Bel Fuse Inc. (Nasdaq:BELFA and Nasdaq:BELFB)

today announced preliminary financial results for the fourth

quarter and full year 2018.

Fourth Quarter 2018

Highlights

- Net sales of $142.7 million, an improvement of 19.0% year over

year

- GAAP net earnings of $4.0 million

compared to a net loss of $20.8 million in fourth quarter

2017. GAAP EPS of $0.31 per Class A share (versus loss per

share of $1.66 in Q4-17) and $0.33 per Class B share (versus loss

per share of $1.74 in Q4-17)

- Non-GAAP net earnings of $4.8

million compared to a net loss of $1.2 million in fourth quarter

2017. Non-GAAP EPS of $0.37 per Class A share (versus loss

per share of $0.09 in Q4-17) and $0.39 per Class B share (versus

loss per share of $0.10 in Q4-17)

- Adjusted EBITDA of $13.2 million (9.2% of sales) compared to

$7.1 million (5.9% of sales) in fourth quarter 2017

Full Year 2018 Highlights

- Net sales of $548.2 million, up 11.5% year over year

- GAAP net earnings of $20.7 million compared to a net loss of

$11.9 million in 2017; the 2017 loss was primarily due to impact of

tax reform

- Adjusted EBITDA of $49.6 million (9.0% of sales) versus $40.4

million (8.2% of sales) in 2017

- Bookings (orders received) during 2018 of $578 million, up 12%

from 2017

- $171.2 million in backlog at December 31, 2018, representing an

increase of $24.7 million, or 17%, from December 31, 2017

Non-GAAP financial measures, such as Non-GAAP

EPS, EBITDA and Adjusted EBITDA, exclude the impact of costs

associated with a legal entity restructuring, ERP system

implementation costs, writeoff of deferred financing costs related

to our debt extinguishment, restructuring charges, the transition

tax related to tax reform enacted in December 2017, and certain

other items. Please refer to the financial information included

with this press release for reconciliations of GAAP financial

measures to Non-GAAP financial measures and our explanation of why

we present Non-GAAP financial measures.

CEO CommentsDaniel Bernstein,

President and CEO, said, “Good execution from each of our three

business units led to substantial growth for Bel in 2018, enabling

us to grow our top-line by $56 million and increase our Adjusted

EBITDA by over $9 million for the year.

Increased demand for our MagJack® products in

support of a key program at one of the world’s leading networking

equipment providers led to a $24 million increase in sales for our

Magnetics Solutions group over 2017 levels. Our Connectivity

Solutions group sales were up $16 million from 2017, largely driven

by participation in key military programs in encryption and

communication applications, coupled with higher demand for our

products within commercial aerospace applications. Our

Power Solutions and Protection group saw its first year of growth

since 2015, as success with our higher-powered AC/DC products in

datacenter applications and our 48v power products with telecom

customers contributed to a sales increase of $16 million from 2017.

Each of our product groups continued to benefit from the

commitment we’ve made to grow our distribution business; our

revenue growth reflects a $15 million increase through this channel

in 2018. Almost a third of our sales are generated through

our distribution partners, and we expect this to remain a key

channel for marketing our products going forward.”

“We are also pleased to report that the first

phase of our ERP system implementation is now complete, as our Bel

Power Solutions business went live on the new system in early

January 2019 without any notable issues. The other phases of

the project will largely leverage Bel’s trained internal resources

which should result in lower ERP implementation costs going

forward, including the elimination of redundant systems. We

continue to manage and optimize our operating expenses in order to

mitigate the ongoing minimum wage rate increases in the countries

in which we operate and the general uncertainty within our industry

surrounding tariffs and trade policy. The positive business

trends noted along with our recent bookings and year-end backlog

level are encouraging indicators for further growth as we head into

2019,” concluded Mr. Bernstein.

Financial Summary

All comparative percentages are on a

year-over-year basis, unless otherwise noted.

Fourth Quarter 2018 Results

Net SalesNet sales were $142.7

million, up 19% from last year’s fourth quarter.

- By geographic segment: Asia was up by 23.2%, Europe sales were

higher by 21.7% and North America was up by 15.4%.

- By product group: Magnetic Solutions sales were up by 26.2%,

Power Solutions and Protection sales grew by 21.1% and Connectivity

Solutions sales were up by 10.4%.

On a consolidated basis, sales increased by

$22.8 million in the fourth quarter of 2018 compared to the same

period of 2017.

Gross ProfitGross profit margin

increased to 21.3%, from 18.5% in the fourth quarter of 2017, as

incremental sales in 2018 led to improved fixed cost absorption,

offset in part by higher labor costs during the year. In

addition, our gross profit margin during the fourth quarter of 2017

had been impacted by inventory-related charges totaling $2.0

million in connection with maintaining our inventory at the lower

of cost or net realizable value.

Selling, General and Administrative

Expenses (SG&A) SG&A expenses were $22.2 million,

up from $21.1 million in the fourth quarter of 2017. The increase

in SG&A expenses during the 2018 period primarily related to a

$0.9 million reduction in cash surrender value of our company-owned

life insurance policies as a result of the declining stock market

environment throughout the quarter. We also incurred higher

legal and professional fees in the fourth quarter of 2018 as

compared to the same period of 2017.

Operating Income Operating

income was $8.0 million, up from $1.0 million in the fourth quarter

of 2017, with an operating margin (operating income as a percentage

of net sales) of 5.6% compared to 0.8% in the fourth quarter of

2017.

Income TaxesThe provision for

income taxes was $2.4 million in the fourth quarter of 2018, as

compared to $19.2 million in the same period of 2017. The

provision for income taxes during the fourth quarter of 2018 was

unfavorably impacted by taxes on foreign earnings (GILTI tax),

partially offset by a decrease in the U.S. tax rate from 35% to 21%

in 2018. The provision for income taxes in the 2017 period

included an $18 million impact from the U.S. Tax Cuts and Jobs Act

which was enacted on December 22, 2017. This resulted in an

effective tax rate of 37.2% during the fourth quarter of 2018,

compared to a not meaningful percentage during the same quarter

last year.

Net Earnings (Loss)The above

factors resulted in net earnings of $4.0 million in the fourth

quarter of 2018 as compared with a net loss of $20.8 million in the

fourth quarter of 2017.

Full Year December 31, 2018

Results

Net SalesNet sales were $548.2

million, up 11.5% from 2017.

- By geographic segment, Europe was up by 14.3%, Asia was higher

by 11.6% and North America was up by 10.5%.

- By product group, Magnetic Solutions sales were up by 15.2%,

Connectivity Solutions sales were 9.6% higher and Power Solutions

and Protection sales were up by 9.9%.

On a consolidated basis, sales increased by

$56.6 million in 2018 compared to 2017, despite a $5.5 million

decline in sales related to the sale of our NPS product line within

the Power Solutions Business.

Gross ProfitGross profit margin

decreased to 20.0%, from 20.8% in 2017, primarily due to an

unfavorable fluctuation in the Chinese Renminbi against the U.S.

Dollar earlier in 2018. The above-mentioned minimum wage

increases in the PRC and an increase in material costs due to

supply constraints also had an unfavorable impact on our gross

profit margin during the 2018 period.

Selling, General and Administrative

Expenses (SG&A) SG&A expenses were $79.9 million,

down from $84.7 million in 2017. The reduction in SG&A expenses

primarily related to a $5.4 million favorable swing in foreign

exchange rates (a gain of $2.6 million in 2018 compared to a

foreign exchange loss of $2.8 million in 2017) and a $1.5 million

reduction in depreciation and amortization expense. These

declines were offset by $2.7 million of higher fringe benefit

expense in the 2018 period.

Operating Income Operating

income was $29.6 million, up from $17.4 million in 2017, with an

operating margin of 5.4% compared to 3.5% in 2017.

Income TaxesThe provision for

income taxes was $2.9 million in 2018 as compared with $21.5

million during 2017. This resulted in an effective tax rate

of 12.3% in 2018, compared to 223.4% in 2017. In addition to

the factors noted above for the fourth quarter, the effective tax

rate for the 2017 period also included U.S. and foreign taxes

accrued for gains recognized on a Bel Fuse legal entity

restructuring transaction.

Net Earnings (Loss)The above

factors resulted in net earnings of $20.7 million in 2018 as

compared with a net loss of $11.9 million in 2017.

Balance Sheet DataAs of December 31, 2018,

working capital was $184.5 million, including $53.9 million of cash

and cash equivalents with a current ratio of 2.7-to-1. In

comparison, as of December 31, 2017, working capital was $178.8

million, including $69.4 million of cash and cash equivalents with

a current ratio of 3.0-to-1. Total debt at December 31, 2018

was $114.2 million as compared to $122.7 million at December 31,

2017, reflecting a decline of $8.5 million primarily due to debt

repayments made during 2018.

Conference CallBel has

scheduled a conference call at 11:00 a.m. ET today. To

participate in the conference call, investors should dial

888-254-3590, or 323-994-2093 if dialing internationally. The

presentation will additionally be broadcast live over the Internet

and will be available at

https://ir.belfuse.com/events-and-presentations. The webcast will

be available via replay for a period of 20 days at this same

Internet address. For those unable to access the live call, a

telephone replay will be available at 844-512-2921, or 412-317-6671

if dialing internationally, using access code 6007761 after 2:00

p.m. ET, also for 20 days.

About BelBel (www.belfuse.com)

designs, manufactures and markets a broad array of products that

power, protect and connect electronic circuits. These

products are primarily used in the networking, telecommunications,

computing, military, aerospace, transportation and broadcasting

industries. Bel's product groups include Magnetic Solutions

(integrated connector modules, power transformers, power inductors

and discrete components), Power Solutions and Protection

(front-end, board-mount and industrial power products, module

products and circuit protection), and Connectivity Solutions

(expanded beam fiber optic, copper-based, RF and RJ connectors and

cable assemblies). The Company operates facilities around the

world.

Forward-Looking Statements

Non-historical information contained in this press release

(including statements regarding anticipated growth from the

Company’s distribution channel, the effects of the ERP system

implementation and other positive business and growth trends) are

forward-looking statements (as described under the Private

Securities Litigation Reform Act of 1995) that involve risks and

uncertainties. Actual results could differ materially from Bel's

projections. Among the factors that could cause actual results to

differ materially from such statements are: the market concerns

facing our customers; the continuing viability of sectors that rely

on our products; the effects of business and economic conditions;

difficulties associated with integrating recently acquired

companies; capacity and supply constraints or difficulties; product

development, commercialization or technological difficulties; the

regulatory and trade environment; risks associated with foreign

currencies; uncertainties associated with legal proceedings; the

market's acceptance of the Company's new products and competitive

responses to those new products; the impact of changes to U.S.

trade and tariff policies; and the risk factors detailed from time

to time in the Company's SEC reports. In light of the risks and

uncertainties impacting our business, there can be no assurance

that any forward-looking statement will in fact prove to be

correct. We undertake no obligation to update or revise any forward

looking statements.

Non-GAAP Financial MeasuresThe

non-GAAP measures identified in this press release as well as in

the supplementary information to this press release (Non-GAAP net

earnings, Non-GAAP EPS, EBITDA and Adjusted EBITDA) are not

measures of performance under accounting principles generally

accepted in the United States of America ("GAAP"). These

measures should not be considered a substitute for, and the reader

should also consider, income from operations, net earnings,

earnings per share and other measures of performance as defined by

GAAP as indicators of our performance or profitability. Our

non-GAAP measures may not be comparable to other similarly-titled

captions of other companies due to differences in the method of

calculation. We present results adjusted to exclude the

effects of certain unusual or special items and their related tax

impact that would otherwise be included under U.S. GAAP, to aid in

comparisons with other periods. We may use Non-GAAP financial

measures to determine performance-based compensation and management

believes that this information may be useful to investors.

Website InformationWe routinely

post important information for investors on our

website, www.belfuse.com, in the "Investor Relations" section.

We use our website as a means of disclosing material, otherwise

non-public information and for complying with our disclosure

obligations under Regulation FD. Accordingly, investors should

monitor the Investor Relations section of our website, in addition

to following our press releases, SEC filings, public conference

calls, presentations and webcasts. The information contained on, or

that may be accessed through, our website is not incorporated by

reference into, and is not a part of, this document.

[Financial tables follow]

| Bel Fuse Inc. |

| Supplementary

Information(1)(2) |

| Condensed Consolidated Statements of

Operations |

| (in thousands, except per share

amounts) |

| (unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

142,734 |

|

$ |

119,940 |

|

$ |

548,184 |

|

$ |

491,611 |

| Cost of

sales |

|

112,319 |

|

97,780 |

|

438,414 |

|

389,262 |

|

Gross profit |

|

30,415 |

|

22,160 |

|

109,770 |

|

102,349 |

| As a % of

net sales |

|

21.3% |

|

18.5% |

|

20.0% |

|

20.8% |

| |

|

|

|

|

|

|

|

|

| Selling,

general and administrative expenses |

|

22,247 |

|

21,052 |

|

79,937 |

|

84,655 |

| As a % of

net sales |

|

15.6% |

|

17.6% |

|

14.6% |

|

17.2% |

|

Restructuring charges |

|

160 |

|

137 |

|

222 |

|

308 |

| |

|

|

|

|

|

|

|

|

|

Income from operations |

|

8,008 |

|

971 |

|

29,611 |

|

17,386 |

| As a % of

net sales |

|

5.6% |

|

0.8% |

|

5.4% |

|

3.5% |

| |

|

|

|

|

|

|

|

|

| Interest

expense |

|

(1,399) |

|

(2,326) |

|

(5,317) |

|

(6,802) |

| Other

income/expense, net |

|

(200) |

|

(221) |

|

(678) |

|

(941) |

|

Earnings before benefit for income taxes |

|

6,409 |

|

(1,576) |

|

23,616 |

|

9,643 |

| |

|

|

|

|

|

|

|

|

| Provision

for income taxes(3) |

|

2,384 |

|

19,211 |

|

2,907 |

|

21,540 |

| Effective

tax rate |

|

37.2% |

|

-1219.0% |

|

12.3% |

|

223.4% |

| Net

earnings (loss) |

|

$ |

4,025 |

|

$ |

(20,787) |

|

$ |

20,709 |

|

$ |

(11,897) |

| As a % of

net sales |

|

2.8% |

|

-17.3% |

|

3.8% |

|

-2.4% |

| |

|

|

|

|

|

|

|

|

| Weighted

average number of shares outstanding: |

|

|

|

|

|

|

|

|

| Class A common shares -

basic and diluted |

|

2,175 |

|

2,175 |

|

2,175 |

|

2,175 |

| Class B common shares -

basic and diluted |

|

10,083 |

|

9,861 |

|

9,939 |

|

9,857 |

| |

|

|

|

|

|

|

|

|

| Net earnings

(loss) per common share: |

|

|

|

|

|

|

|

|

| Class A common shares -

basic and diluted |

|

$ |

0.31 |

|

$ |

(1.66) |

|

$ |

1.62 |

|

$ |

(0.97) |

| Class B common shares -

basic and diluted |

|

$ |

0.33 |

|

$ |

(1.74) |

|

$ |

1.73 |

|

$ |

(0.99) |

|

|

|

|

|

|

|

|

|

|

| |

| (1) The supplementary information included in this press

release for 2018 is preliminary and subject to change prior to the

filing of our upcoming Annual Report on Form 10-K with the

Securities and Exchange Commission. |

|

|

|

|

|

|

|

|

|

|

| (2) The statements of operations for the three months and year

ended December 31, 2017 reflect immaterial reclassifications

related to the retrospective adoption of new accounting guidance

related to presentation of pension costs within the statement of

operations. There was no impact on net earnings in connection

with the adoption of this guidance. |

| |

|

|

|

|

|

|

|

|

| (3) During the fourth quarter of 2017, we recorded $18.0

million of incremental tax related to the enactment of the Tax Cuts

and Jobs Act of 2017. This amount consisted of a transition

tax on our foreign earnings and revaluation of our deferred tax

assets. |

| Bel Fuse Inc. |

| Supplementary

Information(1) |

| Condensed Consolidated Balance

Sheets |

| (in thousands, unaudited) |

|

|

|

December

31,2018 |

|

December

31,2017 |

| |

|

|

|

Assets |

|

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

53,911 |

|

$ |

69,354 |

| Accounts receivable, net |

91,939 |

|

78,808 |

| Inventories |

120,068 |

|

107,719 |

| Other current assets |

24,591 |

|

10,218 |

| Total current

assets |

290,509 |

|

266,099 |

| Property, plant and equipment, net |

43,932 |

|

43,495 |

| Goodwill and other intangible assets, net |

82,506 |

|

89,543 |

| Other assets |

26,577 |

|

32,128 |

| Total assets |

$ |

443,524 |

|

$ |

431,265 |

| |

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

56,171 |

|

$ |

47,947 |

| Current portion of long-term debt |

2,508 |

|

2,641 |

| Other current liabilities |

47,351 |

|

36,712 |

| Total current

liabilities |

106,030 |

|

87,300 |

| Long-term debt |

111,705 |

|

120,053 |

| Other liabilities |

49,319 |

|

65,952 |

| Total liabilities |

267,054 |

|

273,305 |

| Stockholders' equity |

176,470 |

|

157,960 |

| Total liabilities and stockholders'

equity |

$ |

443,524 |

|

$ |

431,265 |

| |

|

|

|

|

| |

| (1) The supplementary information included in this press

release for 2018 is preliminary and subject to change prior to the

filing of our upcoming Annual Report on Form 10-K with the

Securities and Exchange Commission. |

| Bel Fuse Inc. |

| Supplementary Information(1) |

| Reconciliation of GAAP Net Earnings to EBITDA

and Adjusted EBITDA(2) |

| (in thousands, unaudited) |

| |

|

|

|

Three Months

Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

|

GAAP Net earnings (loss) |

|

$ |

4,025 |

|

$ |

19,211 |

|

$ |

20,709 |

|

$ |

21,540 |

| Interest

expense |

(0) |

|

(0) |

|

(0) |

|

(0) |

| Provision

for income taxes |

|

2,384 |

|

(1,576) |

|

2,907 |

|

9,643 |

|

Depreciation and amortization |

4,469 |

|

5,006 |

|

18,207 |

|

20,718 |

|

EBITDA |

|

$ |

10,878 |

|

$ |

22,641 |

|

$ |

41,823 |

|

$ |

51,901 |

| % of net

sales |

25.0% |

|

52.5% |

|

96.2% |

|

120.4% |

| |

|

|

|

|

|

|

|

|

|

Unusual or special items: |

|

|

|

|

|

|

| ERP

system implementation consulting costs |

|

737 |

|

1,073 |

|

2,226 |

|

2,556 |

|

Professional fees related to legal entity restructuring |

|

- |

|

150 |

|

- |

|

350 |

|

Restructuring charges |

|

22,247 |

|

21,052 |

|

79,937 |

|

84,655 |

| |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

33,862 |

|

$ |

44,916 |

|

$ |

123,986 |

|

$ |

139,462 |

| % of net

sales |

77.9% |

|

104.2% |

|

285.3% |

|

323.6% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| (1) The supplementary information included in this press

release for 2018 is preliminary and subject to change prior to the

filing of our upcoming Annual Report on Form 10-K with the

Securities and Exchange Commission. |

| |

| (2) In this press release and supplemental information, we

have included Non-GAAP financial measures, including Non-GAAP net

earnings, Non-GAAP EPS, EBITDA and Adjusted EBITDA. We present

results adjusted to exclude the effects of certain specified items

and their related tax impact that would otherwise be included under

GAAP, to aid in comparisons with other periods. We may use

Non-GAAP financial measures to determine performance-based

compensation and management believes that this information may be

useful to investors. |

| Bel Fuse Inc. |

| Supplementary

Information(1) |

| Reconciliation of GAAP Measures to Non-GAAP

Measures(2) |

| (in thousands, unaudited) |

| |

| The following tables detail the impact of certain unusual or

special items had on the Company's net earnings (loss) per common

Class A and Class B basic and diluted shares ("EPS") and the line

items these items were included on the condensed consolidated

statements of operations. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31,

2018 |

|

Three Months Ended December 31,

2017 |

| |

|

|

|

|

|

Reconciling Items |

|

Earnings before taxes |

|

Provision for income taxes |

|

Net earnings |

|

Class AEPS(3) |

|

Class BEPS(3) |

|

Earnings before taxes |

|

Provision for income taxes |

|

Net (loss) earnings |

|

Class AEPS(3) |

|

Class BEPS(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP measures |

|

$ |

6,409 |

|

$ |

2,384 |

|

$ |

4,025 |

|

$ |

0.31 |

|

$ |

0.33 |

|

$ |

(1,576) |

|

$ |

19,211 |

|

$ |

(20,787) |

|

$ |

(1.66) |

|

$ |

(1.74) |

| Items

included in SG&A expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ERP

system implementation consulting costs |

|

737 |

|

139 |

|

598 |

|

0.05 |

|

0.05 |

|

1,073 |

|

333 |

|

740 |

|

0.06 |

|

0.06 |

|

Professional fees related to legal entity restructuring |

|

- |

|

- |

|

- |

|

- |

|

- |

|

150 |

|

57 |

|

93 |

|

0.01 |

|

0.01 |

| Restructuring

charges |

|

160 |

|

33 |

|

127 |

|

0.01 |

|

0.01 |

|

137 |

|

27 |

|

110 |

|

0.01 |

|

0.01 |

| Writeoff of deferred

financing costs related to debt extinguishment |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1,031 |

|

392 |

|

639 |

|

0.05 |

|

0.05 |

| Items

included in income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impact

from tax reform bill (transition tax and revaluation of deferred

tax assets) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(18,043) |

|

18,043 |

|

1.44 |

|

1.51 |

| Non-GAAP

measures |

|

$ |

7,306 |

|

$ |

2,556 |

|

$ |

4,750 |

|

$ |

0.37 |

|

$ |

0.39 |

|

$ |

815 |

|

$ |

1,977 |

|

$ |

(1,162) |

|

$ |

(0.09) |

|

$ |

(0.10) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

Year Ended December 31, 2018 |

|

Year Ended December 31, 2017 |

| |

|

|

|

|

|

Reconciling Items |

|

Earnings before taxes |

|

Provision for income taxes |

|

Net earnings |

|

Class AEPS(3) |

|

Class BEPS(3) |

|

Earnings before taxes |

|

Provision for income taxes |

|

Net (loss) earnings |

|

Class AEPS(3) |

|

Class BEPS(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP measures |

|

$ |

23,616 |

|

$ |

2,907 |

|

$ |

20,709 |

|

$ |

1.62 |

|

$ |

1.73 |

|

$ |

9,643 |

|

$ |

21,540 |

|

$ |

(11,897) |

|

$ |

(0.97) |

|

$ |

(0.99) |

| Items included in

SG&A expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ERP

system assessment costs |

|

2,226 |

|

419 |

|

1,807 |

|

0.14 |

|

0.15 |

|

2,556 |

|

795 |

|

1,761 |

|

0.14 |

|

0.15 |

|

Professional fees related to legal entity restructuring |

|

- |

|

- |

|

- |

|

- |

|

- |

|

350 |

|

133 |

|

217 |

|

0.02 |

|

0.02 |

| Restructuring

charges |

|

222 |

|

45 |

|

177 |

|

0.01 |

|

0.01 |

|

308 |

|

71 |

|

237 |

|

0.02 |

|

0.02 |

| Writeoff of deferred

financing costs related to debt extinguishment |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1,031 |

|

392 |

|

639 |

|

0.05 |

|

0.05 |

| Items included in

income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transition tax, measurement period adjustment |

|

- |

|

2,628 |

|

(2,628) |

|

(0.21) |

|

(0.22) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

Incremental tax related to legal entity restructuring |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(2,308) |

|

2,308 |

|

0.18 |

|

0.19 |

| Impact

from tax reform bill (transition tax and revaluation of deferred

tax assets) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(18,043) |

|

18,043 |

|

1.44 |

|

1.51 |

| Non-GAAP

measures |

|

$ |

26,064 |

|

$ |

5,999 |

|

$ |

20,065 |

|

$ |

1.57 |

|

$ |

1.68 |

|

$ |

13,888 |

|

$ |

2,580 |

|

$ |

11,308 |

|

$ |

0.88 |

|

$ |

0.95 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) The supplementary information included in this press

release for 2018 is preliminary and subject to change prior to the

filing of our upcoming Annual Report on Form 10-K with the

Securities and Exchange Commission. |

| |

| (2) In this press release and supplemental information, we

have included Non-GAAP financial measures, including Non-GAAP net

earnings (loss), Non-GAAP EPS, EBITDA and Adjusted EBITDA. We

present results adjusted to exclude the effects of certain

specified items and their related tax impact that would otherwise

be included under GAAP, to aid in comparisons with other

periods. We may use Non-GAAP financial measures to determine

performance-based compensation and management believes that this

information may be useful to investors. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) Individual amounts of earnings per share may not agree to

the total due to rounding. |

| |

|

Investor Contact:Darrow Associatestel

516.419.9915pseltzberg@darrowir.com |

|

Company Contact:Daniel

Bernstein President ir@belf.com |

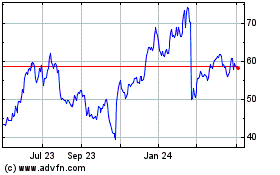

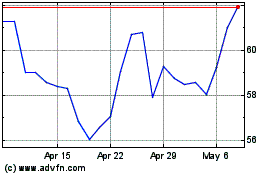

Bel Fuse (NASDAQ:BELFB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bel Fuse (NASDAQ:BELFB)

Historical Stock Chart

From Apr 2023 to Apr 2024