $435 and $15,293, respectively.Medical services segment.

Operating expenses of medical services segment for the three and

nine months ended September 30, 2021 were $1,136,316 and

$2,377,996, respectively.Retail pharmacy segment. Operating

expenses of the retail pharmacy segment for the three and nine

months ended September 30, 2021 were $159,988 and $547,159,

respectively. Operating expenses of the retail pharmacy segment for

the three and nine months ended September 30, 2020 were $1,391,910

and $2,043,438, respectively.

- Other income

(expenses). For three months ended September 30,

2021, BIMI had $158,612 of other expenses, net that included

$74,302 of other expenses and $84,310 of interest expenses. For the

nine months ended September 30, 2021, BIMI had $302,142 of other

expenses, net that included $79,595 of other expenses and $222,547

of interest expenses. For the three months ended September 30,

2020, BIMI reported other income of $5,247 and other interest

expense of $339,780. For the nine months ended September 30, 2020,

BIMI reported other income of $6,973,409 and other interest expense

of $717,226. Other income in both periods includes the gain

generated from the disposal of the NF Group.

- Net

income (loss). As a result of the

foregoing, our net loss was $1,709,876 and $5,276,241 for the three

and nine months ended September 30, 2021. For the three and nine

months ended September 30, 2020, BIMI had a net loss of $1,860,573

and net income of $ 611,090, respectively.

- Cash and working

capital. At September 30, 2021, BIMI had cash of $209,803

and working capital of $2.12 million as compared to cash of

$135,309 and working capital of $9,619,274 at December 31,

2020.

The unaudited condensed consolidated financial

statements included in the quarterly report on Form 10-Q of the

Company that was filed on November 15, 2021 have been prepared

assuming that the Company will continue as a going concern, which

contemplates the realization of assets and the discharge of

liabilities in the normal course of business for the foreseeable

future. The continuation of the Company as a going concern through

the next twelve months is dependent upon (1) the continued

financial support from its stockholders or external financing, and

(2) further implementation of management’s business plan to extend

its operations and generate sufficient revenues and cash flow to

meet its obligations. Management believes that the actions

presently being taken to obtain additional funding and implement

its strategic plan provide the opportunity for the Company to

continue as a going concern.

About BIMI International Medical Inc.

The Company is now exclusively a healthcare products and

services provider, offering a broad range of healthcare products

and related services and operates five private hospitals in China.

For more information, please visit www.usbimi.com.

Safe Harbor StatementCertain matters discussed in this news

release are forward-looking statements that involve a number of

risks and uncertainties including, but not limited to, the

Company’s ability to achieve profitable operations, its ability to

continue to operate as a going concern, its ability to continue to

meet NASDAQ continued listing requirements, the effects of the

spread of COVID-19, the demand for the Company’s products and

services in the People’s Republic of China, general economic

conditions and other risk factors detailed in the Company’s annual

report and other filings with the United States Securities and

Exchange Commission.

IR Contact:Dragon Gate Investment Partners LLC Tel:

+1(646)-801-2803Email: BIMI@dgipl.com

BIMI INTERNATIONAL MEDICAL, INC. AND ITS

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

September 30, 2021 |

|

|

December 31,2020 |

|

|

ASSETS |

|

Unaudited |

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

Cash |

|

$ |

209,803 |

|

|

$ |

135,309 |

|

|

Restricted Cash |

|

|

4,641 |

|

|

|

- |

|

|

Accounts receivable, net |

|

|

11,621,052 |

|

|

|

6,686,552 |

|

|

Advances to suppliers |

|

|

4,387,191 |

|

|

|

2,693,325 |

|

|

Amount due from related parties |

|

|

441,301 |

|

|

|

- |

|

|

Inventories |

|

|

2,117,486 |

|

|

|

735,351 |

|

|

Prepayments and other receivables |

|

|

7,521,587 |

|

|

|

14,880,526 |

|

|

Operating lease-right of use assets-current |

|

|

- |

|

|

|

53,425 |

|

|

Total current assets |

|

|

26,303,061 |

|

|

|

25,184,488 |

|

| NON-CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Deferred tax assets |

|

|

204,181 |

|

|

|

193,211 |

|

|

Property, plant and equipment, net |

|

|

2,517,863 |

|

|

|

910,208 |

|

|

Intangible assets, net |

|

|

17,734 |

|

|

|

- |

|

|

Operating lease-right of use assets |

|

|

3,593,297 |

|

|

|

- |

|

|

Goodwill |

|

|

30,442,738 |

|

|

|

6,914,232 |

|

| |

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

|

36,775,813 |

|

|

|

8,017,651 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

63,078,874 |

|

|

$ |

33,202,139 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Short-term loans |

|

$ |

1,143,183 |

|

|

$ |

904,228 |

|

|

Long-term loans due within one year |

|

|

- |

|

|

|

34,201 |

|

|

Convertible promissory notes, net |

|

|

4,831,736 |

|

|

|

3,328,447 |

|

|

Accounts payable, trade |

|

|

13,469,931 |

|

|

|

5,852,050 |

|

|

Advances from customers |

|

|

392,485 |

|

|

|

194,086 |

|

|

Amount due to related parties |

|

|

839,473 |

|

|

|

226,514 |

|

|

Taxes payable |

|

|

665,405 |

|

|

|

773,649 |

|

|

Other payables and accrued liabilities |

|

|

2,142,202 |

|

|

|

4,228,976 |

|

|

Lease liabilities-current |

|

|

702,789 |

|

|

|

23,063 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

24,187,204 |

|

|

|

15,565,214 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term loans – non-current portion |

|

|

794,538 |

|

|

|

720,997 |

|

|

Lease liabilities -non-current |

|

|

3,308,881 |

|

|

|

22,457 |

|

| TOTAL LIABILITIES |

|

$ |

28,290,623 |

|

|

|

16,308,668 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized;

32,423,350 and 13,254,587 shares issued and outstanding as of

September 30, 2021 and December 31, 2020, respectively |

|

|

32,423 |

|

|

|

13,254 |

|

|

Additional paid-in capital |

|

|

49,580,126 |

|

|

|

26,344,920 |

|

|

Statutory reserves |

|

|

2,263,857 |

|

|

|

2,263,857 |

|

|

Accumulated deficits |

|

|

(18,227,631 |

) |

|

|

(12,914,973 |

) |

|

Accumulated other comprehensive income |

|

|

880,807 |

|

|

|

1,003,392 |

|

| |

|

|

|

|

|

|

|

|

|

Total BIMI International Medical Inc.’s equity |

|

|

34,529,582 |

|

|

|

16,710,450 |

|

| |

|

|

|

|

|

|

|

|

|

NONCONTROLLING INTERESTS |

|

|

258,669 |

|

|

|

183,021 |

|

| |

|

|

|

|

|

|

|

|

|

Total equity |

|

|

34,788,251 |

|

|

|

16,893,471 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

63,078,874 |

|

|

|

33,202,139 |

|

The accompanying notes are an integral part of

the condensed consolidated financial statements

BIMI INTERNATIONAL MEDICAL, INC. AND ITS

SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE

INCOME(UNAUDITED)

|

|

|

For the three months endedSeptember

30 |

|

|

For the nine months ended September

30 |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES |

|

$ |

13,777,494 |

|

|

$ |

3,091,071 |

|

|

|

25,202,485 |

|

|

$ |

7,317,449 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF

REVENUES |

|

|

11,748,385 |

|

|

|

2,833,793 |

|

|

|

20,616,279 |

|

|

|

6,240,962 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS

PROFIT |

|

|

2,029,109 |

|

|

|

257,278 |

|

|

|

4,586,206 |

|

|

|

1,076,487 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

|

|

1,202,387 |

|

|

|

377,977 |

|

|

|

2,429,401 |

|

|

|

1,028,746 |

|

| General and

administrative |

|

|

2,372,056 |

|

|

|

1,311,985 |

|

|

|

7,092,971 |

|

|

|

5,554,939 |

|

| Total operating expenses |

|

|

3,574,443 |

|

|

|

1,689,962 |

|

|

|

9,522,372 |

|

|

|

6,583,685 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM

OPERATIONS |

|

|

(1,545,334 |

) |

|

|

(1,432,684 |

) |

|

|

(4,936,166 |

) |

|

|

(5,507,198 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME

(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(84,310 |

) |

|

|

(339,780 |

) |

|

|

(222,547 |

) |

|

|

(717,226 |

) |

| Other income (expense) |

|

|

(74,302 |

) |

|

|

5,247 |

|

|

|

(79,595 |

) |

|

|

6,973,409 |

|

| Total other income (expense),

net |

|

|

(158,612 |

) |

|

|

(334,533 |

) |

|

|

(302,142 |

) |

|

|

6,256,183 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) BEFORE

INCOME TAXES |

|

|

(1,703,946 |

) |

|

|

(1,767,217 |

) |

|

|

(5,238,308 |

) |

|

|

748,985 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROVISION FOR INCOME

TAXES |

|

|

5,930 |

|

|

|

93,356 |

|

|

|

37,933 |

|

|

|

137,895 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME

(LOSS) |

|

|

(1,709,876 |

) |

|

|

(1,860,573 |

) |

|

|

(5,276,241 |

) |

|

|

611,090 |

|

| Less: net income (loss)

attributable to non-controlling interest |

|

|

(6,444 |

) |

|

|

49,374 |

|

|

|

36,417 |

|

|

|

75,648 |

|

| NET INCOME (LOSS)

ATTRIBUTABLE TO BIMI INTERNATIONAL MEDICAL INC. |

|

$ |

(1,703,432 |

) |

|

$ |

(1,909,947 |

) |

|

$ |

(5,312,658 |

) |

|

$ |

535,442 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE

INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustment |

|

|

(128,005 |

) |

|

|

(108,236 |

) |

|

|

(126,893 |

) |

|

|

34,802 |

|

| TOTAL COMPREHENSIVE INCOME

(LOSS) |

|

|

(1,837,881 |

) |

|

|

(1,968,809 |

) |

|

|

(5,403,134 |

) |

|

|

645,892 |

|

| Less: comprehensive income

(loss) attributable to noncontrolling interest |

|

|

(6,400 |

) |

|

|

1,193 |

|

|

|

(6,345 |

) |

|

|

(1,408 |

) |

| COMPREHENSIVE INCOME (LOSS)

ATTRIBUTABLE TO BIMI INTERNATIONAL MEDICAL INC. |

|

|

(1,831,481 |

) |

|

|

(1,970,002 |

) |

|

|

(5,396,789 |

) |

|

$ |

647,300 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF

COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

27,084,325 |

|

|

|

10,505,821 |

|

|

|

22,864,269 |

|

|

|

9,987,848 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) - basic and

diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.23 |

) |

|

$ |

0.05 |

|

The accompanying notes are an integral part of

the consolidated financial statements

BIMI INTERNATIONAL MEDICAL, INC. AND ITS

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(UNAUDITED)

|

|

|

For the nine months endedSeptember

30 |

|

|

|

|

2021 |

|

|

2020 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(5,276,241 |

) |

|

$ |

611,090 |

|

|

Adjustments to reconcile net income (loss) to cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

179,147 |

|

|

|

810,264 |

|

|

Profit on disposal of NF Group |

|

|

- |

|

|

|

(6,944,469 |

) |

|

Stock compensation |

|

|

585,000 |

|

|

|

- |

|

|

Allowance for doubtful accounts |

|

|

94,037 |

|

|

|

(263,260 |

) |

|

Amortization of discount of convertible promissory notes |

|

|

1,473,306 |

|

|

|

1,950,901 |

|

|

Change in derivative liabilities |

|

|

- |

|

|

|

43,224 |

|

|

Allowance for inventory provision |

|

|

35,013 |

|

|

|

390,923 |

|

|

Impairment loss of intangible assets |

|

|

- |

|

|

|

903,573 |

|

|

Change in operating assets and liabilities |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(5,028,537 |

) |

|

|

(1,284,400 |

) |

|

Advances to suppliers |

|

|

(1,693,866 |

) |

|

|

418,847 |

|

|

Inventories |

|

|

(1,417,149 |

) |

|

|

(2,928,419 |

) |

|

Prepayments and other receivables |

|

|

2,464,793 |

|

|

|

(1,245,981 |

) |

|

Operating lease-right of use assets |

|

|

(3,539,872 |

) |

|

|

- |

|

|

Accounts payable, trade |

|

|

7,617,880 |

|

|

|

4,844,674 |

|

|

Advances from customers |

|

|

198,399 |

|

|

|

(707,586 |

) |

|

Taxes payable |

|

|

(119,214 |

) |

|

|

(9,368 |

) |

|

Operating lease liabilities |

|

|

3,966,150 |

|

|

|

- |

|

|

Other payables and accrued liabilities |

|

|

(2,086,772 |

) |

|

|

594,793 |

|

|

Net cash used in operating activities |

|

|

(2,547,926 |

) |

|

|

(2,815,194 |

) |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Cash received from acquisition of Guanzan Group |

|

|

- |

|

|

|

95,220 |

|

|

Cash received from sale of NF Group |

|

|

- |

|

|

|

10,375,444 |

|

|

Purchase of property, plant and equipment |

|

|

(1,804,536 |

) |

|

|

(121,176 |

) |

|

Net cash provided by (used in) investing activities |

|

|

(1,804,536 |

) |

|

|

10,349,488 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Repayment of short-term loans |

|

|

(34,201 |

) |

|

|

(65,516 |

) |

|

Repayment of long-term loans |

|

|

- |

|

|

|

(48,164 |

) |

|

Net proceeds from issuance of convertible promissory notes |

|

|

4,065,000 |

|

|

|

3,457,325 |

|

|

Proceeds from long-term loan |

|

|

73,541 |

|

|

|

- |

|

|

Proceeds from short-term loans |

|

|

238,955 |

|

|

|

27,371 |

|

|

Amount financed from related parties |

|

|

171,657 |

|

|

|

173,547 |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

4,514,952 |

|

|

|

3,544,563 |

|

|

|

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE ON CASH |

|

|

(83,355 |

) |

|

|

471,155 |

|

|

|

|

|

|

|

|

|

|

|

|

INCREASE IN CASH |

|

|

79,135 |

|

|

|

11,550,012 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS, beginning of period |

|

|

135,309 |

|

|

|

36,674 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS, end of period |

|

|

214,444 |

|

|

$ |

11,586,686 |

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

|

Cash paid for income tax |

|

$ |

49,037 |

|

|

$ |

42,130 |

|

|

Cash paid for interest expense, net of capitalized interest |

|

$ |

128,973 |

|

|

$ |

62,636 |

|

|

|

|

|

|

|

|

|

|

|

|

NON-CASH TRANSACTIONS OF INVESTING AND FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Issuance of shares of common stock for the equity acquisition of

Chongqing Guanzan Technology Co., Ltd. |

|

$ |

3,818,000 |

|

|

$ |

2,717,000 |

|

|

Issuance of shares of common stock for equity acquisition of

Zhongshan Chaohu Hospital |

|

$ |

3,480,000 |

|

|

$ |

- |

|

|

Issuance of shares of common stock for equity acquisition of

Guoyitang Hospital |

|

$ |

3,820,000 |

|

|

$ |

- |

|

|

Issuance of shares of common stock for equity acquisition of

Minkang, Qiangsheng and Eurasia hospitals |

|

$ |

5,930,619 |

|

|

$ |

- |

|

|

Issuance of shares of common stock for prepayment of equity

acquisition of Zhuoda |

|

|

1,452,000 |

|

|

|

- |

|

|

Issuance of shares of common stock for payment of

improvements to offices |

|

$ |

696,896 |

|

|

|

- |

|

|

Goodwill recognized from equity acquisition of Zhongshan Chaohu

Hospital |

|

$ |

10,443,494 |

|

|

$ |

- |

|

|

Goodwill recognized from equity acquisition of Guoyitang

Hospital |

|

$ |

7,154,392 |

|

|

$ |

- |

|

|

Goodwill recognized from equity acquisition of Minkang, Qiangsheng

and Eurasia hospitals |

|

$ |

5,930,619 |

|

|

$ |

- |

|

|

Intangible assets recognized from equity acquisition

of Boqi Group |

|

$ |

- |

|

|

$ |

6,443,170 |

|

|

Outstanding payment for the equity acquisition of Chongqing Guanzan

Technology Co., Ltd. |

|

$ |

- |

|

|

$ |

4,414,119 |

|

|

Outstanding payment for equity acquisition of Zhongshan Chaohu

Hospital |

|

$ |

6,100,723 |

|

|

$ |

- |

|

|

Outstanding payment for equity acquisition of Guoyitang

Hospital |

|

$ |

6,100,723 |

|

|

$ |

- |

|

|

Outstanding payment for equity acquisition of Minkang, Qiangsheng

and Eurasia hospitals |

|

$ |

9,911,416 |

|

|

$ |

- |

|

|

Common stock to be issued upon conversion of convertible promissory

notes |

|

$ |

679 |

|

|

$ |

5,160,473 |

|

The accompanying notes are an integral part of

the consolidated financial statements

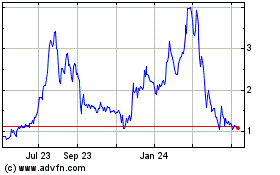

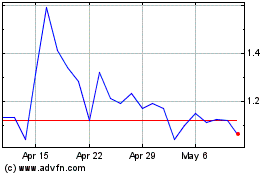

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Apr 2023 to Apr 2024