UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

ATLANTICUS HOLDINGS CORPORATION

(Name of Issuer)

Common Stock, no par value per share

(Title of Class of Securities)

04914Y102

(CUSIP Number)

William R. McCamey

Atlanticus Holdings Corporation

Five Concourse Parkway, Suite 300

Atlanta, Georgia 30328

With a copy to:

Paul Davis Fancher

Troutman Sanders LLP

600 Peachtree Street N.E., Suite 3000

Atlanta, Georgia 30308

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 11, 2019

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

William R. McCamey

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

PF, OO (See Item 3 below.)

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

809,049 (a)

|

|

|

8

|

|

SHARED VOTING POWER

30,000 (b)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

609,049 (c)

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

30,000 (b)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

839,049 (a)(b)(d)

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) ☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.1% (e)

|

|

14

|

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

(a) Includes (i) 175,716 shares of Atlanticus Holdings Corporation’s (the “Issuer”) common stock held directly by the reporting person, (ii) 200,000 shares underlying a restricted stock award, over which the reporting person holds sole voting power and no dispositive power prior to vesting and (iii) 433,333 shares of common stock underlying stock option awards that are currently exercisable or exercisable within 60 days.

(b) Includes 30,000 shares of common stock held by the reporting person’s spouse. Given the reporting person’s position as Chief Financial Officer of the Issuer, this Schedule 13D attributes shared voting and dispositive power to the reporting person over the shares held by the reporting person’s spouse.

(c) Includes (i) 175,716 shares of the Issuer’s common stock held directly by the reporting person and (ii) 433,333 shares of common stock underlying stock option awards that are currently exercisable or exercisable within 60 days.

(d) Excludes 66,667 shares of common stock underlying a stock option award, the final installment of which will vest on August 10, 2020.

(e) Based on 15,919,360 shares of the Issuer’s common stock outstanding as of March 20, 2020, as reported in the Issuer’s Form 10-K for the year ended December 31, 2019, filed with the Securities and Exchange Commission on March 30, 2020.

|

Item 1.

|

Security and Issuer.

|

This statement on Schedule 13D relates to the common stock, no par value per share of Atlanticus Holdings Corporation (the “Issuer”). The principal executive offices of the Issuer are located at Five Concourse Parkway, Suite 300, Atlanta, Georgia 30328.

|

Item 2.

|

Identity and Background.

|

|

|

(a)

|

This statement is filed by William R. McCamey (the “reporting person”).

|

|

|

(b)

|

The principal business address of the reporting person is Atlanticus Holdings Corporation, Five Concourse Parkway, Suite 300, Atlanta, Georgia 30328.

|

|

|

(c)

|

The reporting person’s principal occupation is Chief Financial Officer of the Issuer.

|

|

|

(d)

|

The reporting person has not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

(e)

|

The reporting person has not, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

(f)

|

The reporting person is a citizen of the United States of America.

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

The reporting person acquired beneficial ownership of 375,716 shares of common stock and 433,333 shares of common stock underlying stock options that are currently exercisable or exercisable within 60 days pursuant to the Issuer’s equity compensation plans. The Issuer granted these equity awards to the reporting person in exchange for his service as an officer of the Issuer. Other than personal funds that the reporting person paid to exercise a stock option, the reporting person has not paid any additional consideration in connection with the receipt of these equity awards or the exercise thereof.

The reporting person also beneficially owns 30,000 shares of common stock that are held by the reporting person’s spouse, who acquired such shares pursuant to open market purchases using personal funds.

|

Item 4.

|

Purpose of Transaction.

|

On June 11, 2019, the reporting person’s beneficial ownership of the Issuer’s common stock increased to more than 5% of the Issuer’s outstanding shares of common stock pursuant to the partial vesting of a stock option granted to the reporting person for service as an officer of the Issuer.

The reporting person is the Chief Financial Officer of the Issuer. In this capacity, the reporting person takes, and will continue to take, an active role in the Issuer’s management and strategic direction. Subject to the factors discussed below, applicable law and the policies of the Issuer, the reporting person may from time to time purchase or receive additional securities of the Issuer, or rights or options to purchase such securities, through equity awards, open market or privately negotiated transactions or exercises of derivative securities, or may determine to sell, trade or otherwise dispose of all or some holdings in the Issuer in the public markets, in privately negotiated transactions or otherwise, or take any other lawful action the reporting person deems to be in his best interests, or otherwise, depending upon existing market conditions, the price and availability of such securities and other considerations discussed in this paragraph. The reporting person intends to review on a continuing basis various factors relating to his investment in the Issuer, including but not limited to the Issuer’s business and prospects, the price and availability of the Issuer’s securities, subsequent developments affecting the Issuer, other investment and business opportunities available to the reporting person, the reporting person’s general investment and trading practices, market conditions, estate planning considerations or other factors. The reporting person has not yet determined which of the courses of actions specified in this paragraph he may ultimately take.

Except as set forth herein and other than in the reporting person’s capacity as Chief Financial Officer of the Issuer, the reporting person does not have any present plans or proposals which relate to or would result in any of the following: (a) the acquisition of additional securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (d) any change in the present Board or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the Board; (e) any material change in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate structure; (g) changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person; (h) causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (i) a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended; or (j) any action similar to any of those enumerated in the foregoing clauses (a) through (i); provided that the reporting person may, at any time and subject to applicable law and the policies of the Issuer, review or reconsider his position with respect to the Issuer and reserves the right to develop such plans or proposals that would relate to or result in the transactions described above and may hold discussions with or make proposals to management, the Board, other shareholders of the Issuer or other third parties regarding such matters.

|

Item 5.

|

Interest in Securities of the Issuer.

|

|

|

(a)

|

Items 7 through 11 and 13 of the cover page of this Schedule 13D and the footnotes thereto are incorporated herein by reference.

|

|

|

(b)

|

Items 7 through 11 and 13 of the cover page of this Schedule 13D and the footnotes thereto are incorporated herein by reference.

|

|

|

(c)

|

Other than as described in this Schedule 13D, the reporting person has not effected any transaction in the Issuer’s securities in the last 60 days.

|

|

|

(d)

|

To the knowledge of the reporting person, other than as described in this Schedule 13D, no other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities of the Issuer owned by the reporting person.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Except as set forth herein, including under Item 7 and the exhibits hereto, there are no contracts, arrangements, understandings or relationships between the reporting person and any other person with respect to the securities of the Issuer.

|

Item 7.

|

Material to Be Filed as Exhibits.

|

|

Exhibit

|

|

Description

|

|

|

|

|

A

|

|

Fourth Amended and Restated 2014 Equity Incentive Plan (incorporated by reference from Appendix A to the Issuer’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on April 11, 2019)

|

|

|

|

|

|

B

|

|

Form of Restricted Stock Agreement – Employees (incorporated by reference from Exhibit 10.3 to the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 14, 2019)

|

|

|

|

|

|

C

|

|

Form of Stock Option Agreement – Employees (incorporated by reference from Exhibit 10.5 to the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 14, 2019)

|

SIGNATURE

After reasonable inquiry and to the best of the undersigned’s knowledge and belief, the undersigned hereby certifies that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

/s/ William R. McCamey

|

|

|

|

|

William R. McCamey

|

|

|

|

|

|

|

|

|

|

Date: April 3, 2020

|

|

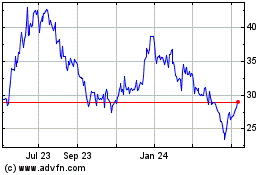

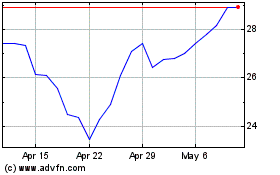

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

From Apr 2023 to Apr 2024