Statement of Changes in Beneficial Ownership (4)

March 25 2021 - 7:21PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

ATI Investment Parent, LLC |

2. Issuer Name and Ticker or Trading Symbol

Array Technologies, Inc.

[

ARRY

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

3901 MIDWAY PLACE NE, |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/23/2021 |

|

(Street)

ALBUQUERQUE, NM 87109

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, par value $0.001 per share | 3/23/2021 | | J(1) | | 237760 (1) | D | $0.00 | 35475457 (3)(4)(5)(6)(7) | D (3)(4)(5)(6)(7) | |

| Common Stock, par value $0.001 per share | 3/23/2021 | | S(2) | | 35475457 (2) | D | $27.23 | 0 (3)(4)(5)(6)(7) | D (3)(4)(5)(6)(7) | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Represents the redemption of a portion of the ATI Investment Parent, LLC ("Parent") interests of certain Parent unitholders in exchange for the Array Technologies, Inc.'s common stock ("Common Stock") held directly by Parent, immediately prior to the consummation of the public offering of Common Stock, which closed on March 23, 2021 (the "Public Offering"). |

| (2) | Represents Common Stock disposed of in connection with the Public Offering. These shares of common stock were disposed at a price per share of $27.23, which is the public offering price per share less underwriting discount. |

| (3) | This Form 4 is being filed jointly by (each, a "Reporting Person" and, collectively, the "Reporting Persons") (i) Oaktree Power Opportunities Fund IV, L.P. (the "Main Fund"); (ii) Oaktree Power Opportunities Fund IV (Parallel), L.P. (the "Parallel Fund"); (iii) Oaktree ATI Investors, L.P. (the "Co-Invest Fund"); (iv) Oaktree Capital Management, L.P. ("OCM"); (v) Oaktree Capital Group, LLC ("OCG"); (vi) Atlas OCM Holdings LLC ("Atlas OCM"); (vii) Brookfield Asset Management, Inc. ("Brookfield"); and (viii) Oaktree Capital Group Holdings, L.P. ("OCGH LP"). |

| (4) | The Main Fund, the Parallel Fund and the Co-Invest Fund are together the controlling member of Parent. We refer to the Main Fund, the Parallel Fund and the Co-Invest Fund, collectively, as the "Oaktree Funds." OCM is the investment manager of each of the Oaktree Funds. As a result, each of the Oaktree Funds and OCM may be deemed to have beneficial ownership of the shares owned by Parent. OCM's asset management business is indirectly controlled by OCG and Atlas OCM. As of March 31, 2020, approximately 61.8% of OCM's business is indirectly owned by Brookfield and the remaining approximately 38.2% is owned by current and former OCM executives and employees. Brookfield's ownership interest in OCM's business is held through OCG, Atlas OCM and other holding entities. |

| (5) | The current and former OCM executives and employees hold their interests through a separate entity, OCGH LP. The board of directors of OCG and of Atlas OCM is currently comprised of: (i) five Oaktree senior executives, Howard S. Marks, Bruce A. Karsh, Jay S. Wintrob, John B Frank, and Sheldon M. Stone; (ii) three independent directors, Stephen J. Gilbert, D. Richard Masson, and Marna C. Whittington; and (iii) two Brookfield senior executives, Justin B. Beber and J. Bruce Flatt. |

| (6) | Each of the Reporting Persons expressly disclaims beneficial ownership of the equity securities reported herein, except to the extent of their respective pecuniary interests therein, and the filing of this Form 4 shall not be construed as an admission that any such Reporting Person is the beneficial owner of any equity securities covered by this Form 4. |

| (7) | The reporting persons are jointly filing this Form 4 pursuant to Rule 16a-3(j) under the Exchange Act. |

Remarks:

Exhibit 99.1 Signatures. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

ATI Investment Parent, LLC

3901 MIDWAY PLACE NE

ALBUQUERQUE, NM 87109 |

| X |

|

|

BROOKFIELD ASSET MANAGEMENT INC.

BROOKFIELD PLACE

181 BAY STREET, SUITE 300

TORONTO, A6 M5J 2T3 |

| X |

|

|

Oaktree Power Opportunities Fund IV, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Power Opportunities Fund IV (Parallel), L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree ATI Investors, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

OAKTREE CAPITAL MANAGEMENT LP

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Capital Group, LLC

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Atlas OCM Holdings, LLC

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Capital Group Holdings, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Signatures

|

| /s/ Charlotte MacVane, as Attorney-in-Fact for ATI Investment Parent, LLC | | 3/25/2021 |

| **Signature of Reporting Person | Date |

| See Signatures Included in Exhibit 99.1 | | 3/25/2021 |

| **Signature of Reporting Person | Date |

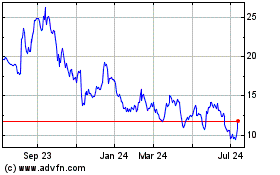

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

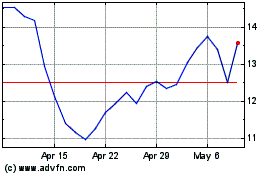

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Apr 2023 to Apr 2024