Amended Statement of Beneficial Ownership (sc 13d/a)

May 14 2019 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

SCHEDULE 13D

———————

Under the Securities Exchange Act of 1934

(Amendment No. 2)

*

Apollo Medical Holdings, Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

03763A207

(CUSIP Number)

Tin Kin Lee, Esq.

Tin Kin Lee Law Offices

1811 Fair Oaks Avenue

South Pasadena, CA 91030

(626) 229-9828

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 10, 2019

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

|

|

|

*

|

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

|

|

|

CUSIP No.

03763A207

|

13D

|

Page 2 of 5 Pages

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSONS

Allied Physicians of California, A Professional Medical Corporation

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

þ

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO – see item 4 below

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

California

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH:

|

|

7

|

SOLE VOTING POWER

1,892,183

|

|

|

8

|

SHARED VOTING POWER

0

|

|

|

9

|

SOLE DISPOSITIVE POWER

1,892,183

|

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,892,183

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.06%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

CUSIP No.

03763A207

|

13D

|

Page 3 of 5 Pages

|

This Amendment No. 2 (this “Amendment”) relates to the Schedule 13D originally filed on behalf of Allied Physicians of California, A Professional Medical Corporation (the “Reporting Person”) with the Securities and Exchange Commission on December 19, 2017, as amended on March 30, 2018 (as amended, the “Schedule 13D”). The text of Items 4, 6 and 7 are hereby amended to describe a proposal involving the Reporting Person which would result in the acquisition by the Reporting Person of additional securities of Apollo Medical Holdings, Inc (the “Issuer”).

|

|

|

ITEM 4.

|

PURPOSE OF TRANSACTION.

|

Item 4 of the Schedule 13D is hereby amended and supplemented by inserting the following information:

On May 10, 2019, the Issuer entered into a series of agreements (collectively, the “Transaction Agreements,” and the transactions contemplated by such Transaction Agreements, the “Transactions”) with two of its affiliates, AP-AMH Medical Corporation, a California professional medical corporation (“AP-AMH”), and the Reporting Person. The Transaction and each of the Transaction Agreements are described in the Form 8-K filed by the Issuer on May 13, 2019.

With respect to Transactions between the Issuer and the Reporting Person, the Reporting Person agreed to purchase 15,015,015 shares of the Issuer’s common stock (such purchased common stock, the “Common Stock”) pursuant to a Common Stock Purchase Agreement (the “Common Stock Purchase Agreement”). The Common Stock Purchase agreement contains, among other terms and conditions, customary representations and warranties by the Issuer for transactions of this nature, covenants regarding the operation of the Issuer between signing of the Common Stock Purchase Agreement and the closing of the purchase, certain conditions to closing, broad mutual indemnification provisions and other miscellaneous provisions. Under the Common Stock Purchase Agreement, (a) no director, officer or other affiliate of the Issuer may vote as a director or shareholder of the Reporting Person in any decision of the Reporting Person as to the voting of any shares of Common Stock held by the Reporting Person, (b) neither the Reporting Person nor any director, officer or other affiliate of the Reporting Person who is a stockholder of the Issuer may vote at any stockholder meeting called in connection with any or all of the Transactions, and (c) neither the Issuer nor any director, officer or other affiliate of the Issuer who is a shareholder of the Reporting Person may vote at any shareholder meeting of the Reporting Person called in connection with any or all of the Transactions. The Common Stock to be sold under the Common Stock Purchase Agreement has not been registered under the Securities Act and is being issued and sold in a private placement pursuant to Section 4(a)(2) thereof.

In addition, the Issuer will grant the Reporting Person certain registration rights with respect to the Common Stock, and the Reporting Person has agreed to restrict its voting powers, pursuant to a Voting and Registration Rights Agreement, which will be signed at the closing of the Transactions (the “Voting and Registration Rights Agreement”). Following the six month anniversary of the execution of the Voting and Registration Rights Agreement, holders of at least 25% of the Common Stock may require that the Issuer prepare and file, and take reasonable actions to support the effectiveness of, a registration statement covering the resale of all of the Common Stock not already covered by an existing and effective registration statement. Under the Voting and Registration Rights Agreement, the Reporting Person will agree that to the extent it has voting power in excess of 9.99% of all voting securities of the Issuer, the Reporting Person will not vote any Common Stock or other voting securities of the Issuer in excess of 9.99%.

The Reporting Person does not have any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a)(j) of Item 4 of Schedule 13D except as set forth herein or such as would occur upon completion of any of the actions discussed above.

|

|

|

|

CUSIP No.

03763A207

|

13D

|

Page 4 of 5 Pages

|

|

|

|

ITEM 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

|

Item 6 of the Schedule 13D is hereby amended to add the following:

The information required by this Item 6 is provided in Items 4 and 7 of this Amendment.

|

|

|

ITEM 7.

|

MATERIAL TO BE FILED AS EXHIBITS.

|

Item 7 of the Schedule 13D is hereby amended to add the following exhibits:

|

|

|

99.1

|

Stock Purchase Agreement, dated May 10, 2019, by and between Allied Physicians of California, a Professional Medical Corporation, a California professional medical corporation and Apollo Medical Holdings, Inc., a Delaware corporation (filed as Exhibit 10.8 to the Issuer’s Form 8-K on May 13, 2019, and incorporated herein by reference).

|

|

99.2

|

Voting and Registration Rights Agreement by and between Allied Physicians of California, a Professional Medical Corporation, a California professional medical corporation and Apollo Medical Holdings, Inc., a Delaware corporation (filed as Exhibit 10.9 to the Issuer’s Form 8-K on May 13, 2019, and incorporated herein by reference).

|

|

|

|

|

CUSIP No.

03763A207

|

13D

|

Page 5 of 5 Pages

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated:

May 14, 2019

|

|

|

|

|

|

Allied Physicians of California,

A Professional Medical Corporation

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas Lam, M.D.

|

|

|

|

|

Name: Thomas Lam, M.D.

|

|

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

|

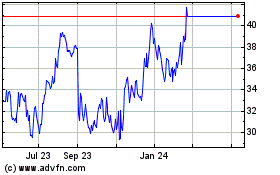

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Apr 2023 to Apr 2024