By Tripp Mickle

Apple Inc. has been exploring opportunities to strengthen its

upstart TV service, including deals for James Bond franchise-owner

MGM Holdings, Inc. and college sports rights, according to people

familiar with the matter.

Executives at Apple met with representatives of MGM and the

Pac-12 Conference this year as the tech giant considers ways to

broaden the appeal of its Apple TV app and TV+, a $4.99 monthly

service that launched last month with nine original programs. The

service anchors an updated TV app that offers subscriptions to

Disney+ and HBO, which give Apple a cut of sales.

Though the conversations with MGM and the Pac-12 were

preliminary and have yet to reach an advanced stage, the talks show

Apple's openness to striking a multibillion-dollar content

agreement in support of its TV service -- even as it forges ahead

with a preferred strategy of developing its own shows, these people

said. A deal with the Pac-12 would be Apple's first foray into live

sports.

Apple is playing catch-up in a TV arms race with Amazon.com Inc.

and others seeking to displace traditional cable operators as the

dominant media service in people's homes. As consumers sever ties

with cable operators and replace them with subscriptions to

services such as Netflix Inc., Amazon and Apple are looking to

increase their revenues by selling subscriptions to their own

streaming-video services and rival offerings from competitors.

Amazon Prime Video service, launched in 2006, has become a hub

for an estimated $2.6 billion in subscription sales to channels

such as Showtime and Starz, according to BMO Capital Markets. The

company has netted those sales from customers drawn to an Amazon

video service that offers original shows, licensed movies and

National Football League games.

Apple's updated TV app and TV+ programs mirror Amazon's offering

but provide a fraction of the shows. A deal for sports rights or a

film library could deepen the offering and pull in more users who

might also sign up for subscriptions to Disney+, HBO and more.

Apple, which has $206 billion in cash, has been reluctant to cut

big deals in the past. Its biggest deal -- a $3 billion acquisition

of Beats Electronics LLC in 2014 -- helped the company jump-start

its music-streaming business.

The Apple Music business became the catalyst for the launch of

subscription services for videogames, news and TV. Those and other

paid subscriptions have become a big contributor to a growing

services business that increased sales 17% to $46.29 billion during

the fiscal year ended in September from the prior fiscal year.

Apple wants to surpass 500 million paid subscriptions next year.

It currently has 450 million paid subscriptions, a 36% increase

from the 330 million it reported in 2018.

"There aren't a lot of potential acquisitions that could

meaningfully change that trajectory," said Matthew Ball, former

head of strategy at Amazon Studios. Still, he said a deal for MGM

or a studio of that size would expand Apple's content offering,

improve new-show development and accelerate growth.

The meetings with MGM included Apple's head of mergers and

acquisitions, Adrian Perica, said people familiar with the matter.

The discussion came as MGM sought a distribution partner in

February for its Epix cable channel. The company also had

discussions with Amazon and others.

Though Apple wasn't interested in Epix, its head of services,

Eddy Cue, has continued to discuss the possibility of a deal for

MGM with Apple advisers, according to some of these people.

MGM could fetch as much as $10 billion, some of these people

said. The company is owned by several private-equity firms,

including Anchorage Capital.

A deal for MGM would give Apple rights to a film library that

includes James Bond and "Silence of the Lambs," as well as TV shows

such as "Fargo" and "The Addams Family." Apple could offer the

shows and films on demand or create new versions of them without

having to pay licensing fees.

More recently, Mr. Cue met with Pac-12 Conference Commissioner

Larry Scott about the conference's effort to sell an equity stake

in its media rights package, valued at up to $5 billion, that

includes the Pac-12 Networks and all marquee football, basketball

and live sports programming that is fully available in 2024,

according to people familiar with the discussions.

Mr. Cue has questioned the value of a deal with the Pac-12

because it would only give Apple rights to some games, people

familiar with his thinking said. He also recognized that if Apple

ever secured rights to all of the conference's best programming, it

would need to show some of those games on traditional, broadcast TV

to satisfy fans.

The conference continues to search for strategic partners for

its media rights and has recently had talks with Apple and Amazon,

among others, people familiar with the matter said.

Mr. Cue's interest in the Pac-12 shows Apple's approach to

sports could eventually go beyond the notifications of coming g

ames and real-time scores it currently offers in its TV app.

The sports industry has largely depended on traditional media

companies for more than $20 billion in annual rights, putting it in

a precarious position in a changing media landscape. The NFL,

Southeastern Conference (SEC), Professional Golf Association and

others are due to negotiate new media deals in the coming

years.

Showing Pac-12 games would help Apple prove it is a viable home

for sports should it pursue the rights to another league.

Mr. Cue is a big fan of Duke University basketball -- his alma

mater -- and the National Basketball Association's Golden State

Warriors. His boss, Chief Executive Tim Cook, is a big fan of his

alma mater's football team -- Auburn University, which plays in the

SEC.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

December 19, 2019 13:24 ET (18:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

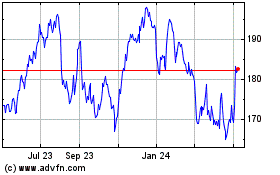

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

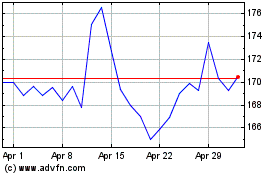

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024