Big 5 Sporting Goods Corporation (NASDAQ: BGFV) (the “Company”), a

leading sporting goods retailer, today reported financial results

for the fiscal 2019 second quarter ended June 30, 2019.

Net sales for the fiscal 2019 second quarter

were $241.0 million compared to net sales of $240.0 million for the

second quarter of fiscal 2018. Same store sales increased

0.7% for the second quarter of fiscal 2019. Net and same

store sales comparisons year-over-year reflect a small negative

impact as a result of the calendar shift of the Easter holiday,

when the Company’s stores are closed, into the second quarter of

fiscal 2019 from the first quarter of fiscal 2018.

Gross profit for the fiscal 2019 second quarter

was $73.1 million compared to $75.3 million in the second quarter

of the prior year. The Company’s gross profit margin was

30.3% in the fiscal 2019 second quarter versus 31.4% in the second

quarter of the prior year. The reduction in gross profit

margin reflected lower merchandise margins, which contracted 80

basis points primarily due to a shift in sales mix, as well as

lower distribution costs capitalized into inventory.

Selling and administrative expense as a

percentage of net sales was 30.0% in the fiscal 2019 second quarter

versus 31.1% in the second quarter of the prior year. Overall

selling and administrative expense for the quarter decreased by

$2.5 million from the prior year mainly due to a favorable

settlement related to the termination of a software contract and

lower print advertising expense and employee benefit-related costs,

partially offset by higher employee labor expense.

Net income for the second quarter of fiscal 2019

was $28,000, or $0.00 per diluted share, including a $0.03 per

diluted share net benefit primarily related to the favorable

settlement of a software contract termination. This compared

to net loss for the second quarter of fiscal 2018 of $0.2 million,

or $0.01 per share.

For the 26-week period ended June 30, 2019, net

sales were $486.3 million compared to net sales of $474.1 million

in the first 26 weeks of last year. Same store sales

increased 2.7% in the first half of fiscal 2019 versus the

comparable period last year. Net income for the first 26

weeks of fiscal 2019 was $1.7 million, or $0.08 per diluted share,

including the $0.03 per diluted share benefit for the software

contract termination and a $0.02 per diluted share charge for the

write-off of deferred tax assets, compared to a net loss for the

first 26 weeks of fiscal 2018 of $1.6 million, or $0.07 per share,

including a $0.01 per share charge for the write-off of deferred

tax assets.

The Company’s revolving credit borrowings were

$62.4 million as of the end of the fiscal 2019 second quarter,

which reflects a reduction in borrowings of $28.2 million, or 31%,

versus the same period in the prior year. The Company’s

merchandise inventories declined 7.5% on a per-store basis as of

the end of the second quarter compared to the prior year

period. The resulting working capital improvements in

inventory and accounts payable, as well as higher net income,

combined to provide $5.6 million in operating cash flow in the

fiscal 2019 year-to-date period, versus a $21.9 million use of cash

in the comparable prior year period.

“We are pleased to achieve our third consecutive

quarter of same store sales growth and deliver earnings exceeding

the top range of our guidance,” said Steven G. Miller, the

Company’s Chairman, President and Chief Executive Officer.

“We had a strong finish to the quarter, benefitting from increased

traffic in California in June in advance of new ammunition

legislation that took effect in July. This allowed us to

overcome the negative impact of the Easter holiday shift and a

significantly cooler than normal start to summer, which impacted

sales of summer products. With our sales performance and

continued focus on prudently managing our inventory levels and

expense structure, we delivered positive cash flow for the quarter,

allowing us to further reduce our borrowings on a year-over-year

basis and strengthen our balance sheet.”

Mr. Miller continued, “For the third quarter to

date, our sales are running down in the low single-digit range

versus the prior year, as the start to the quarter has been

impacted by continued softness in summer-related product sales,

given the slow start to summer weather, particularly in the Pacific

Northwest. We have been comping against relatively strong

sales that were driven by favorable weather during the same period

last year, but we are encouraged by the trending of a number of

core product categories. Looking forward, our sales

comparisons will ease over the balance of the quarter and we

believe that our merchandise assortment is well positioned to drive

upside over the period.”

Quarterly Cash Dividend The

Company's Board of Directors has declared a quarterly cash dividend

of $0.05 per share of outstanding common stock, which will be paid

on September 13, 2019 to stockholders of record as of August 30,

2019.

GuidanceFor the fiscal 2019 third quarter, the

Company expects same store sales to be in the flat to positive low

single-digit range and earnings per diluted share to be in the

range of $0.15 to $0.23, compared to a same store sales decrease of

2.0% and earnings per diluted share of $0.15 in the third quarter

of fiscal 2018. The Company’s fiscal 2019 third quarter

earnings guidance reflects an anticipated increase in merchandise

margins over the prior year period.

Store OpeningsDuring the second

quarter of fiscal 2019, the Company opened one store and for the

fiscal 2019 full year the Company currently anticipates opening

approximately four new stores and closing approximately five

stores.

Conference Call InformationThe

Company will host a conference call and audio webcast today, July

30, 2019, at 2:00 p.m. Pacific (5:00 p.m. ET), to discuss financial

results for the second quarter of fiscal 2019. To access the

conference call, participants in North America should dial (877)

407-9039, and international participants should dial (201)

689-8470. Participants are encouraged to dial in to the

conference call ten minutes prior to the scheduled start

time. The call will also be broadcast live over the Internet

and accessible through the Investor Relations section of the

Company’s website at www.big5sportinggoods.com. Visitors to

the website should select the “Investor Relations” link to access

the webcast. The webcast will be archived and accessible on

the same website for 30 days following the call. A telephone

replay will be available through August 6, 2019 by calling (844)

512-2921 to access the playback; passcode is 13692866.

About Big 5 Sporting Goods CorporationBig 5 is

a leading sporting goods retailer in the western United States,

operating 434 stores under the “Big 5 Sporting Goods” name as of

the fiscal quarter ended June 30, 2019. Big 5 provides a

full-line product offering in a traditional sporting goods store

format that averages 11,000 square feet. Big 5’s product mix

includes athletic shoes, apparel and accessories, as well as a

broad selection of outdoor and athletic equipment for team sports,

fitness, camping, hunting, fishing, tennis, golf, winter and summer

recreation and roller sports.

Except for historical information contained

herein, the statements in this release are forward-looking and made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

known and unknown risks and uncertainties and other factors that

may cause Big 5’s actual results in current or future periods to

differ materially from forecasted results. These risks and

uncertainties include, among other things, changes in the consumer

spending environment, fluctuations in consumer holiday spending

patterns, increased competition from e-commerce retailers, breach

of data security or other unauthorized disclosure of sensitive

personal or confidential information, the competitive environment

in the sporting goods industry in general and in Big 5’s specific

market areas, inflation, product availability and growth

opportunities, changes in the current market for (or regulation of)

firearm-related products, disruption in product flow, seasonal

fluctuations, weather conditions, changes in cost of goods,

operating expense fluctuations, increases in labor and

benefit-related expense, changes in laws or regulations, including

those related to tariffs and duties, lower than expected

profitability of Big 5’s e-commerce platform or cannibalization of

sales from Big 5’s existing store base which could occur as a

result of operating the e-commerce platform, litigation risks,

stockholder campaigns and proxy contests, risks related to Big 5’s

leveraged financial condition, changes in interest rates, credit

availability, higher expense associated with sources of credit

resulting from uncertainty in financial markets and economic

conditions in general. Those and other risks and uncertainties are

more fully described in Big 5’s filings with the Securities and

Exchange Commission, including its Annual Reports on Form 10-K and

Quarterly Reports on Form 10-Q. Big 5 conducts its business in a

highly competitive and rapidly changing environment. Accordingly,

new risk factors may arise. It is not possible for management to

predict all such risk factors, nor to assess the impact of all such

risk factors on Big 5’s business or the extent to which any

individual risk factor, or combination of factors, may cause

results to differ materially from those contained in any

forward-looking statement. Big 5 undertakes no obligation to revise

or update any forward-looking statement that may be made from time

to time by it or on its behalf.

FINANCIAL TABLES FOLLOW

| |

|

|

|

|

|

|

|

BIG 5 SPORTING GOODS CORPORATION |

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

(Unaudited) |

|

|

|

(In thousands, except share amounts) |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

June 30, 2019 |

|

December 30, 2018 |

|

|

|

ASSETS |

|

|

| |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash |

$ |

6,594 |

|

$ |

6,765 |

|

|

|

| Accounts receivable,

net of allowances of $41 and $28, respectively |

|

13,728 |

|

|

14,184 |

|

|

|

| Merchandise

inventories, net |

|

318,604 |

|

|

294,900 |

|

|

|

| Prepaid expenses |

|

9,746 |

|

|

9,224 |

|

|

|

|

Total current assets |

|

348,672 |

|

|

325,073 |

|

|

|

| |

|

|

|

|

|

|

|

Operating lease right-of-use assets, net |

|

262,288 |

|

|

— |

|

|

|

|

Property and equipment, net |

|

71,617 |

|

|

76,488 |

|

|

|

| Deferred income taxes |

|

13,841 |

|

|

14,543 |

|

|

|

| Other assets, net of

accumulated amortization of $1,902 and $1,772, respectively |

|

3,446 |

|

|

3,457 |

|

|

|

|

Total assets |

$ |

699,864 |

|

$ |

419,561 |

|

|

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

| |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

| Accounts payable |

$ |

114,964 |

|

$ |

80,613 |

|

|

|

| Accrued expenses |

|

58,053 |

|

|

67,659 |

|

|

|

| Current portion of

operating lease liabilities |

|

61,352 |

|

|

— |

|

|

|

| Current portion of

finance lease liabilities |

|

2,151 |

|

|

2,322 |

|

|

|

|

Total current liabilities |

|

236,520 |

|

|

150,594 |

|

|

|

| |

|

|

|

|

|

|

| Operating lease liabilities,

less current portion |

|

213,180 |

|

|

— |

|

|

|

| Finance lease liabilities,

less current portion |

|

4,375 |

|

|

4,823 |

|

|

|

| Long-term debt |

|

62,437 |

|

|

65,000 |

|

|

|

| Deferred rent, less current

portion |

|

— |

|

|

14,615 |

|

|

|

| Other long-term

liabilities |

|

8,485 |

|

|

9,668 |

|

|

|

|

Total liabilities |

|

524,997 |

|

|

244,700 |

|

|

|

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

| Common stock, $0.01 par

value, authorized 50,000,000 shares; issued 25,334,814 and |

|

|

|

|

|

|

|

25,074,307 shares, respectively; outstanding 21,684,601 and

21,424,094 shares, respectively |

253 |

|

|

250 |

|

|

|

| Additional paid-in

capital |

|

119,145 |

|

|

118,351 |

|

|

|

| Retained earnings

(1) |

|

97,996 |

|

|

98,787 |

|

|

|

| Less: Treasury stock,

at cost; 3,650,213 shares |

|

(42,527 |

) |

|

(42,527 |

) |

|

|

|

Total stockholders' equity |

|

174,867 |

|

|

174,861 |

|

|

|

|

Total liabilities and stockholders' equity |

$ |

699,864 |

|

$ |

419,561 |

|

|

|

|

|

|

|

|

|

|

|

|

(1) In the first quarter of fiscal 2019, the Company recorded

an after-tax decrease to beginning retained earnings of $0.3

million for a change in accounting principle related to

leases. |

| |

|

|

|

|

|

|

|

|

|

|

BIG 5 SPORTING GOODS CORPORATION |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

(Unaudited) |

|

|

(In thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended |

|

26 Weeks Ended |

|

| |

|

June 30, 2019 |

|

July 1, 2018 |

|

June 30, 2019 |

|

July 1, 2018 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

240,965 |

$ |

239,951 |

|

$ |

486,251 |

$ |

474,129 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

167,848 |

|

164,680 |

|

|

337,258 |

|

326,132 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

73,117 |

|

75,271 |

|

|

148,993 |

|

147,997 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Selling and administrative expense (1) |

|

72,179 |

|

74,656 |

|

|

144,790 |

|

148,144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

938 |

|

615 |

|

|

4,203 |

|

(147 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

738 |

|

793 |

|

|

1,514 |

|

1,449 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

200 |

|

(178 |

) |

|

2,689 |

|

(1,596 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense (benefit)

(2) |

|

172 |

|

70 |

|

|

997 |

|

(39 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

28 |

$ |

(248 |

) |

$ |

1,692 |

$ |

(1,557 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share

(1)(2): |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.00 |

$ |

(0.01 |

) |

$ |

0.08 |

$ |

(0.07 |

) |

|

|

Diluted |

$ |

0.00 |

$ |

(0.01 |

) |

$ |

0.08 |

$ |

(0.07 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted-average shares of

common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

21,118 |

|

20,985 |

|

|

21,074 |

|

20,964 |

|

|

|

Diluted |

|

21,143 |

|

20,985 |

|

|

21,100 |

|

20,964 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) In the second quarter of fiscal 2019, the Company recorded

a favorable settlement of $1.1 million, or $0.03 per diluted share,

related to the termination of a software contract. |

|

(2) In the first half of fiscal 2019 and 2018, the Company

recorded charges of $0.4 million, or $0.02 per diluted share, and

$0.2 million, or $0.01 per share, respectively, to write-off

deferred tax assets related to share-based compensation. |

Contact:

Big 5 Sporting Goods

Corporation

Barry EmersonSr. Vice President and Chief Financial Officer(310)

536-0611

ICR, Inc.John MillsManaging Partner(646) 277-1254

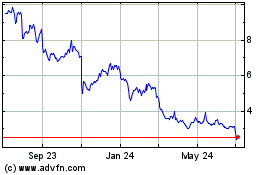

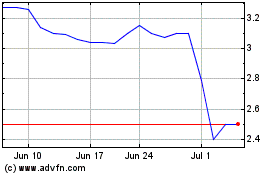

Big 5 Sporting Goods (NASDAQ:BGFV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Big 5 Sporting Goods (NASDAQ:BGFV)

Historical Stock Chart

From Apr 2023 to Apr 2024