Written Communication by the Subject Company Relating to a Third Party Tender Offer (sc14d9c)

June 17 2019 - 8:40AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the Securities Exchange Act of 1934

Array BioPharma Inc.

(Name of Subject Company)

Array BioPharma Inc.

(Name of Persons Filing Statement)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

04269X105

(CUSIP Number of Class of Securities)

Ron Squarer

Chief Executive Officer

3200 Walnut Street

Boulder, Colorado 80301

(303) 381-6600

(Name, address, and telephone numbers of person authorized to receive notices and communications

on behalf of the persons filing statement)

With copies to:

Graham Robinson

Laura Knoll

Skadden, Arps, Slate, Meagher & Flom LLP

500 Boylston Street, 23rd Floor

Boston, Massachusetts, 02116

(617) 573-4800

x

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

This Schedule 14D-9 filing relates solely to preliminary communications made before the commencement of a planned tender offer (the “Offer”) by Arlington Acquisition Sub Inc. (“Purchaser”), a wholly owned subsidiary of Pfizer Inc. (“Pfizer”), for all of the outstanding shares of common stock, par value $0.001 per share of Array BioPharma Inc. (“Array”), to be commenced pursuant to the Agreement and Plan of Merger, dated June 14, 2019, among Array, Pfizer and Purchaser. If successful, the Offer will be followed by a merger of Purchaser with and into Array (the “Merger”).

This Schedule 14D-9 filing consists of the following documents relating to the proposed Offer and Merger:

·

Exhibit 99.1: Joint Press Release dated June 17, 2019

·

Exhibit 99.2: Tweet from Array, June 17, 2019

·

Exhibit 99.3: LinkedIn post from Array, June 17, 2019

·

Exhibit 99.4: Email sent to employees of Array on June 17, 2019

·

Exhibit 99.5: Email sent to investors of Array on June 17, 2019

Notice to Investors and Security Holders

The tender offer for the outstanding common stock of Array (the “Offer”) has not yet commenced. This communication is neither an offer to purchase nor a solicitation of an offer to sell any securities, nor is it a substitute for the tender offer materials that Pfizer and Purchaser will file with the SEC. The solicitation and offer to buy the common stock of Array will only be made pursuant to an offer to purchase and related tender offer materials. At the time the Offer is commenced, Pfizer and Purchaser will file a tender offer statement on Schedule TO and thereafter Array will file a solicitation/recommendation statement on Schedule 14D-9 with the SEC with respect to the Offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. ANY HOLDERS OF SHARES ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. The offer to purchase, the related letter of transmittal and the solicitation/recommendation statement will be made available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting Pfizer or Array. Copies of the documents filed with the SEC by Array will be available free of charge on Array’s internet website at http://investor.arraybiopharma.com/sec-filings or by contacting Array’s Investor Relations Department at (303) 381-6600. Copies of the documents filed with the SEC by Pfizer will be available free of charge on Pfizer’s internet website at https://investors.pfizer.com/financials/sec-filings/default.aspx or by contacting Pfizer’s Investor Relations Department at (212) 733-2323.

In addition to the offer to purchase, the related letter of transmittal and certain other tender offer documents, as well as the solicitation/recommendation statement, Array, Pfizer and Purchaser will each file annual, quarterly and current reports with the SEC. You may read and copy any reports or other information filed by Pfizer or array at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Array’s and Pfizer’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Forward Looking Statements

This communication contains forward-looking information related to Pfizer, Array and the proposed acquisition of Array by Pfizer that involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this document and the accompanying exhibits include, among other things, statements about the potential benefits of the proposed acquisition, anticipated royalties, earnings dilution and accretion, and growth, Pfizer’s and Array’s plans, objectives, expectations and intentions, the financial condition, results of operations and business of Pfizer and Array, the BRAF/MEK combination and Array’s other pipeline and portfolio assets, the anticipated timing of closing of the proposed acquisition and expected plans for financing the proposed acquisition. Risks and uncertainties include, among other things, risks related to the satisfaction or waiver of the conditions to closing the proposed acquisition (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including uncertainties as to how many of Array’s stockholders will tender their shares in the tender offer and the possibility that the acquisition does not close; the possibility that competing offers may be made; risks related to obtaining the requisite consents to the acquisition, including, without limitation, the timing (including possible delays) and receipt of regulatory approvals from various governmental entities (including any conditions, limitations or restrictions placed on these approvals and the risk that one or more governmental entities may deny approval); risks related to the ability to realize the anticipated benefits of the proposed acquisition, including the possibility that the expected benefits and accretion from the proposed acquisition will not be realized or will not

be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of this announcement or the consummation of the proposed acquisition on the market price of Pfizer’s common stock, Pfizer’s credit ratings and/or Pfizer’s operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed acquisition; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies; future business combinations or disposals; the uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement and/or completion dates for clinical trials, regulatory submission dates, regulatory approval dates and/or launch dates, as well as the possibility of unfavorable new clinical data and further analyses of existing clinical data; the risk that clinical trial data are subject to differing interpretations and assessments by regulatory authorities; whether regulatory authorities will be satisfied with the design of and results from Pfizer’s and Array’s clinical studies; whether and when drug applications may be filed in any jurisdictions for any potential indication for the BRAF/MEK combination or any other of Pfizer’s or Array’s pipeline assets; whether and when any such applications may be approved by regulatory authorities, which will depend on myriad factors, including making a determination as to whether the product’s benefits outweigh its known risks and determination of the product’s efficacy and, if approved, whether any such products will be commercially successful; decisions by regulatory authorities impacting labeling, manufacturing processes, safety and/or other matters that could affect the availability or commercial potential of any such products; and competitive developments.

A further description of risks and uncertainties relating to Array can be found in Array’s Annual Report on Form 10-K for the fiscal year ended June 30, 2018, and in its subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which are filed with the SEC and available at www.sec.gov and www.arraybiopharma.com.

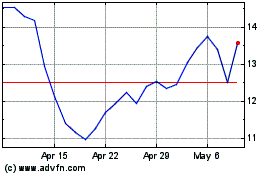

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

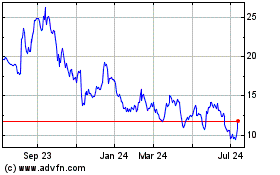

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Apr 2023 to Apr 2024