BOFI HOLDING, INC. Investor Presentation May 2018 NASDAQ: BOFI0

Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, estimates of capital expenditures, plans for future operations, products or services, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2017. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward- looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act. 1

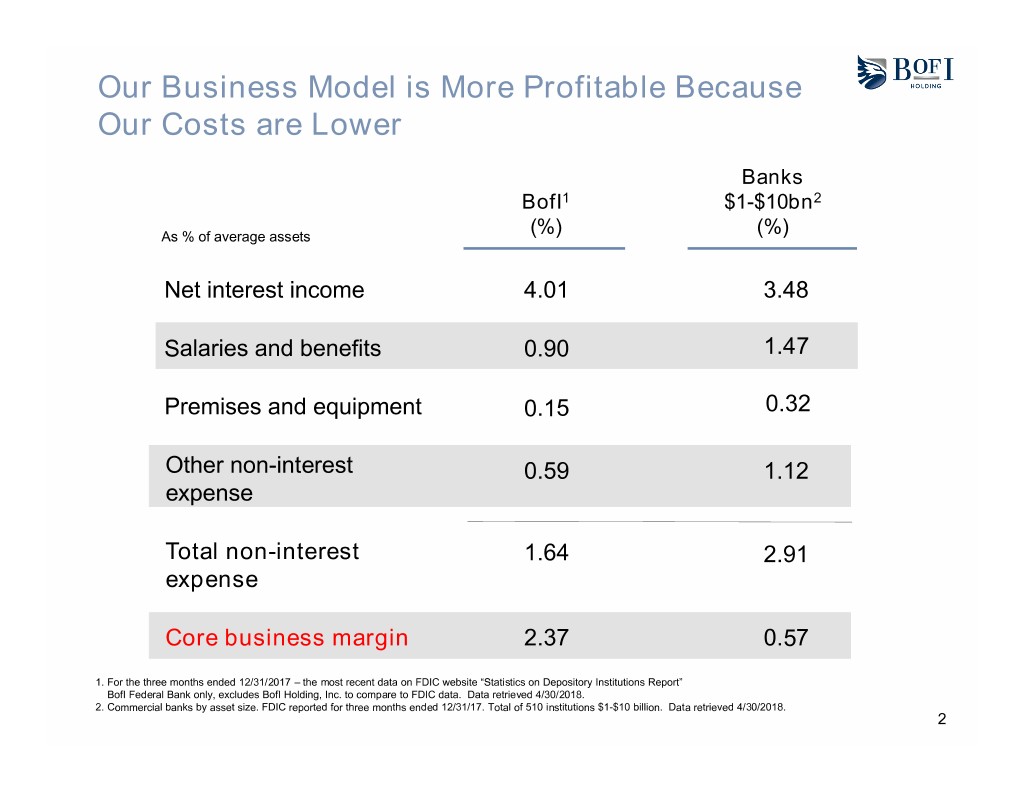

Our Business Model is More Profitable Because Our Costs are Lower Banks BofI1 $1-$10bn2 As % of average assets (%) (%) Net interest income 4.01 3.48 Salaries and benefits 0.90 1.47 Premises and equipment 0.15 0.32 Other non-interest 0.59 1.12 expense Total non-interest 1.64 2.91 expense Core business margin 2.37 0.57 1. For the three months ended 12/31/2017 – the most recent data on FDIC website “Statistics on Depository Institutions Report” BofI Federal Bank only, excludes BofI Holding, Inc. to compare to FDIC data. Data retrieved 4/30/2018. 2. Commercial banks by asset size. FDIC reported for three months ended 12/31/17. Total of 510 institutions $1-$10 billion. Data retrieved 4/30/2018. 2

BofI’s Business Model Is Differentiated From Other Banks Customer Sales Servicing Distribution Acquisition • Digital Marketing • Automated •Self-service • Balance sheet fulfillment • Affinity and • Digital journey • Whole loan sales Distribution • Inbound call center options Partners sales • Direct banker (call center) • Securitization • Data mining/target • Outbound call feeding direct center sales marketing • Minimal outside • Cross-sell sales • Significant inside sales Core Digital Capabilities Integrated Digitally Data Driven Digital Next-Gen Customer Enabled Insight Marketing Technology Experience Operations 3

Fiscal 2017 Highlights Compared with Fiscal 2016 Asset Growth Deposit Growth $ Millions $ Millions 10,000 8,000 8,502 6,900 11.9% 8,000 7,559 6,044 14.2% 6,000 6,000 4,000 4,000 2,000 2,000 0 0 FY 2016 FY 2017 FY 2016 FY 2017 Net Income Diluted EPS $ Millions Diluted EPS 150 134.7 2.5 119.3 13.0% 2.07 2.0 1.85 11.9% 100 1.5 1.0 50 0.5 0 0.0 FY 2016 FY 2017 FY 2016 FY 2017 Return on Equity = 17.78% Return on Assets = 1.68% 4

Fiscal 2018 Third Quarter Highlights Compared with Fiscal 2017 Third Quarter Asset Growth Deposit Growth $ Millions $ Millions 12,000 10,000 9,982 10,000 14.7% 7,964 8,700 8,000 6,800 17.1% 8,000 6,000 6,000 4,000 4,000 2,000 2,000 0 0 Q3 2017 Q3 2018 Q3 2017 Q3 2018 Net Income Diluted EPS $ Millions $ Diluted EPS 60 0.90 51.3 0.80 50 25.0% 0.80 27.0% 41.0 0.70 0.63 40 0.60 30 0.50 0.40 20 0.30 10 0.20 0.10 0 0.00 Q3 2017 Q3 2018 Q3 2017 Q3 2018 Return on Equity = 22.84% Return on Assets = 2.08% 5

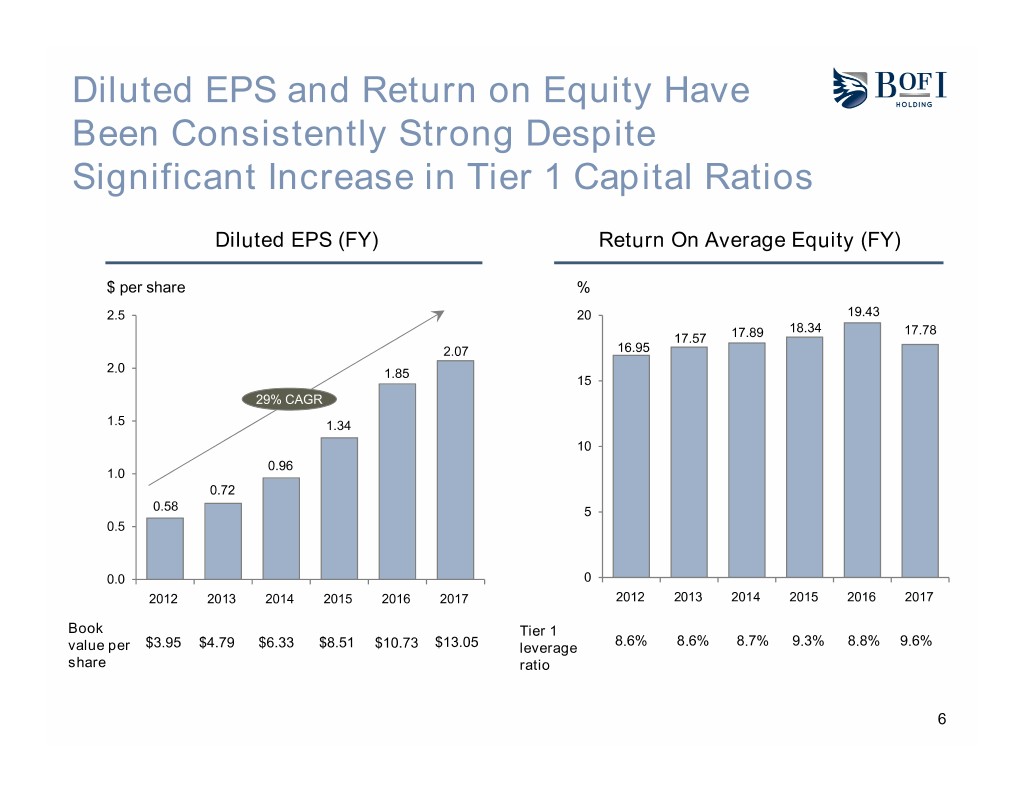

Diluted EPS and Return on Equity Have Been Consistently Strong Despite Significant Increase in Tier 1 Capital Ratios Diluted EPS (FY) Return On Average Equity (FY) $ per share % 2.5 20 19.43 18.34 17.78 17.57 17.89 2.07 16.95 2.0 1.85 15 29% CAGR 1.5 1.34 10 0.96 1.0 0.72 0.58 5 0.5 0.0 0 2012 20132014 2015 2016 2017 2012 20132014 2015 2016 2017 Book Tier 1 8.6% 8.6% 8.7% 9.3% 8.8% 9.6% value per $3.95 $4.79 $6.33 $8.51 $10.73 $13.05 leverage share ratio 6

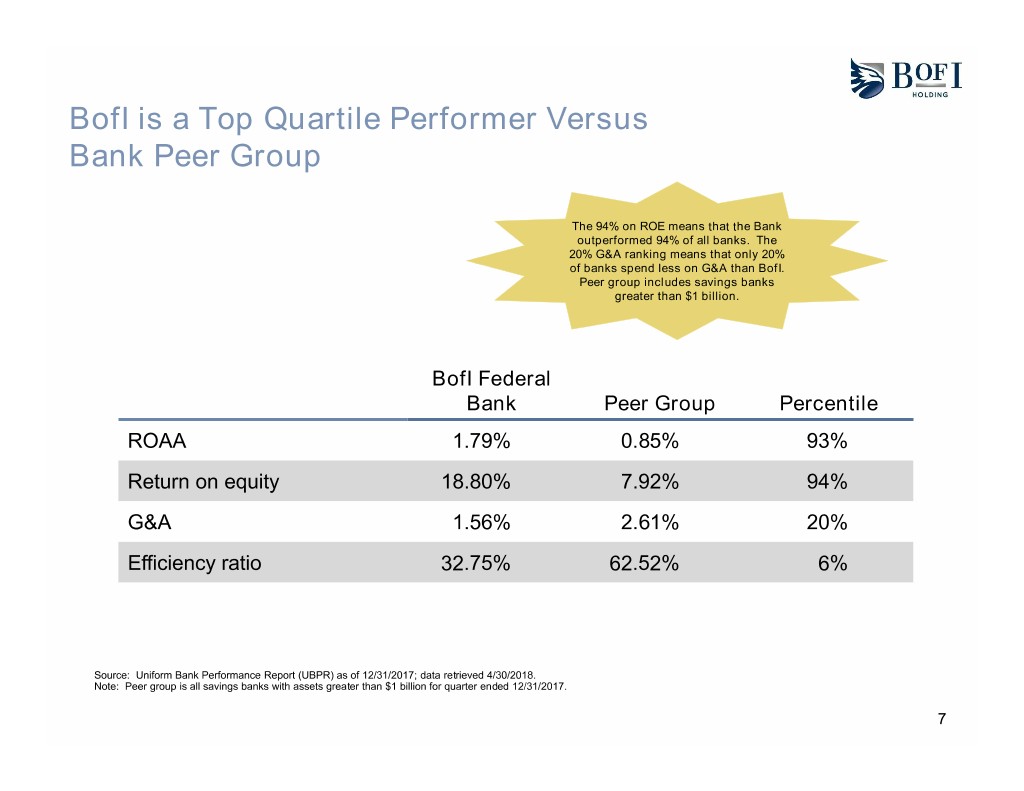

BofI is a Top Quartile Performer Versus Bank Peer Group The 94% on ROE means that the Bank outperformed 94% of all banks. The 20% G&A ranking means that only 20% of banks spend less on G&A than BofI. Peer group includes savings banks greater than $1 billion. BofI Federal Bank Peer Group Percentile ROAA 1.79% 0.85% 93% Return on equity 18.80% 7.92% 94% G&A 1.56% 2.61% 20% Efficiency ratio 32.75% 62.52% 6% Source: Uniform Bank Performance Report (UBPR) as of 12/31/2017; data retrieved 4/30/2018. Note: Peer group is all savings banks with assets greater than $1 billion for quarter ended 12/31/2017. 7

Diverse Lending Business Gain-on-sale Mortgage Banking Single family Jumbo Warehouse Lending Multifamily Commercial Real Estate Small Balance Commercial Lender Finance Asset Backed Lending Lending Equipment Leasing C&I Lending Factoring Bank Loans Large Balance Commercial/Specialty Real Estate Small business H&R Block Franchise Lending Auto Consumer Overdraft Lines Unsecured Lending 8

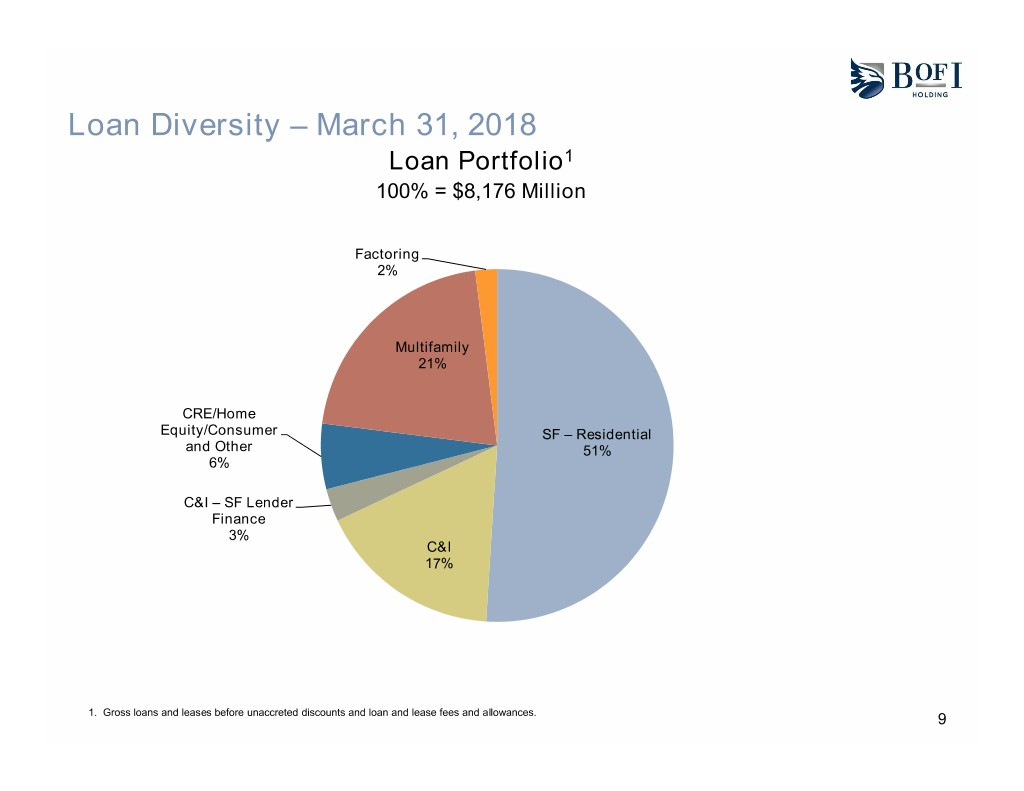

Loan Diversity – March 31, 2018 Loan Portfolio1 100% = $8,176 Million Factoring 2% Multifamily 21% CRE/Home Equity/Consumer SF – Residential and Other 51% 6% C&I – SF Lender Finance 3% C&I 17% 1. Gross loans and leases before unaccreted discounts and loan and lease fees and allowances. 9

Our Asset Growth has been Driven by Strong and Profitable Organic Loan Production Net Loan Portfolio – End of Last Five Quarters ($ in Thousands) $9,000,000 $7,874,431 $8,064,716 $8,000,000 $7,374,493 $7,512,999 $7,020,700 $7,000,000 $6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $‐ Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Multifamily Average 55% 54% 54% 53% 53% Loan to Value Single family 58% 58% 57% 57% 57% 10

Loan Pipeline Remains Strong FY 2018 Q3 $M 1,200 $30 $1,135 $1,105 $113 1,000 $319 800 $122 600 $551 400 200 0 Jumbo Single Agency Commercial Multifamily / Primary Single Family Total Family Single Family & Industral Small Balance Pipeline Warehouse Lending Commercial 11

Loan Origination Growth Fiscal Year Loan Originations Future Plans $ Billions • Organic growth in existing business lines 6 5.6 o Multifamily geographic 5.0 5 1.4 expansion 31.8% 4.3 5-yr CAGR 1.4 o Agency and jumbo 4 1.0 mortgage channel 3.0 expansion 3 0.7 o Small Balance Commercial 2.1 2 4.2 Real Estate expansion 3.6 1.4 1.1 3.3 o Large Balance Commercial / 0.7 2.3 1 Specialty Real Estate 0.7 1.0 expansion 0 2012 2013 2014 2015 2016 2017 • Additional C&I verticals/product expansion Annual • Retail auto lending launch growth rate 53.2% 42.0% 42.2% 15.6% 11.2% • Consumer unsecured installment Loans for sale Loans for investment lending launch 12

Diversified Branchless Deposit Businesses Key Elements Consumer • Demographically targeted brands direct internet • Differentiated products with turn-down product brands options • Exclusive relationships with significant brands, Distribution groups, or employees Partners • Exclusive relationships with financial planners through BofI Advisor • Business banking with simple suite of cash Small business management services banking Deposit Commercial/ Treasury • Full service treasury/cash management Management • 1031 exchange firms Specialty • Title and escrow companies deposits • HOA and property management BIN • Prepaid program managers with focus on large sponsorship national programs 13

Deposit Growth in Checking, Business, and Savings Was Achieved While Transforming the Mix of Deposits June 30, 2013 March 31, 2018 100% of Deposits = $2.1 billion 100% of Deposits = $8.0 billion Checking and Savings – IRA other demand Time deposits deposits 3% 17% 19% Checking and other demand 50% deposits Time deposits 50% 31% 30% Savings Savings Checking Growth (6/2013-3/2018) = 913% Savings Growth (6/2013-3/2018) = 268% 14

Our Business Banking Vertical has Fueled our Deposit Growth while Generating Significant Fee Income Business Deposits by Account Type* Business Banking Deposits Percent (%) ($MM) 5,000 Time Deposits 4,500 2% 4,000 3,844 3,762 3,500 3,067 25% 3,000 Savings & MMDA 2,500 2,449 2,000 1,500 1,420 Checking and other demand deposits 1,000 500 73% 0 Q4 14 Q4 15 Q4 16 Q4 17 Q3 18 * As of 3/31/2018. 15

BofI Customer Base and Deposit Volume is Well Distributed Throughout the United States Number of Accounts Average Deposit Balance BofI Deposits Have National Reach With Customers in Every State 16

BofI Customers are Highly Engaged Customer Engagement Results Engagement Low Activity High Activity Attributes Low Activity User Basic User Engaged Elite Engaged Engagement Score 0s 0 < S < 30 30 ≤ S < 60 ≥ 60 (0-100) Average Lifetime $100 $4000 $6,000 $50,000 Balance Average # of Services -< 5710 Used Average # of POS -< 11025 % of Total Population 22% 15% 41% 23% % of Total Balance 0% 6% 24% 70% Retention Moderate Moderate High High 64% of Population or 94% of Balance are Overall High Engagement Note: Study conducted on Rewards Checking customers 17

Core Deposit Growth Was Sufficiently Strong To Grow Overall Deposits While Changing The Deposit Mix Deposit Growth Future Plans $ Millions • Enhanced digital marketing automation 7,000 6,900 integrated to outbound sales group 6,044 • Products and technology integration 6,000 33.7% 5-yr CAGR targeted to specific industry groups 5,000 4,452 • Create differentiated consumer and 4,000 business banking platform 3,042 3,000 • Enhanced focus on customer service 2,092 2,000 1,615 and user experience 1,000 • Leverage existing and create new distribution partnerships to reduce 0 acquisition cost and leverage external 2012 2013 2014 2015 2016 2017 brands % CDs1 57% 50% 26% 18% 17% 12% % Borrowings2 25% 25% 24% 15% 12% 9% 1 as a % of total deposits 2 as a % of total liabilities 18

Diversified Fee / Non-Interest Income % Fee Income FY 2017* Agency Mortgage Jumbo Banking 22% Multifamily Structured Gain on Sale – Settlement 7% Other Other Cash/Treasury Fee Income Management Consumer Deposit Deposit/ Prepaid Service Fees 64% Tax Payments Prepayment 7% Fee * Excludes securities income 19

Over the Last Eight Years, BofI Has Successfully Started New Products, Added Distribution Channels, and Completed Acquisitions 2011 2012 2013 2014 2015 2016 2017 2018 New product • Business • Warehouse • Treasury/ • Small • Auto • HRB • Retail Auto •Factoring banking Lending cash balance franchising • Refund • Lottery manage- CRE lending Advance ment (H&R •C&I Block) • Prepaid • Unsecured • Agency Consumer Servicing Lending retention Distribution/ • BofI • Netbank •UFB • Virtus • Wholesale • H&R Block • Homebuilder channel advisor • Retail Direct agency retail stores mortgage Structured • Bank X group settlement •IRA M&A • Principal • Union • H&R Block •Equipment • Epiq Trustee Bank Federal Bank leasing Services 20

Key Goals of Universal Digital Bank • Increase chance of offering right product at the right time and place Personalization • Personalization is the right antidote for too much choice, too much content, and not enough time • Eventual artificial intelligence tools assist sale of banking products such as deposits, loans, and mortgages Self-Service • Products optimized by channel, recipient and journey • Self service saves time and cost (e.g., activate and de-activate debit-card in platform, send wires via self-service) • Easy integration of third-party features (e.g., biometrics) Facilitate • Access to value added tools (e.g., robo-advisory, automated savings features) Partnerships either proprietary or third party • Enable creative customer acquisition partners • Provide holistic and interactive and intuitive design experience Customizable • Integrate online experience with other channels Experience • Artificial intelligence and big data credit models enable quick credit Cross-Sell decisions • Customized product recommendations based upon analytical determination of need 21

Universal Digital Bank Consumer Platform Product Development Cross-sell (In-House Apps) • Robo-advisor •Auto •Trusts •IRA Consumer Online • Mortgage Banking Platform • Personal loan App Store Personalization Management & Segmentation • Third party • Real-time retention services/payments • Next-best action • Third-party lending • Transaction mining • Personalized alerts 22

Advanced Data Analytics Provides Key Insights Into Customer Engagement, Profitability, and Retention to Enhance Customer Lifetime Throughout the Bank Framework for Data Analysis Key Learnings Retention & Attrition Drivers to Boost Long-Term Customer Engagement Customer Segmentation Methodology to Understand Usage & Behavior Profitability Analysis at the Individual Customer Level Streamlined Acquisition Process via Lookalike Modeling & Sales Efficiencies 23

We are Expanding our Strategic Partnership with H&R Block H&R Block Overview Products for 2018 Tax Season • Approximately 10,000 U.S branches • Refund Transfer • Files 1 in every 7 U.S. tax returns • Emerald Advance Unsecured Loan • 19.7 million U.S. tax returns per year • Emerald Prepaid Card • 83% of customers receive a refund • Refund Advance Interest-Free Loan • 35% franchise-owned − BofI was exclusive provider in 2018 tax season • Approximately 2,400 employees − BofI provided credit underwriting, loan origination, funding and loan • 55 million visits per year on HRB website servicing • Social media − Interest-free loan is repaid using borrower’s tax refund proceeds − 28,600 Twitter followers − BofI’s profits will depend on − 463,000 Facebook fans origination volume and actual − 1.7 million views on YouTube credit losses 24

Omni Channel Approach for BofI’s 2018 Digital Marketing Strategy Marketing automation implementation Organizational commitment to user experience Infrastructure Digital personas for User personalized interactions Experience Personalization & Data DIGITAL Social employee Paid, STRATEGY engagement Social & Brand & Enhanced branding, Mobile Content messaging and positioning strategy Analytical Business strategy Process Introduced BI reporting Multi-dimensional analysis by tool for analytics geography, customer type, product, media, traffic source 25

Holistic Credit Risk Management Utilize a holistic credit-risk management framework to manage and monitor credit quality at each stage of the What We Do loan life cycle, and leverage specialized Credit Tools to optimize monitoring and reporting capabilities Credit Monitoring & Oversight Portfolio Loan Life Cycle Set Appetite Originations Reporting Special Assets Management Establish Monitor Assets Data-Driven Credit Mitigate BOFI Credit Safe Growth Throughout Decision Framework and Problem Loans Objectives Life Cycle Making Culture • Board of Example of Directors Credit Tools • Annual Strategic Plan • Corporate Governance • Policies & Approval Authorities 26 Credit Tools list is a sampling and is not purported to be comprehensive.

Monitoring & Management Oversight: Core Products Single Family Residential Income Property Lending • Portfolio level monitoring with individual loan reviews • Risk based annual loan review process, with 4 levels completed on an exception basis (i.e. delinquency, depending on financial performance & risk triggers FICO/LTV degradation). • Updated financials at least annually • FICO pulled twice a year • FICO pulled twice a year • Updated AVMs twice a year • Updated AVMs twice a year • Super jumbo loans receive complete annual loan • Updated credit report and property inspections review, including updated credit report requested based on risk triggers • Pledged assets receive refreshed CLTV ratios on a • Classified loans receive quarterly review semiannual basis • Portfolio-level review performed quarterly • Portfolio-level review performed quarterly • Stress testing performed twice a year Commercial Specialty C&I – Lender Finance • Loan reviews at least quarterly • Loan reviews at least quarterly • Project updates at least quarterly • Updated financials at least quarterly • Updated financials at least annually • Borrowing base / custodial reports at least monthly • Site visits & inspections for development projects • Continuous collateral analytics, with quarterly validation Lists are a sampling and are not purported to be comprehensive. 27

Best-in-Class Loan Quality Loans in non-accrual to Total Net Charge-Offs Annualized1 total loans1 (%) (%) 2 0.5 0.26 1 0.78 0.38 0.07 0 0.0 BofI Banks $1-10 bn BofI Banks $1-10 bn 1. From FDIC SDI report at 12/31/2017. Total of 510 institutions included in the $1-$10 billion group. Data retrieved 4/30/2018. 28

Bank Provides Appropriate Resources to Manage Credit and Compliance Risk June 30, June 30, June 30, June 30, Department FTEs 2014 2015 2016 2017 Credit and Quality Control 41 57 65 85 Risk, Internal Asset Review, Compliance, Audit 26 35 44 54 and BSA 29

Investment Summary Full service branchless banking platform with structural cost advantages vs. traditional banks Superior growth and ROE relative to large and small competitors Solid track record of allocating capital to businesses with best risk-adjusted returns New business initiatives will generate incremental growth in customers, loans and profits Robust risk management systems and culture has resulted in lower credit, counterparty and regulatory risks 30

Contact Information Greg Garrabrants, President and CEO Andy Micheletti, EVP/CFO investors@bofi.com www.bofiholding.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@bofi.com 31