Artesian Resources Corporation (Nasdaq: ARTNA), a leading provider

of water and wastewater services, and related services, on the

Delmarva Peninsula, today announced year-to-date and second quarter

results for 2019. Net income for the first six months of 2019

remained consistent compared to the same period in 2018, at $7.4

million. Diluted earnings per share was $0.79 for the six

months ended June 30, 2019, compared to $0.80 for the six months

ended June 30, 2018.

Revenues totaled $40.0 million for the six

months ended June 30, 2019, $0.9 million, or 2.3%, more than

revenues recorded for the same six month period in 2018. Water

sales revenue increased $0.6 million, or 1.8%, for the six months

ended June 30, 2019 compared to the same period a year ago, due to

customer growth and an increase in consumption and Distribution

System Improvement Charge (“DSIC”) revenue. Effective January

1, 2019, the DSIC rate increased from 4.71% to 5.55%, resulting in

an increase of $0.2 million in DSIC revenue for the six months

ended June 30, 2019 compared to the same six month period in

2018. Approximately $3.8 million was refunded to customers

during the second quarter of 2019 related to the impact of the Tax

Cut and Jobs Act (“TCJA”) and the subsequent reduced tariff rates

approved by the Delaware Public Service Commission (“DEPSC”) on

January 31, 2019. The refund amount was previously held in

reserve and was not included in water sales revenue or net

income.

Other utility operating revenue increased $0.2

million, or 8.9%, for the six months ended June 30, 2019 compared

to the same period in 2018 primarily due to an increase in

wastewater revenue from customer growth.

Non-utility operating revenue increased $0.1

million, or 3.8%, for the six months ended June 30, 2019 compared

to the same period in 2018, due to an increase in Service Line

Protection Plans (“SLP Plans”) revenue that covers the cost of

material and labor required to repair or replace participants’

leaking water service lines, clogged sewer lines and internal

plumbing.

Operating expenses, excluding depreciation and

income taxes, increased $0.6 million, or 2.6%, for the six months

ended June 30, 2019, compared to the same period in 2018.

Utility operating expenses increased $0.2 million, or 1.4%, for the

six months ended June 30, 2019 compared to the six months ended

June 30, 2018, primarily due to an increase in payroll and benefit

costs, partially offset by a decrease in maintenance costs.

Non-utility operating expenses increased approximately $0.2

million, or 15.9%, primarily due to an increase in payroll and

benefit costs and in plumbing services related to the SLP

Plans. Property and other taxes increased $0.1 million, or

4.3%, due to an increase in utility plant subject to taxation. In

addition, payroll taxes increased.

Depreciation and amortization expense increased

$0.3 million, or 6.4%, due to continued investment in utility plant

providing supply, treatment, storage and distribution of water to

customers and service to our wastewater customers.

Federal and state income tax expense decreased

$0.4 million, or 13.7%, primarily due to the amortization of the

deferred tax regulatory liability related to the reduction in the

federal corporate income tax rate by the TCJA.

Allowance for funds used during construction

(“AFUDC”) increased $0.2 million as a result of higher long-term

construction activity subject to AFUDC for the six months ended

June 30, 2019 compared to the same period in 2018.

Miscellaneous income decreased $0.2 million, primarily due to a

decrease in the amount of the annual patronage refund paid by

CoBank, ACB. The annual patronage refund rate was reduced in

2019 to 0.80% from 1.00% of the average line of credit and loan

volume outstanding.

Interest expense increased $0.5 million, or

15.7%, primarily due to long-term debt interest associated with the

$7.5 million wastewater loan issued in August 2018 and the $4.5

million wastewater loan issued in December 2018. In addition,

short-term debt interest increased due to an increase in the amount

borrowed under lines of credit and an increase in the interest

rate.

“Artesian continues to make significant

investments in infrastructure. We recently completed upgrades

and improvements to a large treatment facility that produces over 2

million gallons of potable water a day. In addition, we are

completing a million gallon elevated storage tank in an area of our

integrated system experiencing continued new home construction.

These investments allow us to assure our valued customers are

reliably provided high quality water,” said Dian C. Taylor, Chair,

President and CEO.

Second Quarter Results

Net income for the second quarter of 2019 was

$3.8 million, compared to $3.9 million for the second quarter of

2018. Diluted earnings per share was $0.41 for the second

quarter of 2019, compared to $0.42 for the same period in

2018.

Revenues totaled $20.7 million for the three

months ended June 30, 2019, $0.4 million, or 2.0%, more than

revenues for the three months ended June 30, 2018. Water sales

revenue increased $0.3 million, or 1.8%, for the three months ended

June 30, 2019 from the corresponding period in 2018, due to

customer growth and an increase in consumption and DSIC

revenue. Effective January 1, 2019, the DSIC rate increased

from 4.71% to 5.55%, resulting in an increase of $0.1 million in

DSIC revenue for the three months ended June 30, 2019 compared to

the three months ended June 30, 2018.

Other utility operating revenue increased

approximately $0.1 million, or 6.0%, for the three months ended

June 30, 2019 compared to the three months ended June 30,

2018. The increase is primarily due to an increase in

wastewater revenue from customer growth.

Operating expenses, excluding depreciation and

income taxes, increased $0.4 million, or 3.6%, for the three months

ended June 30, 2019, compared to the same period in 2018.

Utility operating expenses increased $0.2 million, or 2.3%, for the

three months ended June 30, 2019 compared to the three months ended

June 30, 2018, primarily due to an increase in payroll and benefit

costs, partially offset by a decrease in maintenance costs.

Non-utility operating expenses increased approximately $0.1

million, or 16.2%, primarily due to an increase in payroll and

benefit costs and in plumbing services related to the SLP

Plans. Property and other taxes increased $0.1 million, or

5.9%, due to an increase in utility plant subject to taxation.

Depreciation and amortization expense increased

$0.2 million, or 7.2%, due to continued investment in utility plant

providing supply, treatment, storage and distribution of water to

customers and service to our wastewater customers.

Federal and state income tax expense decreased

$0.2 million, or 15.3%, primarily due to the amortization of the

deferred tax regulatory liability related to the reduction in the

federal corporate income tax rate by the TCJA.

Interest expense increased $0.2 million, or

16.6%, primarily due to long-term debt interest associated with the

$7.5 million wastewater loan issued in August 2018 and the $4.5

million wastewater loan issued in December 2018. In addition,

short-term debt interest increased due to an increase in the amount

borrowed under lines of credit and an increase in the interest

rate.

About Artesian

ResourcesArtesian Resources Corporation operates as a

holding company of wholly-owned subsidiaries offering water and

wastewater services, and related services, on the Delmarva

Peninsula. Artesian Water Company, the principal subsidiary,

is the oldest and largest regulated water utility on the Delmarva

Peninsula and has been providing water service since 1905.

Artesian supplies 7.9 billion gallons of water per year through

1,311 miles of main to over 300,000 people.

Contact:Nicki TaylorInvestor

Relations(302) 453-6900ntaylor@artesianwater.com

|

Artesian Resources Corporation |

|

Condensed Consolidated Statement of Operations |

|

(In thousands, except per share amounts) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Six months ended |

| |

|

June 30, |

|

|

June 30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

2019 |

|

|

2018 |

| Operating

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Water sales |

$ |

18,192 |

|

|

$ |

17,869 |

|

$ |

35,125 |

|

$ |

34,514 |

|

Other utility operating revenue |

|

1,150 |

|

|

|

1,085 |

|

|

2,270 |

|

|

2,084 |

|

Non-utility operating revenue |

|

1,310 |

|

|

|

1,284 |

|

|

2,642 |

|

|

2,546 |

| |

|

20,652 |

|

|

|

20,238 |

|

|

40,037 |

|

|

39,144 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Utility operating expenses |

|

9,249 |

|

|

|

9,038 |

|

|

18,370 |

|

|

18,121 |

|

Non-utility operating expenses |

|

779 |

|

|

|

671 |

|

|

1,546 |

|

|

1,334 |

|

Depreciation and amortization |

|

2,724 |

|

|

|

2,541 |

|

|

5,438 |

|

|

5,109 |

|

State and federal income taxes |

|

1,325 |

|

|

|

1,564 |

|

|

2,504 |

|

|

2,903 |

|

Property and other taxes |

|

1,255 |

|

|

|

1,185 |

|

|

2,575 |

|

|

2,468 |

| |

|

15,332 |

|

|

|

14,999 |

|

|

30,433 |

|

|

29,935 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

Income |

|

5,320 |

|

|

|

5,239 |

|

|

9,604 |

|

|

9,209 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for funds used during construction |

|

266 |

|

|

|

180 |

|

|

492 |

|

|

268 |

|

Miscellaneous |

|

(58 |

) |

|

|

8 |

|

|

742 |

|

|

927 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Income Before Interest

Charges |

|

5,528 |

|

|

|

5,427 |

|

|

10,838 |

|

|

10,404 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest

Charges |

|

1,750 |

|

|

|

1,501 |

|

|

3,470 |

|

|

3,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

$ |

3,778 |

|

|

$ |

3,926 |

|

$ |

7,368 |

|

$ |

7,404 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - Basic |

|

9,276 |

|

|

|

9,237 |

|

|

9,267 |

|

|

9,230 |

|

Net Income per Common Share - Basic |

$ |

0.41 |

|

|

$ |

0.43 |

|

$ |

0.80 |

|

$ |

0.80 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - Diluted |

|

9,324 |

|

|

|

9,293 |

|

|

9,319 |

|

|

9,287 |

|

Net Income per Common Share - Diluted |

$ |

0.41 |

|

|

$ |

0.42 |

|

$ |

0.79 |

|

$ |

0.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Artesian Resources Corporation |

|

Condensed Consolidated Balance Sheet |

|

(In thousands) |

|

(Unaudited) |

|

|

|

|

|

|

|

| |

June 30, |

|

December 31, |

| |

2019 |

|

2018 |

| Assets |

|

|

|

|

|

|

Utility Plant, at original cost less accumulated depreciation |

$ |

512,153 |

|

$ |

498,678 |

|

Current Assets |

|

10,713 |

|

|

16,118 |

|

Regulatory and Other Assets |

|

15,637 |

|

|

15,034 |

| |

$ |

538,503 |

|

$ |

529,830 |

| |

|

|

|

|

|

| Capitalization and

Liabilities |

|

|

|

|

|

| |

|

|

|

|

|

|

Stockholders' Equity |

$ |

154,503 |

|

$ |

153,251 |

|

Long Term Debt, Net of Current Portion |

|

114,982 |

|

|

115,862 |

|

Current Liabilities |

|

43,749 |

|

|

37,731 |

|

Net Advances for Construction |

|

6,093 |

|

|

6,596 |

|

Contributions in Aid of Construction |

|

142,238 |

|

|

138,015 |

|

Other Liabilities |

|

76,938 |

|

|

78,375 |

| |

$ |

538,503 |

|

$ |

529,830 |

| |

|

|

|

|

|

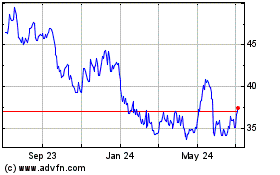

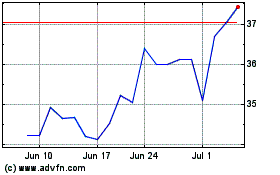

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Apr 2023 to Apr 2024