Substantial progress over the year,

advancing programs andexpanding collaboration with

HEALIOS K.K.

Athersys, Inc. (NASDAQ: ATHX) announced today its fourth quarter

2018 and annual 2018 financial results and recent highlights.

“As we have announced previously, we had a

number of important accomplishments in 2018, including the

initiation of our Phase 3 MASTERS-2 study and the expansion of our

partnership with Healios. Additionally, we completed

enrollment of, and recently announced positive results for, our

exploratory clinical study of MultiStem® treatment of acute

respiratory distress syndrome patients,” commented Dr. Gil Van

Bokkelen, Chairman and Chief Executive Officer of Athersys. “We

also finished the year in a meaningfully stronger financial

position, which was an important objective.”

Fourth Quarter 2018 and Recent Highlights:

- Announced positive results from our exploratory clinical study

of MultiStem cell therapy for treatment of acute respiratory

distress syndrome (ARDS), further confirming the tolerability and

safety profile of MultiStem treatment and demonstrating trends of

lower mortality and greater ventilator-free and ICU-free days; the

study has been selected for presentation at the American Thoracic

Society International Conference in May 2019;

- Our partner, HEALIOS K.K. (Healios), announced plans to

initiate an ARDS trial using MultiStem therapy for patients in

Japan, which, if successful could lead to registration under

Japan’s regenerative medicine regulatory framework;

- Advanced our ischemic stroke program through continued support

of Healios’ Japan TREASURE trial and enrollment of our MASTERS-2

Phase 3 registration study for ischemic stroke;

- Received a $2.0 million payment from Healios for a right of

first negotiation through June 2019 for an option to develop and

commercialize MultiStem therapy for certain indications in China;

Healios may extend the negotiation period through December 2019

with an additional payment of $3.0 million;

- Recognized revenues of $1.5 million and net loss of

$11.3 million, or $0.08 net loss per share, for the quarter

ended December 31, 2018; and

- Ended 2018 with $51.1 million in cash and cash equivalents

and February 28, 2019 with $51.5 million in cash and cash

equivalents, reflecting a solid financial foundation.

Other 2018 Highlights:

- Expanded our collaboration with Healios in June 2018 to include

additional areas - such as development for the treatment of ARDS in

Japan, iPSC and MultiStem cells in combination to treat dysfunction

in certain organs in Japan, and potential use of MultiStem cells

alone or with RPE cells for certain ophthalmological indications

globally - for $20 million in license fees, plus potential

milestone payments and royalties; this followed a $21.1 million

investment by Healios through the purchase of our common stock in

March 2018;

- Commenced the MASTERS-2 Phase 3 registration study for ischemic

stroke and started enrolling patients;

- Completed the enrollment of our exploratory clinical study of

MultiStem cell therapy treatment for ARDS, and announced positive

results soon thereafter as noted above;

- Announced grant funding and began preparations to conduct a

Phase 2 clinical trial evaluating MultiStem cell therapy for early

treatment and prevention of complications after severe traumatic

injury, in collaboration with The University of Texas Health

Science Center at Houston and Hermann Memorial Trauma Center;

- Expanded our process development and manufacturing efforts,

including strategic leadership hires and diversification in our

manufacturing networks; and

- Entered into a new equity facility during the first quarter of

2018 as a follow-on to the existing facility, giving us the right

to sell up to $100 million of common stock over a three-year

period, providing access to capital, as needed, to support

operations.

“We believe we are well-positioned to capitalize

on our innovative MultiStem product platform and to develop and

deliver highly effective new treatments to patients in areas of

substantial unmet medical need, particularly in the critical care

area. The Healios’ TREASURE trial and our MASTERS-2 trial are

making continued progress, and the results from our exploratory

ARDS trial illustrate the potential of MultiStem therapy in other

acute care settings. We continue to work toward the scale-up of our

manufacturing capabilities and to focus on the further development

of other core capabilities and programs, while we continue to

explore additional partnering opportunities,” concluded Dr. Van

Bokkelen.

Fourth Quarter 2018 Financial Results

Revenues increased to $1.5 million for the three months

ended December 31, 2018 compared to $1.2 million for the

three months ended December 31, 2017. Our revenues are

generally derived from license fees, manufacturing-related services

for Healios, royalty and related contract revenue from our

collaborations, and grant revenue.

Research and development expenses decreased to

$10.2 million for the three months ended December 31,

2018 from $12.1 million for the comparable period in 2017. In

2017, approximately $4.7 million of license fees were expensed (of

which $3.2 million was non-cash) related to a settlement and

license agreement. After factoring in this one-time charge, the net

$2.8 million increase is associated with increased clinical

development costs of $1.6 million, personnel costs of

$0.6 million, internal research supplies of $0.2 million

and other expenses of $0.4 million. The $1.6 million

increase in our clinical costs during the period is primarily

related to clinical product manufacturing, covered in part by

Healios, technology transfer services associated with planned Japan

manufacturing for Healios, process development activities to

support large-scale manufacturing, and our MASTERS-2 clinical trial

that began enrolling patients in the third quarter of 2018.

General and administrative expenses increased to

$2.8 million for the three months ended December 31, 2018

from $2.1 million in the comparable period in 2017. The

$0.7 million increase was due primarily to increases in

personnel costs, professional fees, stock compensation costs and

other administrative costs compared to the same period last

year.

Net loss for the fourth quarter was $11.3 million in 2018

compared to a net loss of $13.1 million in the fourth quarter

of 2017. The difference of $1.8 million reflects the above

variances, as well as an increase of $0.3 million in other

income items.

Full Year 2018 Financial Results

Revenues increased to $24.3 million for the year ended December

31, 2018 from $3.7 million in 2017. Our contract revenues from our

collaboration with Healios increased $21.4 million year over year,

reflecting the expansion of our collaboration in June 2018 to

include additional licensed indications, among other things.

Included in our 2018 revenues were royalties and other contract

revenues of $1.5 million ($1.9 million in 2017) primarily related

to our collaboration with RTI Surgical, Inc., which recently

announced that it will cease distribution of its bone graft product

that utilizes our technology.

Research and development expenses increased to $38.7 million for

the year ended December 31, 2018 from $27.8 million for the year

ended December 31, 2017. The increase in research and development

expenses year-over-year of $10.9 million related to increases in

clinical trial and manufacturing process development costs of $11.4

million, personnel costs of $1.6 million, and internal supply and

other costs of $1.6 million. These increases were partially offset

by a decrease in license fees of $3.7 million related to the

settlement and license agreement in 2017 with one-time payments of

cash and stock that concluded in 2018.

General and administrative expenses increased to $10.4 million

in 2018 from $8.5 million in 2017. The $1.9 million increase was

due primarily to increases in personnel costs, legal and

professional services and stock compensation expense.

Net loss was $24.3 million in 2018 compared to a net loss

of $32.2 million in 2017. The difference of $7.9 million

reflects the above variances, as well as a decrease of

$0.1 million in other net expenses.

In the twelve months ended December 31, 2018, net cash used

in operating activities was $13.4 million compared to

$24.0 million in the twelve months ended December 31,

2017. The difference reflects in part license fees paid by Healios

in connection with the collaboration expansion being partially

offset by an increase in clinical development activity in 2018.

At December 31, 2018, we had $51.1 million in cash and

cash equivalents, compared to $29.3 million at

December 31, 2017.

Conference Call

Gil Van Bokkelen, Chairman and Chief Executive Officer, William

(B.J.) Lehmann, President and Chief Operating Officer, and Laura

Campbell, Senior Vice President of Finance, will host a conference

call today to review the results as follows:

|

Date |

|

March 14, 2019 |

|

Time |

|

4:30 p.m. (Eastern Time) |

|

Telephone access: U.S. and Canada |

|

(877) 396-3286 |

|

Telephone access: International |

|

(647) 689-5528 |

|

Encore Password (needed for the replay only) |

|

7677927 |

|

Live webcast |

|

www.athersys.com, under the Investors section |

We encourage shareholders to listen using the webcast link, and

to use the phone line if you intend to ask a question. A replay

will be available on the webcast at www.athersys.com under the

investors section approximately two hours after the call has ended.

Shareholders may also call in for on-demand listening shortly after

the completion of the call until 11:59 PM Eastern Time on March 21,

2019 by dialing (800) 585-8367 or (416) 621-4642 and entering

Encore passcode 7677927. The archived webcast will be available for

one year at the aforementioned URL.

About Athersys

Athersys is an international biotechnology company engaged in

the development of therapeutic products designed to extend and

enhance the quality of human life. The Company is developing its

MultiStem cell therapy product, a patented, adult-derived

“off-the-shelf” stem cell product, initially for disease

indications in the neurological, cardiovascular, and inflammatory

and immune disease areas, and has several ongoing clinical trials

evaluating this potential regenerative medicine product. Athersys

has forged strategic partnerships and a broad network of

collaborations to further advance MultiStem cell therapy toward

commercialization. More information is available at

www.athersys.com. Follow Athersys on Twitter at

www.twitter.com/athersys.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties. These forward-looking

statements relate to, among other things, the expected timetable

for development of our product candidates, our growth strategy, and

our future financial performance, including our operations,

economic performance, financial condition, prospects, and other

future events. We have attempted to identify forward-looking

statements by using such words as “anticipates,” “believes,” “can,”

“continue,” “could,” “estimates,” “expects,” “intends,” “may,”

“plans,” “potential,” “should,” “suggest,” “will,” or other similar

expressions. These forward-looking statements are only predictions

and are largely based on our current expectations. A number of

known and unknown risks, uncertainties, and other factors could

affect the accuracy of these statements. Some of the more

significant known risks that we face that could cause actual

results to differ materially from those implied by forward-looking

statements are the risks and uncertainties inherent in the process

of discovering, developing, and commercializing products that are

safe and effective for use as therapeutics, including the

uncertainty regarding market acceptance of our product candidates

and our ability to generate revenues. These risks may cause our

actual results, levels of activity, performance, or achievements to

differ materially from any future results, levels of activity,

performance, or achievements expressed or implied by these

forward-looking statements. Other important factors to consider in

evaluating our forward-looking statements include: our ability to

raise capital to fund our operations; the timing and nature of

results from our MultiStem clinical trials, including the MASTERS-2

Phase 3 clinical trial and the Healios’ TREASURE clinical trial in

Japan; the possibility of delays in, adverse results of, and

excessive costs of the development process; our ability to

successfully initiate and complete clinical trials of our product

candidates; the possibility of delays, work stoppages or

interruptions in manufacturing by third parties to us, such as due

to material supply constraints, contaminations, or regulatory

issues, which could negatively impact our trials and the trials of

our collaborators; uncertainty regarding market acceptance of our

product candidates and our ability to generate revenues, including

MultiStem cell therapy for the treatment of stroke, acute

respiratory distress syndrome, acute myocardial infarction and

trauma, and the prevention of graft-versus-host disease and other

disease indications; changes in external market factors; changes in

our industry’s overall performance; changes in our business

strategy; our ability to protect and defend our intellectual

property and related business operations, including the successful

prosecution of our patent applications and enforcement of our

patent rights, and operate our business in an environment of rapid

technology and intellectual property development; our possible

inability to realize commercially valuable discoveries in our

collaborations with pharmaceutical and other biotechnology

companies; our ability to work with Healios to reach an agreement

for an option in China; our ability to meet milestones and earn

royalties under our collaboration agreements, including the success

of our collaboration with Healios; our collaborators’ ability to

continue to fulfill their obligations under the terms of our

collaboration agreements and generate sales related to our

technologies; the success of our efforts to enter into new

strategic partnerships and advance our programs, including, without

limitation, in North America, Europe and Japan; our possible

inability to execute our strategy due to changes in our industry or

the economy generally; changes in productivity and reliability of

suppliers; and the success of our competitors and the emergence of

new competitors. You should not place undue reliance on

forward-looking statements contained in this press release, and we

undertake no obligation to publicly update forward-looking

statements, whether as a result of new information, future events

or otherwise.

Contacts:

William (B.J.) LehmannPresident and Chief Operating OfficerTel:

(216) 431-9900bjlehmann@athersys.com

Karen HunadyDirector of Corporate Communications &

Investor RelationsTel: (216) 431-9900khunady@athersys.com

David SchullRusso Partners, LLCTel: (212) 845-4271 or (858)

717-2310David.schull@russopartnersllc.com

(Tables Follow)

Athersys, Inc.Condensed

Consolidated Balance Sheets(Unaudited)(In

thousands)

| |

December 31, |

| |

2018 |

|

2017 |

|

Assets |

|

|

|

| Cash and cash

equivalents |

$ |

51,059 |

|

|

$ |

29,316 |

|

| Accounts

receivable |

262 |

|

|

586 |

|

| Accounts receivable

from Healios, billed and unbilled |

4,728 |

|

|

153 |

|

| Prepaid expenses,

deposits and other |

2,679 |

|

|

1,332 |

|

| Equipment, net |

3,002 |

|

|

2,206 |

|

| Total

assets |

$ |

61,730 |

|

|

$ |

33,593 |

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Accounts payable and

accrued expenses |

$ |

12,801 |

|

|

$ |

9,312 |

|

| Deposit from

Healios |

2,000 |

|

|

— |

|

| Deferred revenue |

674 |

|

|

771 |

|

| Advance from

Healios |

3,139 |

|

|

134 |

|

| Total stockholders’

equity |

43,116 |

|

|

23,376 |

|

| Total

liabilities and stockholders’ equity |

$ |

61,730 |

|

|

$ |

33,593 |

|

Athersys, Inc.Condensed

Consolidated Statements of Operations and Comprehensive

Loss(Unaudited)(In Thousands, Except Per

Share Amounts)

| |

|

Three months endedDecember

31, |

|

Twelve months ended December 31, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenues

(1) |

|

|

|

|

|

|

|

|

| Contract revenue from

Healios |

|

$ |

1,267 |

|

|

$ |

686 |

|

|

$ |

22,276 |

|

|

$ |

918 |

|

| Royalty and other

contract revenue |

|

158 |

|

|

269 |

|

|

1,461 |

|

|

1,925 |

|

| Grant revenue |

|

89 |

|

|

215 |

|

|

554 |

|

|

865 |

|

| Total

revenues |

|

1,514 |

|

|

1,170 |

|

|

24,291 |

|

|

3,708 |

|

| Costs and

expenses |

|

|

|

|

|

|

|

|

| Research and

development |

|

10,167 |

|

|

12,134 |

|

|

38,656 |

|

|

27,841 |

|

| General and

administrative |

|

2,846 |

|

|

2,075 |

|

|

10,442 |

|

|

8,466 |

|

| Depreciation |

|

283 |

|

|

176 |

|

|

855 |

|

|

684 |

|

| Total

costs and expenses |

|

13,296 |

|

|

14,385 |

|

|

49,953 |

|

|

36,991 |

|

| Gain from insurance

proceeds, net |

|

234 |

|

|

— |

|

|

617 |

|

|

— |

|

| Loss from

operations |

|

(11,548 |

) |

|

(13,215 |

) |

|

(25,045 |

) |

|

(33,283 |

) |

| Income from change in

fair value of warrants |

|

— |

|

|

— |

|

|

— |

|

|

728 |

|

| Other income, net |

|

227 |

|

|

115 |

|

|

762 |

|

|

314 |

|

| Net loss and

comprehensive loss |

|

$ |

(11,321 |

) |

|

$ |

(13,100 |

) |

|

$ |

(24,283 |

) |

|

$ |

(32,241 |

) |

| Net loss per common

share — basic and diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.29 |

) |

| Weighted average shares

outstanding — basic and diluted |

|

142,315 |

|

|

119,611 |

|

|

136,641 |

|

|

112,053 |

|

(1) We adopted Accounting Standards Update No. 2014-09, Revenue

from Contracts with Customers, effective January 1, 2018. As a

result, the recognized revenue in 2018 is not accounted for on the

same basis as the prior years and is not comparable largely due to

the timing of revenue recognition.

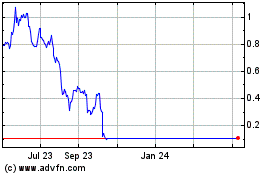

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Apr 2023 to Apr 2024