Current Report Filing (8-k)

May 22 2020 - 5:07PM

Edgar (US Regulatory)

0001005201

false

--12-31

0001005201

2020-05-18

2020-05-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported) May 22, 2020 (May 19, 2020)

ASSERTIO THERAPEUTICS, INC.

(Exact name of registrant as

specified in its charter)

|

Delaware

|

001-13111

|

94-3229046

|

|

(State or other jurisdiction of

|

(Commission

|

(IRS Employer

|

|

incorporation)

|

File Number)

|

Identification No.)

|

100 South Sanders Rd., Suite 300,

Lake Forest,

IL 60045

(Address of principal

executive offices, including zip code)

(224) 419-7106

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name or former

address, if changed since last report)

Securities registered pursuant to

Section 12(b) of the Act: none

|

Title of each class:

|

|

Trading Symbol(s):

|

|

Name of each exchange on which registered:

|

|

Common Stock, $0.0001 par value

|

|

ASRT

|

|

The NASDAQ Stock Market LLC

|

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2 below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth Company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Explanatory Note

On March 17, 2020, Assertio Therapeutics, Inc. ("Assertio

Therapeutics" or "Assertio") announced plans to merge with Zyla Life Sciences (the “Merger”)

and in connection with the Merger, to create a new public holding company, Assertio Holdings, Inc. (“Assertio Holdings”),

by implementing a holding company reorganization (the “Assertio Reorganization”). As a result of the Assertio

Reorganization, Assertio Holdings became the successor issuer to Assertio Therapeutics, Inc. Following the consummation of the

Assertio Reorganization, shares of Assertio Holdings Common Stock are expected to continue to trade on Nasdaq on an uninterrupted

basis under the symbol "ASRT" with new CUSIP number #04546C 106.

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Adoption of Agreement and Plan

of Merger and Consummation of Holding Company Reorganization

As contemplated in the Merger, on May 19, 2020,

Assertio implemented the Assertio Reorganization pursuant to an Agreement and Plan of Merger (the “Reorganization Merger

Agreement”), dated as of May 19, 2020, by and among Assertio, Assertio Holdings and a wholly-owned subsidiary formed

to effectuate the Assertio Reorganization. As a result of the transactions contemplated in the Reorganization Merger Agreement,

Assertio Therapeutics is a direct, wholly-owned subsidiary of Assertio Holdings, with Assertio Holdings assuming Assertio’s

listing on the Nasdaq Stock Market. Each issued and outstanding share of common stock, $0.0001 par value per share, of Assertio

Therapeutics ("Assertio Common Stock") immediately prior to the Assertio Reorganization automatically converted

into an equivalent corresponding share of common stock, $0.0001 par value per share, of Assertio Holdings ("Assertio Holdings

Common Stock") having the same designations, rights, powers, preferences, qualifications, limitations and restrictions

as the converted share of Assertio Common Stock. The stockholders of Assertio Therapeutics will not recognize gain or loss for

U.S. federal income tax purposes upon the conversion of their shares in the Assertio Reorganization.

The Assertio Reorganization was conducted pursuant

to Section 251(g) of the General Corporation Law of the State of Delaware (the “DGCL”), which provides for the

formation of a holding company without a vote of the stockholders of the constituent corporation. The conversion of stock occurred

automatically without an exchange of stock certificates. After the Assertio Reorganization, unless exchanged, stock certificates

that previously represented shares of Assertio Common Stock now represent the same number of shares of Assertio Holdings Common

Stock.

Following the consummation of the Assertio Reorganization,

shares of Assertio Holdings Common Stock continue to trade on the Nasdaq Stock Market on an uninterrupted basis under the symbol

"ASRT" with new CUSIP number #04546C 106. Immediately after consummation of the Assertio Reorganization, Assertio Holdings

has, on a consolidated basis, the same assets, businesses and operations as Assertio Therapeutics had immediately prior to the

consummation of the Assertio Reorganization.

As a result of the Assertio Reorganization, Assertio

Holdings became the successor issuer to Assertio Therapeutics pursuant to 12g-3(a) of the Exchange Act and, as a result, the Assertio

Holdings Common Stock shares are deemed registered under Section 12(b) of the Exchange Act and Assertio Holdings is subject

to the informational requirements of the Exchange Act, and the rules and regulations promulgated thereunder.

The foregoing descriptions of the Assertio Reorganization

and the Reorganization Merger Agreement do not purport to be complete and are qualified in their entirety by reference to the full

text of the Reorganization Merger Agreement, which is filed as Exhibit 2.1 and which is incorporated by reference herein.

|

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer

of Listing.

|

In connection with the Assertio Reorganization,

Assertio notified NASDAQ that the Assertio Reorganization had been completed and requested that the listing for the Assertio Common

Stock be transferred to Assertio Holdings. Following this transfer of the listing, which was effective as of May 20, 2020, Assertio

Holdings’ Common Stock trades under the symbol “ASRT”.

Following the transfer of the listing, NASDAQ filed

with the U.S. Securities and Exchange Commission an application on Form 25 to delist the Assertio shares from NASDAQ and deregister

the Assertio shares under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Assertio intends to file a certificate on Form 15 requesting that Assertio shares be deregistered under the Exchange Act, and that

Assertio’s reporting obligations under Section 15(d) of the Exchange Act be suspended (except to the extent of the succession

of Assertio Holdings to the Exchange Act Section 12(b) registration and reporting obligations of Assertio).

|

|

Item 3.03.

|

Material Modification of Rights of Securityholders.

|

Upon consummation of the Assertio Reorganization,

each share of Assertio Therapeutics Common Stock issued and outstanding immediately prior to the Assertio Reorganization automatically

converted into an equivalent corresponding share of Assertio Holdings Common Stock, having the same designations, rights, powers

and preferences and the qualifications, limitations and restrictions as the corresponding share of Assertio Therapeutics Common

Stock being converted.

The information set forth in Item 1.01 and Item 5.03 is hereby

incorporated by reference in this Item 3.03.

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

|

Directors

Upon consummation of the Assertio Reorganization, the board

of directors was reduced to three members. The following directors resigned from the board as of the effective time of the Assertio

Reorganization: Arthur J. Higgins, Heather L. Mason, William T. McKee, Peter D. Staple, James L. Tyree, David E. Wheadon, Karen

A. Dawes, James P. Fogarty and James J. Galeota, Jr.

The following persons were appointed the directors of Assertio

as of the effective time of the Assertio Reorganization:

|

Name

|

|

Age

|

|

|

Position with Assertio

|

|

Todd N. Smith

|

|

51

|

|

|

President, Chief Executive Officer and Director

|

|

Daniel A. Peisert

|

|

45

|

|

|

Executive Vice President, Chief Financial Officer and Director

|

|

Thomas Allison

|

|

68

|

|

|

Independent Director

|

Thomas J. Allison III is a renowned expert in business

stabilization/growth. Since May 2018, Mr. Allison has served as a Senior Advisor at Portage Point Partners, a corporate interim

management and business advisory firm. He also serves on the board and Audit Committee chair of Monroe Capital, a position he has

held since April 2013. From February to August 2014, Mr. Allison was Chairman of the Board and President of Forge Group, Inc. From

2006 until his retirement in 2012, Mr. Allison served as Executive Vice President and Senior Managing Director of Mesirow Financial

Consulting, LLC, a full-service financial and operational advisory consulting firm headquartered in Chicago. At Mesirow, Mr. Allison

managed complex turnaround situations and advised on major reorganizations and insolvencies. He also served as CEO, CFO or CRO

for several clients. From 2002 to 2006, Mr. Allison served as National Practice Leader of the restructuring practice of Huron Consulting

Group. From 1988 to 2002, he served in a variety of roles at Arthur Andersen, LLC, including Partner-in-Charge, Central Region

Restructuring Practice. Earlier in his career, Mr. Allison served in various capacities at Coopers & Lybrand, First National

Bank of Chicago and the Chicago Police Department. Mr. Allison has previously served as Chairman of the Association for Certified

Turnaround Professionals, Chairman and Director of the Turnaround Management Association, is a Fellow in the American College of

Bankruptcy and has taught as a guest lecturer at Northwestern University and DePaul University. Mr. Allison received his bachelor

of science in commerce and his master of business administration from DePaul University.

|

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

In connection with the consummation of the Assertio

Reorganization, the Certificate of Incorporation of Assertio Therapeutics was amended to add a provision, as required by Section

251(g) of the DGCL, that provides that any act or transaction by or involving Assertio Therapeutics, other than the election or

removal of directors, that requires for its adoption under the DGCL or the Certificate of Incorporation of Assertio Therapeutics,

the approval of the stockholders of Assertio Therapeutics shall require the approval of the stockholders of Assertio Holdings by

the same vote as is required by the DGCL and/or the Certificate of Incorporation of Assertio Therapeutics. The Bylaws of Assertio

Therapeutics were amended to reduce the size of the board of directors of Assertio and to make certain other amendments appropriate

for a wholly-owned subsidiary.

The foregoing descriptions of the amendments to

the Certificate of Incorporation and the Amended and Restated Bylaws of Assertio Therapeutics do not purport to be complete and

are qualified in their entirety by reference to the full text of the Certificate of Merger and the Bylaws, which are filed as Exhibit

3.2 and 3.3, and is incorporated by reference herein.

|

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The Company held its 2020 Annual Meeting on May 19, 2020 to

consider and vote on the following proposals: (i) to approve the issuance of shares of Assertio Holdings Common Stock in connection

with the Merger with Zyla (Proposal 1) (ii) the election of nine directors to hold office until the 2021 Annual Meeting of Stockholders

(Proposal 2); (iii) to approve an increase in the number of shares available for issuance under Assertio's Amended and Restated

2014 Omnibus Incentive Plan (Proposal 3); (iv) to approve an increase in the number of shares available for issuance under Assertio's

Amended and Restated 2004 Employee Stock Purchase Plan (Proposal 4); (v) to approve an amendment to Assertio's certificate of incorporation

to effect a reverse stock split at a ratio of not less than 1-for-2 and not greater than 1-for-4 (Proposal 5); (vi) to approve,

on an advisory basis, the compensation of Assertio's named executive officers (Proposal 6); (vii) to approve, on an advisory basis,

Merger-related executive compensation arrangements (Proposal 7); and (viii) to ratify the appointment of Ernst & Young LLP

as Assertio's independent registered public accounting firm for the fiscal year ended December 31, 2020 (Proposal 8).

A summary of the final voting results for each of the eight

matters voted upon by the stockholders at the 2020 Annual Meeting is set forth below.

Proposal 1: The

stockholders of the Company approved the issuance of shares of Assertio Holdings Common Stock in connection with the Merger

with Zyla. The votes on Proposal 1 were as follows:

|

Votes For

|

|

|

44,392,753

|

|

|

Votes Against

|

|

|

4,320,284

|

|

|

Abstentions

|

|

|

2,418,396

|

|

|

Broker Non-Votes

|

|

|

17,483,188

|

|

Proposal 2: The

stockholders of the Company elected each of the nine nominees to serve on the Board of Directors for a term to expire at the 2021

Annual Meeting of Stockholders and until their successors are elected and qualified, or until their earlier death, retirement,

resignation or removal. The votes on Proposal 2 were as follows:

|

|

|

Shares Voted For

|

|

|

Shares Voted Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

|

James P. Fogarty

|

|

|

46,882,581

|

|

|

|

3,177,875

|

|

|

|

1,070,977

|

|

|

|

17,483,188

|

|

|

Karen A. Dawes

|

|

|

46,762,424

|

|

|

|

3,318,823

|

|

|

|

1,050,186

|

|

|

|

17,483,188

|

|

|

James J. Galeota, Jr.

|

|

|

46,916,892

|

|

|

|

3,055,823

|

|

|

|

1,158,716

|

|

|

|

17,483,188

|

|

|

Arthur J. Higgins

|

|

|

45,894,831

|

|

|

|

4,341,035

|

|

|

|

895,567

|

|

|

|

17,483,188

|

|

|

Heather L. Mason

|

|

|

47,108,557

|

|

|

|

2,937,674

|

|

|

|

1,085,202

|

|

|

|

17,483,188

|

|

|

William T. McKee

|

|

|

46,106,503

|

|

|

|

3,961,204

|

|

|

|

1,063,726

|

|

|

|

17,483,188

|

|

|

Peter D. Staple

|

|

|

48,957,007

|

|

|

|

1,105,170

|

|

|

|

1,069,256

|

|

|

|

17,483,188

|

|

|

James L. Tyree

|

|

|

46,942,077

|

|

|

|

3,142,904

|

|

|

|

1,046,452

|

|

|

|

17,483,188

|

|

|

David E Wheadon

|

|

|

46,985,740

|

|

|

|

3,056,334

|

|

|

|

1,089,359

|

|

|

|

17,483,188

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 3: The

stockholders of the Company approved an increase in the number of shares available for issuance under Assertio's Amended

and Restated 2014 Omnibus Incentive Plan. The votes on Proposal 3 were

as follows:

|

Votes For

|

|

|

35,122,595

|

|

|

Votes Against

|

|

|

15,540,836

|

|

|

Abstentions

|

|

|

468,002

|

|

|

Broker Non-Votes

|

|

|

17,483,188

|

|

Proposal 4: The

stockholders of the Company approved an increase in the number of shares available for issuance under Assertio's Amended

and Restated 2004 Employee Stock Purchase Plan. The votes on Proposal

4 were as follows:

|

Votes For

|

|

|

45,321,763

|

|

|

Votes Against

|

|

|

5,320,260

|

|

|

Abstentions

|

|

|

489,410

|

|

|

Broker Non-Votes

|

|

|

17,483,188

|

|

Proposal 5: The

stockholders of the Company approved an amendment to Assertio's certificate of incorporation to effect a reverse stock split

at a ratio of not less than 1-for-2 and not greater than 1-for-4. The

votes on Proposal 5 were as follows:

|

Votes For

|

|

|

51,993,213

|

|

|

Votes Against

|

|

|

12,071,919

|

|

|

Abstentions

|

|

|

4,549,489

|

|

Proposal 6: The

stockholders of the Company failed to approve on an advisory basis, the compensation of Assertio's named executive officers.

The votes on Proposal 6 were as follows:

|

Votes For

|

|

|

16,351,370

|

|

|

Votes Against

|

|

|

34,534,663

|

|

|

Abstentions

|

|

|

245,400

|

|

|

Broker Non-Votes

|

|

|

17,483,188

|

|

Proposal 7: The

stockholders of the Company approved, on an advisory basis, the Merger-related executive compensation arrangements .

The votes on Proposal 7 were as follows:

|

Votes For

|

|

|

41,866,067

|

|

|

Votes Against

|

|

|

8,902,629

|

|

|

Abstentions

|

|

|

362,737

|

|

|

Broker Non-Votes

|

|

|

17,483,188

|

|

Proposal 8: The

stockholders of the Company ratified the appointment of Ernst & Young LLP as Assertio's independent registered public

accounting firm for the fiscal year ended December 31, 2020 . The votes

on Proposal 8 were as follows:

|

Votes For

|

|

|

62,648,769

|

|

|

Votes Against

|

|

|

836,269

|

|

|

Abstentions

|

|

|

5,129,583

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

Exhibit

No.

|

Description

|

|

|

2.1

|

Agreement and Plan of Merger, dated May 19, 2020, by and among Assertio Therapeutics, Inc., Assertio Holdings, Inc., and Alligator

Merger Sub, Inc.

|

|

|

2.2

|

Certificate of Merger dated May 19, 2020

|

|

|

3.1

|

Amended and Restated By-laws of Assertio Therapeutics, Inc. dated May 19, 2020

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: May 22, 2020

|

|

ASSERTIO THERAPEUTICS,

INC.

|

|

|

|

|

|

/s/ Daniel A. Peisert

|

|

|

Daniel A. Peisert

|

|

|

Chief Financial Officer

|

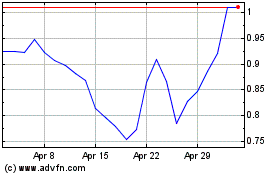

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024