Economic Calendar -- WSJ

September 30 2019 - 3:02AM

Dow Jones News

By Paul Kiernan and Liyan Qi

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 30, 2019).

The week ahead brings data from important business surveys,

trade between the U.S. and the rest of the world and the

all-important monthly employment report. Here is what to watch:

Monday: China will release its official purchasing managers

index right before the weeklong National Day holiday. Economists

expect the manufacturing PMI to inch up to 49.6 this month from

49.5 at the end of August. Massive monetary-policy easing probably

isn't what China wants given its mounting debt problem, but the

country's deepening economic slowdown does require Beijing to be

proactive in its easing efforts, economists say.

Tuesday: The Institute for Supply Management publishes at 10

a.m. ET its monthly reading on U.S. manufacturing activity, which

declined in August for the first time in three years. While that

fueled worries that the global economic slowdown is weighing on the

U.S., economists reckon the index returned to positive territory in

September. The Wall Street Journal consensus forecast has the ISM

manufacturing index rising to 50.2 in September from 49.1 in

August. (A reading of 50 is the cutoff between expansion and

contraction).

Wednesday: Automatic Data Processing, Inc., produces a sneak

peek at U.S. private-sector hiring two days before the Labor

Department's official jobs report. Economists expect the data to

show 138,000 positions were filled in September, consistent with

forecasts for another solid month for job growth.

Thursday: ISM releases its nonmanufacturing indicator at 10 a.m.

ET, providing a window into U.S. services activity in September.

Economists expect the index to remain solidly in expansion, though

falling slightly to 55.2 from 56.4 in August. That would be good

news at a time when a pre-eminent fear among economists is that

factory weakness may spill over into the much larger services

sector.

Investors will also be watching official data on August factory

orders, which are due to publish at the same time and are expected

to rise a modest 0.1% from July.

Friday: The U.S. Labor Department releases its September

employment report, the most closely followed economic indicator of

the month. With the China trade war and the slowdown in Europe

weighing on exports, manufacturing and business investment,

consumers have been the sturdiest pillar supporting economic growth

in the U.S. this year. Economists are expecting a decent report:

nonfarm payrolls up 140,000, the unemployment rate steady at 3.7%,

and average hourly earnings up 3.3% from September 2018. Any sign

of weakness could bode poorly for household spending, especially as

consumers face the effects of higher tariffs on imported goods from

China in coming months.

(END) Dow Jones Newswires

September 30, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

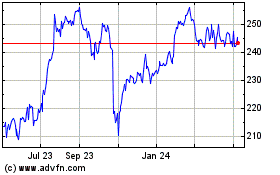

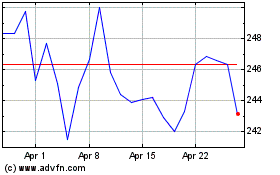

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024