Fiscal 2019 Third Quarter Highlights

- Net sales of $86.3 million, an

increase of 3.0% year over year

- Gross margin declined 10 basis

points year over year to 54.1%

- GAAP EPS of $0.02 per share;

adjusted EPS of $0.19 per share

- Cash provided by operations of $8.3

million; capital expenditures of $0.9 million

- Received unconditional IDE approval

from the FDA to initiate NanoKnife® DIRECT Clinical

Study

- Won patent infringement dispute with

Bard

AngioDynamics, Inc. (NASDAQ:ANGO), a leading provider

of innovative, minimally invasive medical devices for vascular

access, peripheral vascular disease, and oncology, today announced

financial results for the third quarter of fiscal year

2019, which ended February 28, 2019.

“While we had pockets of softness in our financial performance

during the third quarter, our overall performance remains strong,

and we are confident that we will achieve our full-year guidance.

We saw strong growth contributions during the quarter from AngioVac

and Solero, as well as from Fluid Management,” commented Jim

Clemmer, President and Chief Executive Officer of AngioDynamics,

Inc. “Additionally, I am very excited that the FDA has approved the

IDE for our NanoKnife® DIRECT Clinical Study, which is the next

step toward this incredible technology improving the standard of

care for patients afflicted with Stage III pancreatic cancer. The

IDE approval also represents a milestone for AngioDynamics as we

transform into an evidence-based Company focused on therapies and

outcomes facilitated by our unique technologies.”

Third Quarter 2019 Financial Results

Net sales for the third quarter of fiscal 2019 were $86.3

million, an increase of 3.0%, compared to $83.9 million a year ago.

Foreign currency translation did not have a significant impact on

the Company’s sales in the quarter.

- Oncology net sales were $13.9 million,

an increase of 15.1% from $12.1 million a year ago, as strong sales

of Solero, as well as the recent BioSentry and RadiaDyne

acquisitions, more than offset weaker than anticipated NanoKnife

capital sales during the quarter.

- Vascular Interventions and Therapies

net sales in the third quarter of fiscal 2019 were $50.1 million,

an increase of 3.3%, compared to $48.5 million a year ago, as

strong growth in AngioVac was partially offset by a decelerating

decline in the Venous Insufficiency business.

- Vascular Access net sales were $22.3

million, a decrease of 4.0% from $23.3 million a year ago, as lower

sales of midlines, PICCs, and ports were somewhat offset by strong

dialysis sales.

U.S. net sales in the third quarter of fiscal 2019 were $68.3

million, an increase of 3.9% from $65.8 million a year ago, and

International net sales were $18.0 million, a decrease of 0.3% from

$18.1 million a year ago.

Gross margin for the third quarter of fiscal 2019 declined 10

basis points to 54.1% from 54.2% a year ago. This reflects

temporary headwinds related to FX and a one-time positive impact

from plant closures recognized last year. The Company continues to

see gains in gross margin related to operational and supply-chain

improvements.

The Company recorded net income of $0.8 million, or $0.02 per

share, in the third quarter of fiscal 2019. This compares to net

income of approximately $14.0 million, or $0.37 per share, a

year ago.

Excluding the items shown in the non-GAAP reconciliation table

below, adjusted net income for the third quarter of fiscal 2019 was

$7.4 million, or $0.19 per share, compared to adjusted net income

of $8.7 million, or $0.23 per share, in the third quarter of

fiscal 2018.

Adjusted EBITDAS in the third quarter of fiscal 2019, excluding

the items shown in the reconciliation table below, was $14.9

million, compared to $16.8 million in the third quarter of fiscal

2018.

In the third quarter of fiscal 2019, the Company generated $8.3

million in operating cash flow and had capital expenditures of $0.9

million. As of February 28, 2019, the Company had $41.7 million in

cash and cash equivalents and $133.8 million in debt, excluding the

impact of deferred financing costs.

Nine Months Financial Results

For the nine months ended February 28, 2019:

- Net sales were $263.2 million, an

increase of 2.8%, compared to $256.0 million for the same period a

year ago.

- The Company's net income was $2.5

million, or $0.06 per share, compared to net income of $14.2

million, or $0.38 per share, a year ago.

- Gross margin improved 270 basis points

to 53.3% from 50.6% a year ago.

- Excluding the items shown in the

non-GAAP reconciliation table below, adjusted net income was $22.0

million, or $0.57 per share, compared to adjusted net income of

$19.9 million, or $0.53 per share, a year ago.

- Adjusted EBITDAS, excluding the items

shown in the reconciliation table below, was $43.9 million,

compared to $41.5 million for the same period a year ago.

Fiscal Year 2019 Financial Guidance

The Company reiterates its previously announced financial

guidance, continuing to expect fiscal year 2019 net sales in the

range of $354 to $359 million and free cash flow in the range of

$26 to $31 million. Additionally, the Company continues to

expect adjusted earnings per share in the range of $0.82 to

$0.86.

Conference Call

The Company’s management will host a conference call today at

8:00 a.m. ET to discuss its third quarter 2019 results.

To participate in the conference call, dial 1-877-407-0784

(domestic) or 1-201-689-8560 (international) and refer to the

passcode 13688664.

This conference call will also be webcast and can be accessed

from the “Investors” section of the AngioDynamics website at

www.angiodynamics.com. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

A recording of the call will also be available from 11:00 a.m.

ET on Tuesday, April 2, 2019, until 11:59 p.m. ET on Tuesday, April

9, 2019. To hear this recording, dial 1-844-512-2921 (domestic) or

1-412-317-6671 (international) and enter the passcode 13688664.

Use of Non-GAAP Measures

Management uses non-GAAP measures to establish operational goals

and believes that non-GAAP measures may assist investors in

analyzing the underlying trends in AngioDynamics' business over

time. Investors should consider these non-GAAP measures in addition

to, not as a substitute for or as superior to, financial reporting

measures prepared in accordance with GAAP. In this news release,

AngioDynamics has reported adjusted EBITDAS, adjusted net income,

adjusted earnings per share and free cash flow. Management uses

these measures in its internal analysis and review of operational

performance. Management believes that these measures provide

investors with useful information in comparing AngioDynamics'

performance over different periods. By using these non-GAAP

measures, management believes that investors get a better picture

of the performance of AngioDynamics' underlying business.

Management encourages investors to review AngioDynamics' financial

results prepared in accordance with GAAP to understand

AngioDynamics' performance taking into account all relevant

factors, including those that may only occur from time to time but

have a material impact on AngioDynamics' financial results. Please

see the tables that follow for a reconciliation of non-GAAP

measures to measures prepared in accordance with GAAP.

About AngioDynamics, Inc.

AngioDynamics, Inc. is a leading provider of innovative,

minimally invasive medical devices used by professional healthcare

providers for vascular access, peripheral vascular

disease, and oncology. AngioDynamics’ diverse product

lines include market-leading ablation systems, fluid management

systems, vascular access products, angiographic products and

accessories, drainage products, thrombolytic products and venous

products. For more information,

visit www.angiodynamics.com.

Safe Harbor

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements regarding AngioDynamics' expected future financial

position, results of operations, cash flows, business strategy,

budgets, projected costs, capital expenditures, products,

competitive positions, growth opportunities, plans and objectives

of management for future operations, as well as statements that

include the words such as "expects," "reaffirms," "intends,"

"anticipates," "plans," "believes," "seeks," "estimates,"

"optimistic," or variations of such words and similar expressions,

are forward-looking statements. These forward-looking statements

are not guarantees of future performance and are subject to risks

and uncertainties. Investors are cautioned that actual events or

results may differ from AngioDynamics' expectations. Factors that

may affect the actual results achieved by AngioDynamics include,

without limitation, the ability of AngioDynamics to develop its

existing and new products, technological advances and patents

attained by competitors, infringement of AngioDynamics' technology

or assertions that AngioDynamics' technology infringes the

technology of fourth parties, the ability of AngioDynamics to

effectively compete against competitors that have substantially

greater resources, future actions by the FDA or other regulatory

agencies, domestic and foreign health care reforms and government

regulations, results of pending or future clinical trials, overall

economic conditions, the results of on-going litigation, challenges

with respect to fourth-party distributors or joint venture partners

or collaborators, the results of sales efforts, the effects of

product recalls and product liability claims, changes in key

personnel, the ability of AngioDynamics to execute on strategic

initiatives, the effects of economic, credit and capital market

conditions, general market conditions, market acceptance, foreign

currency exchange rate fluctuations, the effects on pricing from

group purchasing organizations and competition, the ability of

AngioDynamics to integrate acquired businesses, as well as the risk

factors listed from time to time in AngioDynamics' SEC filings,

including but not limited to its Annual Report on Form 10-K for the

year ended May 31, 2018. AngioDynamics does not assume any

obligation to publicly update or revise any forward-looking

statements for any reason.

In the United States, the NanoKnife System has received a 510(k)

clearance by the Food and Drug Administration for use in the

surgical ablation of soft tissue and is similarly approved for

commercialization in Canada, the European Union, and

Australia. The NanoKnife System has not been cleared for the

treatment or therapy of a specific disease or condition.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS

(in thousands, except per share data)

Three months ended Nine months ended February 28,

February 28, February 28, February 28, 2019

2018 2019 2018 (unaudited) (unaudited) Net sales $ 86,341 $

83,851 $ 263,184 $ 255,968 Cost of sales (exclusive of intangible

amortization) 39,650 38,403 122,917 126,560

Gross profit 46,691 45,448 140,267

129,408 % of net sales 54.1 % 54.2 % 53.3 % 50.6 %

Operating expenses Research and development 7,210 6,457 22,235

19,005 Sales and marketing 19,413 18,009 59,115 56,378 General and

administrative 8,780 7,723 26,612 23,319 Amortization of

intangibles 5,342 4,191 14,646 12,433 Change in fair value of

contingent consideration 609 31 865 218 Acquisition, restructuring

and other items, net 2,550 4,177 9,700 11,932

Total operating expenses 43,904 40,588 133,173

123,285 Operating income 2,787 4,860 7,094 6,123

Interest expense, net (1,442 ) (740 ) (3,689 ) (2,223 ) Other

income (expense), net (266 ) (49 ) (72 ) 238 Total other

expense, net (1,708 ) (789 ) (3,761 ) (1,985 ) Income before income

taxes 1,079 4,071 3,333 4,138 Income tax expense (benefit) 283

(9,948 ) 866 (10,095 ) Net Income $ 796 $

14,019 $ 2,467 $ 14,233 Earnings per

share Basic $ 0.02 $ 0.38 $ 0.07 $ 0.38 Diluted $ 0.02 $ 0.37 $

0.06 $ 0.38 Weighted average shares outstanding Basic 37,518

37,122 37,446 37,031 Diluted 38,338 37,442 38,350 37,358

ANGIODYNAMICS, INC. AND SUBSIDIARIES GAAP TO

NON-GAAP RECONCILIATION

(in thousands, except per share data)

Reconciliation of Net Income to non-GAAP Adjusted Net

Income:

Three months ended Nine months ended February 28, February

28, February 28, February 28, 2019 2018 2019 2018 (unaudited)

(unaudited) Net Income $ 796 $ 14,019 $ 2,467 $ 14,233

Amortization of intangibles 5,342 4,191 14,646 12,433 Change

in fair value of contingent consideration 609 31 865 218

Acquisition, restructuring and other items, net (1) 2,550 4,177

9,700 11,932 Tax effect of non-GAAP items (2) (1,920 ) (13,766 )

(5,699 ) (18,889 ) Adjusted net income $ 7,377 $ 8,652

$ 21,979 $ 19,927

Reconciliation of

Diluted Earnings Per Share to non-GAAP Adjusted Diluted Earnings

Per Share: Three months ended Nine months ended February

28, February 28, February 28, February 28, 2019 2018 2019 2018

(unaudited) (unaudited) Diluted earnings per share $ 0.02 $

0.37 $ 0.06 $ 0.38 Amortization of intangibles 0.14 0.11

0.38 0.33 Change in fair value of contingent consideration 0.02

0.00 0.02 0.01 Acquisition, restructuring and other items, net (1)

0.07 0.11 0.25 0.32 Tax effect of non-GAAP items (2) (0.06 ) (0.36

) (0.14 ) (0.51 ) Adjusted diluted earnings per share $ 0.19

$ 0.23 $ 0.57 $ 0.53 Adjusted diluted

sharecount 38,338 37,442 38,350 37,358 (1) Includes costs

related to merger and acquisition activities, restructurings, and

unusual items, including asset impairments and write-offs, certain

litigation, and other items.

(2) Adjustment to reflect the income tax

provision on a non-GAAP basis has been calculated assuming no

valuation allowance on the Company’s U.S. deferred tax assets and

an effective tax rate of 23% for February 28, 2019. For February

28, 2018, the effective tax rate i) has been calculated using a

blended rate of 30.62% for the year ended May 31, 2018 due to the

enactment of the Tax Cuts and Jobs Act (the “Act”) that reduced the

federal corporate tax rate to 21%; ii) excludes the benefit

recorded in Q3 fiscal 2018 resulting from remeasurement of the

Company’s deferred tax assets from the Act; iii) tax effects the

non-GAAP adjustment shown above and iv) assumes the Company does

not have a valuation allowance on its U.S. deferred tax assets.

ANGIODYNAMICS, INC. AND SUBSIDIARIES GAAP

TO NON-GAAP RECONCILIATION (Continued)

(in thousands, except per share data)

Reconciliation of Net Income to EBITDAS and Adjusted

EBITDAS:

Three months ended Nine months ended February 28,

February 28, February 28, February 28, 2019 2018 2019 2018

(unaudited) (unaudited) Net Income $ 796 $ 14,019 $ 2,467 $

14,233 Income tax expense (benefit) 283 (9,948 ) 866 (10,095

) Interest expense, net 1,442 740 3,689 2,223 Depreciation and

amortization 6,867 5,718 19,158 17,395 Stock based compensation

2,378 2,058 7,119 5,821 EBITDAS $

11,766 $ 12,587 $ 33,299 $ 29,577

Change in fair value of contingent consideration $ 609 $ 31

$ 865 $ 218 Acquisition, restructuring and other items, net (1)

2,550 4,216 9,700 11,656 Adjusted

EBITDAS $ 14,925 $ 16,834 $ 43,864 $ 41,451

Per diluted share: EBITDAS $ 0.31 $ 0.34 $ 0.87 $

0.79 Adjusted EBITDAS $ 0.39 $ 0.45 $ 1.14 $ 1.11 (1)

Includes costs related to merger and acquisition activities,

restructurings, and unusual items, including asset impairments and

write-offs, certain litigation, and other items.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES NET SALES BY PRODUCT CATEGORY AND BY

GEOGRAPHY

(in thousands)

Three months ended Nine months ended

Feb 28,2019

Feb 28,2018

%Growth

CurrencyImpact

ConstantCurrencyGrowth

Feb 28,2019

Feb 28,2018

%Growth

CurrencyImpact

ConstantCurrencyGrowth

Net Sales by Product Category Vascular Interventions &

Therapies $ 50,115 $ 48,517 3.3% $ 152,603 $ 149,751 1.9% Vascular

Access 22,348 23,279 (4.0)% 69,861 69,091 1.1% Oncology 13,878

12,055 15.1% 40,720 37,126 9.7% Total $

86,341 $ 83,851 3.0% 0.0% 3.4% $ 263,184 $

255,968 2.8% 0.0% 3.1%

Net Sales by Geography United States $ 68,331 $ 65,787 3.9%

0.0% 3.9% $ 207,898 $ 203,020 2.4% 0.0% 2.4% International 18,010

18,064 (0.3)% 2.0% 1.9% 55,286 52,948

4.4% 2.0% 5.6% Total $ 86,341 $ 83,851 3.0% 0.0% 3.4%

$ 263,184 $ 255,968 2.8% 0.0% 3.1%

ANGIODYNAMICS, INC. AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS

(in thousands)

February 28, 2019 May 31, 2018 (unaudited) (audited)

Assets Current assets: Cash and cash equivalents $ 41,704 $

74,096 Marketable securities — 1,317 Total cash and

investments 41,704 75,413 Accounts receivable, net 44,208

39,401 Inventories 52,388 48,916 Prepaid expenses and other 4,440

4,302 Total current assets 142,740 168,032 Property,

plant and equipment, net 41,207 42,461 Other assets 3,610 3,417

Intangible assets, net 166,564 130,310 Goodwill 423,674

361,252 Total assets $ 777,795 $ 705,472

Liabilities and

stockholders' equity Current liabilities: Accounts payable $

18,443 $ 15,775 Accrued liabilities 21,929 34,426 Current portion

of long-term debt 6,250 5,000 Current portion of contingent

consideration 6,673 2,100 Total current liabilities 53,295

57,301 Long-term debt, net of current portion 126,837 86,621

Deferred income taxes 17,834 17,173 Contingent consideration, net

of current portion 20,454 1,161 Other long-term liabilities 5,296

621 Total liabilities 223,716 162,877 Stockholders'

equity 554,079 542,595 Total Liabilities and Stockholders'

Equity $ 777,795 $ 705,472

ANGIODYNAMICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Three months ended Nine months ended February 28,

February 28, February 28, February 28, 2019

2018 2019 2018 (unaudited) (unaudited)

Cash flows from operating

activities: Net Income $ 796 $ 14,019 $ 2,467 $ 14,233

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 6,867 5,718

19,158 17,395 Stock based compensation 2,378 2,058 7,119 5,821

Change in fair value of contingent consideration 609 31 865 218

Deferred income taxes 138 (10,044 ) 633 (10,150 ) Change in

accounts receivable allowances (24 ) (315 ) (99 ) (35 ) Fixed and

intangible asset impairments and disposals 677 22 689 30 Other 12

(78 ) (5 ) (635 ) Changes in operating assets and liabilities, net

of acquisitions: Accounts receivable (785 ) 598 (3,853 ) 2,897

Inventories (1,747 ) (2,511 ) (2,702 ) (1,913 ) Prepaid expenses

and other (325 ) 155 (1,508 ) (548 ) Accounts payable, accrued and

other liabilities (254 ) (5,338 ) (10,336 ) (9,797 )

Net cash

provided by operating activities 8,342 4,315

12,428 17,516

Cash flows from investing

activities: Additions to property, plant and equipment (887 )

(425 ) (2,303 ) (1,647 ) Acquisition of intangibles — (1,265 ) —

(1,265 ) Cash paid in acquisition — — (84,920 ) — Proceeds from

sale of marketable securities 1,350 — 1,350 —

Net cash used in investing activities 463

(1,690 ) (85,873 ) (2,912 )

Cash flows from financing

activities: Proceeds from issuance of long-term debt — — 55,000

— Repayment of long-term debt (11,250 ) (1,250 ) (13,750 ) (3,750 )

Payment of contingent consideration previously established in

purchase accounting — — (2,100 ) (9,500 ) Proceeds from exercise of

stock options and employee stock purchase plan 1,169 822

2,023 2,560

Net cash provided by (used) in

financing activities (10,081 ) (428 ) 41,173 (10,690 )

Effect of exchange rate changes on cash and cash equivalents 160

239 (120 ) 834

Increase (decrease) in cash

and cash equivalents (1,116 ) 2,436 (32,392 ) 4,748 Cash and

cash equivalents at beginning of period 42,820 49,856

74,096 47,544

Cash and cash equivalents at end of

period $ 41,704 $ 52,292 $ 41,704 $ 52,292

ANGIODYNAMICS, INC.

AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION

(in thousands)

Reconciliation of Free Cash Flows:

Three months ended Nine months ended February 28,

February 28, February 28, February 28, 2019 2018 2019 2018

(unaudited) (unaudited) Net cash provided by operating

activities $ 8,342 $ 4,315 $ 12,428 $ 17,516 Additions to property,

plant and equipment (887 ) (425 ) (2,303 ) (1,647 ) Free Cash Flow

$ 7,455 $ 3,890 $ 10,125 $ 15,869

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190402005340/en/

Investors:AngioDynamics, Inc.Michael C. Greiner, Executive Vice

President & CFO(518) 795-1821

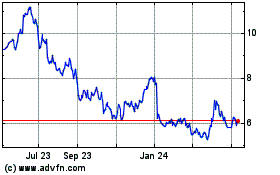

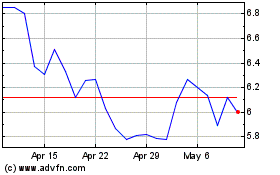

AngioDynamics (NASDAQ:ANGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

AngioDynamics (NASDAQ:ANGO)

Historical Stock Chart

From Apr 2023 to Apr 2024