UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 17, 2020 (March 16, 2020)

ASSERTIO THERAPEUTICS, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-13111

|

|

94-3229046

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

100 S. Saunders Road, Suite 300,

Lake Forest, IL 60045

(Address of Principal Executive Offices;

Zip Code)

(224) 419-7106

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s):

|

|

Name of each exchange on which registered:

|

|

Common Stock, $0.0001 par value

|

|

ASRT

|

|

The Nasdaq Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

x Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Merger Agreement

On

March 16, 2020, Assertio Therapeutics, Inc. a Delaware corporation (“Assertio”), entered into an Agreement

and Plan of Merger (the “Merger Agreement”) with Zyla Life Sciences, a Delaware corporation

(“Zyla”), Alligator Zebra Holdings, Inc., a Delaware corporation and a wholly-owned subsidiary of Assertio

(“Parent”), Alligator Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Assertio Merger

Sub”), and Zebra Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Merger

Sub”). The Merger Agreement provides that, subject to the terms and conditions set forth therein, Merger Sub will

merge with and into Zyla (the “Merger”), with Zyla surviving the Merger and becoming a wholly-owned

subsidiary of Parent. Prior to the consummation of the Merger, Assertio intends to effect a reorganization merger (the

“Assertio Reorganization”) pursuant to which Assertio Merger Sub will merge with and into Assertio, with

Assertio surviving the merger and becoming a wholly-owned subsidiary of Parent. Parent will become Assertio Holdings, Inc. and will

assume Assertio’s listing on the Nasdaq Stock Market (“Nasdaq”).

The

terms of the Merger Agreement provide that, unless otherwise specified in the Merger Agreement, at the effective time of the

Merger, each issued and outstanding share of common stock, par value $0.001 per share, of Zyla (the “Zyla Common

Stock”) will be canceled and automatically converted into the right to receive as merger consideration (the

“Merger Consideration”) 2.5 shares (the “Exchange Ratio”) of common stock, par value

$0.0001 per share, of Parent (the “Parent Common Stock”). On a pro forma basis, the current holders of

Zyla Common Stock will hold in the aggregate approximately 32% of the issued and outstanding capital stock of Parent

immediately after the Merger.

The terms of the Merger Agreement

also provide that, as of immediately prior to the effective time (“Effective Time”) of the Merger, in each case,

subject to certain adjustments in accordance with the Exchange Ratio and other terms set forth in the Merger Agreement (i) each

Zyla stock option, whether vested or unvested, that is outstanding will be cancelled at the Effective Time in exchange for an option

to purchase shares of Parent Common Stock on the same terms and conditions as were applicable to such Zyla stock option as of immediately

prior to the Effective Time (including any vesting or forfeiture provisions or repurchase rights, but taking into account any acceleration

thereof provided under such option), (ii) each Zyla time-based restricted stock unit, whether vested or unvested, that is outstanding

will be cancelled at the Effective Time in exchange for fully-vested Parent Common Stock, (iii) each Zyla performance-based restricted

stock unit, whether vested or unvested, that is outstanding will be cancelled at the Effective Time in exchange for fully-vested

Parent Common Stock, and (iv) each Zyla warrant to purchase shares of Zyla Common Stock that is issued and outstanding will be

cancelled at the Effective Time in exchange for a warrant to purchase shares of Parent Common Stock on the same terms and conditions

as were applicable to such Zyla warrant as of immediately prior to the Effective Time.

The

Merger and the Merger Agreement have been approved by the board of directors of each of Zyla (the “Zyla

Board”), Assertio (the “Assertio Board”) and Parent (the “Parent Board”).

Completion of the Merger is conditioned upon the adoption and approval of the Merger Agreement by (1) the holders of at

least a majority of the outstanding shares of Zyla Common Stock (the “Zyla Stockholder Approval”) and (2)

by the affirmative vote of the majority of the total votes cast to approve the issuance of the Merger Consideration by the

holders of the outstanding shares of common stock of Assertio (the “Assertio Stockholder Approval”).

Completion of the Merger is also subject to other customary closing conditions including (i) the absence of any

injunction order, judgment or decree by any governmental entity that prohibits or makes the consummation of the transaction

illegal, (ii) the registration on From S-4 to be filed with the Securities and Exchange Commission (the

“SEC”) by Parent in connection with the issuance of Parent Common Stock as Merger Consideration being

declared effective by the SEC, (iii) the approval by Nasdaq of the listing of the Parent Common Stock to be issued as Merger

Consideration on Nasdaq, (iv) the execution by each party of certain intercompany agreements, (v) subject to certain

exceptions, the accuracy of each party’s representations and warranties and (vi) compliance in all material respects by

each party with its obligations under the Merger Agreement.

The Merger Agreement contains customary

representations and warranties of both Assertio and Zyla. Each of Assertio and Zyla has agreed to operate its respective business

in the ordinary course in all material respects and to certain other operating covenants and to not take certain specified actions

prior to date of the consummation of the Merger (the “Closing Date”), as set forth more fully in the Merger

Agreement.

Each of Assertio and Zyla has also agreed

to customary “no-shop” restrictions on its ability to solicit alternative acquisition proposals from third parties

and to provide non-public information to, and engage in discussions or negotiations with, third parties regarding alternative acquisition

proposals. Notwithstanding the “no-shop” restrictions, prior to obtaining the Zyla Stockholder Approval, Zyla may under

certain circumstances provide non-public information to, and participate in discussions or negotiations with, third parties with

respect to any unsolicited alternative acquisition proposal that the Zyla Board has determined constitutes or would be reasonably

likely to lead to a Superior Proposal. A “Superior Proposal” is an unsolicited bona fide written offer that is fully

financed or has fully committed financing that the Zyla Board determines in good faith (after consultation with its outside legal

counsel and its financial advisor), taking into account all legal, financial, regulatory and other aspects of the proposal, is

(1) more favorable to the stockholders of Zyla from a financial point of view than the Merger and the other transactions contemplated

by the Merger Agreement (including any adjustment to the terms and conditions proposed by Assertio in response to such a Superior

Proposal in accordance with the terms of the Merger Agreement) and (2) reasonably likely of being completed on the terms proposed

on a timely basis.

Prior to obtaining the Zyla Stockholder

Approval, the Zyla Board may, among other things, change its recommendation that the stockholders of Zyla adopt the Merger Agreement

(a “Change in Recommendation”) in response to a Superior Proposal or an Intervening Event (as defined in the

Merger Agreement), subject to complying with notice and other specified conditions, including giving Assertio the opportunity to

propose revisions to the terms of the Merger Agreement during a period following such notice.

The Merger

Agreement contains certain customary termination rights for Assertio and Zyla, including, among others, the right of (1)

either party to terminate the Merger Agreement if (a) the Merger is not completed by September 12, 2020, unless otherwise

extended pursuant to the terms of the Merger Agreement and (b) either the Zyla Stockholder Approval or the Assertio

Stockholder Approval is not obtained, (2) Assertio to terminate the Merger Agreement as a result of a Change in

Recommendation and (3) Zyla to terminate the Merger Agreement as a result of the Assertio Board changing its recommendation

with respect to the Merger Agreement.

Upon termination of the Merger Agreement

under certain specified circumstances, Zyla will be obligated to pay Assertio a termination fee of $3,400,000. The Merger Agreement

also provides that Assertio or Zyla will be obligated to pay the transaction expenses of the other party, up to a maximum amount

of $1,750,000, upon termination of the Merger Agreement under certain specified circumstances.

Upon consummation

of the Merger and the Assertio Reorganization, the Parent Board will consist of nine directors, of which six of the directors

will be appointed by the Assertio Board and three of the directors will be appointed by the Zyla Board. The initial Parent

Board shall include the President and Chief Executive Officer of Assertio as of immediately prior to the Effective Time, the

President and Chief Executive Officer of Zyla as of immediately prior to the Effective Time, and the Chairman of the Zyla

Board as of immediately prior to the Effective Time, who will become the lead independent director of the Parent Board. The

President and Chief Executive Officer of Zyla as of immediately prior to the Effective Time will become the President and

Chief Executive Officer of Parent, while the President and Chief Executive Officer of Assertio as of immediately prior to

the Effective Time will become the Non-Executive Chairman of the Parent Board. The Senior Vice President and Chief Financial

Officer of Assertio as of immediately prior to the Effective Time will become the Senior Vice President and Chief Financial

Officer of Parent.

The foregoing summary of the Merger Agreement

and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by,

the full text of the Merger Agreement attached hereto as Exhibit 2.1 and incorporated herein by reference.

Voting and Support Agreement

Concurrently with

the execution of the Merger Agreement, Parent entered into voting and support agreements (the “Voting

Agreements”) with certain stockholders of Zyla (each, a “Supporting Stockholder” and,

collectively, the “Supporting Stockholders”) pursuant to which each Supporting Stockholder has agreed,

among other things and subject to the terms and conditions set forth therein, to vote or cause to be voted its shares of Zyla

Common Stock in favor of the adoption of the Merger Agreement and the transactions contemplated thereby, including the

Merger. The shares of Zyla Common Stock covered by the Voting Agreements represent, in the aggregate, a majority of

the total Zyla Common Stock that is issued and outstanding, provided that if the Zyla Board makes a Change in Recommendation

in response to a Superior Proposal or an Intervening Event (as defined in the Merger Agreement), then the shares covered by

the Voting Agreements will only represent 35% of the total Zyla Common Stock that is issued and outstanding.

The foregoing description of the Voting

Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Voting Agreements,

forms of which are attached hereto as Exhibit 10.1 and Exhibit 10.2 and are incorporated herein by reference.

The Merger

Agreement and the Voting Agreements have been attached as exhibits hereto to provide investors with information regarding

their respective terms. They are not intended to provide any other factual information about Assertio, Zyla, Parent or Merger

Sub, their respective businesses, or the actual conduct of their respective businesses during the period prior to the

consummation of the Merger. The representations, warranties and covenants contained in the Merger Agreement and the Voting

Agreements were made only for purposes of such agreements as of the specific dates therein, were made solely for the benefit

of the respective contracting parties to those agreements, may be subject to limitations agreed upon by the contracting

parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk among the

respective parties thereto instead of establishing these matters as facts, and may be subject to standards of materiality

applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and

warranties may not describe the actual state of affairs as of the date they were made or at any other time and investors

should not rely on them as statements of fact.

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

|

Transition Agreement

On March 16, 2020 Assertio entered into

a Transition Agreement (the “Transition Agreement”) with Arthur Higgins, the President and Chief Executive Officer

of Assertio (the “Executive”). The Transition Agreement will become effective as of the Effective Time and,

at such time, the Executive will immediately cease to serve as a full-time employee and the President and Chief Executive Officer

of Assertio. He will commence his engagement as the Non-Executive Chairman of the Parent Board and will serve in such a role until

the 2022 Annual Meeting of the Stockholders of Parent, unless the Executive’s engagement with Parent is terminated earlier

(such period of service, the “Service Term”).

On the Closing Date, the Executive will

receive from Assertio a cash payment in the amount of $400,000. This payment will be subject to the Executive continuing his service

as President and Chief Executive Officer of Assertio through the Closing Date and the Executive’s execution and non-revocation

of a release of claims against Assertio and its affiliates (the “Release”).

During the Service

Term, the Executive will be eligible to receive the following compensation, subject to his continued engagement as the Non-Executive

Chairman of the Parent Board: (i) an annual cash retainer in the amount of $95,000, (ii) a grant of restricted stock units (“RSUs”)

on the date of each Annual Meeting of Stockholders of Assertio or Parent (as applicable) held in calendar years 2020 and 2021 (the

“Director Equity Awards”) with each award having a grant-date value of $190,000 (based on the fair market value

of the shares of Parent Comment Stock covered by such award) and being eligible to vest on the first anniversary on the date of

grant, (iii) a lump-sum severance payment in the amount of $1,200,000 (subject to the Executive’s execution and non-revocation

of the Release) and (iv) a prorated bonus for 2020 in an amount of up to $400,000, subject to the Executive’s achievement

of corporate and personal goals determined by the Compensation Committee of the Assertio Board in consultation with the Executive.

The terms of the Transition

Agreement also address the treatment of the Director Equity Awards and the outstanding equity awards held by the Executive under

Assertio’s existing equity-based compensation plan and any other awards to be issued under such plan through the Closing

Date (the “Existing Awards” and, together with the Director Equity Awards, the “Executive Awards”).

Specifically, the Transition Agreement provides for the following: (i) subject to the Executive’s continued service as the

Non-Executive Chairman of the Parent Board through the 2022 Annual Meeting of the Stockholders of Parent, (A) the Executive Awards

will continue to vest in accordance with their applicable vesting schedules through the date of such meeting and (B) the Executive

will be credited with an additional twelve (12) months of service for purposes of determining the vesting of his Existing Awards

and (ii) if the Executive is not re-elected to serve as a member of the Parent Board at the 2021 Annual Meeting of the Stockholders

of Parent, the Executive will be credited with an additional twelve (12) months of service for purposes of determining the vesting

of his Existing Awards. However, in the event that (i) the Parent Board terminates the Executive’s engagement without Cause

(as defined in the Transition Agreement), then the Executive Awards will continue to vest in accordance with their applicable vesting

schedules through the 2023 Annual Meeting of the Stockholders of Parent or (ii) the Parent Board terminates the Executive’s

engagement for Cause (as defined in the Transition Agreement) or the Executive resigns voluntarily, then the unvested Executive

Awards will be forfeited in exchange for no consideration.

Commencing on the Closing

Date, Parent will provide the Executive with the full cost of health insurance benefits provided to him (as well as his spouse

and dependents) immediately prior to the Closing Date pursuant to COBRA (or other applicable law) through the earlier of eighteen

(18) months after the Closing Date or the date that the Executive is no longer eligible for COBRA or other benefits under applicable

law. This payment will be subject to the Executive continuing his service as President and Chief Executive Officer of Assertio

through the Closing Date and his execution and non-revocation of the Release.

In the event that the

Merger Agreement is terminated for any reason or the Merger does not occur, the Transition Agreement will automatically terminate

and become null and void.

The foregoing description

of the Transition Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Transition Agreement, which is attached hereto as Exhibit 10.3 and is incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

On March 16, 2020,

Assertio issued a joint press release with Zyla announcing their entry into the Merger Agreement described above under Item 1.01.

A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference. On March 17, 2020, Assertio and Zyla hosted a web conference to discuss the Merger. A copy of the presentation is attached

as Exhibit 99.3 hereto and is incorporated herein by reference.

The information

in Item 7.01 of this report on Form 8-K, including the information in Exhibit 99.1 and Exhibit 99.3 hereto, is furnished

pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for any purpose, including for the purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section. The information in Item 7.01 of this Current Report on Form 8-K, including the

information in Exhibit 99.1 hereto, shall not be deemed incorporated by reference into any filing under the Securities Act of

1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general incorporation

language in such filing.

Additional Information and Where to

Find It

This communication may be deemed to be solicitation material

in respect of the proposed Merger. The proposed Merger will be submitted to Assertio’s stockholders and Zyla’s stockholders

for their consideration. In connection with the proposed Merger, Assertio and Zyla intend to file a joint proxy statement (the

“Joint Proxy Statement”) in connection with the solicitation of proxies by Assertio and Zyla in connection with

the proposed Merger. Assertio intends to file a registration statement on Form S-4 (the “Form S-4”) with the

SEC, in which the Joint Proxy Statement will be included as a prospectus. Assertio also intends to file other relevant documents

with the SEC regarding the proposed Merger. The definitive Joint Proxy Statement will be mailed to Assertio’s stockholders

and Zyla’s stockholders when available. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED MERGER,

INVESTORS AND STOCKHOLDERS OF ASSERTIO AND INVESTORS AND STOCKHOLDERS OF ZYLA ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT

REGARDING THE PROPOSED MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

The Joint Proxy Statement, any amendments

or supplements thereto and other relevant materials, and any other documents filed by Assertio or Zyla with the SEC, may be obtained

once such documents are filed with the SEC free of charge at the SEC’s website at www.sec.gov or free of charge from

Assertio at www.assertiotx.com or by directing a request to Assertio’s Investor Relations Department at investor@assertiotx.com or free of charge from Zyla at www.egalet.com or by directing a Zyla’s Investor Relations Department at ir@zyla.com.

No Offer or Solicitation

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act.

Participants in the Solicitation

Assertio, Zyla and certain of their respective executive officers,

directors, other members of management and employees may, under the rules of the SEC, be deemed to be “participants”

in the solicitation of proxies in connection with the proposed Merger. Information regarding Assertio’s directors and executive

officers is available in its Proxy Statement on Schedule 14A for its 2019 Annual Meeting of Stockholders, that was filed with the

SEC on April 8, 2019 and in its Annual Report on Form 10-K for the year ended December 31, 2019, that was filed with the SEC on

March 10, 2020. Information regarding Zyla’s directors and executive officers is available in its Proxy Statement on Schedule

14A for its 2019 Annual Meeting of Stockholders, that was filed with the SEC on November 6, 2019 and in its Annual Report on Form

10-K for the year ended December 31, 2018, that was filed with the SEC on April 30, 2019. These documents may be obtained free

of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description

of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy Statement and other

relevant materials relating to the proposed Merger to be filed with the SEC when they become available.

Cautionary Statement Regarding Forward-Looking Statements

Statements in this Current Report on Form 8-K that are not historical

facts are forward-looking statement that reflect Assertio’s management’s current expectations, assumptions and estimates

of future performance and economic conditions. These forward-looking statements are made in reliance on the safe harbor provisions

of Section 27A of the Securities Act, and Section 21E of the Exchange Act. These forward-looking statements relate to, among other

things, future events or the future performance or operations of Assertio. All statements other than historical facts may be forward-looking

statements; words such as “anticipate,” “believe,” “could,” “design,” “estimate,”

“expect,” “forecast,” “goal,” “guidance,” “imply,” “intend,”

“may”, “objective,” “opportunity,” “outlook,” “plan,” “position,”

“potential,” “predict,” “project,” “prospective,” “pursue,” “seek,”

“should,” “strategy,” “target,” “would,” “will” or other similar expressions

that convey the uncertainty of future events or outcomes are used to identify forward-looking statements. Such forward-looking

statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are

beyond the control of Assertio. Factors that could cause Assertio’s actual results (or the actual results of Parent) to differ

materially from those implied in the forward-looking statements include: (1) the risk that the conditions to the closing of the

proposed Merger are not satisfied, including the risk that required approvals for the proposed Merger from the stockholders of

Assertio or Zyla are not obtained; (2) the occurrence of any event, change or other circumstances that either could give rise to

the right of one or both of Assertio or Zyla to terminate the Agreement; (3) the risk of litigation relating to the proposed Merger;

(4) uncertainties as to the timing of the consummation of the proposed transaction and the ability of each party to consummate

the proposed Merger; (5) risks related to disruption of management time from ongoing business operations due to the proposed Merger;

(6) unexpected costs, charges or expenses resulting from the proposed Merger; (7) the ability of the Assertio and Zyla to retain

and hire key personnel; (8) competitive responses to the proposed Merger and the impact of competitive services; (9) certain restrictions

during the pendency of the merger that may impact Assertio’s or Zyla’s ability to pursue certain business opportunities

or strategic transaction; (10) potential adverse changes to business relationships resulting from the announcement or completion

of the proposed transaction; (11) the combined company’s ability to achieve the growth prospects and synergies expected from

the transaction, as well as delays, challenges and expenses associated with integrating the combined company’s existing businesses;

(12) negative effects of this announcement or the consummation of the proposed Merger on the market price of Assertio’s common

stock, credit ratings and operating results; and (13) legislative, regulatory and economic developments, including changing business

conditions in the industries in which Assertio and Zyla operate. These risks, as well as other risks associated with the proposed

transaction, will be more fully described in the joint proxy statement/prospectus that will be filed with the SEC in connection

with the proposed transaction. Investors and potential investors are urged not to place undue reliance on forward-looking statements

in this communication, which speak only as of this date. While Assertio may elect to update these forward-looking statements at

some point in the future, each specifically disclaims any obligation to update or revise any forward-looking-statements contained

in this press release whether as a result of new information or future events, except as may be required by law. Nothing contained

herein constitutes or will be deemed to constitute a forecast, projection or estimate of the future financial performance of Assertio,

Zyla or Parent, whether following the implementation of the proposed transaction or otherwise.

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

(d)

|

|

Exhibits

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

2.1

|

|

Agreement and Plan of Merger by and among Assertio Therapeutics, Inc., Alligator Zebra Holdings, Inc., Alligator Merger Sub, Inc., Zebra Merger Sub, Inc. and Zyla Life Sciences, dated as of March 16, 2020*

|

|

|

|

10.1

|

|

Form of

Voting and Support Agreement by and among Alligator Zebra Holdings, Inc. and certain Zyla stockholders

|

|

|

|

10.2

|

|

Form of Voting and Support Agreement by and among Alligator Zebra Holdings, Inc. and certain Zyla stockholders

|

|

|

|

10.3

|

|

Transition Agreement by and among Assertio Therapeutics, Inc. and Arthur Higgins, dated as of March 16, 2020

|

|

|

|

99.1

|

|

Joint Press Release, dated March 16, 2020

|

|

|

|

99.2

|

|

Employee FAQs

|

|

|

|

99.3

|

|

Investor Presentation, dated March 17, 2020

|

*Schedules and exhibits have been omitted

pursuant to Item 601(b)(2) of Regulation S-K. Assertio agrees to furnish supplementally a copy of any omitted schedule or exhibit

to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ASSERTIO THERAPEUTICS, INC.

|

|

|

|

|

|

Date: March 17, 2020

|

By:

|

/s/ Daniel A. Peisert

|

|

|

|

Daniel A. Peisert

|

|

|

|

Senior Vice President and Chief Financial Officer

|

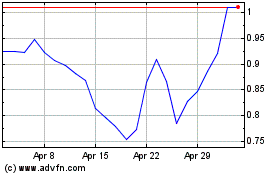

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024