Current Report Filing (8-k)

May 06 2019 - 10:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): May 2, 2019

Balchem Corporation

(Exact name of registrant as specified in its charter)

|

Maryland

|

1-13648

|

13-2578432

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

52 Sunrise Park Road, New Hampton, NY 10958

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (845) 326-5600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

BCPC

|

NASDAQ

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Entry into Securities Purchase Agreement

On May 2, 2019, Balchem Corporation, a Maryland corporation (“Balchem”), entered into a Securities Purchase Agreement (the “Agreement”) among (a)

Balchem, (b) Chemogas Gilde B.V. (“Gilde”), a limited liability company organized and existing under the laws of The Netherlands, (c) Dirk Battig, (d) Dirk Van den Borre, (e) Eric Matthijs, (f) Christophe Marque, (g) Adamo Pia (h) Jurgen De

Smet, and (i) Sebastien Verwilghen (Gilde and the individuals referred to in (c) through (i) being hereinafter referred to as as “Sellers”). The Agreement provides for purchase by Balchem of Chemogas Holding NV, a privately held specialty

gases company, headquartered in Grimbergen, Belgium and its subsidiaries (hereinafter collectively referred to as ”Chemogas”).

Chemogas is a leader in the packaging and distribution of a wide variety of specialty gases, most notably ethylene oxide, primarily in the European and

Asian markets, for medical device sterilization.

The following is a summary of the terms and conditions of the Agreement and certain ancillary agreements contemplated therein:

|

•

|

Pursuant to, and subject to the terms and conditions of, the Agreement, Balchem will acquire all of the issued and outstanding securities of Chemogas Holding NV (the

“Securities”) from the Sellers (the “Acquisition”).

|

|

•

|

The purchase price for the Securities (the “Purchase Price”) is €86,520,586 in cash, subject to certain adjustments as provided in the Agreement.

|

|

•

|

Balchem made customary representations and warranties pursuant to the Agreement.

|

|

•

|

The Sellers made customary representations and warranties pursuant to the Agreement. Such representations and warranties generally survive for 18 months after the

closing date, subject to certain exceptions.

|

|

•

|

The Agreement also includes customary covenants, including certain non-competition and non-solicitation covenants by the Sellers.

|

|

•

|

The Sellers, on a several basis, have agreed, subject to limitations set forth in the Agreement, to indemnify and hold Balchem harmless from and against, among other

things, various losses that may be incurred by Balchem as a result of (i) any breach of any representation or warranty of the Sellers contained in the Agreement, (ii) any breach of any covenant or agreement to be performed by the

Sellers pursuant to the Agreement and (iii) certain other matters, including certain losses related to certain environmental conditions, certain pending litigation and certain claims, actions, suits and proceedings related to

certain pre-closing matters.

|

|

•

|

Closing under the Agreement is subject to customary closing conditions, including, among others, (i) the absence of any law or order or pending proceeding initiated

challenging or prohibiting the Acquisition, (ii) the receipt of required regulatory approvals, and (iii) the absence of a material adverse effect with respect to Chemogas. Balchem

|

currently anticipates that the closing of the acquisition will occur in the second quarter of 2019, although no

assurance can be given in that regard.

|

•

|

Balchem has obtained representation and warranty insurance, subject to exclusions, policy limits and certain other terms and conditions, to obtain coverage for any

loss resulting from any breach of certain representations and warranties made by the Sellers pursuant to the Agreement.

|

The foregoing summary of the Agreement and the Acquisition and the other transactions contemplated thereby does not purport to be complete and is

subject to, and qualified in its entirety by, the full text of the Agreement attached hereto as Exhibit 2.1 and incorporated herein by reference.

The Agreement has been included to provide investors with information regarding its terms. The Agreement is not intended to provide any factual

information about Balchem or Chemogas. The representations, warranties and covenants contained in the Agreement were made only for purposes of the Agreement, were solely for the benefit of the parties to the Agreement and are subject to

limitations agreed upon by the parties to the Agreement, including being qualified by information that was disclosed in the data room provided by the Sellers in respect of the transaction. Moreover, the representations and warranties

contained in the Agreement were made for the purpose of allocating contractual risk between the parties to the Agreement instead of establishing matters as facts and may be subject to standards of materiality applicable to the parties to the

Agreement that differ from those applicable to investors. Investors are not third-party beneficiaries under the Agreement and should not rely on the representations, warranties and covenants contained therein or any descriptions thereof as

characterizations of the actual state of facts or condition of Balchem, Chemogas, or any of their respective subsidiaries or affiliates. Additionally, information concerning the subject matter of the representations and warranties contained

in the Agreement may change after the date of the Agreement, which subsequent information may or may not be fully reflected in Balchem’s public disclosures.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On May 2, 2019, Balchem issued a press release announcing its entry into the Agreement and the Acquisition, a copy of which is attached hereto as

Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 7.01 and in Exhibit 99.1 attached hereto is being furnished to the Securities and Exchange Commission pursuant to

Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall any such information

or exhibits be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”).

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

Securities Purchase Agreement, dated as of May

2, 2019, among Balchem Corporation, Chemogas Gilde B.V., Dirk Battig, Dirk Van den Borre, Eric Matthijs, Christophe Marque, Adamo Pia, Jurgen De Smet and Sebastien Verwilghen.

|

|

|

|

|

|

|

|

|

|

Portions of the Exhibit have been been omitted.

|

|

|

|

|

Press release dated May 2, 2019.

|

|

*

|

Certain schedules and annexes to the Securities Purchase Agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. These schedules and exhibits consist

of: (i) the Data Room Index, (ii) contents of the Data Room (iii) the Locked Box Accounts; (iv) list of Subsidiaries Locked Box Accounts; (v) list of Subsidiaries (vi) the Representations and Warranties Insurance (vii) Form of

receipt for the Purchase Price (viii) draft spouse’s consent letter (ix) the forms of amendments to management agreements with certain individuals or entities (x) list of key employees (xi) list of resigning directors, (xii) form of

resignation letter of the directors, (xiii) countries and areas where the non-compete undertakings the non-solicitation undertakings shall apply (xiv) form of notification to the Company, and (xv) pro rata portion of purchase price

allocable to each Seller.

|

|

**

|

This exhibit is furnished as part of this Current Report on Form 8-K.

|

Cautionary Note Regarding Forward-Looking Statements

This report, including the exhibits filed and furnished herewith, contains both historical and forward-looking statements. All statements other than

statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements generally can be identified

because they relate to the topics set forth above or by the use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “project,” “foresee,” “likely,” “may,” “will,” “would” or other words or

phrases with similar meanings, and include the statements regarding Chemogas’ revenues and growth prospects, as well as the impact of the transaction on Balchem’s earnings per share. Similarly, statements that describe the Balchem’s objectives,

plans or goals, are, or may be, forward-looking statements. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could

vary materially from our expectations and projections. Some of the factors that could cause actual results to differ include, but are not limited to, the following: any delay or failure to complete the acquisition of Chemogas on the terms

previously agreed or difficulty in integrating the acquisition if closed or realizing on the anticipated business from the acquisition; changes to Balchem’s business, its industry, or the overall economic climate, general industry conditions

and competition; product or other liability risk inherent in the design, development, manufacture and marketing of its offerings; inability to enhance Balchem’s existing or introduce new products or services in a timely manner; economic

conditions, such as interest rate and currency

exchange rate fluctuations; technological advances and patents attained by competitors; and difficulty in integrating other acquisitions into Balchem’s

existing business, thereby reducing or eliminating the anticipated benefits of the acquisition of Chemogas. For a more detailed discussion of these and other factors, see the information under the caption “Risk Factors” in Balchem’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the Securities and Exchange Commission. All forward-looking statements in this report speak only as of the date of this report or as of the date they are made and are

qualified in their entirety by the above cautionary statement. Balchem assumes no duty to update its outlook or other forward-looking statements as of any future date, except as required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

BALCHEM CORPORATION

|

|

|

|

|

|

By:/s/ Mark Stach

|

|

|

Mark Stach, General Counsel and Secretary

|

|

|

|

|

Dated: May 6, 2019

|

|

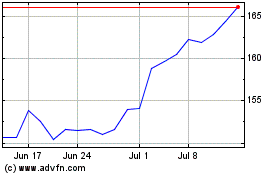

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

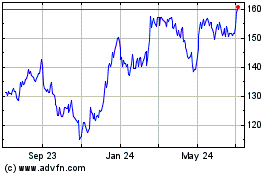

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Apr 2023 to Apr 2024