Current Report Filing (8-k)

April 05 2019 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

|

Date of Report (Date of earliest event reported)

|

April 4, 2019

|

|

|

|

|

|

AquaBounty Technologies, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

001-36426

|

04-3156167

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

2 Mill & Main Place, Suite 395, Maynard, Massachusetts

|

01754

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

|

|

Registrant’s telephone number, including area code

|

978-648-6000

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement.

On April 4, 2019, AquaBounty Technologies, Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with H.C. Wainwright & Co., LLC, as the representative of the underwriters named therein (collectively, the

“Underwriters”), relating to the public offering (the “Offering”) of 2,554,590 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at an offering price of $2.25 per share of Common Stock.

The Offering is expected to close on April 9, 2019, subject to the satisfaction of customary closing conditions. The Company has also granted the Underwriters a 45-day option to purchase up to 383,188 additional shares of Common Stock at the Offering Price, less underwriting discounts and commissions. The net proceeds to the Company are expected to be approximately $5.1 million, assuming no exercise of the Underwriters’ overallotment option and after deducting underwriting discounts and commissions and payment of other estimated expenses associated with the Offering that are payable by the Company.

The Offering is being made pursuant to the Company’s registration statement on Form S-3 (File No. 333-224184), which was initially filed with the Securities and Exchange Commission (the “Commission”) on April 6, 2018, subsequently amended on April 23, 2018, and declared effective by the Commission on April 27, 2018.

The Underwriting Agreement contains customary representations, warranties, and agreements by the Company; customary conditions to closing; indemnification obligations of the Company and the Underwriters, including for liabilities under the Securities Act of 1933, as amended; other obligations of the parties; and termination provisions. Pursuant to the Underwriting Agreement, the Company agreed, subject to certain exceptions, not to offer, issue, or sell any shares of Common Stock or securities convertible into or exercisable or exchangeable for shares of Common Stock for a period of ninety days following the Offering without the prior written consent of H.C. Wainwright & Co., LLC. The foregoing is only a brief description of the terms of the Underwriting Agreement, does not purport to be a complete description of the rights and obligations of the parties thereunder, and is qualified in its entirety by reference to the Underwriting Agreement that is filed as Exhibit 1.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 8.01 Other Events.

On April 4, 2019, AquaBounty Technologies, Inc. issued a press release announcing the pricing of the Offering. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

1.1

|

|

Underwriting Agreement dated as of April 4, 2019, by and between AquaBounty Technologies, Inc. and H.C. Wainwright & Co., LLC, as the representative for the underwriters named therein.

|

|

99.1

|

|

Press release issued by AquaBounty Technologies, Inc. on April 4, 2019, furnished herewith.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AquaBounty Technologies, Inc.

|

|

|

|

(Registrant)

|

|

April 5, 2019

|

|

/s/ David A. Frank

|

|

|

|

David A. Frank

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

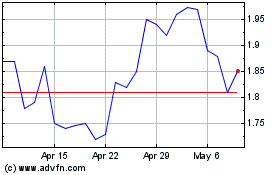

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Mar 2024 to Apr 2024

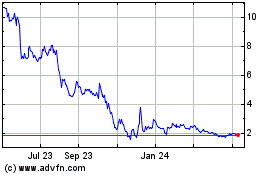

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Apr 2023 to Apr 2024