Beyond Meat, Inc. (NASDAQ:BYND) (“Beyond Meat” or “the Company”), a

leader in plant-based meat, today reported financial results for

its second quarter ended June 27, 2020.

Second Quarter 2020 Financial Highlights1

- Net revenues were $113.3 million, an increase of 69%

year over year.

- Gross profit was $33.7 million, or gross margin of

29.7% of net revenues; Adjusted gross profit was $39.6 million, or

Adjusted gross margin of 34.9% of net revenues, reflecting

exclusion of expenses attributable to COVID-19.

- Net loss was $10.2 million, or $0.16 per common share;

Adjusted net loss was $1.2 million, or $0.02 per diluted common

share, reflecting exclusion of expenses attributable to COVID-19

and early debt extinguishment.

- Adjusted EBITDA was $11.7 million, or

10.3% of net revenues.

Beyond Meat President and CEO Ethan Brown commented, "I am proud

of our record net revenues and growth during a very challenging

period. As the toll of the COVID-19 pandemic took hold across the

foodservice industry, we repurposed assets and repacked and

rerouted products to meet increased consumer activity in the retail

aisles. Throughout the quarter, our brand experienced an enviable

combination of consumer trends – increasing household penetration;

increasing buying levels per household; and strong repeat purchase

rates of nearly 50%2, well above the success threshold for consumer

packaged goods. Further, we forged ahead with our long-term growth

strategy. We invested in expanded operations and sales in the EU

and Asia, in innovation, and in targeted pricing measures during

this period of high beef prices. Most notable in this regard was

the retail introduction of our Cookout Classic™ value pack, which

significantly reduced the price of our burgers from nearly 2 times

that of conventional beef patties to an approximate 20% premium, on

a per pound basis. Though the Cookout Classic™ only reached stores

in the last 2 weeks of the second quarter, it accounted for 16

points of the year-over-year volume growth in our U.S. retail

business. We look forward to continuing to serve our consumers and

customers alike as we all hope for a resolution to the COVID-19

pandemic.”

____________1 This release includes references to non-GAAP

financial measures. Refer to “Non-GAAP Financial Measures” later in

this release for the definitions of the non-GAAP financial measures

presented and a reconciliation of these measures to their closest

comparable GAAP measures.2 According to SPINS/IRI panel data for

the 52-week period ended June 28, 2020.

Second Quarter 2020

Net revenues increased 69% to $113.3 million in the second

quarter of 2020, compared to $67.3 million in the year-ago period.

Growth in net revenues was primarily due to an increase in volume

sold, partially offset by lower net price per pound driven by the

Company’s strategic investments in promotional activity intended to

encourage greater consumer trial. Growth in volume sold was driven

mainly by increased retail channel sales, resulting from

distribution gains both domestically and abroad, higher sales

velocities at existing retail customers, and contribution from new

product introductions. During the quarter, increased retail channel

sales were partially offset by a reduction in foodservice channel

sales as a result of the ongoing COVID-19 pandemic.

Net revenues by channel (unaudited):

| |

|

Three Months Ended |

|

Change |

| (in

thousands) |

|

June 27, 2020 |

|

June 29, 2019 |

|

Amount |

|

% |

|

U.S.: |

|

|

|

|

|

|

|

|

|

Retail |

|

$ |

90,040 |

|

|

$ |

30,531 |

|

|

$ |

59,509 |

|

|

194.9 |

|

% |

|

Foodservice |

|

6,486 |

|

|

16,504 |

|

|

(10,018 |

) |

|

(60.7 |

) |

% |

|

U.S. net revenues |

|

96,526 |

|

|

47,035 |

|

|

49,491 |

|

|

105.2 |

|

% |

|

International: |

|

|

|

|

|

|

|

|

|

Retail |

|

9,572 |

|

|

3,589 |

|

|

5,983 |

|

|

166.7 |

|

% |

|

Foodservice |

|

7,240 |

|

|

16,627 |

|

|

(9,387 |

) |

|

(56.5 |

) |

% |

|

International net revenues |

|

16,812 |

|

|

20,216 |

|

|

(3,404 |

) |

|

(16.8 |

) |

% |

|

Net revenues |

|

$ |

113,338 |

|

|

$ |

67,251 |

|

|

$ |

46,087 |

|

|

68.5 |

|

% |

| |

|

Six Months Ended |

|

Change |

| (in

thousands) |

|

June 27, 2020 |

|

June 29, 2019 |

|

Amount |

|

% |

|

U.S.: |

|

|

|

|

|

|

|

|

|

Retail |

|

$ |

139,963 |

|

|

$ |

49,992 |

|

|

$ |

89,971 |

|

|

180.0 |

|

% |

|

Foodservice |

|

29,117 |

|

|

25,338 |

|

|

3,779 |

|

|

14.9 |

|

% |

|

U.S. net revenues |

|

169,080 |

|

|

75,330 |

|

|

93,750 |

|

|

124.5 |

|

% |

|

International: |

|

|

|

|

|

|

|

|

|

Retail |

|

15,524 |

|

|

3,707 |

|

|

11,817 |

|

|

318.8 |

|

% |

|

Foodservice |

|

25,808 |

|

|

28,420 |

|

|

(2,612 |

) |

|

(9.2 |

) |

% |

|

International net revenues |

|

41,332 |

|

|

32,127 |

|

|

9,205 |

|

|

28.7 |

|

% |

|

Net revenues |

|

$ |

210,412 |

|

|

$ |

107,457 |

|

|

$ |

102,955 |

|

|

95.8 |

|

% |

Gross profit was $33.7 million, or gross margin of 29.7% of net

revenues, in the second quarter of 2020, compared to $22.7 million,

or gross margin of 33.8% of net revenues, in the year-ago period.

Adjusted gross profit, which excludes $5.9 million of costs

associated with product repacking activities due to COVID-19, was

$39.6 million, or Adjusted gross margin of 34.9% of net revenues,

in the second quarter of 2020, compared to Adjusted gross profit of

$22.7 million, or Adjusted gross margin of 33.8% of net revenues,

in the year-ago period. The increase in Adjusted gross profit and

Adjusted gross margin was primarily due to direct materials and

packaging input cost savings, direct labor efficiencies, and an

increase in the volume of products sold in the second quarter of

2020 compared to the year-ago period. The $5.9 million in costs

associated with product repacking activities in the second quarter

of 2020 were driven by the Company’s efforts to repurpose certain

foodservice inventory into retail products as a result of the

sudden shift in consumer demand related to COVID-19. Following

these repacking activities, the Company has rebalanced its mix of

finished goods inventory between retail and foodservice products

and does not anticipate a need for further repacking activity.

Loss from operations in the second quarter of

2020 was $8.2 million compared to income from operations of $2.2

million in the year-ago period. The decrease in income from

operations was primarily driven by increased headcount to support

the Company’s long-term growth, higher share-based compensation

expense, increases in the Company’s marketing initiatives,

continued investments in innovation, product donation costs related

to the Company’s COVID-19 relief campaign, investments in

international expansion initiatives, and higher restructuring

expenses, partially offset by the increase in gross profit during

the quarter.

Net loss was $10.2 million in the second quarter of 2020

compared to net loss of $9.4 million in the year-ago period. Net

loss per diluted common share was $0.16 in the second quarter of

2020 compared to net loss per diluted common share of $0.24

in the year-ago-period. During the second quarter of 2020, net loss

included $5.9 million of costs associated with the product

repacking activities attributable to COVID-19, $1.6 million in

product donation costs related to the Company’s COVID-19 relief

campaign, and $1.5 million of early debt extinguishment costs

associated with the Company’s refinanced credit arrangements.

Excluding these costs, Adjusted net loss was $1.2 million in the

second quarter of 2020, or $0.02 per diluted common share, compared

to Adjusted net income of $2.3 million, or $0.05 per diluted common

share, in the year-ago period.

Adjusted EBITDA was $11.7 million, or 10.3% of net revenues, in

the second quarter of 2020 compared to Adjusted EBITDA of $6.9

million, or 10.2% of net revenues, in the year-ago period.

Chief Financial Officer and Treasurer, Mark Nelson commented,

“With our robust sales momentum and strong, underlying operating

results during the second quarter, we feel confident about Beyond

Meat’s potential to seize upon the growth opportunities ahead of

us. Although COVID-19 has added complexity to managing our

business, we are proud of the way our team has adapted and

continues to execute against our long-term strategic plan, closely

managing near-term risk while continuing to invest in Beyond Meat’s

longer-term future.”

Balance Sheet and Cash Flow Highlights

The Company’s cash and cash equivalents balance was $222.3

million as of June 27, 2020 and total outstanding debt was $50.0

million. Net cash used in operating activities was $44.3 million

for the six months ended June 27, 2020, compared to $22.4 million

for the prior year period. Capital expenditures totaled $26.0

million for the six months ended June 27, 2020 compared to $7.5

million for the prior year period. The increase in capital

expenditures was primarily driven by the Company’s continued

investments in production equipment and facilities related to

capacity expansion initiatives. On April 22, 2020, the Company

announced that it had entered into a new $150 million five-year

secured revolving credit facility, which also includes an accordion

feature for up to an additional $200 million, replacing its prior

credit facilities. Long-term borrowings on the Company’s new

revolving credit facility were $50.0 million as of June 27, 2020,

as compared to short and long-term borrowings under the Company’s

prior credit facilities of $30.6 million as of December 31,

2019.

Update on COVID-19 and 2020 Outlook

Due to the COVID-19 pandemic, as previously communicated, the

Company experienced a meaningful slowdown in its foodservice

business as various regions around the world implemented

stay-at-home orders, resulting in the closure or limited operations

of many of its foodservice customers. At the same time, the

Company experienced an increase in demand by its retail customers

as consumers shifted towards more at-home consumption, which more

than offset the decline in sales to foodservice customers. While

many of the Company’s foodservice customers have reopened, most are

operating under various local restrictions and continue to navigate

a highly uncertain environment. Given the uncertainty regarding the

ultimate duration, magnitude and effects of the COVID-19 pandemic,

management remains unable to predict the continuing impact of

COVID-19 on its business for the balance of the year with

reasonable certainty. As such, the Company’s 2020 outlook,

previously provided on February 27, 2020, remains suspended until

further notice.

Conference Call and Webcast

The Company will host a conference call and webcast to discuss

these results with additional comments and details today at 4:30

p.m. Eastern, 1:30 p.m. Pacific. The conference call webcast will

be available live over the Internet through the “Investors” section

of the Company’s website at www.beyondmeat.com. Investors

interested in participating in the live call can dial 866-221-1171

from the U.S. or 270-215-9602 from international locations. A

telephone replay will be available approximately two hours after

the call concludes through Wednesday, August 19, 2020, by dialing

855-859-2056 from the U.S., or 404-537-3406 from international

locations, and entering confirmation code 4658234.

About Beyond Meat

Beyond Meat, Inc. (NASDAQ: BYND) is one of the fastest growing

food companies in the United States, offering a portfolio of

revolutionary plant-based meats. Founded in 2009, Beyond Meat has a

mission of building meat directly from plants, an innovation that

enables consumers to experience the taste, texture and other

sensory attributes of popular animal-based meat products while

enjoying the nutritional and environmental benefits of eating its

plant-based meat products. Beyond Meat’s brand commitment, Eat What

You Love™, represents a strong belief that by eating its portfolio

of plant-based meats, consumers can enjoy more, not less, of their

favorite meals, and by doing so, help address concerns related to

resource conservation and animal welfare. Beyond Meat’s portfolio

of plant-based proteins were available at approximately 112,000

retail and foodservice outlets in 85 countries worldwide as of June

27, 2020. Visit www.BeyondMeat.com and follow @BeyondMeat,

#BeyondBurger and #GoBeyond on Facebook, Instagram and Twitter.

Forward-Looking StatementsCertain statements in

this release constitute “forward-looking statements" within the

meaning of the federal securities laws. These statements are based

on management's current opinions, expectations, beliefs, plans,

objectives, assumptions and projections regarding financial

performance, prospects, future events and future results, including

ongoing uncertainty related to the COVID-19 pandemic, including the

duration, magnitude and effects of the pandemic and, in particular,

the impact to the foodservice channel, growth trends, our

international expansion plans, market share, new and existing

customers and expense trends, among other matters, and involve

known and unknown risks that are difficult to predict. In some

cases, you can identify forward-looking statements by the use of

words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,”

“anticipate,” “believe,” “estimate,” “predict,” “outlook,”

“potential,” “continue,” “likely,” “will,” “would” and variations

of these terms and similar expressions, or the negative of these

terms or similar expressions. These forward-looking statements are

only predictions, not historical fact, and involve certain risks

and uncertainties, as well as assumptions. Forward-looking

statements should not be read as a guarantee of future performance

or results, and will not necessarily be accurate indications of the

times at, or by which or whether, such performance or results will

be achieved. Actual results, levels of activity, performance,

achievements and events could differ materially from those stated,

anticipated or implied by such forward-looking statements. While

Beyond Meat believes that its assumptions are reasonable, it is

very difficult to predict the impact of known factors, and, of

course, it is impossible to anticipate all factors that could

affect actual results. There are many risks and uncertainties that

could cause actual results to differ materially from

forward-looking statements made herein including, but not limited

to, the effects of global outbreaks of pandemics or contagious

diseases or fear of such outbreak, such as the recent COVID-19

pandemic, including on our ability to expand in new geographic

markets or the timing of such expansion efforts; estimates of our

expenses, future revenues, capital requirements and our needs for

additional financing; our ability to effectively manage our growth;

our estimates of the size of market opportunities; our ability to

effectively expand our manufacturing and production capacity; our

ability to accurately forecast demand for our products and manage

our inventory; our ability to successfully enter new geographic

markets, manage our international expansion and comply with any

applicable laws and regulations; the effects of increased

competition from our market competitors and new market entrants;

the success of our marketing initiatives and the ability to grow

brand awareness, maintain, protect and enhance our brand, attract

and retain new customers and grow our market share; our ability to

attract, maintain and effectively expand our relationships with key

strategic foodservice partners; our ability to attract and retain

our suppliers, distributors, co-manufacturers and customers; our

ability to procure sufficient high-quality raw materials to

manufacture our products; the availability of pea protein that

meets our standards; our ability to diversify the protein sources

used for our products; the volatility associated with ingredient

and packaging costs; real or perceived quality or health issues

with our products or other issues that adversely affect our brand

and reputation; changes in the tastes and preferences of our

consumers; our ability to accurately predict taste preferences and

purchasing habits of consumers in new geographic markets; our

ability to accurately predict consumer trends and demand and

successfully introduce and commercialize new products and improve

existing products; significant disruption in, or breach in security

of our information technology systems and resultant interruptions

in service and any related impact on our reputation; the attraction

and retention of qualified employees and key personnel; the effects

of natural or man-made catastrophic events particularly involving

our or any of our co‑manufacturers’ manufacturing facilities or our

suppliers’ facilities; the impact of marketing campaigns aimed at

generating negative publicity regarding our products, brand and

plant‑based industry category; the effectiveness of our internal

controls; changes in laws and government regulation affecting our

business, including Food and Drug Administration governmental

regulation and state regulation; changes in laws, regulations or

policies of governmental agencies or regulators relating to the

labeling or naming of our products; the impact of adverse economic

conditions; the financial condition of, and our relationships with

our suppliers, co-manufacturers, distributors, retailers and

foodservice customers, and their future decisions regarding their

relationships with us; the ability of our suppliers and

co‑manufacturers to comply with food safety, environmental or other

laws and regulations; seasonality; the sufficiency of our cash and

cash equivalents to meet our liquidity needs and service our

indebtedness; outcomes of legal or administrative proceedings;

foreign exchange fluctuations; our, our suppliers’ and our

co-manufacturers’ ability to protect our proprietary technology and

intellectual property adequately; and the risks discussed under the

heading “Risk Factors” in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2019 and the Company’s Quarterly

Report on Form 10-Q for the quarter ended June 27, 2020 to be filed

with the SEC, as well as other factors described from time to time

in the Company's filings with the SEC. All forward-looking

statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by the cautionary statements

set forth above. Such forward-looking statements are made only as

of the date of this release. Beyond Meat undertakes no obligation

to publicly update or revise any forward-looking statement because

of new information, future events, changes in assumptions or

otherwise, except as otherwise required by law. If we do update one

or more forward-looking statements, no inference should be made

that we will make additional updates with respect to those or other

forward-looking statements.

Non-GAAP Financial Measures

The Company refers to certain financial measures that are not

recognized under U.S. generally accepted accounting principles

(GAAP) in this press release, including: Adjusted gross profit,

Adjusted gross margin, Adjusted net (loss) income, Adjusted net

(loss) income per diluted common share, Adjusted EBITDA and

Adjusted EBITDA as a % of net revenues. See “Non-GAAP Financial

Measures” below for additional information and reconciliations of

such non-GAAP financial measures.

Availability of Information on Beyond Meat’s Website and

Social Media Channels

Investors and others should note that Beyond Meat routinely

announces material information to investors and the marketplace

using SEC filings, press releases, public conference calls,

webcasts and the Beyond Meat Investor Relations website. We also

intend to use certain social media channels as a means of

disclosing information about us and our products to consumers, our

customers, investors and the public (e.g., @BeyondMeat,

#BeyondBurger and #GoBeyond on Facebook, Instagram and

Twitter). The information posted on social media channels is

not incorporated by reference in this press release or in any other

report or document we file with the SEC. While not all of the

information that the Company posts to the Beyond Meat Investor

Relations website or to social media accounts is of a material

nature, some information could be deemed to be material.

Accordingly, the Company encourages investors, the media, and

others interested in Beyond Meat to review the information that it

shares at the “Investors” link located at the bottom of the

Company’s webpage at

https://investors.beyondmeat.com/investor-relations and to sign up

for and regularly follow the Company’s social media accounts. Users

may automatically receive email alerts and other information about

the Company when enrolling an email address by visiting "Request

Email Alerts" in the "Investors" section of Beyond Meat’s website

at https://investors.beyondmeat.com/investor-relations.

Contacts

Media:Shira Zackai917-715-8522szackai@beyondmeat.com

Investors: Katie

Turner646-277-1228Katie.turner@icrinc.com

BEYOND MEAT,

INC.Condensed Consolidated Statements of

Operations(In thousands, except share and per

share data)(unaudited)

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 27, 2020 |

|

June 29, 2019 |

|

June 27, 2020 |

|

June 29, 2019 |

|

Net revenues |

|

$ |

113,338 |

|

|

|

$ |

67,251 |

|

|

|

$ |

210,412 |

|

|

|

$ |

107,457 |

|

|

| Cost of goods sold |

|

79,687 |

|

|

|

44,510 |

|

|

|

139,070 |

|

|

|

73,945 |

|

|

| Gross profit |

|

33,651 |

|

|

|

22,741 |

|

|

|

71,342 |

|

|

|

33,512 |

|

|

| Research and development

expenses |

|

6,016 |

|

|

|

4,212 |

|

|

|

12,210 |

|

|

|

8,710 |

|

|

| Selling, general and

administrative expenses |

|

34,292 |

|

|

|

15,515 |

|

|

|

61,607 |

|

|

|

26,692 |

|

|

| Restructuring expenses |

|

1,509 |

|

|

|

847 |

|

|

|

3,882 |

|

|

|

1,241 |

|

|

| Total operating expenses |

|

41,817 |

|

|

|

20,574 |

|

|

|

77,699 |

|

|

|

36,643 |

|

|

| (Loss) income from

operations |

|

(8,166 |

) |

|

|

2,167 |

|

|

|

(6,357 |

) |

|

|

(3,131 |

) |

|

| Other expense, net: |

|

|

|

|

|

|

|

|

| Interest expense |

|

(569 |

) |

|

|

(741 |

) |

|

|

(1,274 |

) |

|

|

(1,474 |

) |

|

| Remeasurement of warrant

liability |

|

— |

|

|

|

(11,744 |

) |

|

|

— |

|

|

|

(12,503 |

) |

|

| Other, net |

|

(1,454 |

) |

|

|

898 |

|

|

|

(744 |

) |

|

|

1,039 |

|

|

| Total other expense, net |

|

(2,023 |

) |

|

|

(11,587 |

) |

|

|

(2,018 |

) |

|

|

(12,938 |

) |

|

| Loss before taxes |

|

(10,189 |

) |

|

|

(9,420 |

) |

|

|

(8,375 |

) |

|

|

(16,069 |

) |

|

| Income tax expense |

|

16 |

|

|

|

21 |

|

|

|

15 |

|

|

|

21 |

|

|

| Net loss |

|

$ |

(10,205 |

) |

|

|

$ |

(9,441 |

) |

|

|

$ |

(8,390 |

) |

|

|

$ |

(16,090 |

) |

|

| Net loss per share available

to common stockholders—basic and diluted |

|

$ |

(0.16 |

) |

|

|

$ |

(0.24 |

) |

|

|

$ |

(0.14 |

) |

|

|

$ |

(0.69 |

) |

|

| Weighted average common shares

outstanding—basic and diluted |

|

62,098,861 |

|

|

|

39,081,359 |

|

|

|

61,904,360 |

|

|

|

23,206,203 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BEYOND MEAT, INC. |

|

Condensed Consolidated Balance Sheets |

|

(In thousands, except share and per share

data) |

|

(unaudited) |

| |

|

June 27, 2020 |

|

December 31, 2019 |

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

222,334 |

|

|

|

$ |

275,988 |

|

|

|

Accounts receivable |

|

45,986 |

|

|

|

40,080 |

|

|

|

Inventory |

|

143,033 |

|

|

|

81,596 |

|

|

|

Prepaid expenses and other current assets |

|

17,990 |

|

|

|

5,930 |

|

|

|

Total current assets |

|

429,343 |

|

|

|

403,594 |

|

|

| Property, plant, and

equipment, net |

|

70,286 |

|

|

|

47,474 |

|

|

| Operating lease right-of-use

assets |

|

23,637 |

|

|

|

— |

|

|

| Other non-current assets,

net |

|

4,552 |

|

|

|

855 |

|

|

|

Total assets |

|

$ |

527,818 |

|

|

|

$ |

451,923 |

|

|

| Liabilities and Stockholders’

Equity: |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

51,567 |

|

|

|

$ |

26,923 |

|

|

|

Wages payable |

|

2,024 |

|

|

|

1,768 |

|

|

|

Accrued bonus |

|

1,416 |

|

|

|

4,129 |

|

|

|

Current portion of operating lease liabilities |

|

1,944 |

|

|

|

— |

|

|

|

Accrued expenses and other current liabilities |

|

8,829 |

|

|

|

3,805 |

|

|

|

Short-term borrowings under revolving credit facility and bank term

loan |

|

— |

|

|

|

11,000 |

|

|

|

Current portion of finance lease liabilities |

|

72 |

|

|

|

72 |

|

|

|

Total current liabilities |

|

65,852 |

|

|

|

47,697 |

|

|

| Long-term liabilities: |

|

|

|

|

|

Revolving credit facility |

|

$ |

50,000 |

|

|

|

$ |

— |

|

|

|

Operating lease liabilities, net of current portion |

|

21,871 |

|

|

|

— |

|

|

|

Long-term portion of bank term loan, net |

|

— |

|

|

|

14,637 |

|

|

|

Equipment loan, net |

|

— |

|

|

|

4,932 |

|

|

|

Finance lease obligations and other long-term liabilities |

|

185 |

|

|

|

567 |

|

|

|

Total long-term liabilities |

|

$ |

72,056 |

|

|

|

$ |

20,136 |

|

|

| Commitments and

Contingencies |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

| Preferred stock, par value

$0.0001 per share—500,000 shares authorized, none issued and

outstanding |

|

$ |

— |

|

|

|

$ |

— |

|

|

| Common stock, par value

$0.0001 per share—500,000,000 shares authorized; 62,425,640 and

61,576,494 shares issued and outstanding at June 27, 2020 and

December 31, 2019, respectively |

|

6 |

|

|

|

6 |

|

|

| Additional paid-in

capital |

|

540,576 |

|

|

|

526,199 |

|

|

| Accumulated deficit |

|

(150,505 |

) |

|

|

(142,115 |

) |

|

| Accumulated other

comprehensive loss |

|

(167 |

) |

|

|

— |

|

|

|

Total stockholders’ equity |

|

$ |

389,910 |

|

|

|

$ |

384,090 |

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

527,818 |

|

|

|

$ |

451,923 |

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

BEYOND MEAT, INC. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(In thousands) |

|

(unaudited) |

| |

|

Six Months Ended |

| |

|

June 27, 2020 |

|

June 29, 2019 |

| Cash flows from

operating activities: |

|

|

|

|

|

Net loss |

|

$ |

(8,390 |

) |

|

|

$ |

(16,090 |

) |

|

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

5,855 |

|

|

|

3,957 |

|

|

|

Non-cash lease expense |

|

1,186 |

|

|

|

— |

|

|

|

Share-based compensation expense |

|

13,535 |

|

|

|

2,678 |

|

|

|

Loss on sale of fixed assets |

|

183 |

|

|

|

— |

|

|

|

Amortization of debt issuance costs |

|

93 |

|

|

|

78 |

|

|

|

Loss on extinguishment of debt |

|

1,538 |

|

|

|

— |

|

|

|

Change in preferred and common stock warrant liabilities |

|

— |

|

|

|

12,503 |

|

|

|

Net change in operating assets and

liabilities: |

|

|

|

|

|

Accounts receivable |

|

(5,907 |

) |

|

|

(21,762 |

) |

|

|

Inventories |

|

(61,437 |

) |

|

|

(12,438 |

) |

|

|

Prepaid expenses and other assets |

|

(12,192 |

) |

|

|

(2,131 |

) |

|

|

Accounts payable |

|

21,564 |

|

|

|

9,799 |

|

|

|

Accrued expenses and other current liabilities |

|

818 |

|

|

|

1,028 |

|

|

|

Operating lease liabilities |

|

(1,181 |

) |

|

|

— |

|

|

|

Long-term liabilities |

|

— |

|

|

|

12 |

|

|

|

Net cash used in operating activities |

|

$ |

(44,335 |

) |

|

|

$ |

(22,366 |

) |

|

| Cash flows from

investing activities: |

|

|

|

|

|

Purchases of property, plant and equipment |

|

$ |

(26,031 |

) |

|

|

$ |

(7,502 |

) |

|

|

Proceeds from sale of fixed assets |

|

— |

|

|

|

232 |

|

|

|

Purchases of property, plant and equipment held for sale |

|

(2,288 |

) |

|

|

(3,121 |

) |

|

|

Payment of security deposits |

|

(9 |

) |

|

|

(487 |

) |

|

|

Net cash used in investing activities |

|

$ |

(28,328 |

) |

|

|

$ |

(10,878 |

) |

|

| Cash flows from

financing activities: |

|

|

|

|

|

Proceeds from issuance of common stock pursuant to the initial

public offering, net of issuance costs |

|

$ |

— |

|

|

|

$ |

255,448 |

|

|

|

Proceeds from revolving credit facility |

|

50,000 |

|

|

|

— |

|

|

|

Debt issuance costs |

|

(1,183 |

) |

|

|

— |

|

|

|

Debt extinguishment costs |

|

(1,200 |

) |

|

|

— |

|

|

|

Repayment of revolving credit line |

|

(6,000 |

) |

|

|

— |

|

|

|

Repayment of term loan |

|

(20,000 |

) |

|

|

— |

|

|

|

Repayment of equipment loan |

|

(5,000 |

) |

|

|

— |

|

|

|

Principal payments under finance lease obligations |

|

(34 |

) |

|

|

(21 |

) |

|

|

Proceeds from exercise of stock options |

|

3,824 |

|

|

|

533 |

|

|

|

Payments of minimum withholding taxes on net share settlement of

equity awards |

|

(1,231 |

) |

|

|

— |

|

|

|

Net cash provided by financing activities |

|

$ |

19,176 |

|

|

|

$ |

255,960 |

|

|

| |

|

|

|

|

|

|

|

|

| Net (decrease) increase in

cash and cash equivalents |

|

$ |

(53,487 |

) |

|

|

$ |

222,716 |

|

|

| Effect of exchange rate

changes on cash |

|

(167 |

) |

|

|

— |

|

|

| Cash and cash equivalents at

the beginning of the period |

|

275,988 |

|

|

|

54,271 |

|

|

| Cash and cash equivalents at

the end of the period |

|

$ |

222,334 |

|

|

|

$ |

276,987 |

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

Interest |

|

$ |

1,265 |

|

|

|

$ |

1,445 |

|

|

|

Taxes |

|

$ |

15 |

|

|

|

$ |

21 |

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

Non-cash additions to property, plant and equipment |

|

$ |

4,499 |

|

|

|

$ |

1,003 |

|

|

|

Offering costs, accrued not yet paid |

|

$ |

— |

|

|

|

$ |

578 |

|

|

|

Non-cash additions to property, plant and equipment held for

sale |

|

$ |

— |

|

|

|

$ |

646 |

|

|

|

Operating lease right-of-use assets obtained in exchange for lease

liabilities |

|

$ |

12,516 |

|

|

|

$ |

— |

|

|

|

Reclassification of warrant liability to additional paid-in

capital in connection with the initial public offering |

|

$ |

— |

|

|

|

$ |

14,421 |

|

|

|

Conversion of convertible preferred stock to common stock upon

initial public offering |

|

$ |

— |

|

|

|

$ |

199,540 |

|

|

|

Note receivable from sale of assets held for sale |

|

$ |

5,158 |

|

|

|

$ |

— |

|

|

|

|

|

|

Non-GAAP Financial Measures

Beyond Meat uses the non-GAAP financial measures set forth below

in assessing its operating performance and in its financial

communications. Management believes these non-GAAP financial

measures provide useful additional information to investors about

current trends in the Company's operations and are useful for

period-over-period comparisons of operations. In addition,

management uses these non-GAAP financial measures to assess

operating performance and for business planning measures. These

non-GAAP financial measures should not be considered in isolation

or as a substitute for the comparable GAAP measures. In addition,

these non-GAAP financial measures may not be computed in the same

manner as similarly titled measures used by other companies.

Adjusted gross profit and Adjusted gross

marginAdjusted gross profit is defined as net revenues

less cost of goods sold adjusted to exclude, when applicable, costs

attributable to COVID-19 activities which are not considered to be

part of the Company’s normal business activities. Adjusted gross

margin is defined as Adjusted gross profit divided by net

revenues.

Adjusted gross profit and Adjusted gross margin are presented to

provide additional perspective on underlying trends in the

Company’s gross profit and gross margin, which we believe is useful

supplemental information for investors to be able to gauge and

compare the Company’s current business performance from one period

to another.

Adjusted net (loss) income and Adjusted net (loss)

income per diluted common shareAdjusted net (loss) income

is defined as net (loss) income adjusted to exclude, when

applicable, costs attributable to COVID-19 activities, as well as

other special items, which are those items deemed not to be

reflective of the Company’s ongoing normal business activities.

Adjusted net (loss) income per diluted common share is defined as

Adjusted net (loss) income divided by the number of diluted common

shares outstanding.

We consider Adjusted net (loss) income and Adjusted net (loss)

income per diluted common share to be indicators of operating

performance because excluding special items allows for

period-over-period comparisons of our ongoing operations. Adjusted

net (loss) income per diluted common share is a performance measure

and should not be used as a measure of liquidity.

Adjusted EBITDA and Adjusted EBITDA as a % of net

revenuesAdjusted EBITDA is defined as net (loss) income

adjusted to exclude, when applicable, income tax expense (benefit),

interest expense, depreciation and amortization expense,

restructuring expenses, share-based compensation expense, expenses

attributable to COVID-19, remeasurement of our warrant liability,

and Other, net, including investment income and foreign currency

transaction gains and losses. Adjusted EBITDA as a % of net

revenues is defined as Adjusted EBITDA divided by net revenues.

We use Adjusted EBITDA and Adjusted EBITDA as a % of net

revenues because they are important measures upon which our

management assesses our operating performance. We use Adjusted

EBITDA and Adjusted EBITDA as a % of net revenues as key

performance measures because we believe these measures facilitate

internal comparisons of our historical operating performance on a

more consistent basis, and we also use these measures for our

business planning purposes. In addition, we believe Adjusted EBITDA

and Adjusted EBITDA as a % of net revenues are widely used by

investors, securities analysts, ratings agencies and other parties

in evaluating companies in our industry as a measure of our

operational performance.

Limitations related to the use of non-GAAP financial

measuresThere are a number of limitations related to the

use of Adjusted gross profit, Adjusted gross margin, Adjusted net

(loss) income, Adjusted net (loss) income per diluted common share,

and Adjusted EBITDA rather than their most directly comparable GAAP

measures. Some of these limitations are:

- Adjusted gross profit and Adjusted gross margin exclude costs

associated with activities deemed to be non-recurring or not part

of the Company’s normal business activities, which are subjective

determinations made by management and may not actualize as

expected;

- Adjusted net (loss) income and Adjusted net (loss) income per

diluted common share exclude costs associated with activities

deemed to be non-recurring or not part of the Company’s normal

business activities, which are subjective determinations made by

management and may not actualize as expected;

- Adjusted EBITDA excludes depreciation and amortization expense

and, although these are non-cash expenses, the assets being

depreciated may have to be replaced in the future increasing our

cash requirements;

- Adjusted EBITDA does not reflect interest expense, or the cash

required to service our debt, which reduces cash available to

us;

- Adjusted EBITDA does not reflect income tax payments that

reduce cash available to us;

- Adjusted EBITDA does not reflect restructuring expenses that

reduce cash available to us;

- Adjusted EBITDA does not reflect expenses attributable to

COVID-19 that reduce cash available to us;

- Adjusted EBITDA does not reflect share-based compensation

expense and therefore does not include all of our compensation

costs;

- Adjusted EBITDA does not reflect Other, net, including

investment income and foreign currency transaction gains and

losses, that may increase or decrease cash available to us;

and

- other companies, including companies in our industry, may

calculate Adjusted EBITDA differently, which reduces its usefulness

as a comparative measure.

The following tables present the reconciliation of Adjusted

gross profit and Adjusted gross margin to their most comparable

GAAP measures, gross profit and gross margin, respectively, as

reported (unaudited):

| |

|

Three Months Ended |

|

Six Months Ended |

| (in

thousands) |

|

June 27, 2020 |

|

June 29, 2019 |

|

June 27, 2020 |

|

June 29, 2019 |

|

Gross profit, as reported |

|

$ |

33,651 |

|

|

$ |

22,741 |

|

|

$ |

71,342 |

|

|

$ |

33,512 |

|

| Repacking costs attributable

to COVID-19 |

|

5,915 |

|

|

— |

|

|

5,915 |

|

|

— |

|

| Adjusted gross profit |

|

$ |

39,566 |

|

|

$ |

22,741 |

|

|

$ |

77,257 |

|

|

$ |

33,512 |

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 27, 2020 |

|

June 29, 2019 |

|

June 27, 2020 |

|

June 29, 2019 |

|

Gross margin, as reported |

|

29.7 |

% |

|

33.8 |

% |

|

33.9 |

% |

|

31.2 |

% |

| Repacking costs attributable

to COVID-19, as a percentage of net revenues |

|

5.2 |

% |

|

— |

% |

|

2.8 |

% |

|

— |

% |

| Adjusted gross margin |

|

34.9 |

% |

|

33.8 |

% |

|

36.7 |

% |

|

31.2 |

% |

| |

|

|

|

|

|

|

|

|

The following tables present the reconciliation of Adjusted net

(loss) income and Adjusted net (loss) income per diluted common

share to their most comparable GAAP measures, net (loss) income and

net (loss) income per common share available to common

stockholders—diluted, respectively, as reported (unaudited):

|

|

|

Three Months Ended |

|

Six Months Ended |

|

(in thousands) |

|

June 27, 2020 |

|

June 29, 2019 |

|

June 27, 2020 |

|

June 29, 2019 |

|

Net loss, as reported |

|

$ |

(10,205 |

) |

|

|

$ |

(9,441 |

) |

|

|

$ |

(8,390 |

) |

|

|

$ |

(16,090 |

) |

|

| Repacking costs attributable

to COVID-19 |

|

5,915 |

|

|

|

— |

|

|

|

5,915 |

|

|

|

— |

|

|

| Product donations attributable

to COVID-19 relief efforts |

|

1,567 |

|

|

|

— |

|

|

|

2,742 |

|

|

|

— |

|

|

| Remeasurement of warrant

liability |

|

— |

|

|

|

11,744 |

|

|

|

— |

|

|

|

12,503 |

|

|

| Loss on extinguishment of

debt |

|

1,538 |

|

|

|

— |

|

|

|

1,538 |

|

|

|

— |

|

|

| Adjusted net (loss)

income |

|

$ |

(1,185 |

) |

|

|

$ |

2,303 |

|

|

|

$ |

1,805 |

|

|

|

$ |

(3,587 |

) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

| (in thousands, except

share and per share amounts) |

|

June 27, 2020 |

|

June 29, 2019 |

|

June 27, 2020 |

|

June 29, 2019 |

|

Numerator: |

|

|

|

|

|

|

|

|

|

Net loss, as reported |

|

$ |

(10,205 |

) |

|

|

$ |

(9,441 |

) |

|

|

$ |

(8,390 |

) |

|

|

$ |

(16,090 |

) |

|

| Aggregate non-GAAP adjustments

as listed above |

|

9,020 |

|

|

|

11,744 |

|

|

|

10,195 |

|

|

|

12,503 |

|

|

| Adjusted net (loss) income

used in computing basic and diluted Adjusted net (loss) income per

diluted common share |

|

$ |

(1,185 |

) |

|

|

$ |

2,303 |

|

|

|

$ |

1,805 |

|

|

|

$ |

(3,587 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Denominator: |

|

|

|

|

|

|

|

|

| Weighted average shares used

in computing Adjusted net (loss) income per share, basic |

|

62,098,861 |

|

|

|

39,081,359 |

|

|

|

61,904,360 |

|

|

|

23,206,203 |

|

|

| Dilutive effect of shares

issuable under options and RSUs |

|

— |

|

|

|

5,054,823 |

|

|

|

4,093,396 |

|

|

|

— |

|

|

| Weighted average shares used

in computing adjusted net (loss) income per share, diluted |

|

62,098,861 |

|

|

|

44,136,182 |

|

|

|

65,997,756 |

|

|

|

23,206,203 |

|

|

| Adjusted net (loss) income per

common share, diluted |

|

$ |

(0.02 |

) |

|

|

$ |

0.05 |

|

|

|

$ |

0.03 |

|

|

|

$ |

(0.15 |

) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

(in thousands) |

|

June 27, 2020 |

|

June 29, 2019 |

|

June 27, 2020 |

|

June 29, 2019 |

|

Diluted net loss per share, as reported |

|

$ |

(0.16 |

) |

|

|

$ |

(0.24 |

) |

|

|

$ |

(0.14 |

) |

|

|

$ |

(0.69 |

) |

|

| Repack costs related to

COVID-19 |

|

0.09 |

|

|

|

— |

|

|

|

0.10 |

|

|

|

— |

|

|

| Product donations related to

COVID-19 relief efforts |

|

0.03 |

|

|

|

— |

|

|

|

0.05 |

|

|

|

— |

|

|

| Remeasurement of warrant

liability |

|

— |

|

|

|

0.29 |

|

|

|

— |

|

|

|

0.54 |

|

|

| Loss on extinguishment of

debt |

|

0.02 |

|

|

|

— |

|

|

|

0.02 |

|

|

|

— |

|

|

| Adjusted net (loss) income per

diluted share |

|

$ |

(0.02 |

) |

|

|

$ |

0.05 |

|

|

|

$ |

0.03 |

|

|

|

$ |

(0.15 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table presents the reconciliation of Adjusted

EBITDA to its most comparable GAAP measure, net loss, as reported

(unaudited):

| |

|

Three Months Ended |

|

Six Months Ended |

| (in

thousands) |

|

June 27, 2020 |

|

June 29, 2019 |

|

June 27, 2020 |

|

June 29, 2019 |

|

Net loss, as reported |

|

$ |

(10,205 |

) |

|

|

$ |

(9,441 |

) |

|

|

$ |

(8,390 |

) |

|

|

$ |

(16,090 |

) |

|

| Income tax expense |

|

16 |

|

|

|

21 |

|

|

|

15 |

|

|

|

21 |

|

|

| Interest expense |

|

569 |

|

|

|

741 |

|

|

|

1,274 |

|

|

|

1,474 |

|

|

| Depreciation and amortization

expense |

|

3,272 |

|

|

|

2,052 |

|

|

|

5,855 |

|

|

|

3,957 |

|

|

| Restructuring expenses(1) |

|

1,509 |

|

|

|

847 |

|

|

|

3,882 |

|

|

|

1,241 |

|

|

| Share-based compensation

expense |

|

7,586 |

|

|

|

1,823 |

|

|

|

13,535 |

|

|

|

2,678 |

|

|

| Expenses attributable to

COVID-19(2) |

|

7,482 |

|

|

|

— |

|

|

|

8,657 |

|

|

|

— |

|

|

| Remeasurement of warrant

liability |

|

— |

|

|

|

11,744 |

|

|

|

— |

|

|

|

12,503 |

|

|

| Other, net |

|

1,454 |

|

|

|

(898 |

) |

|

|

744 |

|

|

|

(1,039 |

) |

|

| Adjusted EBITDA |

|

$ |

11,683 |

|

|

|

$ |

6,889 |

|

|

|

$ |

25,572 |

|

|

|

$ |

4,745 |

|

|

| Net loss as a % of net

revenues |

|

(9.0 |

) |

% |

|

(14.0 |

) |

% |

|

(4.0 |

) |

% |

|

(15.0 |

) |

% |

| Adjusted EBITDA as a % of net

revenues |

|

10.3 |

|

% |

|

10.2 |

|

% |

|

12.2 |

|

% |

|

4.4 |

|

% |

____________

|

(1 |

) |

Primarily comprised of legal and other expenses associated with the

dispute with a co-manufacturer with whom an exclusive supply

agreement was terminated in May 2017. |

|

(2 |

) |

Comprised of $5.9 million in

repacking costs attributable to COVID-19 and $1.6 million in

product donation costs related to the Company’s COVID-19 relief

campaign in the three months ended June 27, 2020, and $5.9 million

in repacking costs attributable to COVID-19 and $2.8 million in

product donation costs related to the Company’s COVID-19 relief

campaign in the six months ended June 27, 2020. Expenses

attributable to COVID-19 in the six months ended June 27, 2020

include $1.2 million in product donation costs related to the

Company’s COVID-19 relief campaign in the first quarter of 2020,

which were not previously included in the Company’s Adjusted EBITDA

calculation as these were deemed immaterial to the Company’s first

quarter 2020 financial results. Given the significant increase in

COVID-19-related expenses in the second quarter of 2020, and to

facilitate better comparison from period to period, management

determined that it was appropriate to recast its previous first

quarter 2020 Adjusted EBITDA calculation to include these

costs. |

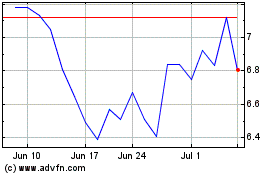

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Apr 2023 to Apr 2024