Axogen, Inc. (NASDAQ: AXGN), a global leader in developing and

marketing innovative surgical solutions for peripheral nerve

injuries, today reported financial results and business highlights

for the second quarter ended June 30, 2021.

Second Quarter 2021 Financial Results and

Recent Business Highlights

- Net revenue was $33.6 million during

the quarter, a 52% increase compared to second quarter 2020 revenue

of $22.1 million.

- Gross margin was 78.9% for the

quarter, compared to 74.7% one year ago. Gross margin would have

been approximately 83.1% excluding the impact of a one-time charge

of approximately $1.4 million reflecting the write-down of

inventory and production costs related to the previously disclosed

suspension of market availability of Avive® Soft Tissue Membrane

pending ongoing discussions with the FDA.

- Net loss for the quarter was $7.9

million, or $0.19 per share, compared to a net loss of $8.1

million, or $0.20 per share, in the second quarter of 2020.

- Adjusted net loss was $3.7 million for

the quarter, or $0.09 per share, compared with adjusted net loss of

$5.9 million, or $0.15 per share, in the second quarter of

2020.

- Adjusted EBITDA loss was $2.4 million

for the quarter, compared to an adjusted EBITDA loss of $5.7

million in the second quarter of 2020.

- The balance of cash, cash equivalents,

and investments on June 30, 2021 was $106.2 million, compared to a

balance of $97.2 million on March 31, 2021. The net increase

includes $15.0 million of additional debt proceeds drawn from the

Company’s debt facility with Oberland Capital, and net operating

cash flow in the quarter of $1.2 million, partially offset by

facilities capital expenditures of $7.2 million.

- Appointed John H. Johnson to the

Axogen, Inc. Board of Directors on July 19, 2021. Mr. Johnson has

more than 30 years of experience in the biopharma industry,

currently serves on the board of directors of Strongbridge

Biopharma, Verastem Oncology, and BioAgilytix and is the CEO of

Strongbridge Biopharma.

“I am pleased with our Q2 performance, as our team

continued to execute in a dynamic healthcare market,” commented

Karen Zaderej, chairman, CEO, and president of Axogen, Inc.

“Surgeon demand for our products continued to increase as we drove

deeper penetration in our customer accounts. Despite the ongoing

impact of the pandemic, the success of our commercial strategy,

supported by our ten-year investment in meaningful clinical data,

provides us with increasing confidence in the long-term growth

outlook for our business.”

Additional Operational and Business

Highlights

- Core accounts in the second quarter

were 306, a 34% increase compared to 228 in the second quarter of

2020 and continue to represent approximately 60% of total

revenue.

- Active accounts were 959, a 22%

increase compared to 789 in the second quarter a year ago. Revenue

from the top 10% of our active accounts continued to represent

approximately 35% of total revenue in the quarter.

- Ended the quarter with 109 direct

sales representatives, an increase of three from the prior quarter

and compared to 112 one year ago.

- Ended the quarter with 164

peer-reviewed clinical publications featuring Axogen’s nerve repair

product portfolio.

Updating 2021 Financial Guidance

Management is updating financial guidance, expecting full-year 2021

revenue will be in the range of $134.5 million to $137.5 million

versus the prior range of $133.0 million to $136.0 million.

Additionally, management continues to expect full-year 2021 gross

margin to remain above 80%.

Conference CallThe Company will

host a conference call and webcast for the investment community

today at 4:30 p.m. ET. Investors interested in participating by

phone are invited to call toll free at 1-877-407-0993 or use the

direct dial-in number 1-201-689-8795. Those interested in listening

to the conference call live via the Internet can do so by visiting

the Investors page of the Company’s website at www.axogeninc.com

and clicking on the webcast link on the Investors home page.

Following the conference call, a replay will be

available on the Company’s website at www.axogeninc.com under

Investors.

About AxogenAxogen (AXGN) is

the leading company focused specifically on the science,

development, and commercialization of technologies for peripheral

nerve regeneration and repair. Axogen employees are passionate

about helping to restore peripheral nerve function and quality of

life to patients with physical damage or transection to peripheral

nerves by providing innovative, clinically proven, and economically

effective repair solutions for surgeons and health care providers.

Peripheral nerves provide the pathways for both motor and sensory

signals throughout the body. Every day, people suffer traumatic

injuries or undergo surgical procedures that impact the function of

their peripheral nerves. Physical damage to a peripheral

nerve, or the inability to properly reconnect peripheral nerves,

can result in the loss of muscle or organ function, the loss of

sensory feeling, or the initiation of pain.

Axogen's platform for peripheral nerve repair

features a comprehensive portfolio of products, including Avance®

Nerve Graft, a biologically active off-the-shelf processed human

nerve allograft for bridging severed peripheral nerves without the

comorbidities associated with a second surgical site; Axoguard

Nerve Connector®, a porcine submucosa extracellular matrix (ECM)

coaptation aid for tensionless repair of severed peripheral nerves;

Axoguard Nerve Protector®, a porcine submucosa ECM product used to

wrap and protect damaged peripheral nerves and reinforce the nerve

reconstruction while preventing soft tissue attachments; and

Axoguard Nerve Cap®, a porcine submucosa ECM product used to

protect a peripheral nerve end and separate the nerve from the

surrounding environment to reduce the development of symptomatic or

painful neuroma. The Axogen portfolio of products is available in

the United States, Canada, the United Kingdom, South Korea, and

several other European and international countries.

Cautionary Statements Concerning

Forward-Looking StatementsThis press release contains

“forward-looking” statements as defined in the Private Securities

Litigation Reform Act of 1995. These statements are based on

management's current expectations or predictions of future

conditions, events, or results based on various assumptions and

management's estimates of trends and economic factors in the

markets in which we are active, as well as our business plans.

Words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” “estimates,” “projects,” “forecasts,”

“continue,” “may,” “should,” “will,” “goals,” and variations of

such words and similar expressions are intended to identify such

forward-looking statements. The forward-looking statements may

include, without limitation, statements related to the

expected impact of COVID-19 on our business, statements regarding

our growth, our 2021 financial guidance, product development,

product potential, regulatory process and approvals, APC renovation

timing and expense, financial performance, sales growth, product

adoption, market awareness of our products, data validation, our

assessment of our internal controls over financial reporting, our

visibility at and sponsorship of conferences and educational

events. The forward-looking statements are and will be subject to

risks and uncertainties, which may cause actual results to differ

materially from those expressed or implied in such forward-looking

statements. Forward-looking statements contained in this press

release should be evaluated together with the many uncertainties

that affect our business and our market, particularly those

discussed under Part I, Item 1A., “Risk Factors,” of our Annual

Report on Form 10-K for the fiscal year ended December 31, 2020, as

well as other risks and cautionary statements set forth in our

filings with the U.S. Securities and Exchange Commission.

Forward-looking statements are not a guarantee of future

performance, and actual results may differ materially from those

projected. The forward-looking statements are representative only

as of the date they are made and, except as required by applicable

law, we assume no responsibility to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, changed circumstances, or otherwise.

About Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, we

use the non-GAAP financial measures of EBITDA, which measures

earnings before interest, income taxes, depreciation and

amortization, and Adjusted EBITDA which further excludes non-cash

stock compensation expense and litigation and related expenses. We

also use the non-GAAP financial measures of Adjusted Net Income or

Loss and Adjusted Net Income or Loss Per Common Share - basic and

diluted which excludes non-cash stock compensation expense and

litigation and related expenses from Net Loss and Net Loss Per

Common Share - basic and diluted, respectively. These non-GAAP

measures are not based on any comprehensive set of accounting rules

or principles and should not be considered a substitute for, or

superior to, financial measures calculated in accordance with GAAP,

and may be different from non-GAAP measures used by other

companies. In addition, these non-GAAP measures should be read in

conjunction with our financial statements prepared in accordance

with GAAP. The reconciliations of Axogen’s GAAP financial measures

to the corresponding non-GAAP measures should be carefully

evaluated.

We use these non-GAAP financial measures for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. We believe that these

non-GAAP financial measures provide meaningful supplemental

information regarding our performance and that both management and

investors benefit from referring to these non-GAAP financial

measures in assessing our performance and when planning,

forecasting, and analyzing future periods. We believe these

non-GAAP financial measures are useful to investors because (1)

they allow for greater transparency with respect to key metrics

used by management in its financial and operational decision-making

and (2) they are used by our institutional investors and the

analyst community to help them analyze the performance of our

business.

Contact:Axogen,

Inc.Peter J. Mariani, Executive Vice President and Chief

Financial OfficerInvestorRelations@AxogenInc.com

|

|

AXOGEN, INC. |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

(unaudited) |

|

|

(In Thousands, Except Share Amounts) |

|

|

|

|

|

|

|

|

|

|

|

June 30, |

December 31, |

|

|

|

|

|

2021 |

|

|

2020 |

|

|

|

Assets |

|

|

|

|

|

|

Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

53,078 |

|

|

$ |

48,767 |

|

|

|

Restricted cash |

|

|

6,333 |

|

|

|

6,842 |

|

|

|

Investments |

|

|

46,839 |

|

|

|

55,199 |

|

|

|

Accounts receivable, net |

|

|

18,182 |

|

|

|

17,618 |

|

|

|

Inventory |

|

|

13,415 |

|

|

|

12,529 |

|

|

|

Prepaid expenses and other |

|

|

3,948 |

|

|

|

4,296 |

|

|

|

Total current assets |

|

|

141,795 |

|

|

|

145,251 |

|

|

|

Property and equipment,

net |

|

|

50,952 |

|

|

|

38,398 |

|

|

|

Operating lease

right-of-use assets |

|

|

15,272 |

|

|

|

15,614 |

|

|

|

Finance lease

right-of-use assets |

|

|

53 |

|

|

|

64 |

|

|

|

Intangible

assets |

|

|

2,460 |

|

|

|

2,054 |

|

|

|

Total

assets |

|

$ |

210,532 |

|

|

$ |

201,381 |

|

|

|

|

|

|

|

|

|

|

Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

Current

liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

19,839 |

|

|

$ |

21,968 |

|

|

|

Current maturities of long-term lease obligations |

|

|

1,789 |

|

|

|

863 |

|

|

|

Total current liabilities |

|

|

21,628 |

|

|

|

22,831 |

|

|

|

Long-term debt, net of

financing fees |

|

|

46,081 |

|

|

|

32,027 |

|

|

|

Debt derivative

liability |

|

|

3,776 |

|

|

|

2,497 |

|

|

|

Long-term lease

obligations |

|

|

20,344 |

|

|

|

20,874 |

|

|

|

Other long-term

liabilities |

|

|

— |

|

|

|

3 |

|

|

|

Total liabilities |

|

|

91,829 |

|

|

|

78,232 |

|

|

|

Shareholders’

equity: |

|

|

|

|

|

|

Common stock, $.01 par value per share; 100,000,000 shares

authorized; 40,842,717 and 40,618,766 shares issued and

outstanding |

|

|

413 |

|

|

|

406 |

|

|

|

Additional paid-in capital |

|

|

336,495 |

|

|

|

326,390 |

|

|

|

Accumulated deficit |

|

|

(218,205 |

) |

|

|

(203,647 |

) |

|

|

Total shareholders’ equity |

|

|

118,703 |

|

|

|

123,149 |

|

|

|

Total liabilities and

shareholders' equity |

|

$ |

210,532 |

|

|

$ |

201,381 |

|

|

|

|

|

|

|

|

|

AXOGEN, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

Three and Six Months ended June 30, 2021 and

2020 |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

Revenues |

|

$ |

33,580 |

|

|

$ |

22,116 |

|

|

$ |

64,617 |

|

|

$ |

46,377 |

|

|

Cost of goods sold |

|

|

7,092 |

|

|

|

5,605 |

|

|

|

12,264 |

|

|

|

10,421 |

|

|

Gross profit |

|

|

26,488 |

|

|

|

16,511 |

|

|

|

52,353 |

|

|

|

35,956 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

19,250 |

|

|

|

14,290 |

|

|

|

37,224 |

|

|

|

32,128 |

|

|

Research and development |

|

|

5,723 |

|

|

|

4,071 |

|

|

|

11,471 |

|

|

|

8,685 |

|

|

General and administrative |

|

|

8,669 |

|

|

|

6,404 |

|

|

|

17,032 |

|

|

|

11,906 |

|

|

Total costs and expenses |

|

|

33,642 |

|

|

|

24,765 |

|

|

|

65,727 |

|

|

|

52,719 |

|

|

Loss from operations |

|

|

(7,154 |

) |

|

|

(8,254 |

) |

|

|

(13,374 |

) |

|

|

(16,763 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

29 |

|

|

|

237 |

|

|

|

63 |

|

|

|

548 |

|

|

Interest expense |

|

|

(565 |

) |

|

|

(31 |

) |

|

|

(1,010 |

) |

|

|

(62 |

) |

|

Change in fair value of derivatives |

|

|

(84 |

) |

|

|

— |

|

|

|

(105 |

) |

|

|

— |

|

|

Other expense |

|

|

(124 |

) |

|

|

(57 |

) |

|

|

(132 |

) |

|

|

(20 |

) |

|

Total other expense |

|

|

(744 |

) |

|

|

149 |

|

|

|

(1,184 |

) |

|

|

466 |

|

|

Net loss |

|

$ |

(7,898 |

) |

|

$ |

(8,105 |

) |

|

$ |

(14,558 |

) |

|

$ |

(16,297 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – basic and diluted |

|

|

41,081 |

|

|

|

39,823 |

|

|

|

40,894 |

|

|

|

39,761 |

|

|

Loss per common share – basic and diluted |

|

$ |

(0.19 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.41 |

) |

|

|

|

|

|

|

|

|

|

|

|

Adjusted net loss - non GAAP |

|

|

(3,694 |

) |

|

|

(5,883 |

) |

|

|

(6,823 |

) |

|

|

(13,519 |

) |

|

Adjusted loss per common share – basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.34 |

) |

|

|

|

|

|

|

|

|

|

|

|

AXOGEN, INC. |

|

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP

FINANCIAL MEASURES |

|

Three and Six Months ended June 30, 2021 and

2020 |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

$ |

26,488 |

|

|

$ |

16,511 |

|

|

$ |

52,353 |

|

|

$ |

35,956 |

|

|

Avive inventory write-down and production costs |

|

|

1,429 |

|

|

|

- |

|

|

|

1,429 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross Profit |

|

$ |

27,917 |

|

|

$ |

16,511 |

|

|

$ |

53,782 |

|

|

$ |

35,956 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(7,898 |

) |

|

$ |

(8,105 |

) |

|

$ |

(14,558 |

) |

|

$ |

(16,297 |

) |

|

Depreciation and amortization expense |

|

|

661 |

|

|

|

346 |

|

|

|

1,501 |

|

|

|

665 |

|

|

Investment income |

|

|

(29 |

) |

|

|

(237 |

) |

|

|

(63 |

) |

|

|

(548 |

) |

|

Income tax |

|

|

62 |

|

|

|

58 |

|

|

|

67 |

|

|

|

38 |

|

|

Interest expense |

|

|

565 |

|

|

|

31 |

|

|

|

1,010 |

|

|

|

62 |

|

|

EBITDA - non GAAP |

|

$ |

(6,639 |

) |

|

$ |

(7,907 |

) |

|

$ |

(12,043 |

) |

|

$ |

(16,080 |

) |

|

|

|

|

|

|

|

|

|

|

|

Non cash stock compensation expense |

|

|

3,804 |

|

|

|

2,222 |

|

|

|

6,499 |

|

|

|

2,778 |

|

|

Litigation and related costs |

|

|

400 |

|

|

|

— |

|

|

|

1,236 |

|

|

|

- |

|

|

Adjusted EBITDA - non GAAP |

|

$ |

(2,435 |

) |

|

$ |

(5,685 |

) |

|

$ |

(4,308 |

) |

|

$ |

(13,302 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(7,898 |

) |

|

$ |

(8,105 |

) |

|

$ |

(14,558 |

) |

|

$ |

(16,297 |

) |

|

Non cash stock compensation expense |

|

|

3,804 |

|

|

|

2,222 |

|

|

|

6,499 |

|

|

|

2,778 |

|

|

Litigation and related costs |

|

|

400 |

|

|

|

— |

|

|

|

1,236 |

|

|

|

— |

|

|

Adjusted Net Loss - non GAAP |

|

$ |

(3,694 |

) |

|

$ |

(5,883 |

) |

|

$ |

(6,823 |

) |

|

$ |

(13,519 |

) |

|

Weighted average common shares outstanding – basic and diluted |

|

|

41,081 |

|

|

|

39,823 |

|

|

|

40,894 |

|

|

|

39,761 |

|

|

Adjusted loss per common share – basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.34 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

AXOGEN, INC. |

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

SHAREHOLDERS' EQUITY |

|

|

|

|

Six Months Ended June 30, 2021 and 2020 |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

Total |

|

|

|

|

Shares |

|

Amount |

|

Additional Paid-in Capital |

|

Accumulated Deficit |

|

Shareholders' Equity |

|

|

For the Three Months Ended June 30, 2021: |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at March 31, 2021 |

|

40,842,717 |

|

|

$ |

408 |

|

|

$ |

329,603 |

|

|

$ |

(210,307 |

) |

|

$ |

119,704 |

|

|

|

Net loss |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7,898 |

) |

|

|

(7,898 |

) |

|

|

Stock-based compensation |

|

- |

|

|

|

- |

|

|

|

3,804 |

|

|

|

- |

|

|

|

3,804 |

|

|

|

Issuance of restricted /performance service awards |

|

44,411 |

|

|

|

|

|

|

|

|

|

- |

|

|

|

Exercise of stock options and employee stock purchase plan |

|

449,980 |

|

|

|

5 |

|

|

|

3,088 |

|

|

|

- |

|

|

|

3,093 |

|

|

|

Balance at June 30, 2021 |

|

41,337,108 |

|

|

$ |

413 |

|

|

$ |

336,495 |

|

|

$ |

(218,205 |

) |

|

$ |

118,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended June 30, 2021: |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2020 |

|

40,618,766 |

|

|

$ |

406 |

|

|

$ |

326,390 |

|

|

$ |

(203,647 |

) |

|

$ |

123,149 |

|

|

|

Net loss |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(14,558 |

) |

|

|

(14,558 |

) |

|

|

Stock-based compensation |

|

- |

|

|

|

- |

|

|

|

6,499 |

|

|

|

- |

|

|

|

6,499 |

|

|

|

Issuance of restricted /performance service awards |

|

138,944 |

|

|

|

1 |

|

|

|

(1 |

) |

|

|

- |

|

|

|

- |

|

|

|

Shares surrendered by employees to pay taxes |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

Exercise of stock options and employee stock purchase plan |

|

579,398 |

|

|

|

6 |

|

|

|

3,607 |

|

|

|

- |

|

|

|

3,613 |

|

|

|

Balance at June 30, 2021 |

|

41,337,108 |

|

|

$ |

413 |

|

|

$ |

336,495 |

|

|

$ |

(218,205 |

) |

|

$ |

118,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, 2020: |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at March 31, 2020 |

|

39,738,767 |

|

|

$ |

397 |

|

|

$ |

311,850 |

|

|

$ |

(188,053 |

) |

|

$ |

124,194 |

|

|

|

Net loss |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(8,105 |

) |

|

|

(8,105 |

) |

|

|

Stock-based compensation |

|

- |

|

|

|

- |

|

|

|

2,222 |

|

|

|

- |

|

|

|

2,222 |

|

|

|

Issuance of restricted and performan stock units |

|

10,021 |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

Shares surrendered by employees to pay taxes |

|

(1,766 |

) |

|

|

- |

|

|

|

(17 |

) |

|

|

- |

|

|

|

(17 |

) |

|

|

Exercise of stock options and employee stock purchase plan |

|

273,758 |

|

|

|

3 |

|

|

|

1463 |

|

|

|

|

|

1,466 |

|

|

|

Balance at June 30, 2020 |

|

40,020,780 |

|

|

$ |

400 |

|

|

$ |

315,518 |

|

|

$ |

(196,158 |

) |

|

$ |

119,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended June 30, 2020: |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2019 |

|

39,589,755 |

|

|

$ |

396 |

|

|

$ |

311,618 |

|

|

$ |

(179,861 |

) |

|

$ |

132,153 |

|

|

|

Net loss |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(16,297 |

) |

|

|

(16,297 |

) |

|

|

Stock-based compensation |

|

- |

|

|

|

- |

|

|

|

2,778 |

|

|

|

- |

|

|

|

2,778 |

|

|

|

Issuance of restricted /performance service awards |

|

145,943 |

|

|

|

1 |

|

|

|

(1 |

) |

|

|

- |

|

|

|

- |

|

|

|

Shares surrendered by employees to pay taxes |

|

(38,736 |

) |

|

|

(1 |

) |

|

|

(657 |

) |

|

|

- |

|

|

|

(658 |

) |

|

|

Exercise of stock options and employee stock purchase plan |

|

323,818 |

|

|

|

4 |

|

|

|

1,780 |

|

|

|

- |

|

|

|

1,784 |

|

|

|

Balance at June 30, 2020 |

|

40,020,780 |

|

|

$ |

400 |

|

|

$ |

315,518 |

|

|

$ |

(196,158 |

) |

|

$ |

119,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AXOGEN, INC. |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

|

Six Months ended June 30, 2021 and 2020 |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(14,558 |

) |

|

$ |

(16,297 |

) |

|

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation |

|

|

1,405 |

|

|

|

618 |

|

|

|

Amortization of right-of-use assets |

|

|

960 |

|

|

|

802 |

|

|

|

Amortization of intangible assets |

|

|

96 |

|

|

|

72 |

|

|

|

Amortization of deferred financing fees |

|

|

227 |

|

|

|

— |

|

|

|

Provision for bad debt |

|

|

(65 |

) |

|

|

(115 |

) |

|

|

Provision for inventory write down |

|

|

2,455 |

|

|

|

1,624 |

|

|

|

Change in fair value of derivatives |

|

|

105 |

|

|

|

— |

|

|

|

Change in investment gains and losses |

|

|

31 |

|

|

|

(141 |

) |

|

|

Share-based compensation |

|

|

6,499 |

|

|

|

2,778 |

|

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(498 |

) |

|

|

3,010 |

|

|

|

Inventory |

|

|

(3,341 |

) |

|

|

(600 |

) |

|

|

Prepaid expenses and other |

|

|

199 |

|

|

|

(1,699 |

) |

|

|

Accounts payable and accrued expenses |

|

|

(5,061 |

) |

|

|

(4,212 |

) |

|

|

Operating Lease Obligations |

|

|

35 |

|

|

|

(915 |

) |

|

|

Cash paid for interest portion of Finance Leases |

|

|

(1 |

) |

|

|

— |

|

|

|

Contract and other liabilities |

|

|

(3 |

) |

|

|

(6 |

) |

|

|

Net cash used in operating activities |

|

|

(11,515 |

) |

|

|

(15,081 |

) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of short-term investments |

|

|

(10,924 |

) |

|

|

(13,183 |

) |

|

|

Purchase of property and equipment |

|

|

(23,966 |

) |

|

|

(22,965 |

) |

|

|

Sale/Maturities of short-term investments |

|

|

32,295 |

|

|

|

59,883 |

|

|

|

Cash payments for intangible assets |

|

|

(692 |

) |

|

|

(216 |

) |

|

|

Net cash provided by/ (used for) investing

activities |

|

|

(3,287 |

) |

|

|

23,519 |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from the issuance long term debt |

|

|

15,000 |

|

|

|

35,000 |

|

|

|

Proceeds from the paycheck protection program |

|

|

— |

|

|

|

7,820 |

|

|

|

Repayment of paycheck protection program |

|

|

— |

|

|

|

(7,820 |

) |

|

|

Payments of debt issuance costs |

|

|

— |

|

|

|

(350 |

) |

|

|

Payments for repurchase of common stock for employee tax

withholding |

|

|

— |

|

|

|

(658 |

) |

|

|

Cash paid for debt portion of finance leases |

|

|

(8 |

) |

|

|

(8 |

) |

|

|

Proceeds from exercise of stock options and warrants |

|

|

3,612 |

|

|

|

1,784 |

|

|

|

Net cash provided by financing activities |

|

|

18,604 |

|

|

|

35,768 |

|

|

|

|

|

|

|

|

|

|

Net increase in cash, cash equivalents and restricted cash |

|

|

3,802 |

|

|

|

44,206 |

|

|

|

Cash, cash equivalents and restricted cash,

beginning of year |

|

|

55,609 |

|

|

|

41,724 |

|

|

|

Cash, cash equivalents and restricted cash, end of

period |

|

$ |

59,411 |

|

|

$ |

85,930 |

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow

activity: |

|

|

|

|

|

|

Cash paid for interest |

|

|

739 |

|

|

|

23 |

|

|

|

Supplemental disclosure of non-cash investing and financing

activities |

|

|

|

|

|

|

Acquisition of fixed assets in accounts payable and accrued

expenses |

|

|

3,035 |

|

|

|

617 |

|

|

|

Obtaining a right-of-use asset in exchange for a lease

liability |

|

|

371 |

|

|

|

796 |

|

|

|

Embedded derivative associated with the long-term debt |

|

|

1,173 |

|

|

|

2,563 |

|

|

|

Acquisition of intangible assets in accounts payable and accrued

expenses |

|

|

190 |

|

|

|

— |

|

|

|

|

|

|

|

|

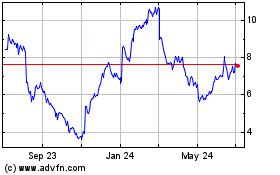

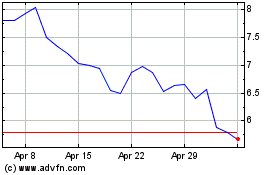

Axogen (NASDAQ:AXGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axogen (NASDAQ:AXGN)

Historical Stock Chart

From Apr 2023 to Apr 2024