A.M. Best Revises Outlooks to Stable for Arch Reinsurance Ltd. and Its Subsidiaries

October 11 2018 - 1:24PM

Business Wire

A.M. Best has revised the outlooks to stable from

negative and affirmed the Financial Strength Rating (FSR) of A+

(Superior) and the Long-Term Issuer Credit Rating (Long-Term ICR)

of “aa-” of Arch Reinsurance Ltd. (Arch) (Bermuda) and its

strategic affiliates. A.M. Best also has revised the outlooks to

stable from negative and affirmed the Long-Term ICR of “a-” and all

Long-Term Issue Credit Ratings (Long-Term IRs) of the ultimate

holding company, Arch Capital Group Ltd (Arch Capital) (Bermuda)

(NASDAQ:ACGL), and Arch Capital Group (US) Inc (Delaware), and Arch

Capital Finance LLC (Delaware). (See below for a detailed listing

of the companies and ratings.)

The ratings reflect Arch’s balance sheet strength, which A.M.

Best categorizes as strongest, as well as its strong operating

performance, favorable business profile and appropriate enterprise

risk management. The ratings are based on Arch's historically

strong operating performance compared with its peers, its balance

sheet strength, as measured by Best's Capital Adequacy Ratio, and

strong management team. Arch continues to outperform many of its

peers on most operating metrics while maintaining a strong

risk-adjusted capital position despite the soft pricing

environment, significant stressed ultimate loss stress test

required by the A.M. Best’s “Evaluating Mortgage Insurers”

methodology, and low risk-adjusted investment market returns. In

years with large market losses such as Hurricanes Katrina, Rita and

Wilma in 2005; the financial crisis in 2008; the string of global

catastrophes in 2011; and the natural catastrophe activity

experienced in 2017, Arch has performed well compared with almost

all of its peers. This robust performance is in part the result of

Arch's strong risk management framework. In addition, Arch has

demonstrated that it will actively manage the re/insurance

cycle.

Arch has strived to seek opportunities for return over the past

several years with its entry into the mortgage insurance business

serving as a recent example of this flexibility. Arch has

demonstrated an ability to execute its business plan prudently, but

remain nimble enough to take advantage of opportunities.

Partially offsetting these positive rating factors are the

significant increase in financial leverage as Arch issued senior

unsecured notes and preferred shares at the end of 2016, the

proceeds of which helped fund the purchase of United Guaranty

Corporation (United Guaranty). Interest and preferred dividend

coverage remains strong. While both financial leverage and coverage

have always remained supportive of the ratings, the outlook

revision to stable recognizes the pay down of some financial

leverage and the significant increase in capital from retained net

income during 2017, which improved Arch’s financial leverage

measures substantially. A.M. Best recognizes the additional risk

assumed by the organization, which has improved, but remains higher

than historical norms. Additionally, the revised outlook to stable

reflects the successful operational integration of United Guaranty,

as well as the significant contribution of the United Guaranty

business to Arch’s net income and retained earnings during

2017.

A.M. Best also recognizes that the mortgage insurance business

relies heavily on financial models that can vary from actual

results. A.M. Best utilized what it believes to be a conservative

stress scenario for Arch's mortgage insurance book of business when

calculating stress tested risk-adjusted capitalization. Mortgage

insurance products have a relatively long exposure period when

compared with most of Arch's current property casualty insurance

and reinsurance products, which can be characterized as medium tail

on average. A.M. Best considered long-term sources of liquidity in

the evaluation of these potential tail risk events.

Arch's ratings may be downgraded, or the outlook may revert to

negative if the operating performance of the group decays

substantially, if financial leverage measures significantly

increase, or if risk-adjusted capitalization declines

precipitously. It should be noted that Arch’s operating performance

for the natural catastrophe ridden year of 2017, which was also the

first full calendar year of United Guaranty mortgage insurance

contribution, was significantly better than nearly all of the

comparison companies as measured by underwriting performance and

return on equity.

Lastly, Arch’s ratings outlooks were revised to stable in part

due to the successful management changes in which the CEO and CFO

were replaced by strong, long-tenured Arch executives. Arch was

able to avail itself of the company’s deep talent pool for these

transitions, which occurred during 2018. Also, Arch has been able

to retain significant executives from United Guaranty, all of whom

have been fully integrated into Arch’s operations.

The FSR of A+ (Superior) and the Long-Term ICRs of "aa-" have

been affirmed with the outlooks revised to stable from negative for

Arch Reinsurance Ltd. and its following affiliates:

- Arch Reinsurance Company

- Arch Insurance Company

- Arch Specialty Insurance Company

- Arch Excess & Surplus Insurance

Company

- Arch Indemnity Insurance Company

- Arch Insurance Canada Ltd.

- Alwyn Insurance Company Ltd.

- Arch Insurance Company (Europe)

Limited

The following Long-Term IRs have been affirmed with the outlooks

revised to stable from negative:

Arch Capital Group Ltd---- "a-" on $300 million 7.35%

senior unsecured notes, due 2034-- "bbb" on $325 million 6.75%

non-cumulative preferred shares, Series C-- “bbb” on $450 million

5.25% non-cumulative preferred shares, Series C

Arch Capital Group (U.S.) Inc. (guaranteed by Arch Capital Group

Ltd)---- "a-" on $500 million 5.144% senior unsecured notes,

due 2043

Arch Capital Finance LLC (guaranteed by Arch Capital Group

Ltd)—-- "a-" on $500 million 4.011% senior unsecured notes,

due 2026-- "a-" on $450 million 5.031% senior unsecured notes, due

2046

The following indicative Long-Term IRs under the existing shelf

registration have been affirmed with the outlooks revised to stable

from negative:

Arch Capital Group Ltd---- "a-" on senior unsecured

debt-- "bbb+" on subordinated debt-- "bbb" on preferred stock

Arch Capital Group (US) Inc (guaranteed by Arch Capital Group

Ltd.)—-- "a-" on senior unsecured debt-- "bbb+" on subordinated

debt-- "bbb" on preferred stock

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings. For information on the proper media use of Best’s

Credit Ratings and A.M. Best press releases, please view

Guide for Media - Proper Use of Best’s Credit Ratings and A.M.

Best Rating Action Press Releases.

A.M. Best is a global rating agency and information provider

with a unique focus on the insurance industry. Visit

www.ambest.com for more information.

Copyright © 2018 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181011005798/en/

Steven M. Chirico, CPADirector+1 908 439 2200,

ext. 5087steven.chirico@ambest.comorRobert

DeRoseSenior Director+1 908 439 2200, ext.

5453robert.derose@ambest.comorChristopher

SharkeyManager, Public Relations+1 908 439 2200, ext.

5159christopher.sharkey@ambest.comorJim

PeavyDirector, Public Relations+1 908 439 2200, ext.

5644james.peavy@ambest.com

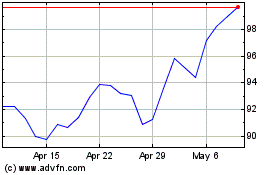

Arch Capital (NASDAQ:ACGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arch Capital (NASDAQ:ACGL)

Historical Stock Chart

From Apr 2023 to Apr 2024