Current Report Filing (8-k)

May 23 2019 - 4:16PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 23, 2019

|

BANCFIRST

CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

OKLAHOMA

|

0-14384

|

73-1221379

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

101 North Broadway, Oklahoma City, Oklahoma

|

73102

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code

|

(405) 270-1086

|

|

N/A

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act

of 1934.

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 Par Value Per Share

|

|

BANF

|

|

NASDAQ Global Select Market System

|

|

|

Item 5.07.

|

Submission of Matters

to a Vote of Security Holders.

|

|

|

(a)

|

On May 23, 2019, BancFirst Corporation (the “Company”)

held its annual meeting of shareholders. As of the record date on April 5, 2019, the total number of shares of common stock outstanding

and entitled to vote at the annual meeting was 32,617,788, of which 30,423,905 shares were represented at the meeting in person

or by proxy. The purpose of the annual meeting was to vote on five proposals: (i) to elect the 21 directors nominated by our board;

and (ii) to amend the BancFirst Corporation Stock Option Plan to increase the number of shares of common stock authorized to be

granted to 350,000 shares and to extend the term of the plan from December 31, 2019 to December 31, 2024; (iii) to amend the BancFirst

Corporation Non-Employee Directors’ Stock Option Plan to increase the number of shares of common stock authorized to be

granted to 50,000 shares and to extend the term of the plan from December 31, 2019 to December 31, 2024; (iv) to amend the BancFirst

Corporation Directors’ Deferred Stock Compensation Plan to increase the number of shares of common stock authorized to be

granted to 40,000 shares and to extend the term of the plan from December 31, 2019 to December 31, 2024; and (v) to ratify BKD,

LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. Each of the foregoing proposals

was set forth and described in the Notice of Annual Meeting and Proxy Statement of the Company dated April 10, 2019. At the meeting,

the shareholders elected all 21 directors; amended the BancFirst Corporation Stock Option Plan; amended the BancFirst Corporation

Non-Employee Directors’ Stock Option Plan; amended the BancFirst Corporation Directors’ Deferred Stock Compensation

Plan; and ratified our independent auditors.

|

|

|

(b)

|

The number of votes cast for or against, as well as

the number of abstentions and broker non-votes as to each such matter (where applicable), are set forth below:

|

|

Description of Proposal

|

|

Number of Shares

|

|

Proposal No.

1

-Election of Directors

|

|

For

|

|

Withheld

|

|

Broker Non-Votes

|

|

Dennis L. Brand

|

|

28,756,138

|

|

196,210

|

|

|

1,471,557

|

|

C.L. Craig, Jr.

|

|

28,356,882

|

|

595,466

|

|

|

1,471,557

|

|

F. Ford Drummond

|

|

28,262,978

|

|

689,370

|

|

|

1,471,557

|

|

Joseph Ford

|

|

28,228,601

|

|

723,747

|

|

|

1,471,557

|

|

David R. Harlow

|

|

28,877,054

|

|

75,294

|

|

|

1,471,557

|

|

William O. Johnstone

|

|

28,761,907

|

|

190,441

|

|

|

1,471,557

|

|

Frank Keating

|

|

28,332,631

|

|

619,717

|

|

|

1,471,557

|

|

Bill G. Lance

|

|

28,921,128

|

|

31,220

|

|

|

1,471,557

|

|

Dave R. Lopez

|

|

28,345,333

|

|

607,015

|

|

|

1,471,557

|

|

William Scott Martin

|

|

28,267,020

|

|

685,328

|

|

|

1,471,557

|

|

Tom H. McCasland, III

|

|

28,361,066

|

|

591,282

|

|

|

1,471,557

|

|

Ronald J. Norick

|

|

28,359,364

|

|

592,984

|

|

|

1,471,557

|

|

David E. Rainbolt

|

|

28,866,638

|

|

85,710

|

|

|

1,471,557

|

|

H.E. Rainbolt

|

|

28,879,148

|

|

73,200

|

|

|

1,471,557

|

|

Robin Roberson

|

|

28,230,210

|

|

722,138

|

|

|

1,471,557

|

|

Michael S. Samis

|

|

28,848,270

|

|

104,078

|

|

|

1,471,557

|

|

Darryl Schmidt

|

|

28,757,935

|

|

194,413

|

|

|

1,471,557

|

|

Natalie Shirley

|

|

28,385,157

|

|

567,191

|

|

|

1,471,557

|

|

Michael K. Wallace

|

|

28,353,495

|

|

598,853

|

|

|

1,471,557

|

|

Gregory G. Wedel

|

|

28,232,791

|

|

719,557

|

|

|

1,471,557

|

|

G. Rainey Williams, Jr.

|

|

28,293,355

|

|

658,993

|

|

|

1,471,557

|

|

Proposal No. 2

- To Amend the

|

|

For

|

|

Against

|

|

Abstained

|

|

Broker Non-Votes

|

|

BancFirst Corporation Stock Option Plan

|

|

28,641,962

|

|

125,086

|

|

185,300

|

|

1,471,557

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

No. 3

- To Amend the

|

|

For

|

|

Against

|

|

Abstained

|

|

Broker Non-Votes

|

|

BancFirst Corporation Non-Employee Directors’ Stock Option Plan

|

|

28,592,403

|

|

237,911

|

|

122,034

|

|

1,471,557

|

|

|

|

|

|

|

|

|

|

|

|

Proposal No. 4

- To Amend the

|

|

For

|

|

Against

|

|

Abstained

|

|

Broker Non-Votes

|

|

BancFirst Corporation Directors’ Deferred Stock Compensation Plan

|

|

28,717,792

|

|

107,767

|

|

126,789

|

|

1,471,557

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

No. 5

- To Ratify

|

|

For

|

|

Against

|

|

Abstained

|

|

Broker Non-Votes

|

|

the Independent Registered Public Accounting Firm

|

|

30,399,762

|

|

8,384

|

|

15,759

|

|

-

|

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

BancFirst Corporation Announces Declaration

of Quarterly Dividend on its common stock and an Interest Payment on its BFC Capital Trust II

On May 23, 2019,

BancFirst Corporation’s Board of Directors declared a $0.30 per share cash dividend on its common stock. The dividend is

payable July 15, 2019, to shareholders of record on June 28, 2019. BancFirst Corporation will also pay the quarterly interest

payment on $26.8 million of its 7.20% Junior Subordinated Debentures related to the trust preferred securities issued by its statutory

trust subsidiary, BFC Capital Trust II. The trust will use the proceeds of the interest payment to pay a dividend of $0.45 per

share on the trust preferred securities, payable July 15, 2019, to shareholders of record on June 28, 2019.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

BANCFIRST

CORPORATION

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date:

May

23, 2019

|

/s/Kevin Lawrence

|

|

|

|

Kevin Lawrence

|

|

|

|

Executive Vice President

|

|

|

|

Chief Financial Officer

|

|

|

|

(Principal Financial Officer)

|

|

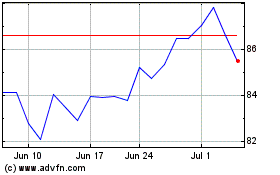

BancFirst (NASDAQ:BANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

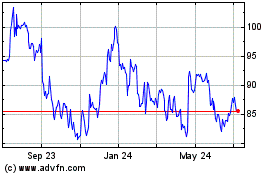

BancFirst (NASDAQ:BANF)

Historical Stock Chart

From Apr 2023 to Apr 2024