Current Report Filing (8-k)

May 06 2020 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): May 6, 2020 (April 30, 2020)

APOLLO MEDICAL HOLDINGS, INC.

(Exact Name of Registrant as Specified

in Charter)

|

Delaware

|

|

001-37392

|

|

95-4472349

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1668 S. Garfield Avenue, 2nd Floor, Alhambra,

CA 91801

(Address of Principal Executive Offices,

and Zip Code)

(626) 282-0288

Registrant’s Telephone Number,

Including Area Code

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AMEH

|

Nasdaq Capital Market

|

Introductory Note.

As previously disclosed in the Current

Report on Form 8-K filed on January 7, 2020, by Apollo Medical Holdings, Inc., a Delaware corporation (the “Company”),

with the U.S. Securities and Exchange Commission (the “SEC”), on December 31, 2019, Universal Care Acquisition Partners,

LLC, a Delaware limited liability company (“UCAP”), entered into a Stock Purchase Agreement (the “SPA”)

among UCAP, Bright Health Company of California, Inc., a California corporation (“Bright”), Bright Health, Inc., a

Delaware corporation (solely for purposes of section 13.22 thereto), Universal Care, Inc., a California corporation doing business

as Brand New Day (“Universal”), Howard E. And Elaine H. Davis Family Trust, Howard E. And Elaine H. Davis Grandchildren’s

Trust, Jeffrey V. Davis, Jay B. Davis, Laura Davis-Loschiavo, Marc M. Davis, Peter And Helen Lee Family Trust, and, in their respective

capacities as seller representatives, Kenneth Sim, M.D., Thomas Lam, M.D., Jay Davis and Jeffrey Davis. Pursuant to the SPA, UCAP

and all of the other shareholders of Universal agreed to sell to Bright all of their respective shares of capital stock in Universal.

This Current Report on Form 8-K is being filed in connection with the consummation on April 30, 2020 (the “Closing Date”)

of the transactions contemplated by the SPA. Universal is a private full-service health plan.

UCAP has a 48.9% ownership interest in

Universal (the “Percentage Interest”). UCAP is a wholly-owned subsidiary of Allied Physicians of California, a Professional

Medical Corporation dba Allied Pacific of California IPA (“APC”), and both are consolidated variable interest entities

of the Company. As set forth in the Company’s definitive proxy statement filed with the SEC on July 31, 2019 (the “Proxy

Statement”), the Percentage Interest is an “Excluded Asset” that remains solely for the benefit of APC and its

shareholders. As such, any proceeds or gain on the sale of APC’s indirect ownership interest in Universal will have no impact

on the Series A Dividend payable by APC to AP-AMH Medical Corporation as described in the Proxy Statement and consequently the

sale will not affect net income attributable to the Company.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information provided in the Introductory

Note to this Current Report on Form 8-K is incorporated by reference in this Item 2.01.

As described in the Introductory Note above,

on the Closing Date and pursuant to the SPA, UCAP and all of the other shareholders of Universal sold to Bright all of their respective

shares of capital stock in Universal. In connection with such sale, on the Closing Date, APC received approximately $69.2 million

in cash proceeds (including $16.5 million as repayment of indebtedness owed to APC), plus non-cash consideration consisting of

shares of Bright Health, Inc.’s preferred stock having a stipulated value of approximately $33.3 million. In addition, pursuant

to the terms of the SPA, upon release from escrow, APC is entitled to receive all or that portion of the following escrowed amounts

that have not been offset or reserved for claims: (i) cash consideration of approximately $15.6 million, plus (ii) non-cash

consideration consisting of shares of Bright Health, Inc.’s preferred stock having a stipulated value of approximately $5.9

million.

The foregoing description of the SPA does

not purport to be complete and is subject to, and qualified in its entirety by, the full text of the SPA, which is attached as

Exhibit 2.1 to this Current Report on Form 8-K filed by the Company, the terms of which are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(b) Pro Forma Financial

Information.

The pro forma financial information required by this item is

filed as Exhibit 99.1 and incorporated herein by reference.

|

2.1

|

|

Stock Purchase Agreement, dated as of December 31, 2019, among Universal Care Acquisition Partners, LLC, a Delaware limited liability company, Bright Health Company of California, Inc., a California corporation, Bright Health, Inc., a Delaware corporation (solely for purposes of section 13.22 thereto), Universal Care, Inc., a California corporation doing business as Brand New Day, Howard E. And Elaine H. Davis Family Trust, Howard E. And Elaine H. Davis Grandchildren’s Trust, Jeffrey V. Davis, Jay B. Davis, Laura Davis-Loschiavo, Marc M. Davis, Peter And Helen Lee Family Trust, and, in their respective capacities as seller representatives, Kenneth Sim, M.D., Thomas Lam, M.D., Jay Davis and Jeffrey Davis.

|

|

99.1

|

|

Unaudited pro forma consolidated financial information of Apollo Medical Holdings, Inc. for the year ended December 31, 2019.

|

SIGNATURES

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

APOLLO MEDICAL HOLDINGS, INC.

|

|

|

|

|

Dated: May 6, 2020

|

By:

|

/s/ Thomas S. Lam, M.D.

|

|

|

Name:

|

Thomas S. Lam, M.D.

|

|

|

Title:

|

Co-CEO & President

|

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Mar 2024 to Apr 2024

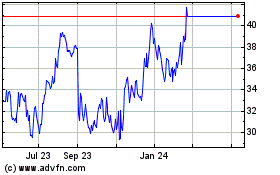

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Apr 2023 to Apr 2024