Beasley Broadcast Group, Inc. (Nasdaq: BBGI) (“Beasley” or the

“Company”), a large- and mid-size market radio broadcaster, today

announced operating results for the three-month and six-month

periods ended June 30, 2019.

The results presented herein reflect actual results including

the operations of WXTU-FM in the three and six months ended June

30, 2019.

Summary of Second Quarter

Results

|

In millions, except per share data |

Three Months EndedJune 30, |

Six Months EndedJune 30, |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net revenue |

$ |

65.7 |

$ |

61.6 |

$ |

123.3 |

$ |

116.8 |

|

Operating income1 |

|

10.7 |

|

10.7 |

|

17.5 |

|

11.1 |

|

Net income1 |

|

4.3 |

|

4.9 |

|

5.6 |

|

1.8 |

|

Net income per diluted share1 |

$ |

0.15 |

$ |

0.18 |

$ |

0.20 |

$ |

0.06 |

|

Station operating income (SOI - non-GAAP) |

|

17.9 |

|

16.7 |

|

28.1 |

|

26.3 |

1 Operating income, net income and net

income per diluted share were impacted by a $4.4 million charge due

to the change in fair value of contingent consideration in the six

months ended June 30, 2018 and a $3.5 million gain on dispositions

in the six months ended June 30, 2019.

The $4.0 million, or 6.5%, year-over-year

increase in net revenue during the three months ended June 30,

2019, reflects increased revenue in the Company’s Philadelphia

market cluster, primarily due to the September 2018 acquisition of

WXTU-FM, and increased revenue in the Company’s Boston market

cluster. Net revenue for the three months ended June 30, 2019 was

comparable to net revenue for the same period in 2018 at the

Company’s other market clusters.

Beasley reported operating income of $10.7

million in the second quarter of 2019. Second quarter 2019 interest

expense increased by approximately $0.7 million to $4.5 million

reflecting additional borrowings related to the WXTU-FM acquisition

and a higher overall cost of borrowings. As a result of these

factors, Beasley reported net income of $4.3 million or $0.15 per

diluted share in the three months ended June 30, 2019, compared to

net income of $4.9 million or $0.18 per diluted share in the three

months ended June 30, 2018.

Station Operating Income (SOI, a non-GAAP

financial measure) rose $1.2 million or 7.5% year-over-year in the

second quarter of 2019 to $17.9 million. The year-over-year

increase reflects the net revenue growth during the period which

more than offset a 6.2% year-over-year rise in station operating

expenses related to the Company’s expanded platform.

Please refer to the “Calculation of SOI” and

“Reconciliation of SOI to Net Income” tables at the end of this

announcement for a discussion regarding SOI calculations.

Commenting on the financial results, Caroline

Beasley, Chief Executive Officer, said, “The strategic and

financial benefits of our initiatives to further expand and

diversify Beasley’s broadcast and digital platform are evident in

our second quarter financial results and further highlights the

progress we are making to reinforce and grow Beasley’s leadership

position across all audio platforms in our markets. Record second

quarter net revenue of $65.7 million was driven by the strength of

our station clusters in three of our top five largest revenue

markets as well as contributions from recent acquisitions and more

than offset approximately $1.0 million in combined political and

United States Traffic Network (USTN) revenue recorded in the

comparable 2018 period, which was non-recurring in 2019. Reflecting

the strong operating leverage in Beasley’s business model, second

quarter revenue growth of 6.5% drove a 7.5% year-over-year increase

in SOI and overall margin improvement.

“Beasley’s reported second quarter free cash

flow declined to $5.5 million from $8.4 million in the comparable

2018 period due to higher capital expenses related to the ongoing

build-out of our Philadelphia studios and increases in taxes,

corporate overhead and interest expense offsetting the $1.2 million

increase in SOI. Importantly, year-to-date operating results and

third quarter trends continue to pace consistently with our

internal forecasts.

“During the second quarter, we continued to make

significant progress toward transforming Beasley into a fully

diversified, local multi-media company through select investments

in our existing platform and opportunistic accretive transactions.

In June, we entered into a definitive agreement to acquire WDMK-FM

and three translators used to broadcast WDMK’s HD2 signal in

Detroit, Michigan from Urban One for $13.5 million. This

transaction is expected to be immediately accretive to Beasley’s

free cash flow, excluding one-time transaction costs. The

acquisition of WDMK-FM and the WDMK-HD2 translators represent a

strategically and financially compelling growth opportunity for our

shareholders and further enhances our revenue and competitive

position in Detroit with a strong cluster of four FM stations in

the country’s thirteenth largest market.

“We also continued to advance our initiatives

focused on leveraging our premium local programming and brands,

while aggressively rolling out our digital offerings and

distribution capabilities to create new value for listeners and

advertisers. In the second quarter, the early success of our

digital sales, digital content development and podcasting

strategies resulted in digital revenue growth and higher levels of

audience engagement.

“In addition to our growth and diversification

initiatives, we remain committed to enhancing shareholder value

through capital returns and leverage reduction. In the second

quarter, we used cash from operations to pay our twenty-third

consecutive quarterly cash dividend and made voluntary debt

repayments of $4.0 million, with total outstanding debt of $245.5

million as of June 30, 2019.

“Looking ahead to the second half of 2019, we

remain committed to our strategic priorities of improving top- and

bottom-line performance, reducing debt and leverage, and returning

capital to shareholders through our quarterly cash dividend. With

enhanced opportunities to monetize our strong core programming and

local brands, we remain confident in the radio industry and in

Beasley’s growth prospects going forward. We look forward to

realizing the strategic benefits of the WDMK-FM and WDMK-HD2

translators transaction later this year and continue to believe

that our ongoing initiatives to diversify and drive revenue,

productivity and efficiency across our platform, combined with

prudent management of our capital structure, are proven initiatives

for sustained long-term financial growth and enhanced shareholder

value.”

Conference Call and Webcast

InformationThe Company will host a conference

call and webcast today, August 5, 2019, at 10:00 a.m. ET to discuss

its financial results and operations. To access the

conference call, interested parties may dial 334/777-6978,

conference ID 7350889 (domestic and international callers).

Participants can also listen to a live webcast of the call at the

Company’s website at www.bbgi.com. Please allow 15 minutes to

register and download and install any necessary software. Following

its completion, a replay of the webcast can be accessed for five

days on the Company’s website, www.bbgi.com.

Questions from analysts, institutional investors

and debt holders may be e-mailed to ir@bbgi.com at any time up

until 9:00 a.m. ET on Monday, August 5, 2019. Management will

answer as many questions as possible during the conference call and

webcast (provided the questions are not addressed in their prepared

remarks).

About Beasley Broadcast

GroupCelebrating its 58th anniversary this year, Beasley

Broadcast Group, Inc., (www.bbgi.com) was founded in 1961 by George

G. Beasley who remains the Company’s Chairman of the Board.

Beasley Broadcast Group owns and operates 64 stations (46 FM and 18

AM) in 15 large- and mid-size markets in the United States.

Approximately 19 million consumers listen to Beasley radio stations

weekly over-the-air, online and on smartphones and tablets, and

millions regularly engage with the Company’s brands and

personalities through digital platforms such as Facebook, Twitter,

text, apps and email. For more information, please visit

www.bbgi.com.

DefinitionsStation Operating

Income (SOI) consists of net revenue less station operating

expenses. We define station operating expenses as cost of

services and selling, general and administrative expenses.

Free Cash Flow (FCF) consists of SOI less

station stock-based compensation expense, corporate general and

administrative expenses, interest expense, current income tax

expense and capital expenditures plus amortization of debt issuance

costs and interest income.

SOI and FCF are measures widely used in the

radio broadcast industry. The Company recognizes that because

SOI and FCF are not calculated in accordance with GAAP, they are

not necessarily comparable to similarly titled measures employed by

other companies. However, management believes that SOI and

FCF provide meaningful information to investors because they are

important measures of how effectively we operate our business

(i.e., operate radio stations) and assist investors in comparing

our operating performance with that of other radio companies.

Note Regarding Forward-Looking

StatementsStatements in this release that are

“forward-looking statements” are based upon current expectations

and assumptions, and involve certain risks and uncertainties within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. Words or expressions such as “Looking ahead,” “look

forward,” “intends,” “believe,” “hope,” “plan,” “expects,”

“expected,” “anticipates” or variations of such words and similar

expressions are intended to identify such forward-looking

statements. Forward-looking statements by their nature

address matters that are, to different degrees, uncertain, such as

statements about expected income; shareholder value; revenues; and

growth. Key risks are described in our reports filed with the

SEC including in our annual report on Form 10-K and quarterly

reports on Form 10-Q. Readers should note that

forward-looking statements are subject to change and to inherent

risks and uncertainties and may be impacted by several factors,

including:

- external economic forces that could

have a material adverse impact on our advertising revenues and

results of operations;

- the ability of our radio stations

to compete effectively in their respective markets for advertising

revenues;

- our ability to develop compelling

and differentiated digital content, products and services;

- audience acceptance of our content,

particularly our radio programs;

- our ability to respond to changes

in technology, standards and services that affect the radio

industry;

- our dependence on federally issued

licenses subject to extensive federal regulation;

- actions by the FCC or new

legislation affecting the radio industry;

- our dependence on selected market

clusters of radio stations for a material portion of our net

revenue;

- credit risk on our accounts

receivable;

- the risk that our FCC broadcasting

licenses and/or goodwill could become impaired;

- our substantial debt levels and the

potential effect of restrictive debt covenants on our operational

flexibility and ability to pay dividends;

- the failure or destruction of the

internet, satellite systems and transmitter facilities that we

depend upon to distribute our programming;

- disruptions or security breaches of

our information technology infrastructure;

- the loss of key personnel;

- the fact that we are controlled by

the Beasley family, which creates difficulties for any attempt to

gain control of us;

- our ability to integrate acquired

businesses and achieve fully the strategic and financial objectives

related thereto and their impact on our financial condition and

results of operations; and

- other economic, business,

competitive, and regulatory factors affecting our business,

including those set forth in our filings with the SEC.

Our actual performance and results could differ

materially because of these factors and other factors discussed in

our SEC filings, including but not limited to our annual reports on

Form 10-K or quarterly reports on Form 10-Q, copies of which can be

obtained from the SEC, www.sec.gov, or our website,

www.bbgi.com. All information in this release is as of August

5, 2019, and we undertake no obligation to update the information

contained herein to actual results or changes to our

expectations.

-tables follow-

BEASLEY BROADCAST GROUP,

INC.Consolidated Statements of Operations (Unaudited)

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| Net revenue |

$ |

65,658,748 |

|

|

$ |

61,625,296 |

|

|

$ |

123,346,302 |

|

|

$ |

116,778,923 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Station operating expenses (including stock- based

compensation and excluding depreciation and amortization

shown separately below) |

|

47,759,693 |

|

|

|

44,967,293 |

|

|

|

95,210,875 |

|

|

|

90,480,140 |

|

|

Corporate general and administrative expenses (including

stock-based compensation) |

|

5,423,561 |

|

|

|

4,440,299 |

|

|

|

10,385,975 |

|

|

|

7,722,772 |

|

|

Transaction expenses |

|

55,163 |

|

|

|

- |

|

|

|

296,511 |

|

|

|

- |

|

|

Depreciation and amortization |

|

1,742,687 |

|

|

|

1,562,052 |

|

|

|

3,511,474 |

|

|

|

3,108,786 |

|

|

Change in fair value of contingent consideration |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,415,925 |

|

|

Gain on dispositions |

|

- |

|

|

|

- |

|

|

|

(3,545,755 |

) |

|

|

- |

|

|

Total operating expenses |

|

54,981,104 |

|

|

|

50,969,644 |

|

|

|

105,859,080 |

|

|

|

105,727,623 |

|

|

Operating income |

|

10,677,644 |

|

|

|

10,655,652 |

|

|

|

17,487,222 |

|

|

|

11,051,300 |

|

| Non-operating income

(expense): |

|

|

|

|

|

|

|

|

Interest expense |

|

(4,547,036 |

) |

|

|

(3,805,575 |

) |

|

|

(9,137,921 |

) |

|

|

(7,430,815 |

) |

|

Other income (expense), net |

|

38,193 |

|

|

|

27,311 |

|

|

|

(194,390 |

) |

|

|

476,212 |

|

|

Income before income taxes |

|

6,168,801 |

|

|

|

6,877,388 |

|

|

|

8,154,911 |

|

|

|

4,096,697 |

|

| Income tax expense |

|

1,899,800 |

|

|

|

1,958,776 |

|

|

|

2,532,647 |

|

|

|

2,339,277 |

|

|

Net income |

$ |

4,269,001 |

|

|

$ |

4,918,612 |

|

|

$ |

5,622,264 |

|

|

$ |

1,757,420 |

|

|

|

|

|

|

|

|

|

|

| Basic net income per share |

$ |

0.15 |

|

|

$ |

0.18 |

|

|

$ |

0.20 |

|

|

$ |

0.06 |

|

| Diluted net income per share |

$ |

0.15 |

|

|

$ |

0.18 |

|

|

$ |

0.20 |

|

|

$ |

0.06 |

|

| Basic common shares

outstanding |

|

27,776,682 |

|

|

|

27,344,752 |

|

|

|

27,668,814 |

|

|

|

27,530,043 |

|

| Diluted common shares

outstanding |

|

27,838,939 |

|

|

|

27,523,310 |

|

|

|

27,740,491 |

|

|

|

27,710,563 |

|

| |

|

|

|

|

|

|

|

Selected Balance Sheet Data -

Unaudited(in thousands)

|

|

June 30,2019 |

|

December 31,2018 |

|

Cash and cash equivalents |

$ |

12,272 |

|

$ |

13,434 |

| Working capital |

|

33,110 |

|

|

42,086 |

| Total assets |

|

723,896 |

|

|

681,085 |

| Long term debt, net of

unamortized debt issuance costs |

|

237,244 |

|

|

242,777 |

| Stockholders’ equity |

$ |

279,217 |

|

$ |

275,034 |

| |

|

|

|

|

|

Selected Statement of Cash Flows Data –

Unaudited

|

|

Six Months EndedJune 30, |

|

|

|

2019 |

|

|

|

2018 |

|

| Net cash provided by operating activities |

$ |

11,533,939 |

|

|

$ |

10,982,567 |

|

| Net cash used in investing activities |

|

(3,369,405 |

) |

|

|

(2,329,499 |

) |

| Net cash used in financing activities |

|

(9,325,978 |

) |

|

|

(7,753,709 |

) |

| Net increase (decrease) in cash and cash equivalents |

$ |

(1,161,444 |

) |

|

$ |

899,359 |

|

| |

|

|

|

|

|

|

|

Calculation of SOI –

Unaudited

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| Net revenue |

$ |

65,658,748 |

|

|

$ |

61,625,296 |

|

|

$ |

123,346,302 |

|

|

$ |

116,778,923 |

|

| Station operating expenses |

|

(47,759,693 |

) |

|

|

(44,967,293 |

) |

|

|

(95,210,875 |

) |

|

|

(90,480,140 |

) |

|

SOI |

$ |

17,899,055 |

|

|

$ |

16,658,003 |

|

|

$ |

28,135,427 |

|

|

$ |

26,298,783 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income

to SOI – Unaudited

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| Net income |

$ |

4,269,001 |

|

|

$ |

4,918,612 |

|

|

$ |

5,622,264 |

|

|

$ |

1,757,420 |

|

| Corporate general and

administrative expenses |

|

5,423,561 |

|

|

|

4,440,299 |

|

|

|

10,385,975 |

|

|

|

7,722,772 |

|

| Transaction expenses |

|

55,163 |

|

|

|

- |

|

|

|

296,511 |

|

|

|

- |

|

| Depreciation and

amortization |

|

1,742,687 |

|

|

|

1,562,052 |

|

|

|

3,511,474 |

|

|

|

3,108,786 |

|

| Change in fair value of

contingent consideration |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,415,925 |

|

| Gain on dispositions |

|

- |

|

|

|

- |

|

|

|

(3,545,755 |

) |

|

|

- |

|

| Interest expense |

|

4,547,036 |

|

|

|

3,805,575 |

|

|

|

9,137,921 |

|

|

|

7,430,815 |

|

| Other income (expense), net |

|

(38,193 |

) |

|

|

(27,311 |

) |

|

|

194,390 |

|

|

|

(476,212 |

) |

| Income tax expense |

|

1,899,800 |

|

|

|

1,958,776 |

|

|

|

2,532,647 |

|

|

|

2,339,277 |

|

|

SOI |

$ |

17,899,055 |

|

|

$ |

16,658,003 |

|

|

$ |

28,135,427 |

|

|

$ |

26,298,783 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Revenue to

FCF – Unaudited

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| Net revenue |

$ |

65,658,748 |

|

|

$ |

61,625,296 |

|

|

$ |

123,346,302 |

|

|

$ |

116,778,923 |

|

| Station operating

expenses |

|

(47,759,693 |

) |

|

|

(44,967,293 |

) |

|

|

(95,210,875 |

) |

|

|

(90,480,140 |

) |

| Station stock-based

compensation expense |

|

85,002 |

|

|

|

221,046 |

|

|

|

208,149 |

|

|

|

373,464 |

|

| Corporate general and

administrative expenses |

|

(4,960,947 |

) |

|

|

(3,957,941 |

) |

|

|

(9,461,934 |

) |

|

|

(6,775,060 |

) |

| Interest expense |

|

(4,547,036 |

) |

|

|

(3,805,575 |

) |

|

|

(9,137,921 |

) |

|

|

(7,430,815 |

) |

| Amortization of debt issuance

costs |

|

483,983 |

|

|

|

470,376 |

|

|

|

967,966 |

|

|

|

940,752 |

|

| Interest income |

|

32,289 |

|

|

|

31,721 |

|

|

|

74,180 |

|

|

|

63,204 |

|

| Current income tax

expense |

|

(1,326,448 |

) |

|

|

(309,984 |

) |

|

|

(1,493,124 |

) |

|

|

(315,281 |

) |

| Capital expenditures |

|

(2,153,273 |

) |

|

|

(953,503 |

) |

|

|

(3,994,405 |

) |

|

|

(2,126,999 |

) |

|

FCF |

$ |

5,512,625 |

|

|

$ |

8,354,143 |

|

|

$ |

5,298,338 |

|

|

$ |

11,028,048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT:B. Caroline

Beasley

Chief Executive

Officer

Beasley Broadcast Group, Inc.239/263-5000 or ir@bbgi.com

Joseph Jaffoni, Jennifer NeumanJCIR212/835-8500 or

bbgi@jcir.com

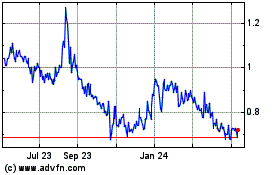

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

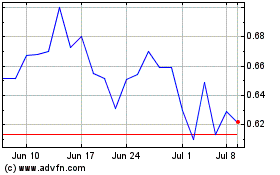

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Apr 2023 to Apr 2024