Astec Industries, Inc. (Nasdaq: ASTE) today reported results

for their first quarter ended March 31, 2019.

Net sales for the first quarter of 2019 were

$325.8 million compared to $325.5 million for the first quarter of

2018. Domestic sales decreased 2.7% to $262.8 million for the

first quarter of 2019 from $270.1 million for the first quarter of

2018. International sales increased 13.7% to $63.0 million

for the first quarter of 2019 from $55.4 million for the first

quarter of 2018.

Earnings for the first quarter of 2019 were

$14.3 million or $0.63 per diluted share, compared to $20.3 million

or $0.87 per diluted share in the first quarter of 2018, a decrease

in earnings per share of 27.6%. As adjusted for the impact of

pellet plant activity in the first quarter of 2018, earnings per

diluted share decreased $0.33 or 34.4%.

Commenting on the announcement of the quarterly

results, Richard J. Dorris, Interim Chief Executive Officer,

stated, “We are disappointed that our performance in the first

quarter did not meet our expectations. All three segments

experienced pricing pressure from competitors in a tighter market

and temporary weather related shutdowns at seven of our

subsidiaries impacted our ability to build and ship

equipment.”

Mr. Dorris continued, “Lower than expected

volumes impacted our gross margins at several of our

subsidiaries. As we’ve previously discussed, our SGA&E is

also temporarily at a higher run rate than normal due to our

ongoing strategic sourcing project. Bookings were also

affected by the weather as customers were unable to work in

unusually wet or icy conditions in much of the U.S.”

The Company’s backlog at March 31, 2019 was

$236.5 million, a decrease of $208.4 million or 46.8% compared to

the March 31, 2018 backlog of $444.9 million. Domestic

backlog decreased 52.6% to $161.8 million at March 31, 2019 from

$341.1 million at March 31, 2018. The international backlog

at March 31, 2019 was $74.7 million compared to $103.8 million at

March 31, 2018, a decrease of 28.0%. Adjusted for pellet

plant backlog included in the March 31, 2018 backlog, the Company’s

backlog decreased $143.8 million or 37.8%.

Mr. Dorris concluded, “While we are paying close

attention to the decrease in our backlog, we note that we

experienced historical high points in our backlogs in the first

quarter of 2018. We have already made a number of moves to

adjust our capacity and, while we’ve seen some positive

developments in recent order intake, we will continue to monitor

the backlog and make adjustments where necessary.”

Consolidated financial information for the first

quarter ended March 31, 2019 and additional information related to

segment revenues and profits are attached as addenda to this press

release.

Investor Conference Call and Web

Simulcast

Astec will conduct a conference call on April

23, 2019, at 10:00 A.M. Eastern Time to review its first quarter

results as well as current business conditions. The number to

call for this interactive teleconference is (877) 407-9210.

International callers should dial (201) 689-8049. Please

reference Astec Industries.

The Company will also provide an online Web

simulcast and rebroadcast of the conference call. The live

broadcast of Astec’s conference call will be available online at

the Company’s website:

www.astecindustries.com/conferencecalls. An archived webcast will

be available for 90 days at www.astecindustries.com.

A replay of the conference call will be

available through midnight on Tuesday, May 7, 2019 by dialing (877)

481-4010, or (919) 882-2331 for international callers, Replay ID#

47335. A transcription of the conference call will be made

available under the Investor Relations section of the Astec

Industries, Inc. website within 5 business days after the call.

Astec Industries, Inc.,

(www.astecindustries.com), is a manufacturer of specialized

equipment for asphalt road building; aggregate processing; oil, gas

and water well drilling and concrete production. Astec's

manufacturing operations are divided into three primary business

segments: road building, (Infrastructure Group); aggregate

processing and mining equipment (Aggregate and Mining Group); and

equipment for the extraction and production of fuels and water

drilling equipment (Energy Group).

The information contained in this press release

contains “forward-looking statements” (within the meaning of the

Private Securities Litigation Reform Act of 1995) regarding the

future performance of the Company, including statements about the

effects on the Company from (i) product demand and pricing

pressure, (ii) the effect of its strategic sourcing project (iii)

efforts to adjust manufacturing capacity, and (iv) its backlog

activity. These forward-looking statements reflect management’s

expectations and are based upon currently available information,

and the Company undertakes no obligation to update or revise such

statements. These statements are not guarantees of

performance and are inherently subject to risks and uncertainties,

many of which cannot be predicted or anticipated. Future

events and actual results, financial or otherwise, could differ

materially from those expressed in or implied by the

forward-looking statements. Important factors that could

cause future events or actual results to differ materially

include: general uncertainty in the economy, oil, gas and

liquid asphalt prices, rising steel prices, decreased funding for

highway projects, the relative strength/weakness of the dollar to

foreign currencies, production capacity, general business

conditions in the industry, demand for the Company’s products,

seasonality and cyclicality in operating results, seasonality of

sales volumes or lower than expected sales volumes, lower than

expected margins on custom equipment orders, competitive activity,

tax rates and the impact of future legislation thereon, and those

other factors listed from time to time in the Company’s reports

filed with the Securities and Exchange Commission, including but

not limited to the Company’s annual report on Form 10-K for the

year ended December 31, 2018.

For Additional Information Contact:

David C. Silvious Vice President and Chief Financial Officer

Phone: (423) 899-5898 Fax: (423) 899-4456

E-mail: dsilvious@astecindustries.comOr

Stephen C. Anderson Vice President, Director

of Investor Relations & Corporate Secretary Phone: (423)

899-5898 Fax: (423) 899-4456

E-mail: sanderson@astecindustries.com

| |

|

|

| Astec Industries, Inc. |

| Condensed Consolidated Balance

Sheets |

| (in thousands) |

| (unaudited) |

| |

|

|

Mar 31 |

Mar 31 |

|

|

|

2019 |

|

|

2018 |

|

|

Assets |

|

|

|

Current assets |

|

|

|

Cash and cash equivalents |

$ |

28,606 |

|

$ |

41,940 |

|

|

Investments |

|

1,589 |

|

|

1,751 |

|

|

Receivables, net |

|

137,211 |

|

|

153,854 |

|

|

Inventories |

|

366,835 |

|

|

411,159 |

|

|

Prepaid expenses and other |

|

41,832 |

|

|

23,533 |

|

|

Total current assets |

|

576,073 |

|

|

632,237 |

|

|

Property and equipment, net |

|

192,143 |

|

|

189,287 |

|

|

Other assets |

|

104,089 |

|

|

96,841 |

|

|

Total assets |

$ |

872,305 |

|

$ |

918,365 |

|

|

Liabilities and equity |

|

|

|

Current liabilities |

|

|

|

Accounts payable - trade |

$ |

76,451 |

|

$ |

68,833 |

|

|

Other current liabilities |

|

114,342 |

|

|

117,609 |

|

|

Total current liabilities |

|

190,793 |

|

|

186,442 |

|

|

Long-term debt, less current maturities |

|

56,629 |

|

|

1,357 |

|

|

Non-current liabilities |

|

25,617 |

|

|

22,490 |

|

|

Total equity |

|

599,266 |

|

|

708,076 |

|

|

Total liabilities and equity |

$ |

872,305 |

|

$ |

918,365 |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| Astec Industries, Inc. |

| Condensed Consolidated Statements of

Income |

| (in thousands, except per share

data) |

| (unaudited) |

| |

|

|

Three Months Ended |

|

|

Mar 31 |

|

|

|

2019 |

|

|

2018 |

|

|

Net sales |

$ |

325,780 |

|

$ |

325,453 |

|

|

Cost of sales |

|

249,254 |

|

|

247,448 |

|

|

Gross profit |

|

76,526 |

|

|

78,005 |

|

|

Selling, general, administrative & engineering expenses |

|

58,348 |

|

|

52,078 |

|

|

Income from operations |

|

18,178 |

|

|

25,927 |

|

|

Interest expense |

|

(648 |

) |

|

(150 |

) |

|

Other |

|

525 |

|

|

512 |

|

|

Income before income taxes |

|

18,055 |

|

|

26,289 |

|

|

Income taxes |

|

3,781 |

|

|

6,022 |

|

|

Net income attributable to controlling interest |

$ |

14,274 |

|

$ |

20,267 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Earnings

per Common Share |

|

|

| Net

income attributable to controlling interest |

|

|

|

Basic |

$ |

0.63 |

|

$ |

0.88 |

|

|

Diluted |

$ |

0.63 |

|

$ |

0.87 |

|

|

|

|

|

| |

|

|

| Weighted average common

shares outstanding |

|

|

|

Basic |

|

22,498 |

|

|

23,045 |

|

|

Diluted |

|

22,646 |

|

|

23,236 |

|

| |

|

|

| Astec Industries, Inc. |

|

| Segment Revenues and Profits |

|

| For the three months ended March 31, 2019 and

2018 |

|

| (in thousands) |

|

| (unaudited) |

|

|

|

Infrastructure Group |

Aggregate and MiningGroup |

Energy Group |

Corporate Group |

Total |

|

| 2019 Revenues |

|

154,994 |

|

|

106,531 |

|

|

64,255 |

|

|

- |

|

325,780 |

|

|

|

2018 Revenues |

|

147,094 |

|

|

119,067 |

|

|

59,292 |

|

|

- |

|

325,453 |

|

|

|

Change $ |

|

7,900 |

|

|

(12,536 |

) |

|

4,963 |

|

|

- |

|

327 |

|

|

|

Change % |

|

5.4 |

% |

|

(10.5 |

%) |

|

8.4 |

% |

|

- |

|

0.1 |

% |

|

|

|

|

|

|

|

|

|

|

2019 Gross Profit |

|

35,506 |

|

|

25,545 |

|

|

15,479 |

|

|

(4 |

) |

76,526 |

|

|

|

2019 Gross Profit % |

|

22.9 |

% |

|

24.0 |

% |

|

24.1 |

% |

|

- |

|

23.5 |

% |

|

|

2018 Gross Profit |

|

33,280 |

|

|

29,289 |

|

|

15,286 |

|

|

150 |

|

78,005 |

|

|

|

2018 Gross Profit % |

|

22.6 |

% |

|

24.6 |

% |

|

25.8 |

% |

|

- |

|

24.0 |

% |

|

|

Change |

|

2,226 |

|

|

(3,744 |

) |

|

193 |

|

|

(154 |

) |

(1,479 |

) |

|

|

|

|

|

|

|

|

|

|

2019 Profit (Loss) |

|

15,238 |

|

|

8,678 |

|

|

3,394 |

|

|

(13,469 |

) |

13,841 |

|

|

|

2018 Profit (Loss) |

|

14,852 |

|

|

13,110 |

|

|

4,611 |

|

|

(11,248 |

) |

21,325 |

|

|

|

Change $ |

|

386 |

|

|

(4,432 |

) |

|

(1,217 |

) |

|

(2,221 |

) |

(7,484 |

) |

|

|

Change % |

|

2.6 |

% |

|

(33.8 |

%) |

|

(26.4 |

%) |

|

(19.7 |

%) |

(35.1 |

%) |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Segment

revenues are reported net of intersegment revenues. Segment

gross profit is net of profit on intersegment |

|

|

| revenues. A reconciliation of total segment profits to

the Company's net income attributable to controlling interest is as

follows (in thousands): |

|

|

|

|

|

|

|

|

|

| |

|

Three months ended March 31 |

|

|

| |

|

|

2019 |

|

|

2018 |

|

Change $ |

|

|

| Total profit for all

segments |

|

$ |

13,841 |

|

$ |

21,325 |

|

$ |

(7,484 |

) |

|

|

| Recapture

(elimination) of intersegment profit |

|

377 |

|

|

(1,109 |

) |

|

1,486 |

|

|

|

| Net loss

attributable to non-controlling interest |

|

56 |

|

|

51 |

|

|

5 |

|

|

|

| Net income attributable to controlling interest |

$ |

14,274 |

|

$ |

20,267 |

|

$ |

(5,993 |

) |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Astec Industries, Inc. |

|

|

| Backlog by Segment |

|

|

| March 31, 2019 and 2018 |

|

|

| (in thousands) |

|

|

| (unaudited) |

|

|

|

|

Infrastructure Group |

Aggregate and MiningGroup |

Energy Group |

Total |

|

|

|

2019 Backlog |

|

80,553 |

|

|

103,640 |

|

|

52,355 |

|

|

236,548 |

|

|

|

|

2018 Backlog |

|

230,649 |

|

|

138,687 |

|

|

75,591 |

|

|

444,927 |

|

|

|

|

Change $ |

|

(150,096 |

) |

|

(35,047 |

) |

|

(23,236 |

) |

|

(208,379 |

) |

|

|

|

Change % |

|

(65.1 |

%) |

|

(25.3 |

%) |

|

(30.7 |

%) |

|

(46.8 |

%) |

|

|

|

2018 Pellet Backlog |

|

64,600 |

|

|

- |

|

|

- |

|

|

64,600 |

|

|

|

|

2018 Backlog as Adjusted |

|

166,049 |

|

|

138,687 |

|

|

75,591 |

|

|

380,327 |

|

|

|

|

As Adjusted Change $ |

|

(85,496 |

) |

|

(35,047 |

) |

|

(23,236 |

) |

|

(143,779 |

) |

|

|

|

As Adjusted Change % |

|

(51.5 |

%) |

|

(25.3 |

%) |

|

(30.7 |

%) |

|

(37.8 |

%) |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Astec Industries, Inc. |

|

|

|

|

|

| Reconciliation of GAAP EPS to EPS As Adjusted |

|

|

|

|

|

| For the three months ended March 31, 2018 |

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

Fully Diluted EPS |

$ |

0.87 |

|

|

|

|

|

|

|

EPS impact of Pellet Activity |

|

0.09 |

|

|

|

|

|

|

|

EPS As Adjusted |

$ |

0.96 |

|

|

|

|

|

|

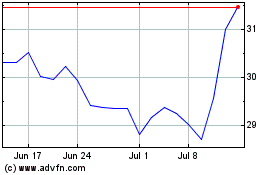

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

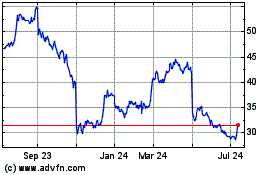

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Apr 2023 to Apr 2024