Artesian Resources Corporation (Nasdaq: ARTNA), a leading provider

of water and wastewater services, and related services, on the

Delmarva Peninsula, today announced earnings results for 2018.

Net income increased 2.1% to $14.3 million, compared to $14.0

million in 2017. Diluted net income per common share

increased 2.0% to $1.54, compared to $1.51 for 2017.

Approximately $3.3 million of water sales

revenue was placed in reserve in 2018. In accordance with the

Delaware Public Service Commission’s January 31, 2019 approval of a

reduction in Delaware water rates, the reserved revenue is to be

refunded to customers in the second quarter of 2019 to return the

savings from the Tax Cuts and Jobs Act’s (“TCJA”) reduction in the

corporate tax rate. The overall decrease in water sales

revenue compared to the prior year arising from the reduction in

water rates was partially offset by an increase in water

consumption and an increase in the number of customers served of

approximately 2.0%. Water sales revenue was $70.8 million in

2018, a decrease of $2.3 million, or 3.1%, from $73.1 million in

2017.

Other utility operating revenue increased 6.7%

to $4.5 million in 2018 from $4.2 million in 2017 as a result of an

increase in wastewater customers served in new and existing

developments in Sussex County, Delaware. “The number of

Delaware wastewater customers we serve grew by 16.6% in 2018 and we

expect to see continued growth in our customer base in Sussex

County, Delaware as a result of the strategic investments we have

made in infrastructure to support residential development and the

growing desirability of this area as a retirement community,” said

Dian C. Taylor, Chair, President and CEO.

Non-utility revenue increased 2.5% to $5.1

million in 2018 from $5.0 million in 2017, primarily due to an

increase in Service Line Protection Plans (“SLP Plans”)

revenue. The SLP Plans provide coverage for all material and

labor required to repair or replace participants’ leaking water

service or clogged sewer lines and internal plumbing lines.

Operating expenses, excluding depreciation and

income taxes, increased $0.4 million, or 0.9%, for the year ended

December 31, 2018 compared to the year ended December 31,

2017. Property and other taxes increased $0.2 million, or

5.0%, primarily due to an increase in utility plant subject to

taxation. Non-utility expenses increased approximately $0.1

million, or 3.7%, primarily due to an increase in plumbing services

related to the SLP Plans.

Depreciation and amortization expense increased

$0.7 million, or 7.7%, for the year ended December 31, 2018

compared to the year ended December 31, 2017, primarily due to

continued investment in utility plant providing supply, treatment,

storage and distribution of water to customers and service to our

wastewater customers.

Federal and state income tax expense decreased

$2.3 million, or 31.6%, from $7.3 million in 2017 to $5.0 million

in 2018, primarily due to the reduction in the federal corporate

income tax rate as a result of the TCJA.

Miscellaneous income increased $0.7 million for

the year ended December 31, 2018 compared to the year ended

December 31, 2017, primarily due to an increase in the amount of

the patronage payment from CoBank, ACB, related to the refinancing

of two First Mortgage bonds in January 2017 and a one-time

additional patronage payment in 2018 related to savings generated

from the TCJA.

Interest expense increased $0.1 million,

primarily due to an increase in borrowing under lines of credit.

This increase was mostly offset by a decrease in interest

charges due to a refinancing of the Series P First Mortgage bond in

January 2018, reducing the interest rate from 6.58% to 4.71%.

In 2018, we invested $49.1 million, compared to

$41.1 million in 2017, in infrastructure projects including

installation of transmission and distribution facilities,

replacement of aging mains, rehabilitation of treatment facilities,

redevelopment of wells and pumping equipment and upgrades to

computer, transportation and meter reading equipment as well as

investments in wastewater facilities in Delaware. Our

wastewater facilities investments included completing construction

of an eight mile pipeline, a 90 million gallon storage lagoon and

spray irrigation facilities to dispose of treated process

wastewater from a new industrial customer, service for which is

expected to begin in 2019. “We firmly believe that

investments we have made in infrastructure deliver the dual-benefit

of sustaining economic growth and improving the quality of our

environment in the region, and are vital to our ability to continue

to increase shareholder value,” said Taylor.

Fourth Quarter Financial Results

Financial results for the fourth quarter of

2018, specifically the reduction in water sales revenue and state

and federal income taxes, reflect the revenue reserve to be

refunded to customers and the implementation effect of the TCJA

including one-time adjustments that impacted the comparative period

of the fourth quarter of 2017. Utility and non-utility

operating expenses increased primarily due to increases in payroll

and repairs and maintenance expenses.

About Artesian

ResourcesArtesian Resources Corporation operates as a

holding company of wholly-owned subsidiaries offering water and

wastewater services, and related services, on the Delmarva

Peninsula. Artesian Water Company, the principal subsidiary,

is the oldest and largest regulated water utility on the Delmarva

Peninsula and has been providing water service since 1905.

Artesian supplies 7.9 billion gallons of water per year through

1,311 miles of main to over 300,000 people.

Forward Looking StatementsThis

release contains forward looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995 regarding,

among other things, our anticipated expansion of service in Sussex

County, Delaware, our investment in infrastructure projects and

wastewater facilities, continued growth in the number of customers

served and our ability to continue to increase shareholder value.

These statements involve risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied by such forward-looking statements including: changes in

weather, changes in our contractual obligations, changes in

government policies, the timing and results of our rate requests,

failure to receive regulatory approval, changes in economic and

market conditions generally, and other matters discussed in our

filings with the Securities and Exchange Commission. While

the Company may elect to update forward-looking statements, we

specifically disclaim any obligation to do so and you should not

rely on any forward-looking statement as representation of the

Company’s views as of any date subsequent to the date of this

release.

Contact:Nicki TaylorInvestor

Relations(302) 453-6900ntaylor@artesianwater.com

| Artesian Resources Corporation |

| Condensed Consolidated Statement of Operations |

| (In thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Twelve months ended |

| |

|

December 31, |

|

|

December 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

2017 |

| Operating

Revenues |

|

|

|

|

|

|

|

|

|

|

|

| Water

sales |

$ |

16,846 |

|

|

$ |

17,830 |

|

|

$ |

70,829 |

|

$ |

73,058 |

| Other

utility operating revenue |

|

1,183 |

|

|

|

1,102 |

|

|

|

4,456 |

|

|

4,177 |

|

Non-utility operating revenue |

|

1,314 |

|

|

|

1,256 |

|

|

|

5,126 |

|

|

5,000 |

| |

|

19,343 |

|

|

|

20,188 |

|

|

|

80,411 |

|

|

82,235 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

|

|

| Utility

operating expenses |

|

9,877 |

|

|

|

9,715 |

|

|

|

38,330 |

|

|

38,277 |

|

Non-utility operating expenses |

|

810 |

|

|

|

691 |

|

|

|

2,879 |

|

|

2,777 |

|

Depreciation and amortization |

|

2,666 |

|

|

|

2,530 |

|

|

|

10,288 |

|

|

9,555 |

| State and

federal income taxes |

|

254 |

|

|

|

892 |

|

|

|

4,991 |

|

|

7,295 |

| Property

and other taxes |

|

1,235 |

|

|

|

1,195 |

|

|

|

4,968 |

|

|

4,731 |

| |

|

14,842 |

|

|

|

15,023 |

|

|

|

61,456 |

|

|

62,635 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

Income |

|

4,501 |

|

|

|

5,165 |

|

|

|

18,955 |

|

|

19,600 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Allowance

for funds used during construction |

|

209 |

|

|

|

107 |

|

|

|

622 |

|

|

334 |

|

Miscellaneous |

|

(60 |

) |

|

|

(5 |

) |

|

|

953 |

|

|

226 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Income Before

Interest Charges |

|

4,650 |

|

|

|

5,267 |

|

|

|

20,530 |

|

|

20,160 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest

Charges |

|

1,705 |

|

|

|

1,563 |

|

|

|

6,252 |

|

|

6,177 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net

Income |

$ |

2,945 |

|

|

$ |

3,704 |

|

|

$ |

14,278 |

|

$ |

13,983 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Common Shares Outstanding - Basic |

|

9,249 |

|

|

|

9,207 |

|

|

|

9,239 |

|

|

9,175 |

| Net

Income per Common Share - Basic |

$ |

0.32 |

|

|

$ |

0.40 |

|

|

$ |

1.55 |

|

$ |

1.52 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Common Shares Outstanding - Diluted |

|

9,303 |

|

|

|

9,274 |

|

|

|

9,293 |

|

|

9,242 |

| Net

Income per Common Share - Diluted |

$ |

0.32 |

|

|

$ |

0.40 |

|

|

$ |

1.54 |

|

$ |

1.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Artesian Resources CorporationCondensed

Consolidated Balance Sheets(In thousands)(Unaudited)

| |

December 31, |

|

December 31, |

| |

2018 |

|

2017 |

|

Assets |

|

|

|

|

|

| Utility

Plant, at original cost less accumulated depreciation |

$ |

498,678 |

|

$ |

460,502 |

| Current

Assets |

|

16,118 |

|

|

18,985 |

|

Regulatory and Other Assets |

|

15,034 |

|

|

15,152 |

| |

$ |

529,830 |

|

$ |

494,639 |

| |

|

|

|

|

|

| Capitalization

and Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

$ |

153,251 |

|

$ |

146,644 |

| Long Term

Debt, Net of Current Portion |

|

115,862 |

|

|

105,587 |

| Current

Liabilities |

|

37,731 |

|

|

28,461 |

| Net

Advances for Construction |

|

6,596 |

|

|

7,797 |

|

Contributions in Aid of Construction |

|

138,015 |

|

|

128,286 |

| Other

Liabilities |

|

78,375 |

|

|

77,864 |

| |

$ |

529,830 |

|

$ |

494,639 |

| |

|

|

|

|

|

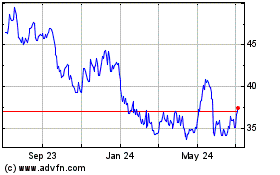

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

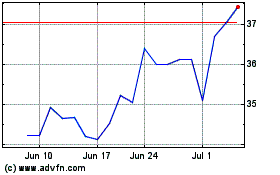

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Apr 2023 to Apr 2024