Registration No. 333-227183

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AudioEye, Inc.

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

7372

(Primary Standard Industrial

Classification Code Number)

|

|

20-2939845

(I.R.S. Employer

Identification No.)

|

5210 E. Williams Circle, Suite 750

Tucson, Arizona 85711

(866) 331-5324

(Address, including zip code and telephone number, including

area code, of registrant’s principal executive offices)

|

Todd Bankofier

Chief Executive Officer

5210 E. Williams Circle, Suite 750

Tucson, Arizona 85711

(866) 331-5324

(Name, address, including zip code and telephone

number, including area code, of agent for service)

|

Copies to:

Katherine F. Ashton, Esq.

Bryan Cave Leighton Paisner LLP

120 Broadway, Suite 300

Santa Monica, California

(310) 576-2100

Approximate date of commencement of proposed

sale to public:

As soon as practicable after this registration

statement becomes effective.

If any of the securities

being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, check the following box:

x

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering:

¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering:

¨

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b–2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

x

|

|

Smaller reporting company

|

x

|

|

Emerging growth company

|

¨

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act.

¨

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION

STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT

WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A)

OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING

PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 (this “Post-Effective

Amendment”) to AudioEye, Inc.’s Registration Statement on Form S-1 (File No. 333-227183) (the “Registration Statement”),

as declared effective by the Securities and Exchange Commission (the “SEC”) on September 14, 2018 is being filed in

order to (i) include the information contained in the Registrant’s Annual Report on Form 10-K for the fiscal year ended December

31, 2018 that was filed with the SEC on March 27, 2019, (ii) include the information contained in the Registrant’s Quarterly

Report on Form 10-Q for the quarterly period ended March 31, 2019 that was filed with the SEC on May 14, 2019, and (iii) make certain

other updates to the Registration Statement.

The information included in this filing updates

the Registration Statement and the prospectus contained therein. No additional securities are being registered under this Post-Effective

Amendment. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

The information in this

prospectus is not complete and may be changed. The securities offered pursuant to this prospectus may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Dated July 5, 2019

PRELIMINARY PROSPECTUS (Subject to Completion)

AudioEye, Inc.

2,322,925 SHARES OF COMMON STOCK

This prospectus covers

the sale by the selling stockholders identified in this prospectus under the section titled “Selling Stockholders”

(the “Selling Stockholders”) of up to 2,322,925 shares of the common stock of AudioEye, Inc., a Delaware corporation

(together with its subsidiary, “we” or “our”), which includes 380,719 shares of common stock issuable upon

the exercise of warrants.

We will pay all expenses,

except for any brokerage expenses, fees, discounts and commissions, which will all be paid by the Selling Stockholders, incurred

in connection with the offering described in this prospectus. Our common stock is more fully described in the section of this prospectus

entitled “Description of Securities.”

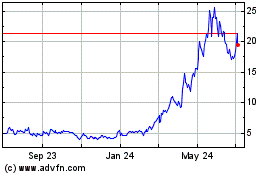

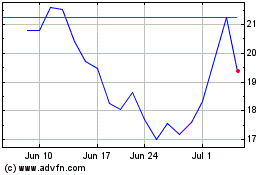

Our common stock has been

listed on The NASDAQ Capital Market (“NASDAQ”) under the symbol “AEYE” since September 4, 2018. Prior to

September 4, 2018, our common stock was quoted on the OTCQB (the Venture Market) and the Over the Counter “OTC” Bulletin

Board (each being part of the OTC Markets Group) since April 13, 2013 under the same symbol. The closing price of our common stock

as reported on the NASDAQ on June 28, 2019, was $7.90 per share.

The prices at which the

Selling Stockholders may sell the shares of common stock that are part of this offering will be determined by the prevailing market

price for the shares at the time the shares are sold, or at such a price or prices determined, from time to time, by the Selling

Stockholders. See “Plan of Distribution.” The Selling Stockholders may be deemed “underwriters” within

the meaning of the Securities Act of 1933, as amended, (the “Securities Act”), in connection with the sale of their

common stock under this prospectus.

We will not receive any

of the proceeds from the sale of the shares of common stock owned by the Selling Stockholders, but we may receive funds from the

exercise of their warrants upon exercise. Any proceeds received from the exercise of the warrants will be used by us for working

capital and general corporate purposes.

You should read this prospectus,

and any amendment or supplement, together with additional information described under the heading “General” before

you decide to invest. You should not assume that the information in this prospectus is accurate as of any date other than the date

on the front of this document.

Our principal executive

offices are located at 5210 E. Williams Circle, Suite 750, Tucson, Arizona 85711, and our telephone number is (866) 331-5324.

Our home page on the Internet can be located at www.audioeye.com. Information included on our website is not part of this prospectus.

See the section of this

document titled “Risk Factors” beginning on page 11 for certain factors relating to an investment in the shares of

common stock offered hereby.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY OTHER STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE COMMON STOCK OFFERED HEREBY

OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is July 5, 2019

TABLE OF CONTENTS

You should rely only

on the information contained in this prospectus. We and the Selling Stockholders have not authorized anyone to provide you with

information different from that which is contained in this prospectus or in any free writing prospectus prepared by or on behalf

of us to which we have referred you. We and the Selling Stockholders are offering to sell, and seeking offers to buy, shares of

our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus may only be accurate

on the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of securities.

STATEMENT REGARDING FORWARD LOOKING STATEMENTS

Some of the statements

included in this prospectus and any prospectus supplement contain forward-looking statements made pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in

this prospectus and any prospectus supplement, including statements regarding our plans, objectives, goals, strategies, future

events, capital expenditures, future results or our future financial performance, our competitive strengths, our business strategy

and the trends in our industry are forward-looking statements.

In some cases, you can

identify forward-looking statements by terminology such as “may,” “could,” “should,” “expects,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,”

“proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or

our industry’s actual results, levels of activity, performance or achievements to be materially different from any future

results, levels of activity, performance or achievements expressed or implied by these forward=looking statements. You should read

statements that contain these words carefully, because they discuss our expectations about our future operating results or our

future financial condition or state other “forward-looking” information.

Because these forward-looking

statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events

or developments to differ materially from those expressed or implied by these forward-looking statements. Factors that could cause

actual results, events or developments to differ from those contained in the forward-looking statements include but are not limited

to:

|

|

·

|

the uncertain market acceptance of our existing and future products;

|

|

|

·

|

our need for, and the availability of, additional capital in the future to fund our operations and the development of new products;

|

|

|

·

|

the success, timing and financial consequences of new strategic relationships or licensing agreements we may enter into;

|

|

|

·

|

rapid changes in Internet-based applications that may affect the utility and commercial viability of our products;

|

|

|

·

|

the timing and magnitude of expenditures we may incur in connection with our ongoing product development activities;

|

|

|

·

|

the level of competition from our existing competitors and from new competitors in our marketplace; and

|

|

|

·

|

the regulatory environment for our products and services.

|

In addition, you should

refer to the “Risk Factors” section of this prospectus beginning on page 11 for a discussion of other factors

that may cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking

statements. You should be aware that the occurrence of any of the events described in this prospectus and any prospectus supplement

could substantially harm our business, results of operations and financial condition, and that upon the occurrence of any of these

events, the trading price of our securities could decline. As a result of these factors, we cannot assure you that the forward-looking

statements in this prospectus and any prospectus supplement will prove to be accurate. Furthermore, if our forward-looking statements

prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements,

you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives

and plans in any specified time frame, if at all. Accordingly, you should not place undue reliance on these forward-looking statements.

All subsequent written and oral forward-looking statements attributable to us or the persons acting on our behalf are expressly

qualified in their entirety by the applicable cautionary statements. We undertake no obligation to update any of these forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by applicable law or regulation.

PROSPECTUS SUMMARY

The following summary

highlights information contained elsewhere in this prospectus. It may not contain all the information that may be important

to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and our historical financial statements and related

notes included elsewhere in this prospectus or any accompanying prospectus supplement before making an investment decision. In

this prospectus, unless the context requires otherwise, all references to “we,” “our,” “us,”

“AudioEye” and the “Company” refer to AudioEye, Inc., a Delaware corporation.

The Company

AudioEye is a marketplace

leader providing digital accessibility technology solutions for our clients’ customers through our Ally Platform products.

Our solutions advance accessibility with patented technology that reduces barriers, expands access for individuals with disabilities,

and enhances the user experience for a broader audience of users

.

We believe that, when implemented our solutions offer

businesses the opportunity to reach more customers, improve brand image, build additional brand loyalty, and, most importantly,

provide an accessible and usable web experience to the expansive and ever-growing population of individuals with disabilities throughout

the world. In addition, our solutions help organizations comply with internationally accepted Web Content Accessibility Guidelines

(“WCAG”) as well as U.S., Canadian, Australian, and United Kingdom accessibility laws.

We generate revenues through

the sale of subscriptions of our software-as-a-service (“SaaS”) technology platform, called the AudioEye Ally Platform,

to website owners, publishers, developers, Content Management System (“CMS”) platform providers and operators through

the delivery of managed services combined with the implementation of our solutions. Our solutions have been adopted by some of

the largest and most influential companies in the world. Our customers span disparate industries and target market verticals, which

encompass (but are not limited to) the following categories: human resources, finance, retail/ecommerce, food services, automotive,

transportation, hospitality, media, and education. Government agencies, both at the federal level and state and local levels have

also integrated our software in their digital platforms.

AudioEye customers fall

into one of two distinct sales channels: direct and indirect. In the direct channel, AudioEye sales personnel engage directly with

the customer. In the indirect channel, AudioEye engages with customers, who are referred to as Indirect Channel Partners, who provide

a website hosting platform for their end-user customers, and who serve as an authorized reseller of the AudioEye solution to their

customers. Indirect channel sales have been a key factor in the acceleration of the AudioEye sales and marketing strategy. By working

with strategically identified resellers, these partners provide a unique opportunity allowing AudioEye to onboard more end-user

customers in a shorter period of time. By working with providers of the proprietary content management systems, AudioEye leverages

economies of scale to deliver the AudioEye solution in a cost-effective and highly efficient way. In middle and lower markets,

this strategy has helped make accessibility accessible to industries that would otherwise neglect the important issue of digital

inclusion, altogether. We believe that there is significant opportunity for us to increase revenues by delivering our solutions

through this indirect channel and therefore will continue to invest capital and resources in expanding our strategic partner business.

Business History

AudioEye, Inc. was

formed as a Delaware corporation on May 20, 2005. On August 1, 2018, the Company amended its Certificate of Incorporation

to implement a reverse stock split in the ratio of 1 share for every 25 shares of common stock and to reduce the number of authorized

shares of common stock from 250,000,000 to 50,000,000. As a result, 186,994,384 shares of our common stock were exchanged

for 7,479,775 shares of our common stock (inclusive of 992,000 shares of common stock sold on August 6, 2018). All numbers in this

prospectus have been adjusted where necessary to reflect this reverse stock split.

Private Placement of Common Stock

On August 6, 2018,

we sold 992,000 shares of our common stock at $6.25 per share for net proceeds of $5,561,215, after costs and expenses of $638,785.

In addition, on August 23, 2018, we sold 8,000 shares of our common stock at a sales price of $6.25 per share for net proceeds

of $48,000, after costs and expenses of $2,000.

Amendment of Common Stock Purchase Agreement

On August 23, 2018, the

Company entered into an Amended and Restated Common Stock and Warrant Purchase Agreement, which amended the Common Stock Purchase

Agreement dated September 29, 2017, pursuant to which we issued warrants to the purchasers of our common stock thereunder. Pursuant

to such agreement, the Company issued an additional 85,719 warrants to certain purchasers. The warrants have a term of 5 years

and an exercise price of $6.25.

Risk Factors

Our business is subject

to risks, as discussed more fully in the section entitled “Risk Factors.” Risks discussed in the “Risk Factors”

section should be carefully considered before investing in our common stock. In particular, the following risks, among others,

may have an adverse effect on our business, which could cause the trading price of our common stock to decline and result in a

loss of all or a portion of your investment:

|

|

·

|

the uncertain market acceptance of our existing and future products;

|

|

|

·

|

our need for, and the availability of, additional capital in the future to fund our operations and the development of new products;

|

|

|

·

|

rapid changes in Internet-based applications that may affect the utility and commercial viability of our products;

|

|

|

·

|

the timing and magnitude of expenditures we may incur in connection with our ongoing product development activities;

|

|

|

·

|

the success, timing and financial consequences of new strategic relationships or licensing agreements we may enter into;

|

|

|

·

|

the level of competition from our existing and from new competitors in our marketplace; and

|

|

|

·

|

regulatory environment for our products and services.

|

Our Principal Executive Offices

Our principal executive

offices are located at 5210 E. Williams Circle, Suite 750, Tucson, Arizona 85711. Our telephone number is (866) 331-5324.

General

We maintain a website

at www.audioeye.com (this reference to our website is an inactive textual reference only and is not intended to incorporate our

website into this prospectus). We file reports with the Securities and Exchange Commission

(“SEC”) and make available, free of charge, on or through our website, our annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K, proxy and information statements and amendments to those reports

filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. In

addition, the SEC maintains a website at www.sec.gov containing reports, proxy and information statements and other information

regarding issuers that file electronically with the SEC. Information on the SEC’s website does not constitute part of this

prospectus. Our website also contains copies of our corporate governance guidelines, code of business conduct and ethics, related

party transaction policy and whistleblower policy, and copies of the charters for our audit committee, compensation committee

and nominating and corporate governance committee.

THE OFFERING

|

Common stock offered by the Selling Stockholders:

|

|

2,322,925, with up to 380,719 shares of our common stock to be offered by the Selling Stockholders upon the exercise of outstanding common stock purchase warrants and up to 1,942,206 shares of our common stock to be offered by the Selling Stockholders.

|

|

|

|

|

|

Common stock outstanding prior to the offering:

|

|

7,656,046

|

|

|

|

|

|

Common stock outstanding after this offering:

|

|

8,036,765 (1)

|

|

|

|

|

|

Use of proceeds:

|

|

We will not receive any proceeds from the sale of the common stock offered by the Selling Stockholders. However, we will receive proceeds from the exercise price of the warrants if the warrants are exercised for cash. We intend to use those proceeds, if any, for general corporate purposes. We will, however, bear the costs associated with the sale of shares by the Selling Stockholders.

|

|

|

|

|

|

NASDAQ trading symbol:

|

|

“AEYE”

|

|

|

|

|

|

Risk factors:

|

|

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 11 of this prospectus before deciding whether or not to invest in shares of our common stock.

|

|

(1)

|

The number of shares of common stock outstanding is based upon 7,656,046 shares outstanding as of June 14, 2019, which assumes the exercise of all warrants with respect to those shares being registered for resale pursuant to the registration statement of which this prospectus forms a part.

|

The number of shares of

common stock outstanding after this offering excludes:

|

|

·

|

954,602 shares of common stock issuable upon the exercise of currently outstanding options at a weighted average exercise price of $4.41 per share;

|

|

|

·

|

1,707,820 shares of common stock issuable upon the exercise of currently outstanding warrants at a weighted average exercise price of $4.27 per share; and

|

|

|

·

|

288,819 shares of common stock issuable upon the conversion of all shares of Series A

Convertible Preferred Stock; and

|

|

|

·

|

907,061 shares of common stock available for future issuance under the AudioEye, Inc. Equity Incentive Compensation Plans.

|

Summary

Financial Data

Because this is only a

summary of our financial information, it does not contain all of the financial information that may be important to you. Therefore,

you should carefully read all of the information in this prospectus and any prospectus supplement, including the financial statements

and their explanatory notes and the section entitled “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” before making a decision to invest in our common stock. The information contained in the following

summary is derived from our financial statements for the three months ended March 31, 2019 and 2018 and the years ended December 31,

2018 and 2017. Our historical results are not necessarily indicative of the results to be expected in the future, and our operating

results for the three months ended March 31, 2019 are not necessarily indicative of the results that may be expected for the entire

year ending December 31, 2019.

|

|

|

Three Months Ended

March 31,

|

|

|

Years Ended

December 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

2018

|

|

|

2017

|

|

|

Revenues

|

|

$

|

1,985,678

|

|

|

$

|

1,149,342

|

|

|

$

|

5,660,427

|

|

|

$

|

2,739,439

|

|

|

Cost of revenue

|

|

|

902,984

|

|

|

|

587,464

|

|

|

|

2,626,815

|

|

|

|

1,384,145

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

1,082,694

|

|

|

|

561,878

|

|

|

|

3,033,612

|

|

|

|

1,355,294

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

|

871,875

|

|

|

|

610,662

|

|

|

|

2,462,865

|

|

|

|

1,421,127

|

|

|

Research and development

|

|

|

215,253

|

|

|

|

49,667

|

|

|

|

194,429

|

|

|

|

181,303

|

|

|

General and administrative

|

|

|

2,136,326

|

|

|

|

1,064,625

|

|

|

|

4,950,138

|

|

|

|

4,271,510

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

3,223,454

|

|

|

|

1,724,954

|

|

|

|

7,607,432

|

|

|

|

5,873,940

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(2,140,760

|

)

|

|

|

(1,163,076

|

)

|

|

|

(4,573,820

|

)

|

|

|

(4,518,646

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on derivative liabilities

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(155,027

|

)

|

|

Unrealized gain (loss) on marketable securities

|

|

|

(18

|

)

|

|

|

228

|

|

|

|

(240

|

)

|

|

|

(450

|

)

|

|

Loss on settlement of debt

|

|

|

-

|

|

|

|

-

|

|

|

|

(267,812

|

)

|

|

|

(15,724

|

)

|

|

Interest income (expense), net

|

|

|

(648

|

)

|

|

|

237

|

|

|

|

(178,002

|

)

|

|

|

(917,992

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(2,141,426

|

)

|

|

|

(1,162,611

|

)

|

|

|

(5,019,874

|

)

|

|

|

(5,607,839

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on Series A convertible preferred stock

|

|

|

(12,945

|

)

|

|

|

(13,750

|

)

|

|

|

(53,740

|

)

|

|

|

(75,206

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss available to common stockholders

|

|

$

|

(2,154,371

|

)

|

|

$

|

(1,176,361

|

)

|

|

$

|

(5,073,614

|

)

|

|

$

|

(5,683,045

|

)

|

RISK FACTORS

In addition to the other

information included in this Prospectus, the following factors should be carefully considered in evaluating our business, financial

position and future prospects. Any of the following risks, either alone or taken together, could materially and adversely affect

our business, financial position and future prospects. If one or more of these or other risks or uncertainties materialize, or

if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we have projected.

Investing in our common stock is highly speculative and involves a high degree of risk. Any potential investor should carefully

consider the risks and uncertainties described below before purchasing any shares of our common stock. There may be additional

risks that we do not presently know or that we currently believe are immaterial which could also materially adversely affect our

business, financial position and future prospects. As a result, the trading price of our stock could decline, and you might

lose all or part of your investment. Our business, financial condition and operating results, or the value of any investment you

make in the common stock of our company, or both, could be adversely affected by any of the factors listed and described below.

Risks Relating to Our Business and Industry

We have a history of generating significant

losses and may not be able to achieve and sustain profitability, in which case investors may lose their entire investment.

To date, we have not been

profitable, and we may never achieve profitability on a full-year or consistent basis. We incurred net losses of $5,019,874 for

the year ended December 31, 2018 and $2,141,426 for the quarter ended March 31, 2019. As of March 31, 2019, we have an accumulated

deficit of $44,284,527. If we continue to experience losses, we may not be able to continue our operations, and investors may lose

their entire investment in our Company.

Our future development requires substantial

capital, and we may be unable to obtain needed capital or financing on satisfactory terms, or at all, which would prevent us from

fully developing our business and generating revenues.

As of March 31, 2019, our

cash available was $4,089,717. Our business plan requires additional capital expenditures, and our capital outlays could increase

substantially over the next several years as we continue to implement our business plan. As a result, we may need to raise additional

capital, through future private or public equity offerings, strategic alliances and/or debt financing. Our future capital requirements

will depend on many factors, including: market conditions, sales and marketing costs, mergers and acquisition activity, if any,

costs of litigation in enforcing our patents, and information technology development and acquisition costs. No assurance can be

given that we can successfully raise additional equity or debt capital, or that such financing will be available to us on favorable

terms, if at all.

We have been subject to litigation and may in the future be

subject to additional litigation, which could have a material adverse effect on our financial position and results of operations.

We have been and may become

involved in various disputes and allegations incidental to our business operations. Because it is not possible to determine when

and whether these disputes and allegations may arise or the ultimate disposition of such matters, the resolution of any such matters,

should they arise, could have a material adverse effect on our financial position and results of operations.

Current economic and credit conditions

could adversely affect our plan of operations.

Our ability to secure additional

financing and satisfy our financial obligations under indebtedness outstanding from time to time will depend upon our future operating

performance, which is subject to the prevailing general economic and credit market conditions, including interest rate levels and

the availability of credit generally, and financial, business and other factors, many of which are beyond our control. The prolonged

worsening of credit market conditions would have a material adverse effect on our ability to secure financing on favorable terms,

if at all.

Our revenue and collections may be materially

adversely affected by an economic downturn.

Recent

macroeconomic conditions have shown signs of volatility and potential weakness. We believe commercial purchasing habits and corporate

information technology budgets have improved in recent years but remain relatively constrained and subject to such volatile and

potentially weak economic conditions. Any deterioration in prevailing economic conditions would likely result in reduced demand

for our services and products, which could have a material adverse effect on our business financial position or results of operations

.

An increase in market interest rates

could increase our interest costs on future debt and could adversely affect our stock price.

If interest rates increase,

so could our interest costs for any new debt. This increased cost could make financing, including the financing of any acquisition,

costlier. We may incur variable interest rate indebtedness in the future. Rising interest rates could limit our ability to refinance

debt when it matures or cause us to pay higher interest rates upon any refinancing and increased interest expense on any refinanced

indebtedness.

Our success is dependent on certain members

of our management and technical teams.

Our success has depended,

and continues to depend, on the efforts and talents of our senior management team and key material employees, including our engineers,

product managers, sales and marketing personnel, and professional services personnel. Our future success will also depend upon

our continued ability to identify, hire and retain additional skilled and highly qualified personnel, which will require significant

time, expense and attention. We cannot assure you that our management will remain in place or as to the time it will take for us

to identify, hire and retain any required additional members of our management and technical teams. We do not maintain “key

person” life insurance policies. The loss of any of our management and technical team members, or our inability to identify,

hire and retain any required additional management and technical personnel, could have a material adverse effect on our results

of operations and financial condition, as well as on the market price of our common stock.

We intend to pursue new strategic opportunities

which may result in the use of a significant amount of our management resources or significant costs, and we may not be able to

fully realize the potential benefit of such opportunities.

We intend to seek other

strategic partners to help us pursue our strategic, marketing, sales and technical objectives. Although we may devote significant

time and resources in pursuit of such transactions, we may struggle to successfully identify such opportunities, or to successfully

conclude transactions with potential strategic partners. Should we be unable to identify or conclude important strategic transactions,

our business prospects and operations could be adversely affected as a result of the devotion of significant managerial effort

required to pursue such opportunities and the challenges of achieving our objectives in the absence of strategic partners. In addition,

we may incur significant costs in connection with seeking acquisitions or other strategic opportunities regardless of whether the

transaction is completed, and in combining operations if such a transaction is completed. In the event that we consummate an acquisition

or strategic alternative in the future, we cannot assure you that we would fully realize the potential benefit of such a transaction.

Our business plan may not be realized.

If our business plan proves to be unsuccessful, our business may fail, and you may lose your entire investment.

Our operations are subject

to all of the risks inherent in the establishment of a new business enterprise with a limited operating history. The likelihood

of our success must be considered in light of the problems, expenses, complications, and delays frequently encountered in connection

with the development of a new business. Unanticipated events may occur that could affect the actual results achieved during the

forecast periods. Consequently, the actual results of operations during the forecast periods will vary from the forecasts, and

such variations may be material. In addition, the degree of uncertainty increases with each successive year presented in our business

plan. We cannot assure you that we will succeed in the anticipated operation of our business plan. If our business plan proves

to be unsuccessful, our business may fail, and you may lose your entire investment.

We have experienced and will continue

to experience competition as more companies seek to provide products and services similar to our products and services and because

larger and better-financed competitors may adversely affect our ability to compete in the marketplace and achieve profitability,

our business may be damaged or fail.

Competition in our market

is intense, and we expect competition for our products and services to become even more intense. We compete directly against other

companies offering similar products and services that compete or will compete directly with our products and services. We also

compete against established vendors in our markets. These companies may incorporate other competitive technologies into their product

offerings, whether developed internally or by third parties. There are also established consultants who offer services to help

their customers obtain compliance with accessibilities standards. In many cases these consultants compete for the same funding

from our prospective customers. For the foreseeable future, substantially all of our competitors are likely to be larger, better-financed

companies that may develop products superior to our current and future products and services, which could create significant competitive

advantages for those companies. Our future success depends on our ability to compete effectively with our competitors, and we may

have difficulty competing with larger, established competitors. Generally, these competitors have:

|

|

·

|

substantially greater financial, technical, and marketing resources;

|

|

|

|

|

|

|

·

|

a larger customer base;

|

|

|

|

|

|

|

·

|

better name recognition; and

|

|

|

|

|

|

|

·

|

more expansive or different product and service offerings.

|

These competitors may command

a larger market share than we do, which may enable them to establish a stronger competitive position, in part, through greater

marketing opportunities. Further, our competitors may be able to respond more quickly than we are to new or emerging technologies

and changes in user preferences and to devote greater resources to developing new products and offering new services. These competitors

may develop products or services that are comparable or superior to ours. If we fail to address competitive developments quickly

and effectively, we may not be able to remain a viable business.

If we are not able to adequately protect

our patented and other intellectual property rights, our operations and revenues would be negatively impacted.

Our ability to compete

largely depends on the superiority, uniqueness and value of our technology and intellectual property. To protect our intellectual

property rights, we rely on a combination of patent, trademark, copyright, and trade secret laws, confidentiality agreements with

our employees and third parties, and protective contractual provisions. We cannot assure you that infringement or invalidity claims

(or claims for indemnification resulting from any infringement claims) will not be asserted or prosecuted against us or that any

such assertions or prosecutions will not materially adversely affect our business.

Regardless of whether any

future claims are valid or can be successfully asserted, defending against such claims could cause us to incur significant costs

and could divert resources away from our other activities. In addition, assertion of infringement claims could result in injunctions

that prevent us from distributing our products and offering our services. In addition to challenges against our existing patents,

any of the following could also reduce the value of our intellectual property now or in the future:

|

|

·

|

applications for patents, trademarks, and copyrights relating to our business may not be granted and, if granted, may be challenged or invalidated;

|

|

|

|

|

|

|

·

|

issued trademarks, copyrights or patents may not provide us with any competitive advantages;

|

|

|

|

|

|

|

·

|

our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our intellectual property and technology; and

|

|

|

|

|

|

|

·

|

our efforts may not prevent the development and design by others of products, services or technologies similar to, competitive with, or superior to those that we have developed or may in the future develop.

|

Also, we may not be able

to effectively protect our intellectual property rights in certain foreign countries where we may do business in the future or

from which competitors may operate. Obtaining patents will not necessarily protect our technology or prevent our international

competitors from developing similar products or technologies. Our inability to adequately protect our patented and other intellectual

property rights would have a negative impact on our operations and revenues.

In addition, legal standards

relating to the validity, enforceability, and scope of protection of intellectual property rights in Internet-related businesses

are uncertain and still evolving. Because of the growth of the Internet and Internet-related businesses, patent applications are

continuously and simultaneously being filed in connection with Internet-related technology. There are a significant number of U.S.

and foreign patents and patent applications in our areas of interest, and we believe that there has been, and is likely to continue

to be, significant litigation in the industry regarding patent and other intellectual property rights.

We may commence legal proceedings against

third parties who we believe are infringing on our intellectual property rights, and if we are forced to litigate to defend our

intellectual property rights, or to defend claims by third parties against us relating to intellectual property rights, legal fees

and court injunctions could adversely affect our financial condition and potentially limit or even end our business.

At present, we do not have

any active or pending litigation related to any violation of our patents. We expect an increase in the number of third parties

who could violate our patents as the market develops new uses of similar products and services and begin to increase their adoption

of the technology and integrate it into their businesses. We foresee the potential need to enter into active litigation to defend

and enforce our patents. We anticipate that these legal proceedings could continue for several years and may require significant

expenditures for legal fees and other expenses. In the event we are not successful through appeal and do not subsequently obtain

monetary and injunctive relief, these litigation matters may significantly reduce our financial resources and have a material impact

on our ability to continue our operations. The time and effort required of our management to effectively pursue or defend these

litigation matters may adversely affect our ability to operate our business, since time spent on matters related to the lawsuits

would take away from the time spent on managing and operating the business. Any such potential lawsuits may result in an outcome

that is unfavorable to our stockholders and the Company.

The burdens of being a public company

may adversely affect our ability to develop our business and pursue a litigation strategy.

Since we are a public company,

our management must devote substantial time, attention, and financial resources to comply with U.S. securities laws and stock exchange

requirements. This may have a material adverse effect on our management’s ability to effectively and efficiently develop

our business initiatives. In addition, our disclosure obligations under U.S. securities laws may require us to disclose information

publicly that could have a material adverse effect on our potential litigation strategies.

The current U.S. regulatory environment

for our products and services remains unclear, and new or revised regulations may adversely affect our U.S. business.

We cannot assure you that

our existing or planned product and service offerings will be in compliance with local, state, and/or federal U.S. laws or the

laws of any foreign jurisdiction where we operate or may operate in the future. Further, we cannot assure you that we will not

unintentionally violate such laws or that such laws will not be modified, or that new laws will not be enacted in the future, which

would cause us to be in violation of such laws. More aggressive domestic or international regulation of the Internet may materially

and adversely affect our business, financial condition, operating results, and future prospects.

As pressure of legal ramifications from

non-compliance with Web Accessibility increases, customers may not be inclined to permit or may delay AudioEye from promoting customer

relationships and/or the specifics associated with those relationships, and if this restricts our public communications about our

business with existing or potential investors and stockholders, it may negatively impact our ability to maintain or gain interest

in our business from those investors and stockholders.

Due to an undefined regulatory

environment and a heightened sensitivity by plaintiffs seeking retribution for inaccessible and unusable digital interfaces, any

organization may be sued or faced with legal demands claiming non-compliance with the Americans with Disabilities Act of 1990.

As these legal actions or demands may be initiated with or without merit, they present a new level of risk for website owners and

publishers. In an effort to avoid any potential unwanted attention pertaining to the subject of compliance, AudioEye clients have

enforced or may enforce rigid restrictions pertaining to AudioEye’s promotion of their involvement or engagement with AudioEye,

regardless of the level of success or positive impact any such engagement may have or have had on their businesses. Whether through

the enforcement of non-disclosure agreements or through specific non-disclosure language associated with client contracts, if AudioEye

is not empowered to promptly make public announcements about its client base and the adoption and success of AudioEye products

and services, there may be a deleterious effect on the Company’s capacity to accelerate its business growth or attract investment

from existing or future investors and stockholders.

Our business greatly depends on the growth

of online services, Internet of Things (“IOT”), kiosks, streaming, and other next-generation Internet-based applications,

which growth may not occur as expected, or at all, which would harm our business.

The Internet may ultimately

prove not to be a viable commercial marketplace for such applications for several reasons, including:

|

|

·

|

unwillingness of consumers to shift to and use other such next-generation Internet-based audio applications;

|

|

|

|

|

|

|

·

|

refusal to purchase our products and services;

|

|

|

|

|

|

|

·

|

perception by end-users with respect to product and service quality and performance;

|

|

|

|

|

|

|

·

|

limitations on access and ease of use;

|

|

|

|

|

|

|

·

|

congestion leading to delayed or extended response times;

|

|

|

|

|

|

|

·

|

inadequate development of Internet infrastructure to keep pace with increased levels of use; and

|

|

|

|

|

|

|

·

|

increased government regulations.

|

Because of these and other

factors, the growth of online services, IOT, kiosks, streaming, and other next-generation Internet-based applications may be impeded

or not occur as expected. As a result, our business and operations could be adversely impacted.

If the market for our online services

does not grow as anticipated, our business would be adversely affected.

While other next-generation

Internet-based applications have grown rapidly in personal and professional use, we cannot assure you that the adoption of our

products and services will grow at a comparable rate or grow at all, which would adversely affect our business and results of operations.

We expect that we will experience long

and unpredictable sales cycles, which may impact our operating results.

We expect

that our sales cycles will be long and unpredictable due to a number of uncertainties such as:

|

|

·

|

the need to educate existing and potential customers about the current state of accessibility for those with disabilities;

|

|

|

|

|

|

|

·

|

customers’ willingness to invest potentially substantial resources and infrastructures to take advantage of our products and services;

|

|

|

|

|

|

|

·

|

customers’ budgetary constraints;

|

|

|

|

|

|

|

·

|

the timing of customers’ budget cycles; and

|

|

|

|

|

|

|

·

|

delays caused by customers’ internal review and procurement processes.

|

These factors may create

additional lead time before a sale is finalized and may lead to longer than expected and unpredictable sales cycles, which could

delay or reduce our revenue and impact our operating results.

Our expansion into new products, services,

technologies, and geographic regions subjects us to additional business, legal, financial, and competitive risks.

We may have limited or

no experience in our newer market segments, and our customers may not adopt our new offerings. These offerings may present new

and difficult technology challenges, and we may be subject to claims if customers of these offerings experience service disruptions

or failures or other quality issues. In addition, profitability, if any, in our newer activities may be lower than in our older

activities, and we may not be successful enough in these newer activities to recoup our investments in them. If any of this were

to occur, it could damage our reputation, limit our growth, and negatively affect our operating results.

We face risks related to system interruption

and lack of redundancy.

We experience occasional

system interruptions and delays that make our websites and services unavailable or slow to respond and prevent us from efficiently

providing services to third parties, which may reduce our net sales and the attractiveness of our products and services. If we

are unable to continually add software and hardware, effectively upgrade our systems and network infrastructure, and take other

steps to improve the efficiency of our systems, it could cause system interruptions or delays and adversely affect our business

and operating results.

Our computer and communications

systems and operations could be damaged or interrupted by fire, flood, power loss, telecommunications failure, earthquakes, acts

of war or terrorism, acts of God, computer viruses, physical or electronic break-ins, and similar events or disruptions. Any of

these events could cause system interruption, delays, and loss of critical data, and could prevent us from providing services,

which could make our product and service offerings less attractive and subject us to liability. Our systems are not fully redundant,

and our disaster recovery planning may not be sufficient. In addition, we may have inadequate insurance coverage to compensate

for any related losses. Any of these events could damage our reputation and business and, to the extent, if any, that such events

can be remedied, may be expensive to remedy.

Government regulation is evolving, and unfavorable changes

could harm our business.

We are subject to general

business regulations and laws, as well as regulations and laws specifically governing the Internet, e-commerce, electronic devices,

and other services. Existing and future laws and regulations may impede our growth. These regulations and laws may cover taxation,

privacy, data protection, pricing, content, copyrights, distribution, mobile communications, electronic device certification, electronic

waste, energy consumption, environmental regulation, electronic contracts and other communications, competition, consumer protection,

web services, the provision of online payment services, information reporting requirements, unencumbered Internet access to our

services, the design and operation of websites, the characteristics and quality of products and services, and the commercial operation

of unmanned aircraft systems. It is not clear how existing laws governing issues such as property ownership, libel, and personal

privacy apply to the Internet, e-commerce, digital content, and web services. Unfavorable regulations and laws could diminish the

demand for our products and services and increase our cost of doing business.

We could be subject to additional sales

tax or other indirect tax liabilities.

U.S. Supreme Court decisions

restrict the imposition of obligations to collect state and local sales taxes with respect to remote sales. However, an increasing

number of states have considered or adopted laws or administrative practices that attempt to impose obligations on out-of-state

businesses to collect taxes on their behalf. A successful assertion by one or more states or foreign countries requiring us to

collect taxes where we do not currently do so could result in substantial tax liabilities, including for past sales, as well as

penalties and interest.

We may be subject to risks related to

government contracts and related procurement regulations.

Our contracts with U.S.,

as well as state, local, and foreign, government entities are subject to various procurement regulations and other requirements

relating to their formation, administration, and performance. We may be subject to audits and investigations relating to our government

contracts, and any violations could result in various civil and criminal penalties and administrative sanctions, including termination

of contracts, refunding or suspending of payments, forfeiture of profits, payment of fines, and suspension or debarment from future

government business. In addition, such contracts may provide for termination by the government at any time, without cause.

If we do not successfully continue to

develop our products and services in a cost-effective manner to meet customer demand in the rapidly evolving market for next-generation

Internet-based applications and services, our business may fail.

The market for next-generation

Internet-based applications and services is characterized by rapidly changing technology, evolving industry standards, changes

in customer needs, and frequent new service and product introductions. Our future success will depend, in part, on our ability

to use new technologies effectively, to continue to develop our technical expertise and proprietary technology, to enhance our

existing products and services, and to develop new products and services that meet changing customer needs on a timely and cost-effective

basis. We may not be able to adapt quickly enough to changing technology, customer requirements, and industry standards. If we

fail to use new technologies effectively, to develop our technical expertise and new products and services, or to enhance existing

products and services on a timely basis, either internally or through arrangements with third parties, our product and service

offerings may fail to meet customer needs, which would adversely affect our revenues and prospects for growth.

In addition, if we are

unable to, for technological, legal, financial, or other reasons, adapt in a timely manner to changing market conditions or customer

requirements, we could lose customers, any strategic alliances, and market share. Sudden changes in user and customer requirements

and preferences, the frequent introduction of new products and services embodying new technologies, and the emergence of new industry

standards and practices could render our existing products, services and systems obsolete. The emerging nature of products and

services in the technology and communications industry and their rapid evolution will require that we continually improve the performance,

features, and reliability of our products and services. Our survival and success will depend, in part, on our ability to:

|

|

·

|

design, develop, launch and/or license our products, services, and technologies that address the increasingly sophisticated and varied needs of our existing and prospective customers; and

|

|

|

·

|

respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis.

|

The development of our

products and services and other patented technology involves significant technological and business risks and requires substantial

expenditures and lead time. We may be unable to use new technologies effectively. Updating our technology internally and licensing

new technology from third parties may also require us to incur significant additional expenditures.

If our products and services do not gain

market acceptance, we may not be able to fund future operations.

A number of factors may

affect the market acceptance of our products or services or any other products or services we develop or acquire, including, among

others:

|

|

·

|

the price of our products or services relative to other competitive products and services;

|

|

|

·

|

the perception by users of the effectiveness of our products and services;

|

|

|

·

|

our ability to fund our sales and marketing efforts; and

|

|

|

·

|

the effectiveness of our sales and marketing efforts.

|

If our products and services

do not gain market acceptance, we may not be able to fund future operations, including the development of new products and services

and/or our sales and marketing efforts for our current products and services, which inability would have a material adverse effect

on our business, financial condition, and operating results.

We continually develop new products and

product enhancements and actively capitalize software development costs, while making educated assumptions to anticipate the attributed

revenue to be derived from each development or enhancement. If our assumptions are incorrect or if we are unable to accurately

attribute revenue to each respective product or product enhancement, we may have to account for impairment, thus causing us to

reverse the capitalized expenditures.

Our product developers

are consistently programming new products and enhancements to existing products. Under the guidance of U.S. Accounting Standard,

ASC 350-40, we make determinations to estimate the useful life of each of these products and enhancements. Based on these determinations,

we amortize software expenses over a pre-determined period of time. Based on our financial forecasts and regular impairment testing,

we believe that cash flows will be realized from our product development and product enhancements and will be sufficient to recover

the value of the Company’s expenditures. Should our estimates turn out to be inaccurate or should the business fail to attract

new revenue in relation to each respective product or product enhancement, we may have to reverse or write off the related capitalized

expenses.

Our products and services are highly

technical and may contain undetected errors, which could result in claims against us and cause harm to our reputation and adversely

affect our business.

Our products and services

are highly technical and complex and, when deployed, may contain errors or defects. Despite testing, some errors in our products

and services may only be discovered after they have been installed and used by customers. Any errors or defects discovered in our

products and services after commercial release could result in failure to achieve market acceptance, loss of revenue or delay in

revenue recognition, loss of customers, and increased service and warranty cost, any of which could adversely affect our business,

operating results and financial condition. In addition, we could face claims for product liability, tort, or breach of warranty.

The performance of our products and services could have unforeseen or unknown adverse effects on the networks over which they are

delivered as well as on third-party applications and services that utilize our products and services, which could result in legal

claims against us, harming our business. Furthermore, we expect to provide implementation, consulting, and other technical services

in connection with the implementation and ongoing maintenance of our products and services, which typically involves working with

sophisticated software, computing systems, and communications systems. While our contracts with customers may contain provisions

relating to warranty disclaimers and liability limitations, those provisions may not be upheld. Defending a lawsuit, regardless

of its merit, is costly and may divert our management’s attention and adversely affect the market’s perception of us

and our products and services. In addition, if our business liability insurance coverage proves inadequate or future coverage is

unavailable on acceptable terms or at all, our business, operating results and financial condition could be adversely impacted.

Malfunctions of third-party communications

infrastructure, hardware and software expose us to a variety of risks we cannot control, and those risks could result in harm to

our business.

Our business depends upon

the capacity, reliability and security of the infrastructure owned by third parties over which our product and service offerings

are deployed. We have no control over the operation, quality or maintenance of a significant portion of that infrastructure or

over whether those third parties will upgrade or improve their equipment. We do depend on these companies to maintain the operational

integrity of our integrated connections. If one or more of these companies is unable or unwilling to supply or expand its levels

of service in the future, our operations could be adversely impacted. System interruptions or increases in response time could

result in a loss of potential or existing users and, if sustained or repeated, could reduce the appeal of the services to users.

In addition, users depend on real-time communications; outages caused by increased traffic could result in delays and system failures.

These types of occurrences could cause users to perceive that our products and services do not function properly and could therefore

adversely affect our ability to attract and retain strategic partners and customers.

Security breaches, computer viruses,

and computer hacking attacks could harm our business, financial condition, results of operations, or reputation.

Security breaches, computer

malware and computer hacking attacks have become more prevalent in our industry. Any security breach caused by hacking, which involves

efforts to gain unauthorized access to information or systems, or to cause intentional malfunctions or loss or corruption of data,

software, hardware or other computer equipment, or the inadvertent transmission of computer viruses could adversely affect our

business, financial condition, results of operations or reputation.

Our corporate systems,

third-party systems and security measures may be breached due to the actions of outside parties, employee error, malfeasance, a

combination of these, or otherwise, and, as a result, an unauthorized party may obtain access to our data or any third-party data

we may possess. Any such security breach could require us to comply with various breach notification laws and may expose us to

litigation, remediation and investigation costs, increased costs for security measures, loss of revenue, damage to our reputation,

and potential liability.

System failure or interruption or our

failure to meet increasing demands on our systems could harm our business.

The success of our product

and service offerings depends on the uninterrupted operation of various systems, secure data centers, and other computer and communication

networks that we use or establish. To the extent the number of users of networks utilizing our future products and services suddenly

increases, the technology platform and hosting services which will be required to accommodate a higher volume of traffic may result

in slower response times, service interruptions or delays or system failures. The deployment of our products, services, systems

and operations will also be vulnerable to damage or interruption from:

|

|

·

|

power loss, transmission cable cuts and other telecommunications failures;

|

|

|

·

|

damage or interruption caused by fire, earthquake and other natural disasters;

|

|

|

·

|

computer viruses or software defects; and

|

|

|

·

|

physical or electronic break-ins, sabotage, intentional acts of vandalism, terrorist attacks and other events beyond our control.

|

System interruptions or

failures and increases or delays in response time could result in a loss of potential or existing users and, if sustained or repeated,

could reduce the appeal of our products and services to users. These types of occurrences could cause users to perceive that our

products and services do not function properly and could therefore adversely affect our ability to attract and retain strategic

partners and customers.

Our ability to sell our solutions can

be affected by the quality of our technical support and our failure to deliver high-quality technical support services could have

a material adverse effect on our sales and results of operations.

If we do not effectively

assist our customers in deploying our products and services, succeed in helping our customers quickly resolve post-deployment issues

and provide effective ongoing support, or if potential customers perceive that we may not be able to successfully deliver the foregoing,

our ability to sell our products and services would be adversely affected, and our reputation with customers and potential customers

could be harmed. As a result, our failure to deliver and maintain high-quality technical support services to our customers could

result in customers choosing to use our competitors’ products or services in the future.

Growth of internal operations and business

may strain our financial resources.

We may need to significantly

expand the scope of our operating and financial systems in order to build our business. Our growth rate may place a significant

strain on our financial resources for several reasons, including, but not limited to, the following:

|

|

·

|

the need for continued development of our financial and information management systems;

|

|

|

·

|

the need to manage relationships with resellers, distributors and strategic partners;

|

|

|

·

|

the need to hire and retain skilled management, technical and other personnel necessary to support and manage our business; and

|

|

|

·

|

the need to train and manage our employee base.

|

The addition of products

and services and the attention they demand may also strain our management resources.

We do not expect to pay any dividends

for the foreseeable future, which will affect the extent to which our investors realize any future gains on their investment.

We have not paid and do

not anticipate that we will pay any dividends to holders of our convertible preferred and common stock in the foreseeable future.

Accordingly, investors must rely on the ability to convert preferred stock to common stock and on sales of their common stock after

price appreciation, which may never occur, as the only way to realize any future gains on their investment.

We will need to recruit and retain additional

qualified personnel to successfully grow our business.

Our future success will

depend in part on our ability to attract and retain qualified operations, marketing and sales personnel as well as technical personnel.

Inability to attract and retain such personnel could adversely affect our business. Competition for technical, sales, marketing

and executive personnel is intense, particularly in the technology and Internet sectors. We cannot assure you that we will be able

to attract or retain such personnel.

If we fail to establish and maintain

effective internal control over financial reporting and effective disclosure controls, we may not be able to report financial results

accurately or on a timely basis, or to detect fraud, which could have a material adverse effect on our business and stock price.

In connection with our

annual report on Form 10-K for the year ended December 31, 2018 (the “2018 Annual Report”) and our Annual Report on

Form 10-K for the year ended December 31, 2017, our management carried out an evaluation of the effectiveness of the design and

operation of our disclosure controls and procedures. Based on that evaluation, our Principal Executive and Financial Officer concluded

that, primarily due to material weaknesses in our internal control over financial reporting as described in those filings, our

disclosure controls and procedures were not effective as of December 31, 2018 or 2017.

In addition, our management

has identified, and we have disclosed in our 2018 Annual Report, control deficiencies in our financial reporting process that,

as of December 31, 2018, constituted material weaknesses in our internal control over financial reporting. These material weaknesses,

which relate to the segregation of duties and the lack of formal policies that provide for multiple levels of supervision and reviews,

also existed at December 31, 2017. Management has evaluated, and continues to evaluate, avenues for mitigating our internal controls

weaknesses, but mitigating controls to completely mitigate internal control weaknesses have been deemed to be impractical and prohibitively

costly, due to the size of our organization at the current time and limited capital resources. Management expects to continue to

use reasonable care in following and seeking improvements to effective internal control processes that have been and continue to

be in use at the Company. Our management also determined that our internal control over financial reporting was ineffective as

of December 31 in each of 2012 through 2016.

Failure to establish and

maintain the required internal control over financial reporting or related procedures, and to establish and maintain effective

disclosure controls and procedures, or any failure of those controls or procedures once established, could adversely impact our