Current Report Filing (8-k)

May 28 2019 - 11:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): May 27, 2019

Balchem Corporation

(Exact name of registrant as specified in its charter)

|

|

|

13-2578432

|

(State or other jurisdiction of incorporation)

|

|

(IRS Employer Identification No.)

|

52 Sunrise Park Road, New Hampton, NY 10958

(Address of principal executive offices) (Zip Code

Registrant’s telephone number, including area code: (845) 326-5600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Name of each exchange on which registered

|

|

|

Common Stock, par value $.06-2/3 per share.

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

As previously reported, on May 2, 2019, Balchem

Corporation (“

Balchem

”) entered into

a

Securities Purchase Agreement (the “

Agreement

”) among (a) Balchem, (b) Chemogas Gilde B.V. (“

Gilde

”), a limited liability company organized and existing under the laws of The Netherlands, (c) Dirk Battig, (d) Dirk Van den Borre, (e) Eric Matthijs, (f) Christophe Marque, (g) Adamo Pia (h) Jurgen

De Smet, and (i) Sebastien Verwilghen (Gilde and the individuals referred to in (c) through (i) being hereinafter referred to as as “

Sellers

”). The

Agreement provides for purchase by Balchem of Chemogas Holding NV, a privately held specialty gases company, headquartered in Grimbergen, Belgium and its subsidiaries (hereinafter collectively referred to as ”

Chemogas

”).

On May 27, 2019, Balchem closed its acquisition of Chemogas from the Sellers (the “

Closing

”). Prior to the Closing, neither Balchem, any of its affiliates, any of its directors or officers, nor any associate of any of its directors or officers had any material relationship with

any of the other parties to the Agreement, other than with respect to the acquisition.

At the Closing, Balchem paid €88,578,586 to the Sellers and repaid €8,460,654 of Chemogas’ indebtedness. The purchase price

was determined as a result of arms’ length negotiation among Balchem and the Sellers.

The purchase price was financed through the Balchem’s existing revolving credit facility and cash on hand.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On May 28, 2019, Balchem issued a press release announcing the Closing, a copy of which is attached hereto as Exhibit 99.1 and

is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

Securities Purchase Agreement, dated as of May 2, 2019, among Balchem Corporation, Chemogas Gilde B.V., Dirk Battig, Dirk Van den Borre,

Eric Matthijs, Christophe Marque, Adamo Pia, Jurgen De Smet and Sebastien Verwilghen (incorporated by reference to Exhibit 2.1 of Balchem Corporation’s Current Report on Form 8-K dated and filed on May 6, 2019 (SEC File No. 001-13648

19798353).

|

|

|

|

|

Press release dated May 28, 2019.

|

|

*

|

This exhibit is furnished as part of this Current Report on Form 8-K.

|

Cautionary Note Regarding Forward-Looking Statements

This report, including the exhibits filed and furnished herewith, contains both historical and forward-looking statements. All statements

other than statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements generally can be

identified because they relate to the topics set forth above or by the use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “project,” “foresee,” “likely,” “may,” “will,” “would” or

other

words or phrases with similar meanings, and include the statements regarding Chemogas’ revenues and growth prospects, as well as the impact of the transaction on Balchem’s

earnings per share. Similarly, statements that describe the Balchem’s objectives, plans or goals, are, or may be, forward-looking statements. These statements are based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our expectations and projections. Some of the factors that could cause actual results to differ include, but are not limited to, the following: any

delay or failure to complete the acquisition of Chemogas on the terms previously agreed or difficulty in integrating the acquisition if closed or realizing on the anticipated business from the acquisition; changes to Balchem’s business, its industry,

or the overall economic climate, general industry conditions and competition; product or other liability risk inherent in the design, development, manufacture and marketing of its offerings; inability to enhance Balchem’s existing or introduce new

products or services in a timely manner; economic conditions, such as interest rate and currency exchange rate fluctuations; technological advances and patents attained by competitors; and difficulty in integrating other acquisitions into Balchem’s

existing business, thereby reducing or eliminating the anticipated benefits of the acquisition of Chemogas. For a more detailed discussion of these and other factors, see the information under the caption “Risk Factors” in Balchem’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2018 filed with the Securities and Exchange Commission. All forward-looking statements in this report speak only as of the date of this report or as of the date they are made and are qualified in their

entirety by the above cautionary statement. Balchem assumes no duty to update its outlook or other forward-looking statements as of any future date, except as required by law.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Mark Stach, General Counsel and Secretary

|

|

|

|

|

|

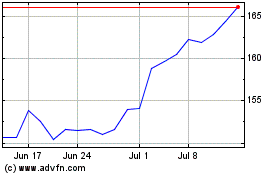

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

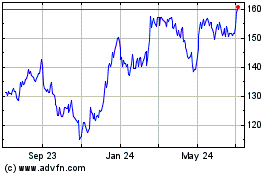

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Apr 2023 to Apr 2024