Balchem Corporation (NASDAQ: BCPC) today reported for the first

quarter 2019 net earnings of $18.8 million, compared to net

earnings of $19.3 million for the first quarter 2018. First quarter

adjusted net earnings(a) were $23.7 million, compared to $24.4

million in the prior year quarter. First quarter adjusted EBITDA(a)

was $39.7 million, compared to $40.7 million in the prior year

quarter.

First Quarter 2019 Financial

Highlights:

- First quarter net sales of $157.0 million, a decrease of $4.4

million, or 2.7%, compared to the prior year quarter.

- Year over year quarterly sales growth in two of our four

segments; Human Nutrition and Health and Specialty Products with

record first quarter sales in Human Nutrition and Health.

- First quarter adjusted EBITDA was $39.7 million, a decrease of

$1.1 million, or 2.6%, from the prior year.

- First quarter GAAP net earnings were $18.8 million, a decrease

of $0.6 million, or 2.9%, from the prior year, primarily due to

lower earnings before income tax expense within our Animal

Nutrition and Health segment and a higher effective tax rate due to

lower excess tax benefits from stock-based compensation and

increased state taxes. These net earnings resulted in GAAP earnings

per share of $0.58. Quarterly adjusted net earnings of $23.7

million decreased $0.7 million or 2.8% from the prior year,

resulting in adjusted earnings per share(a) of $0.73.

- Quarterly cash flows from operations were $22.5 million for the

first quarter 2019 with quarterly free cash flow(a) of $14.0

million.

Recent Highlights:

- On May 2, 2019, the Company signed a definitive agreement to

acquire 100% of the outstanding common shares of Chemogas NV, a

privately held specialty gases company, headquartered in

Grimbergen, Belgium. Chemogas is a leader in the packaging and

distribution of a wide variety of specialty gases, most notably

ethylene oxide for medical device sterilization, primarily in the

European and Asian markets. Closing of the transaction is still

subject to the completion of customary closing conditions.

- Our Animal Nutrition and Health team launched our newest

innovation in amino acid nutrition for Ruminants with the arrival

of AminoShure XM, rumen protected methionine. This next generation

product offers enhanced bioavailability and superior feed stability

that allows it to deliver industry-leading value for dairy farmers

around the world.

Ted Harris, Chairman, CEO, and President of

Balchem said, “Overall, we are pleased with the progress made in

the first quarter. Continued growth in Human Nutrition and Health

and Specialty Products was, however, more than offset by the

expected headwinds we experienced in Animal Nutrition and Health,

driven by the prior year benefits from Chinese supply disruptions

not repeating, and the lower oil and gas fracking activity that

impacted our Industrial Products segment.”

Mr. Harris went on to add, “We are very excited

about the acquisition of Chemogas NV. The combination of our two

companies clearly creates the global leader in the critical supply

of ethylene oxide to the medical device sterilization industry

which will significantly enhance our ability to service and support

our customers on a more global basis.”

Results for Period Ended March 31, 2019

(unaudited)(Dollars in thousands, except per share

data)

| |

Three Months Ended |

| |

March 31, |

| |

|

2019 |

|

|

2018 |

| Net sales |

$ |

157,029 |

|

$ |

161,410 |

| Gross margin |

|

49,095 |

|

|

51,459 |

| Operating expenses |

|

22,615 |

|

|

24,219 |

| Earnings from

operations |

|

26,480 |

|

|

27,240 |

| Other expense |

|

1,687 |

|

|

2,063 |

| Earnings before income tax

expense |

|

24,793 |

|

|

25,177 |

| Income tax expense |

|

6,010 |

|

|

5,831 |

| Net earnings |

$ |

18,783 |

|

$ |

19,346 |

| |

|

|

|

|

|

| Diluted net earnings per

common share |

$ |

0.58 |

|

$ |

0.60 |

| |

|

|

|

|

|

| Adjusted EBITDA(a) |

$ |

39,680 |

|

$ |

40,740 |

| Adjusted net

earnings(a) |

$ |

23,730 |

|

$ |

24,418 |

| Adjusted net earnings per

common share(a) |

$ |

0.73 |

|

$ |

0.76 |

| |

|

|

|

|

|

| Shares used in the

calculations of diluted and adjusted net earnings per common

share |

|

32,509 |

|

|

32,327 |

| |

|

|

| (a) See

“Non-GAAP Financial Information” for a reconciliation of GAAP and

non-GAAP financial measures. |

Segment Financial Results for the First Quarter of

2019:

The Human Nutrition &

Health segment generated record first quarter sales of

$85.1 million, an increase of $2.1 million or 2.5% compared to the

prior year quarter. The increase was driven by higher sales within

our ingredient solutions business into food and beverage markets,

along with increased sales in our cereal systems business. Record

quarterly earnings from operations for this segment of $13.7

million increased $0.8 million or 6.0% compared to $12.9 million in

the prior year quarter, primarily due to the aforementioned higher

sales and lower amortization expense, partially offset by mix.

Excluding the effect of non-cash expense associated with

amortization of acquired intangible assets for first quarter of

2019 and 2018 of $5.0 million and $5.5 million, respectively,

adjusted earnings from operations(a) for this segment were $18.7

million, compared to $18.4 million in the prior year quarter.

The Animal Nutrition &

Health segment generated quarterly sales of $43.4 million,

a decrease of $2.8 million or 6.0% compared to the prior year

quarter. The decreased sales were primarily due to lower European

monogastric species volumes, partially offset by higher global

ruminant species volumes. First quarter earnings from operations

for this segment of $5.3 million were down from the prior year

comparable quarter of $7.5 million, primarily due to lower volumes

and margins in the European monogastric business as a result of

increased competitive activity. Excluding the effect of non-cash

expense associated with amortization of acquired intangible assets

for the first quarter of 2019 and 2018 of $0.2 million and $0.1

million, respectively, adjusted earnings from operations for this

segment were $5.4 million, compared to $7.5 million in the prior

year quarter.

The Specialty Products segment

generated first quarter sales of $18.4 million, an increase of $0.7

million or 3.9% compared to the prior year quarter, primarily due

to higher sales of ethylene oxide for the medical device

sterilization market. Record first quarter earnings from operations

for this segment were $6.7 million, versus $5.0 million in the

prior year comparable quarter, an increase of $1.7 million or

33.0%, primarily due to the aforementioned higher sales and

improved mix. Excluding the effect of non-cash expense associated

with amortization of acquired intangible assets for the first

quarter of 2019 and 2018 of $0.7 million and $0.7 million,

respectively, adjusted earnings from operations for this segment

were $7.4 million, compared to $5.8 million in the prior year

quarter.

The Industrial Products segment

sales of $10.1 million decreased $4.4 million or 30.2% from the

prior year comparable quarter, primarily due to reduced sales

volumes of choline and choline derivatives used in shale fracking

applications. Earnings from operations for the Industrial Products

segment were $1.6 million, a decrease of $0.8 million or 34.0%

compared with the prior year comparable quarter, primarily due to

the aforementioned lower sales volumes.

Consolidated gross margin for the quarter ended March 31, 2019

of $49.1 million decreased by $2.4 million or 4.6%, compared to

$51.5 million for the prior year comparable period. Gross margin as

a percentage of sales was 31.3% as compared to 31.9% in the prior

year period. The decrease was primarily due to mix and the

increased competitive activity in the European monogastric market.

Operating expenses of $22.6 million for the quarter were down $1.6

million from the prior year comparable quarter, primarily due to a

decrease in certain compensation-related expenses. Excluding

non-cash operating expense associated with amortization of

intangible assets of $5.1 million, operating expenses were $17.5

million, or 11.1% of sales.

Interest expense was $1.6 million in the first

quarter of 2019. Our effective tax rates for the three months ended

March 31, 2019 and 2018 were 24.2% and 23.2%, respectively. The

increase in the effective tax rate from the prior year is primarily

due to lower excess tax benefits from stock-based compensation and

higher state taxes.

For the quarter ended March 31, 2019, cash flows

provided by operating activities were $22.5 million, and quarterly

free cash flow was $14.0 million. The $157.9 million of net working

capital on March 31, 2019 included a cash balance of $39.0 million,

which reflects revolving loan payments of $16.0 million, dividend

payments of $15.1 million, and capital expenditures of $8.5 million

in the first quarter of 2019. The Company continues to invest in

projects across all facilities to improve capabilities and

operating efficiencies.

Ted Harris, Chairman, CEO, and President of

Balchem said, “Our first quarter earnings once again highlight the

strength of our business model, particularly in light of the

specific headwinds we faced in the quarter. We delivered sales

growth in two of our four reporting segments, and when adjusting

for the prior year benefit from the Chinese supply disruptions, the

underlying Animal Nutrition and Health segment grew nicely. We

remain cautious regarding the Industrial Products segment, although

we do expect fracking activity to pick up in the later part of the

year.”

Mr. Harris went on to add, “Moving forward, we

will continue to drive our strategic growth initiatives, through

both organic investments in new manufacturing capabilities and new

product development, as well as value creating acquisitions.”

Quarterly Conference CallA

quarterly conference call will be held on Friday, May 3, 2019, at

11:00 AM Eastern Time (ET) to review first quarter 2019 results.

Ted Harris, Chairman of the Board, CEO and President and Martin

Bengtsson, CFO will host the call. We invite you to listen to the

conference by calling toll-free 1-877-407-8289 (local dial-in

1-201-689-8341), five minutes prior to the scheduled start time of

the conference call. The conference call will be available for

replay two hours after the conclusion of the call through end of

day Friday, May 17, 2019. To access the replay of the conference

call, dial 1-877-660-6853 (local dial-in 1-201-612-7415), and use

conference ID #13690170.

Segment InformationBalchem

Corporation reports four business segments: Human Nutrition &

Health; Animal Nutrition & Health; Specialty Products; and

Industrial Products. The Human Nutrition & Health segment

delivers customized food and beverage ingredient systems, as well

as key nutrients into a variety of applications across the food,

supplement and pharmaceutical industries. The Animal Nutrition

& Health segment manufactures and supplies products to numerous

animal health markets. Through Specialty Products, Balchem provides

specialty-packaged chemicals for use in healthcare and other

industries, and also provides chelated minerals to the

micronutrient agricultural market. The Industrial Products segment

manufactures and supplies certain derivative products into

industrial applications.

Forward-Looking StatementsThis

release contains forward-looking statements, which reflect

Balchem’s expectation or belief concerning future events that

involve risks and uncertainties. Balchem can give no assurance that

the expectations reflected in forward-looking statements will prove

correct and various factors could cause results to differ

materially from Balchem’s expectations, including risks and factors

identified in Balchem’s annual report on Form 10-K for the year

ended December 31, 2018. Forward-looking statements are qualified

in their entirety by the above cautionary statement. Balchem

assumes no duty to update its outlook or other forward-looking

statements as of any future date.

Contact: Mary Ann Brush, Balchem

Corporation (Telephone: 845-326-5600)

|

|

|

|

Selected Financial Data (unaudited) |

|

|

($ in 000’s) |

|

|

|

Three Months Ended |

|

Business Segment Net Sales |

March 31, |

| |

|

| |

2019 |

|

2018 |

| Human Nutrition &

Health |

$ |

85,149 |

|

$ |

83,063 |

| Animal Nutrition &

Health |

|

43,361 |

|

|

46,141 |

| Specialty Products |

|

18,424 |

|

|

17,740 |

| Industrial Products |

|

10,095 |

|

|

14,466 |

| Total |

$ |

157,029 |

|

$ |

161,410 |

| |

Three Months Ended |

|

Business Segment Earnings Before Income Taxes |

March 31, |

| |

2019 |

|

2018 |

|

| Human Nutrition &

Health |

$ |

13,703 |

|

$ |

12,932 |

|

| Animal Nutrition &

Health |

|

5,256 |

|

|

7,484 |

|

| Specialty Products |

|

6,697 |

|

|

5,034 |

|

| Industrial Products |

|

1,637 |

|

|

2,479 |

|

| Transaction costs,

integration costs and unallocated legal fees |

|

(804 |

) |

|

(689 |

) |

| Unallocated amortization

expense |

|

(9 |

) |

|

— |

|

| Interest and other

expense |

|

(1,687 |

) |

|

(2,063 |

) |

| Total |

$ |

24,793 |

|

$ |

25,177 |

|

| |

|

| |

|

| Selected Balance

Sheet Items |

March 31, |

|

December 31, |

| |

2019 |

|

2018 |

| Cash and Cash

Equivalents |

$ |

39,004 |

|

$ |

54,268 |

|

| Accounts Receivable,

net |

|

99,834 |

|

|

99,545 |

|

| Inventories |

|

66,764 |

|

|

67,187 |

|

| Other Current Assets |

|

16,064 |

|

|

5,314 |

|

| Total Current Assets |

|

221,666 |

|

|

226,314 |

|

| |

|

|

| Property, Plant &

Equipment, net |

|

188,036 |

|

|

194,339 |

|

| Goodwill |

|

446,453 |

|

|

447,995 |

|

| Intangible Assets with

Finite Lives, net |

|

100,088 |

|

|

105,985 |

|

| Right of Use Assets |

|

8,036 |

|

|

— |

|

| Other Assets |

|

7,609 |

|

|

6,722 |

|

| Total Assets |

$ |

971,888 |

|

$ |

981,355 |

|

| |

|

|

| Current Liabilities |

$ |

63,810 |

|

$ |

82,056 |

|

| Revolving Loan |

|

140,000 |

|

|

156,000 |

|

| Deferred Income Taxes |

|

44,311 |

|

|

44,309 |

|

| Long-Term Obligations |

|

13,258 |

|

|

7,372 |

|

| Total Liabilities |

|

261,379 |

|

|

289,737 |

|

| |

|

|

| Stockholders' Equity |

|

710,509 |

|

|

691,618 |

|

| |

|

|

| Total Liabilities and

Stockholders' Equity |

$ |

971,888 |

|

$ |

981,355 |

|

| |

|

|

|

|

|

|

Balchem

CorporationCondensed Consolidated Statements of

Cash Flows(Dollars in thousands)(unaudited)

| |

Three Months Ended |

| |

March 31, |

| |

2019 |

|

|

2018 |

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

| Net

earnings |

$ |

18,783 |

|

|

$ |

19,346 |

|

| Adjustments

to reconcile net earnings to net cash provided by operating

activities: |

|

|

|

|

|

|

|

| Depreciation

and amortization |

|

10,836 |

|

|

|

11,127 |

|

| Stock

compensation expense |

|

1,631 |

|

|

|

1,793 |

|

| Other

adjustments |

|

(2,432 |

) |

|

|

(1,078 |

) |

| Changes in

assets and liabilities |

|

(6,335 |

) |

|

|

(5,709 |

) |

| Net

cash provided by operating activities |

|

22,483 |

|

|

|

25,479 |

|

| |

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

| Capital

expenditures and intangible assets acquired |

|

(8,507 |

) |

|

|

(3,854 |

) |

| Insurance

Proceeds |

|

2,727 |

|

|

|

1,590 |

|

| Net

cash used in investing activities |

|

(5,780 |

) |

|

|

(2,264 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

| Principal

payments on long-term and revolving debt |

|

(16,000 |

) |

|

|

(8,750 |

) |

| Proceeds

from stock options exercised |

|

288 |

|

|

|

1,261 |

|

| Dividends

paid |

|

(15,135 |

) |

|

|

(13,421 |

) |

| Other |

|

(727 |

) |

|

|

(786 |

) |

| Net

cash used in financing activities |

|

(31,574 |

) |

|

|

(21,696 |

) |

| |

|

|

|

|

|

|

|

| Effect of

exchange rate changes on cash |

|

(393 |

) |

|

|

744 |

|

| |

|

|

|

|

|

|

|

| (Decrease)

increase in cash and cash equivalents |

|

(15,264 |

) |

|

|

2,263 |

|

| |

|

|

|

|

|

|

|

| Cash and cash

equivalents, beginning of period |

|

54,268 |

|

|

|

40,416 |

|

| Cash and cash

equivalents, end of period |

$ |

39,004 |

|

|

$ |

42,679 |

|

Non-GAAP Financial Information

In addition to disclosing financial results in

accordance with United States (U.S.) generally accepted accounting

principles (GAAP), this earnings release contains non-GAAP

financial measures that we believe are helpful in understanding and

comparing our past financial performance and our future results.

The non-GAAP financial measures disclosed by the company exclude

certain business combination accounting adjustments and certain

other items related to acquisitions, certain unallocated equity

compensation, and certain one-time or unusual transactions. These

non-GAAP financial measures should not be considered a substitute

for, or superior to, financial measures calculated in accordance

with GAAP, and the financial results calculated in accordance with

GAAP and reconciliations from these results should be carefully

evaluated. Management believes that these non-GAAP measures provide

useful information about the Company's core operating results and

thus are appropriate to enhance the overall understanding of the

Company's past financial performance and its prospects for the

future. The non-GAAP financial measures in this press release

include adjusted gross margin, adjusted earnings from operations,

adjusted net earnings and the related adjusted per diluted share

amounts, EBITDA, adjusted EBITDA, adjusted income tax expense, and

free cash flow. EBITDA is defined as earnings before interest,

other expense/income, taxes, depreciation and amortization.

Adjusted EBITDA is defined as earnings before interest, other

expense/income, taxes, depreciation, amortization, stock-based

compensation, acquisition-related expenses, indemnification

settlements, legal settlements, unallocated legal fees and the fair

valuation of acquired inventory. Adjusted income tax expense is

defined as income tax expense adjusted for the impact of ASU

2016-09. Free cash flow is defined as net cash provided by

operating activities less capital expenditures.

Set forth below are reconciliations of the non-GAAP financial

measures to the most directly comparable GAAP financial

measures.

Table 1

Reconciliation of Non-GAAP Measures to

GAAP (Dollars in thousands, except per share data)

(unaudited)

| |

Three Months Ended |

| |

March 31, |

| |

2019 |

|

2018 |

| Reconciliation of

adjusted gross margin |

|

|

|

|

|

|

| GAAP gross margin |

$ |

49,095 |

|

|

$ |

51,459 |

|

| Amortization of intangible

assets (1) |

|

734 |

|

|

|

842 |

|

| Adjusted gross margin |

$ |

49,829 |

|

|

$ |

52,301 |

|

| |

|

|

|

|

|

|

| Reconciliation of

adjusted earnings from operations |

|

|

|

|

|

|

| GAAP earnings from

operations |

$ |

26,480 |

|

|

$ |

27,240 |

|

| Amortization of intangible

assets (1) |

|

5,842 |

|

|

|

6,282 |

|

| Transaction costs,

integration costs and unallocated legal fees (2) |

|

804 |

|

|

|

689 |

|

| Adjusted earnings from

operations |

$ |

33,126 |

|

|

$ |

34,211 |

|

| |

|

|

|

|

|

|

| Reconciliation of

adjusted net earnings |

|

|

|

|

|

|

| GAAP net earnings |

$ |

18,783 |

|

|

$ |

19,346 |

|

| Amortization of intangible

assets (1) |

|

5,913 |

|

|

|

6,391 |

|

| Transaction costs,

integration costs and unallocated legal fees (2) |

|

804 |

|

|

|

689 |

|

| Income tax adjustment

(3) |

|

(1,770 |

) |

|

|

(2,008 |

) |

| Adjusted net earnings |

$ |

23,730 |

|

|

$ |

24,418 |

|

| |

|

|

|

|

| Adjusted net earnings per

common share - diluted |

$ |

0.73 |

|

|

$ |

0.76 |

|

(1) Amortization of intangible assets: Amortization of

intangible assets consists of amortization of customer

relationships, trademarks and trade names, developed technology,

regulatory registration costs, patents and trade secrets, and other

intangibles acquired primarily in connection with business

combinations. We record expense relating to the amortization of

these intangibles in our GAAP financial statements. Amortization

expenses for our intangible assets are inconsistent in amount and

are significantly impacted by the timing and valuation of an

acquisition. Consequently, our non-GAAP adjustments exclude these

expenses to facilitate an evaluation of our current operating

performance and comparisons to our past operating performance.

(2) Transaction costs, integration costs and

unallocated legal fees: Transaction and integration costs related

to acquisitions are expensed in our GAAP financial statements.

Unallocated legal fees for transaction-related non-compete

agreement disputes are expensed in our GAAP financial statements.

Management excludes these items for the purposes of calculating

Adjusted EBITDA and other non-GAAP financial measures. We believe

that excluding these items from our non-GAAP financial measures is

useful to investors because these are items associated with each

transaction and are inconsistent in amount and frequency causing

comparison of current and historical financial results to be

difficult.

(3) Income tax adjustment: For purposes of

calculating adjusted net earnings and adjusted diluted earnings per

share, we adjust the provision for (benefit from) income taxes to

tax effect the taxable and deductible non-GAAP adjustments

described above as they have a significant impact on our income tax

(benefit) provision. Additionally, the income tax adjustment is

adjusted for the impact of adopting ASU 2016-09, “Improvements to

Employee Share-Based Payment Accounting” and uses our non-GAAP

effective rate applied to both our GAAP earnings before income tax

expense and non-GAAP adjustments described above. See Table 3 for

the calculation of our non-GAAP effective tax rate.

The following table sets forth a reconciliation of Net Income

calculated using amounts determined in accordance with GAAP to

EBITDA and to Adjusted EBITDA for the three months ended March 31,

2019 and 2018.

Table 2(unaudited)

| |

Three

Months Ended |

| |

March 31, |

| |

2019 |

|

2018 |

|

Net income - as reported |

$ |

18,783 |

|

$ |

19,346 |

| Add back: |

|

|

|

|

|

| Provision for income taxes |

|

6,010 |

|

|

5,831 |

| Other expense |

|

1,687 |

|

|

2,063 |

| Depreciation and amortization |

|

10,765 |

|

|

11,018 |

| EBITDA |

|

37,245 |

|

|

38,258 |

| Add back certain items: |

|

|

|

|

|

| Non-cash compensation expense related to equity

awards |

|

1,631 |

|

|

1,793 |

| Transaction costs, integration costs and

unallocated legal fees |

|

804 |

|

|

689 |

| Adjusted EBITDA |

$ |

39,680 |

|

$ |

40,740 |

The following table sets forth a reconciliation of our GAAP

effective income tax rate to our non-GAAP effective income tax rate

for the three months ended March 31, 2019 and 2018.

Table 3(unaudited)

| |

Three Months Ended |

| |

March 31, |

| |

|

|

Effective Tax |

|

|

Effective Tax |

| |

|

2019 |

Rate |

|

2018 |

Rate |

| GAAP Income Tax

Expense |

$ |

6,010 |

24.2% |

|

$ |

5,831 |

23.2% |

| Impact of ASU 2016-09

adoption(4) |

|

111 |

|

|

|

287 |

|

| Adjusted Income Tax

Expense |

$ |

6,121 |

24.7% |

|

$ |

6,118 |

24.3% |

(4) Impact of ASU 2016-09 adoption: In March 2016, the FASB

issued ASU No. 2016-09, “Improvements to Employee Share- Based

Payment Accounting” (“ASU 2016-09”), which addresses the accounting

for share-based payment transactions, including the income tax

consequences, classification of awards as either equity or

liabilities, and classification on the statement of cash flows. The

Company adopted ASU 2016-09 on January 1, 2017 prospectively (prior

periods have not been restated). The primary impact of adoption was

the recognition during the three months ended March 31, 2019 and

2018, of excess tax benefits as a reduction to the provision for

income taxes and the classification of these excess tax benefits in

operating activities in the consolidated statement of cash flows

instead of financing activities. The presentation requirements for

cash flows related to employee taxes paid for withheld shares had

no impact to any of the periods presented in the consolidated

statement of cash flows, since such cash flows have historically

been presented in financing activities. The Company also elected to

continue estimating forfeitures when determining the amount of

stock-based compensation costs to be recognized in each period. No

other provisions of ASU 2016-09 had a material impact on the

Company’s financial statements or disclosures.

The following table sets forth a reconciliation of net cash

provided by operating activities to free cash flow for the three

months ended March 31, 2019 and 2018.

Table 4(unaudited)

| |

Three Months Ended |

| |

March 31, |

| |

2019 |

|

|

|

2018 |

| Net cash provided by

operating activities |

$ |

22,483 |

|

|

$ |

25,479 |

|

| Capital expenditures |

|

(8,488 |

) |

|

|

(3,735 |

) |

| Free cash flow |

$ |

13,995 |

|

|

$ |

21,744 |

|

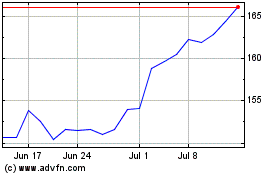

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

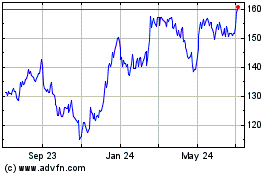

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Apr 2023 to Apr 2024