|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To Prospectus Dated July 15, 2019)

|

Registration No. 333-232550

|

Anavex Life Sciences Corp.

Up to $30,331,854

Common Stock

This prospectus supplement relates to the issuance

and sale of up to $30,331,854 in shares of our common stock, to Lincoln Park Capital Fund, LLC, or Lincoln Park, from time to time,

in one or more transactions in amounts, at prices, and on terms that will be determined at the time these securities are offered

pursuant to a purchase agreement between us and Lincoln Park, dated as of June 7, 2019, or the Purchase Agreement, whereby Lincoln

Park committed to purchase up to $50,000,000 of our common stock. See “The Lincoln Park Transaction” for a description

of the Purchase Agreement. Lincoln Park is an “underwriter” within the meaning of Section 2(a)(11) of the Securities

Act of 1933, as amended, or the Securities Act.

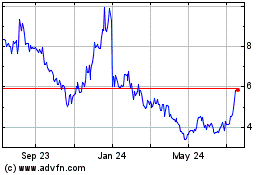

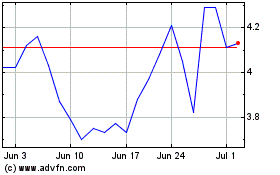

Our common stock is currently listed

on the Nasdaq Capital Market under the symbol “AVXL”. On April 27, 2020 the last reported sale price of our common

stock was $3.41 per share.

We will pay the expenses incurred in registering

the shares, including legal and accounting fees. See “Plan of Distribution”.

Investing in our securities involves

a high degree of risk. See the section entitled “Risk Factors” on page S-7 of this prospectus supplement and the

section entitled “Risk Factors” beginning on page 11 of the accompanying prospectus, and in the documents

we filed with the Securities and Exchange Commission that are incorporated in this prospectus supplement by reference for certain

risks and uncertainties you should consider.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is May 1, 2020.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

We are providing information to you

about this offering of our common stock in two separate documents that are bound together: (1) this prospectus supplement,

which describes the specific terms of this offering, and (2) the accompanying base prospectus, which provides general information,

some of which may not apply to this offering. This prospectus supplement may also add to, update or change information contained

in the accompanying base prospectus. If information in this prospectus supplement is inconsistent with the accompanying base prospectus,

you should rely on this prospectus supplement. Generally, when we refer to this “prospectus,” we are referring to both

documents combined.

This prospectus supplement, the accompanying

base prospectus and any free-writing prospectus that we prepare or authorize contain and incorporate by reference information that

you should consider when making your investment decision. We have not, and Lincoln Park has not, authorized anyone to provide you

with additional or different information. If anyone provides you with different or inconsistent information, you should not rely

on it. You should not assume that the information contained in this prospectus supplement or the accompanying base prospectus is

accurate as of any date other than the date on the front of those documents or that any information we have incorporated by reference

is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results

of operations and prospects may have changed since those dates.

This prospectus supplement is part

of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf”

registration process. Under the shelf registration process, we may from time to time offer and sell any combination of the securities

described in the accompanying prospectus up to a total dollar amount of $250 million, of which this offering is a part.

We are not, and Lincoln Park is not,

making an offer or sale of our common stock in any jurisdiction where such offer or sale is not permitted.

The information in this prospectus

supplement is not complete. You should carefully read this prospectus supplement and the accompanying base prospectus, including

the information incorporated by reference herein and therein, before you invest, as these documents contain information you should

consider when making your investment decision.

None of Anavex Life Sciences Corp.,

Lincoln Park or any of their representatives are making any representation to you regarding the legality of an investment in our

common stock by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and

related aspects of an investment in our common stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement contains

forward-looking statements. All statements other than statements of historical facts contained in this prospectus supplement, including

statements regarding our anticipated future clinical and regulatory milestone events, future financial position, business strategy

and plans and objectives of management for future operations, are forward-looking statements. The words “believe,”

“may,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“should,” “forecast,” “could,” “suggest,” “plan,” and similar expressions,

as they relate to us, are intended to identify forward-looking statements. Such forward-looking statements include, without limitation,

statements regarding:

|

|

·

|

our ability to generate any revenue or to continue as a going concern;

|

|

|

·

|

our ability to successfully conduct clinical

and preclinical trials for our product candidates;

|

|

|

·

|

our ability to raise additional capital

on favorable terms and the impact of such activities on our stockholders and stock price;

|

|

|

·

|

the impact of the COVID-19 outbreak and

its effect on us;

|

|

|

·

|

our ability to execute our development

plan on time and on budget;

|

|

|

·

|

our products’ ability to demonstrate

efficacy or an acceptable safety profile of our product candidates;

|

|

|

·

|

our ability to obtain the support of qualified

scientific collaborators;

|

|

|

·

|

our ability, whether alone or with commercial

partners, to successfully commercialize any of our product candidates that may be approved for sale;

|

|

|

·

|

our ability to identify and obtain additional

product candidates;

|

|

|

·

|

our reliance on third parties in non-clinical

and clinical studies;

|

|

|

·

|

our ability to defend against product

liability claims;

|

|

|

·

|

our ability to safeguard against security

breaches;

|

|

|

·

|

our ability to obtain and maintain sufficient

intellectual property protection for our product candidates;

|

|

|

·

|

our ability to comply with our intellectual

property licensing agreements;

|

|

|

·

|

our ability to defend against claims of

intellectual property infringement;

|

|

|

·

|

our ability to comply with the maintenance

requirements of the government patent agencies;

|

|

|

·

|

our ability to protect our intellectual

property rights throughout the world;

|

|

|

·

|

the anticipated start dates, durations

and completion dates of our ongoing and future clinical studies;

|

|

|

·

|

the anticipated designs of our future

clinical studies;

|

|

|

·

|

our anticipated future regulatory submissions

and our ability to receive regulatory approvals to develop and market our product candidates; and

|

|

|

·

|

our anticipated future cash position.

|

We have based these forward-looking

statements largely on our current expectations and projections about future events, including the responses we expect from the

U.S. Food and Drug Administration, or FDA, and other regulatory authorities and financial trends that we believe may affect our

financial condition, results of operations, business strategy, preclinical and clinical trials and financial needs. These forward-looking

statements are subject to a number of risks, uncertainties and assumptions including without limitation the risks described in

“Risk Factors” in “Part I, Item 1A” of our Annual Report on Form 10-K for the fiscal year ended September

30, 2019. These risks are not exhaustive. We operate in a very competitive and rapidly changing environment. New risk factors emerge

from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements. You should not rely upon forward-looking statements as predictions of future

events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or

occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by

applicable laws including the securities laws of the United States, we assume no obligation to update or supplement forward-looking

statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This summary highlights information

contained elsewhere in this prospectus supplement and the accompanying base prospectus. It does not contain all of the information

that you should consider before making an investment decision. You should read this entire prospectus supplement, the accompanying

base prospectus and the documents incorporated herein by reference for a more complete understanding of this offering of common

stock. Please read “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2019 for

information regarding risks you should consider before investing in our common stock.

Throughout this prospectus supplement,

when we use the terms “Anavex,” “we,” “us,” “our” or the “Company,”

we are referring either to Anavex Life Sciences Corp. in its individual capacity or to Anavex Life Sciences Corp. and its operating

subsidiaries collectively, as the context requires.

Our Company

Overview

Anavex Life Sciences Corp. is a clinical stage

biopharmaceutical company engaged in the development of differentiated therapeutics by applying precision medicine to central nervous

system (“CNS”) diseases with high unmet need. We analyze genomic data from clinical studies to identify biomarkers,

which we use to select patients that will receive the therapeutic benefit for the treatment of neurodegenerative and neurodevelopmental

diseases.

Our lead compound, ANAVEX®2-73,

is being developed to treat Alzheimer’s disease, Parkinson’s disease and potentially other central nervous system diseases,

including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder caused by mutations in the X-linked

gene, methyl-CpG-binding protein 2 (“MECP2”).

Clinical Studies Overview

Alzheimer’s Disease

In November 2016, we completed a Phase 2a clinical

trial, consisting of PART A and PART B, which lasted a total of 57 weeks, for ANAVEX®2-73 in mild-to-moderate Alzheimer’s

patients. This open-label randomized trial met both primary and secondary endpoints and was designed to assess the safety and exploratory

efficacy of ANAVEX®2-73 in 32 patients. ANAVEX®2-73 targets sigma-1 and muscarinic receptors, which

have been shown in preclinical studies to reduce stress levels in the brain believed to restore cellular homeostasis and to reverse

the pathological hallmarks observed in Alzheimer’s disease. In October 2017, we presented positive pharmacokinetic (PK) and

pharmacodynamic (PD) data from the Phase 2a study, which established a concentration-effect relationship between ANAVEX®2-73

and study measurements. These measures obtained from all patients who participated in the entire 57 weeks include exploratory cognitive

and functional scores as well as biomarker signals of brain activity. Additionally, the study appears to show that ANAVEX®2-73

activity is enhanced by its active metabolite (ANAVEX19-144), which also targets the sigma-1 receptor and has a half-life approximately

twice as long as the parent molecule.

In March 2016, we received approval from the

Ethics Committee in Australia to extend the Phase 2a clinical trial by an additional 108 weeks, which had been requested by patients

and their caregivers. Subsequently, in May 2018, we received approval from the Ethics Committee in Australia to further extend

the Phase 2a extension trial for an additional two years. The two consecutive trial extensions have allowed participants who completed

the 52-week PART B of the study to continue taking ANAVEX®2-73, providing an opportunity to gather extended safety

data for a cumulative time period of five years.

In October 2018, we presented new long-term

clinical data for ANAVEX®2-73 in a presentation at the 2018 Clinical Trials on Alzheimer’s Disease (CTAD)

Meeting. At 148 weeks into the five-year extended Phase 2a clinical study, data confirmed a significant association between ANAVEX®2-73

concentration and both exploratory functional and cognitive endpoints as measured by the Alzheimer’s Disease Cooperative

Study-Activities of Daily Living (ADCS-ADL) evaluation and the Mini Mental State Examination (MMSE), respectively. The

cohort of patients treated with higher ANAVEX®2-73 concentration maintained ADCS-ADL performance compared to the

lower concentration cohort (p<0.0001). As well, the patient cohort with the higher ANAVEX®2-73 concentration

performed better at MMSE compared to the lower concentration cohort (p<0.0008). A significant impact on the drug response levels

of both the SIGMAR1 (p<0.0080) and COMT (p<0.0014) genomic biomarkers, identified and specified at week 57, was also confirmed

over the 148-week period. Further, ANAVEX®2-73 demonstrated continued favorable safety and tolerability through

148 weeks.

A larger Phase 2b/3 double-blind, placebo-controlled

study of ANAVEX®2-73 in Alzheimer’s disease commenced in August 2018, which is independent of the ongoing

Phase 2a extension study. The Phase 2b/3 study will enroll approximately 450 patients for 48 weeks, randomized 1:1:1 to two different

ANAVEX®2-73 doses or placebo. The trial is currently taking place in Australia; however, additional regions are

being added. The ANAVEX®2-73 Phase 2b/3 study design incorporates genomic precision medicine biomarkers identified

in the ANAVEX®2-73 Phase 2a study. Primary and secondary endpoints will assess safety and both cognitive and functional

efficacy, measured through Alzheimer’s Disease Assessment Scale – Cognition (ADAS-Cog), ADCS-ADL and Clinical Dementia

Rating – Sum of Boxes for cognition and function (CDR-SB).

In October 2019, we initiated a long-term open

label extension study, entitled the ATTENTION-AD study, for patients who have completed the 48-week Phase 2b/3 placebo-controlled

trial. This study is expected to last two years and will give patients the opportunity to continue their treatment.

Rett Syndrome

In February 2016, we presented positive preclinical

data for ANAVEX®2-73 in Rett syndrome, a rare neurodevelopmental disease. The study was funded by the International

Rett Syndrome Foundation (“Rettsyndrome.org”). In January 2017, we were awarded a financial grant from Rettsyndrome.org

of a minimum of $0.6 million to cover some of the costs of a multicenter Phase 2 clinical trial of ANAVEX®2-73 for

the treatment of Rett syndrome. This award is being received in quarterly instalments which commenced during fiscal 2018.

In March 2019, we commenced the first Phase

2 clinical trial in a planned Rett syndrome program of ANAVEX®2-73 for the treatment of Rett syndrome. The studies

will be conducted in a range of patient age demographics and geographic regions.

The first Phase 2 study, which commenced in

March 2019, is taking place in the United States and is a randomized double-blind, placebo-controlled safety, tolerability, pharmacokinetic

and efficacy study of oral liquid ANAVEX®2-73 formulation to treat Rett syndrome. Pharmacokinetic and dose findings

will be investigated in a total of 21 patients over a 7-week treatment period including ANAVEX®2-73-specific genomic

precision medicine biomarkers. All patients who participate in the study will be eligible to receive ANAVEX®2-73

under a voluntary open label extension protocol. Primary and secondary endpoints include safety as well as Rett syndrome conditions

such as cognitive impairment, motor impairment, behavioral symptoms and seizure activity. The ANAVEX®2-73 Phase

2 Rett syndrome study designs incorporate genomic precision medicine biomarkers identified in the ANAVEX®2-73 Phase

2a Alzheimer’s disease study.

In June 2019, we commenced the second Phase

2 study of ANAVEX®2-73 for the treatment of Rett syndrome, called the AVATAR study. This study is taking place in

Australia using a convenient once-daily oral liquid ANAVEX®2-73 formulation. Similar to the United States-based

Phase 2 study for Rett syndrome, the study will evaluate the safety and efficacy of ANAVEX®2-73 in approximately

33 patients over a 7-week treatment period including ANAVEX®2-73 specific precision medicine biomarkers. All patients

who participate in the study will be eligible to receive ANAVEX®2-73 under a voluntary open label extension protocol.

In September 2019, we announced approval from

the Australian Human Research Ethics Committee to commence the third study of ANAVEX®2-73 for the treatment of Rett

syndrome, called the EXCELLENCE study. Similar to the AVATAR study, this study is taking place in Australia and is using a convenient

once-daily oral liquid ANAVEX®2-73 formulation. The study will evaluate the safety and efficacy of ANAVEX®2-73

in at least 69 pediatric patients, aged 5 to 18, over a 12-week treatment period incorporating ANAVEX®2-73 specific

precision medicine biomarkers. All patients who participate in the study will be eligible to receive ANAVEX®2-73

under a voluntary open label extension protocol.

Parkinson’s Disease

In September 2016, we presented positive preclinical

data for ANAVEX®2-73 in Parkinson’s disease, which demonstrated significant improvements on all measures:

behavioral, histopathological, and neuroinflammatory endpoints. The study was funded by the Michael J. Fox Foundation. Additional

data was announced in October 2017 from the model for experimental parkinsonism. The data presented indicates that ANAVEX®2-73

induces robust neurorestoration in experimental parkinsonism. The encouraging results we have gathered in this model, coupled with

the favorable profile of this compound in the Alzheimer’s disease trial, support the notion that ANAVEX®2-73

is a promising clinical candidate drug for Parkinson’s disease dementia.

In October 2018, we initiated

a double-blind, randomized, placebo-controlled Phase 2 trial with ANAVEX®2-73 in Parkinson’s Disease Dementia

(PDD), which will study the effect of the compound on both the cognitive and motor impairment of Parkinson’s disease. The

Phase 2 study will enroll approximately 120 patients for 14 weeks, randomized 1:1:1 to two different ANAVEX®2-73

doses or placebo. The ANAVEX®2-73 Phase 2 PDD study design incorporates genomic precision medicine biomarkers identified

in the ANAVEX®2-73 Phase 2a study. The study has completed enrollment and topline results from this study are expected

by mid-2020.

Recent Developments

On March 11, 2020,

the World Health Organization declared the outbreak of a novel strain of coronavirus, COVID-19, a global pandemic, which continues

to spread throughout the United States and around the world. Effective as of March 20, 2020, the governor of the State of

New York issued a shelter-in-place order, which directed all businesses in the State of New York to cease non-essential operations

at physical locations in the counties, and these orders will continue to be in effect through April 29, 2020, unless extended,

rescinded, or amended. Similar orders have been issued in other state and local jurisdictions across the United States and in other

countries. Because of the nature of our operations, we are currently considered to be an essential business so, to date, our operations

have only been partially affected by this order. As we continue to actively advance all of our clinical programs, we are in close

contact with our principal investigators and clinical sites, which are primarily located in the United States and Australia, and

are assessing the impact of COVID-19 on our clinical trials, product candidate testing, expected timelines and costs on an ongoing

basis. In light of recent developments relating to the COVID-19 global pandemic, the focus of healthcare providers and hospitals

is the prioritization of healthcare resources toward fighting the virus. This partial disruption, although temporary, may impact

our operations and overall business by delaying the progress of our research and development programs, including our planned preclinical

studies and clinical trials. The impact of COVID-19 is evolving rapidly and its future effects are uncertain. Given the uncertainty

of the situation, the duration of the disruption and related financial impact cannot be reasonably estimated at this time. We will

continue to evaluate the impact of the COVID-19 pandemic on our business and expect to reevaluate the timing of our anticipated

preclinical and clinical objectives as we learn more and the impact of COVID-19 on our industry becomes more clear.

Corporate Information

Our principal executive office is located at

51 West 52nd Street, 7th Floor, New York, NY 10019-6163, and our telephone number is 844.689.3939. Our website address is www.anavex.com.

No information found on our website is part of this prospectus. Also, this prospectus may include the names of various government

agencies or the trade names of other companies. Unless specifically stated otherwise, the use or display by us of such other parties’

names and trade names in this prospectus is not intended to and does not imply a relationship with, or endorsement or sponsorship

of us by, any of these other parties.

THE OFFERING

|

Common stock offered by us in the Lincoln Park offering

|

Up to $30,000,000 of shares of our common stock we may sell

to Lincoln Park from time to time until the expiration of the registration statement of which this prospectus is a part or the

earlier termination of the Purchase Agreement by us; and

Up to 97,318 additional commitment shares valued at $331,854 based

on $3.41, the closing price of our common stock on The Nasdaq Capital Market on April 27 2020, which is the amount of additional

shares we may issue for no cash consideration to Lincoln Park from time to time pro-rata in connection with the purchase

of $30,000,000 of shares of our common stock under the Purchase Agreement.

|

|

|

|

|

Use of Proceeds

|

We intend to use the net proceeds from this offering for general corporate purposes, which may include, among other things, working capital, capital expenditures and funding additional clinical and preclinical development of our pipeline candidates. See “Use of Proceeds” on page S-8.

|

|

|

|

|

Risk Factors

|

You should read the “Risk Factors” section on page S-7 of this prospectus supplement and the other risks identified in the documents incorporated by reference herein before making a decision to purchase common stock in this offering.

|

|

|

|

|

Nasdaq Capital Market symbol

|

“AVXL.”

|

The number of shares of common stock shown

above to be outstanding after this offering is based on 58,664,946 shares of common stock outstanding as of April 27, 2020 and

excludes the following:

|

|

●

|

9,986,266 shares of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted- average exercise price of $3.47 per share; and

|

|

|

●

|

500,000 shares of common stock issuable upon the exercise of outstanding warrants with a weighted-average exercise price of $3.88 per share.

|

RISK FACTORS

An investment in our common stock

involves a significant degree of risk. Before you invest in our common stock you should carefully consider those risk factors included

in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, any subsequently filed Quarterly

Reports on Form 10-Q and any subsequently filed Current Reports on Form 8-K, which are incorporated herein by reference, and those

risk factors that may be included in any applicable prospectus supplement, together with all of the other information included

in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference, in evaluating an

investment in our common stock. If any of the risks discussed in the foregoing documents were to occur, our business, financial

condition, results of operations and cash flows could be materially adversely affected. Please read “Cautionary Statement

Regarding Forward-Looking Statements.”

Risks Relating to the Purchase Agreement

The sale or issuance of our common stock

to Lincoln Park may cause dilution and the sale of the shares of common stock acquired by Lincoln Park, or the perception that

such sales may occur, could cause the price of our common stock to fall.

On June 7, 2019, we entered into the Purchase

Agreement with Lincoln Park, pursuant to which Lincoln Park has committed to purchase up to $50 million of shares of our common

stock (of which $30,000,000 of such shares are registered hereunder), and we may still issue up to 97,318 additional commitment

shares pro-rata in connection with the purchase of shares of our common stock under the Purchase Agreement. We may sell purchase

shares to Lincoln Park pursuant to the Purchase Agreement at our discretion from time to time for a 36-month period, which commenced

on June 7, 2019.

We previously issued 324,383 shares of our

common stock to Lincoln Park for no cash consideration as a fee for Lincoln Park’s execution of the Purchase Agreement, and

we issued 15,032 additional commitment shares pro-rata in connection with the purchase of 1,500,000 shares of our common stock

under the Purchase Agreement between June 7 and July 19, 2019, all of which were registered under our registration statement (File

No. 333-207600). Following the effectiveness of the registration statement of which this prospectus supplement is a part, we also

issued 49,841 additional commitment shares pro-rata in connection with the purchase of 5,964,584 shares of our common stock under

the Purchase Agreement pursuant to a prospectus supplement dated September 13, 2019.

The purchase price for the shares that we may

sell to Lincoln Park under the Purchase Agreement will fluctuate based on the price of our common stock. Depending on market liquidity

at the time, sales of such shares may cause the trading price of our common stock to fall.

We have the right to control the timing and

amount of any sales of our shares to Lincoln Park in our sole discretion, subject to certain limits on the amount of shares that

can be sold on a given date. Sales of shares of our common stock, if any, to Lincoln Park will depend upon market conditions and

other factors to be determined by us. Therefore, Lincoln Park may ultimately purchase all, some or none of the shares of our common

stock that may be sold pursuant to the Purchase Agreement and, after it has acquired shares, Lincoln Park may sell all, some or

none of those shares. Sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our

common stock. Additionally, the sale of a substantial number of shares of our common stock to Lincoln Park, or the anticipation

of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a

price that we might otherwise wish to effect sales, which could have a materially adverse effect on our business and operations.

You may experience future dilution as a result of future equity

offerings or the exercise of stock options.

To raise additional capital, we may in the

future offer additional shares of our common stock at prices that may not be the same as the price per share in this offering.

The price per share at which we sell additional shares of our common stock in future transactions may be higher or lower than the

price per share paid by investors in this offering. In addition, we have a significant number of stock options outstanding. To

the extent that outstanding stock options may be exercised, or other shares issued, you may experience further dilution.

We may not be able to access sufficient

funds under the Purchase Agreement when needed.

Our ability to sell shares to Lincoln Park

and obtain funds under the Purchase Agreement is limited by the terms and conditions in the Purchase Agreement, including restrictions

on the amounts we may sell to Lincoln Park at any one time, and a limitation on our ability to sell shares to Lincoln Park to the

extent that it would cause Lincoln Park to beneficially own more than 4.99% of our outstanding shares of common stock. Additionally,

we will only be able to sell or issue to Lincoln Park 10,076,680 shares in total, which is equal to 19.99% of the shares of common

stock outstanding on the date of the Purchase Agreement unless we obtain shareholder approval or the average price of such sales

exceeds the price of our common stock on June 7, 2019 as determined under NASDAQ rules. Therefore, we currently do not, and may

not in the future, have access to the full amount available to us under the Purchase Agreement. In addition, any amounts we sell

under the Purchase Agreement may not satisfy all of our funding needs, even if we are able and choose to sell and issue all of

our common stock currently registered.

Our management might apply the net proceeds from this offering in ways

with which you do not agree and in ways that may impair the value of your investment.

We currently intend to use the net proceeds from this offering primarily

for working capital and general corporate purposes. Our management has broad discretion as to the use of such proceeds and you

will be relying on the judgment of our management regarding the application of these proceeds. Our management might apply these

proceeds in ways with which you do not agree, or in ways that ultimately do not yield a favorable return. If our management applies

such proceeds in a manner that does not yield a significant return, if any, on our investment of such net proceeds, it could compromise

our ability to pursue our growth strategy and adversely affect the market price of our common stock.

Risks Relating to Our Business Operations

The COVID-19 coronavirus could adversely

impact our business, including our clinical trials, and financial condition.

In December 2019, a novel strain of coronavirus,

COVID-19, was reported to have surfaced in Wuhan, China. Since then, the COVID-19 coronavirus has spread to multiple countries,

including the United States, Australia and European and Asia-Pacific countries, including countries in which we have planned or

active clinical trial sites. On January 30, 2020, the World Health Organization announced a global health emergency and in March

2020 classified the outbreak of the COVID-19 coronavirus as a pandemic, based on the rapid increase in exposure globally. As the

COVID-19 coronavirus continues to spread around the globe, we may experience disruptions that could potentially impact our business

and clinical trials.

In addition, the spread of COVID-19 coronavirus

has had and may continue to severely impact the trading price of shares of our common stock and could further severely impact our

ability to raise additional capital on a timely basis or at all.

The global outbreak of the COVID-19 coronavirus continues to rapidly

evolve. The extent to which the COVID-19 coronavirus may impact our business, including our clinical trials, and financial condition

will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic

spread of the disease, the duration of the outbreak, travel restrictions and social distancing in the United States and other countries,

business closures or business disruptions and the effectiveness of actions taken in the United States and other countries to contain

and treat the disease.

As a result of the COVID-19 coronavirus, on

March 27, 2020, the President of the United States signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The CARES Act, among other things, includes provisions relating to refundable payroll tax credits, deferment of employer side social

security payments, net operating loss carryback periods, alternative minimum tax credit refunds, modifications to the net interest

deduction limitations, increased limitations on qualified charitable contributions, and technical corrections to tax depreciation

methods for qualified improvement property.

It also appropriated funds for the SBA Paycheck

Protection Program loans that are forgivable in certain situations to promote continued employment, as well as Economic Injury

Disaster Loans to provide liquidity to small businesses harmed by COVID-19. There is no assurance we are eligible for these funds

or will be able to obtain them.

We do not expect the enactment of the CARES

Act will have a material impact on our financial condition, results of operations, or liquidity.

USE OF PROCEEDS

We intend to use the net proceeds from this offering for

general corporate purposes, which may include, among other things, working capital, capital expenditures and funding additional

clinical and preclinical development of our pipeline candidates.

DILUTION

The sale of

our common stock to Lincoln Park pursuant to the Purchase Agreement will have a dilutive impact on our stockholders. In addition,

the lower our stock price is at the time we exercise our right to sell shares to Lincoln Park, the more shares of our common stock

we will have to issue to Lincoln Park pursuant to the Purchase Agreement and our existing stockholders would experience greater

dilution. We calculate

net tangible

book value

per share

by dividing

the net

tangible

book value,

which

is tangible

assets

less

total

liabilities,

by the

number

of outstanding

shares

of common

stock.

Dilution

represents

the difference

between

the portion

of the

amount

per share

paid by purchasers

of shares

in this

offering

and the

as adjusted

net tangible

book value

per share

of our common

stock

immediately

after

giving

effect

to this

offering.

Our net

tangible

book value

as of December

31, 2019 was approximately

$26.0 million,

or $0.46 per share.

After

giving

effect

to the

sale of

common

stock

pursuant

to this

prospectus

supplement

and accompanying

prospectus

in the

aggregate

amount

of $30,000,000

at an assumed

offering

price

of $3.41 per share,

the last

reported

sale price

of our common

stock

on the

Nasdaq

Capital Market

on April 27, 2020, and

after

deducting

estimated

aggregate

offering

expenses

payable

by us, our

net tangible

book value

as of December

31, 2019 would

have

been $55.9 million,

or $0.85 per share

of common

stock.

This

represents

an immediate

increase

in the

net tangible

book value

of $0.39 per share

to our existing

stockholders

and an

immediate

dilution

in net

tangible

book value

of $2.56 per share

to new

investors.

The following

table

illustrates

this

per share

dilution:

|

Assumed public offering price per share

|

|

|

|

|

$

|

3.41

|

|

|

Net tangible book value per share as of December 31, 2019

|

|

$

|

0.46

|

|

|

|

|

|

Increase per share attributable to new investors

|

|

$

|

0.39

|

|

|

|

|

|

As adjusted net tangible book value per share as of December 31, 2019

after giving effect to this offering

|

|

|

|

|

$

|

0.85

|

|

|

Dilution per share to new investors purchasing shares in this offering

|

|

|

|

|

$

|

2.56

|

|

The table above assumes for illustrative purposes that an aggregate

of 8,797,654 shares of our common stock are sold pursuant to this prospectus supplement and the accompanying prospectus at a price

of $3.41 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on April

27, 2020, for aggregate gross proceeds of $30.0 million. The shares sold in this offering, if any, will be sold from time

to time at various prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price

of $3.41 per share shown in the table above, assuming all of our common stock in the aggregate amount of $30.0 million is sold

at that price, would result in an adjusted net tangible book value per share after the offering of $0.87 per share and would increase

the dilution in net tangible book value per share to new investors in this offering to $3.54 per share, after deducting estimated

aggregate offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed

offering price of $3.41 per share shown in the table above, assuming all of our common stock in the aggregate amount of $30.0 million

is sold at that price, would result in an adjusted net tangible book value per share after the offering of $0.80 per share and

would decrease the dilution in net tangible book value per share to new investors in this offering to $1.61 per share, after deducting

estimated aggregate offering expenses payable by us.

The above table and

discussion are based on 57,080,356 shares

of common stock outstanding as of December

31, 2019 and

exclude the following, all as of December 31, 2019:

|

|

·

|

8,726,266 shares

of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted-average exercise

price of $3.54 per

share; and

|

|

|

·

|

500,000 shares

of common stock issuable upon the exercise of outstanding warrants with a weighted-average exercise price of $3.88

per share.

|

To the extent that options or warrants outstanding as of December 31, 2019 have

been or are exercised, or other shares are issued, investors purchasing shares in this offering could experience further dilution.

In addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe

we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the

sale of equity, the issuance of these securities could result in further dilution to our stockholders.

LINCOLN PARK TRANSACTION

On June 7, 2019, we entered into the Purchase

Agreement and a Registration Rights Agreement (the “RRA”) with Lincoln Park. Pursuant to the terms of the Purchase

Agreement, Lincoln Park has agreed to purchase from us up to $50 million of shares of our common stock (subject to certain limitations).

On June 12, 2019, we filed a prospectus supplement

to our registration statement (File No. 333-207600) (the “2016 Registration Statement”) covering the issuance and sale

of (i) up to $20 million in shares of our common stock, (ii) 324,383 initial commitment shares as a commitment fee for Lincoln

Park for entering into the Purchase Agreement and (iii) 64,877 additional commitment shares. At September 11, 2019, we had sold

1,500,000 shares of common stock under the Purchase Agreement for gross proceeds of $4,634,505 and have issued 15,032 additional

commitment shares (in addition to the 324,383 initial commitment shares), all of which were registered under the 2016 Registration

Statement. As of September 6, 2019, the 2016 Registration Statement was no longer remain effective pursuant to Rule 415 under the

Securities Act), so we have deregistered all remaining shares of common stock issuable under the Purchase Agreement and registered

under the 2016 Registration Statement that have not been issued to Lincoln Park.

On July 3, 2019, we filed the

registration statement of which this prospectus supplement is a part, registering up to $250 million in securities utilizing

a shelf registration process and on September 13, 2019 following the deregistration of all shares remaining registered under

the 2016 Registration Statement, we filed a prospectus supplement to cover the issuance and sale of up to $15,514,532 of

shares of our common stock. As of May 1, 2020 all of such shares have been sold and/or issued to Lincoln Park.

Pursuant to the terms of the RRA, which requires

us to register purchase shares and additional commitment shares in order to sell purchase shares to Lincoln Park, we are filing

this prospectus supplement to cover (i) the offer and sale of up to $30,000,000 of shares of our common stock and (ii) the issuance

of up to 97,318 additional commitment shares to be issued pro-rata to Lincoln Park if and when we direct Lincoln Park to purchase

all of the available shares of common stock under the Purchase Agreement.

Purchase of Shares Under the Purchase Agreement

We may, from time to time until July 1, 2022,

in our sole discretion and subject to certain conditions outside of Lincoln Park’s control, direct Lincoln Park to purchase

up to 200,000 shares (the “Regular Purchase Share Limit”) of our common stock on any business day (each such purchase,

a “Regular Purchase”); provided that (i) the Regular Purchase Share Limit may be increased to up to 225,000 shares

if the closing price of our common stock is not below $4.00 on such date and (ii) the Regular Purchase Share Limit may be increased

to up to 250,000 shares if the closing price of our common stock is not below $6.00 on such date; and provided further that we

may also mutually agree with Lincoln Park to increase the Regular Purchase Share Limit to up to 1,000,000 shares and to make multiple

purchases in a given day. Additionally, all such share and dollar amounts shall be appropriately adjusted for any reorganization,

recapitalization, non-cash dividend, stock split or other similar transaction as provided in the Purchase Agreement, and in no

event shall Lincoln Park purchase more than $2,000,000 worth of our common stock pursuant to a Regular Purchase on any single business

day. The purchase price per share for each such Regular Purchase will be equal to the lower of:

|

|

●

|

the lowest sale price for our common stock on the purchase date of such shares; or

|

|

|

●

|

the arithmetic average of the three lowest closing sale prices for our common stock during the 10 consecutive business days ending on the business day immediately preceding the purchase date of such shares.

|

In addition to the Regular Purchases described

above, in the event we have directed Lincoln Park to purchase shares of our common stock not less than the Regular Purchase Share

Limit then in effect, on such purchase date we may also direct Lincoln Park to purchase an additional amount of our common stock

on the following business day (an “Accelerated Purchase”), not to exceed the lesser of:

|

|

●

|

30% of the aggregate shares of our common stock traded during normal trading hours on the purchase date; and

|

|

|

●

|

200% of the number of purchase shares purchased pursuant to the corresponding Regular Purchase.

|

The purchase price per share for each such

Accelerated Purchase will be equal to the lower of:

|

|

●

|

96% of the volume weighted average price during (i) the entire trading day on the purchase date, if the volume of shares of our common stock traded on the purchase date has not exceeded a volume maximum calculated in accordance with the Purchase Agreement, or (ii) the portion of the trading day of the purchase date (calculated starting at the beginning of normal trading hours) until such time at which the volume of shares of our common stock traded has exceeded such volume maximum; or

|

|

|

●

|

the closing sale price of our common stock on the purchase date.

|

In the event we have directed Lincoln Park

to purchase shares of our common stock in the full amount available for an Accelerated Purchase, on the date of such Accelerated

Purchase (which is the business day following the corresponding Regular Purchase), we may also direct Lincoln Park to purchase

an additional amount of our common stock under the same terms set forth above for an Accelerated Purchase (an “Additional

Accelerated Purchase”).

In the case of Regular Purchases, Accelerated

Purchases and Additional Accelerated Purchases, the purchase price per share will be adjusted for any reorganization, recapitalization,

non-cash dividend, stock split, reverse stock split or other similar transaction as set forth in the Purchase Agreement.

The Purchase Agreement limits our sales of

shares of common stock to Lincoln Park to 10,076,680 shares of our common stock, representing 19.99% of the shares of common stock

outstanding on the date of the Purchase Agreement unless (i) shareholder approval is obtained to issue more than such amount or

(ii) the average price of all applicable sales of our common stock to Lincoln Park under the Purchase Agreement equals or exceeds

the lower of (A) the closing price of our common stock on the Nasdaq Capital Market immediately preceding on June 7, 2019 or (B)

the average of the closing price of our common stock on the Nasdaq Capital Market for the five Business Days immediately preceding

on June 7, 2019, in each case calculated in accordance with Nasdaq rules.

Other than as set forth above, there are no

trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales

of our common stock to Lincoln Park.

Events of Default

Events of default under the Purchase Agreement

include the following:

|

|

●

|

the effectiveness of the registration statement of which this prospectus forms a part, or any other registration statement registering securities under the Purchase Agreement, lapses for any reason (including, without limitation, the issuance of a stop order), or any required prospectus supplement and accompanying prospectus are unavailable for the sale by Lincoln Park of our common stock offered hereby, and such lapse or unavailability continues for a period of 10 consecutive business days or for more than an aggregate of 30 business days in any 365-day period;

|

|

|

●

|

suspension by our principal market of our common stock from trading on the Nasdaq Capital Market for a period of three consecutive business days;

|

|

|

●

|

the delisting of the Common Stock from the NASDAQ Capital Market; provided, however, that the Common Stock is not immediately thereafter trading on the New York Stock Exchange, the NASDAQ Global Market, he NASDAQ Global Select Market, the NYSE American, the NYSE Arca or the OTC Bulletin Board, OTCQX or OTCQB operated by the OTC Markets Group, Inc. (or nationally recognized successor to any of the foregoing);

|

|

|

●

|

the transfer agent’s failure for three business days to issue to Lincoln Park shares of our common stock which Lincoln Park is entitled to receive under the Purchase Agreement;

|

|

|

●

|

any breach of the representations or warranties or covenants contained in the Purchase Agreement or any related agreement which has or which could have a material adverse effect on us subject to a cure period of five business days;

|

|

|

●

|

any voluntary or involuntary participation or threatened participation in insolvency or bankruptcy proceedings by or against us; and

|

|

|

●

|

if at any time we are not eligible to transfer our common stock electronically or a material adverse change in our business, financial condition, operations or prospects has occurred.

|

Lincoln Park does not have the right to terminate

the Purchase Agreement upon any of the events of default set forth above. During an event of default, all of which are outside

of Lincoln Park’s control, shares of our common stock cannot be sold by us or purchased by Lincoln Park under the Purchase

Agreement.

Our Termination Rights

We have the unconditional right, at any time,

for any reason and without any payment or liability to us, to give notice to Lincoln Park to terminate the Purchase Agreement.

In the event of bankruptcy proceedings by or against us, the Purchase Agreement will automatically terminate without action of

any party.

No Short-Selling or Hedging by Lincoln Park

Lincoln Park has agreed that neither it nor

any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior

to the termination of the Purchase Agreement.

Lincoln Park’s Registration Rights

Although the Purchase Agreement provides that

we may sell up to $50 million of shares of our common stock to Lincoln Park, we are only registering the $30,000,000 in shares

of common stock remaining to be purchased under the Purchase Agreement, and we are only registering the 97,318 remaining additional

commitment shares issuable under the Purchase Agreement under this prospectus supplement, as permitted by the RRA. Additionally,

if we do sell all of the shares of common stock covered hereunder, we will be required to file a new prospectus supplement covering

additional shares of common stock to be sold, and issued as additional commitment shares, to Lincoln Park under the Purchase Agreement.

Amount of Potential Proceeds to be Received

under the Purchase Agreement

|

Assumed Average Purchase Price Per Share

|

|

|

Number of Registered Shares to be Issued if Full Purchase(1)

|

|

|

Percentage of Outstanding Shares After Giving Effect to the Issuance to Lincoln Park(2)

|

|

|

Proceeds from the Sale of Shares Under the Purchase Agreement Registered in this Offering

|

|

|

$

|

2.50

|

|

|

|

12,097,318

|

|

|

|

17.10%

|

|

|

|

$30,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

3.41

|

(3)

|

|

|

8,894,972

|

|

|

|

13.17%

|

|

|

|

$30,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

5.00

|

|

|

|

6,097,318

|

|

|

|

9.41%

|

|

|

|

$30,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

7.50

|

|

|

|

4,097,318

|

|

|

|

6.53%

|

|

|

|

$30,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

10.00

|

|

|

|

3,097,318

|

|

|

|

5.01%

|

|

|

|

$30,000,000

|

|

_______________

|

|

(1)

|

Although the Purchase Agreement provides that we may sell up to $50,000,000 of our common stock to Lincoln Park, we are registering $30,331,854 of shares hereunder (inclusive of the 97,318 additional commitment shares that may be issued to Lincoln Park as a commitment fee) under this prospectus supplement, which may or may not cover all the shares we ultimately sell to Lincoln Park under the Purchase Agreement, depending on the purchase price per share. As a result, we have included in this column only those shares that we have initially reserved.

|

|

|

(2)

|

The denominator is

based on 58,664,946 shares outstanding as of April 27, 2020 and is inclusive of the 97,318 additional

commitment shares and the number of shares set forth in the adjacent column which we would have sold to Lincoln Park at the

applicable assumed average purchase price per share. The numerator includes the additional commitment shares that may be

issued to Lincoln Park pro rata. The number of shares in such column does not include shares that may be issued to Lincoln

Park under the Purchase Agreement which are not covered under this prospectus supplement.

|

|

|

(3)

|

The closing price of our common stock on April 27, 2020.

|

PLAN OF DISTRIBUTION

This prospectus supplement

and the accompanying prospectus include the issuance and sale of up to $30,331,854 of shares of our common stock that we may issue

to Lincoln Park from time to time under the Purchase Agreement. This prospectus supplement and the accompanying prospectus also

cover the resale of these shares by Lincoln Park to the public.

We entered into the Purchase

Agreement with Lincoln Park on June 7, 2019. In consideration for entering into the Purchase Agreement, we issued 324,383 shares

of our common stock to Lincoln Park as initial commitment shares, and may issue up to 162,191 shares of our common stock as additional

commitment shares (of which 97,318 additional commitment shares are registered hereunder) in connection with the purchase of our

common stock by Lincoln Park. The Purchase Agreement provides that, upon the terms and subject to the conditions set forth therein,

Lincoln Park is committed to purchase an aggregate of up to $50 million of shares of our common stock ($30,000,000 in shares is

registered hereunder) over the 36-month term of the Purchase Agreement. See “Lincoln Park Transaction.”

Lincoln Park is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act. Lincoln Park has informed us that it will use an unaffiliated broker-dealer

to effectuate all sales, if any, of the common stock that it may purchase from us pursuant to the Purchase Agreement. Such sales

will be made on the NASDAQ Capital Market at prices and at terms then prevailing or at prices related to the then current market

price. Each such unaffiliated broker-dealer will be an underwriter within the meaning of Section 2(a)(11) of the Securities Act.

Lincoln Park has informed us that each such broker-dealer will receive commissions from Lincoln Park that will not exceed customary

brokerage commissions.

We know of no existing

arrangements between Lincoln Park and any other stockholder, broker, dealer, underwriter, or agent relating to the sale or distribution

of the shares offered by this Prospectus. At the time a particular offer of shares is made, a prospectus supplement, if required,

will be distributed that will set forth the names of any agents, underwriters, or dealers and any compensation from the selling

stockholder, and any other required information.

We will pay all of the

expenses incident to the registration, offering, and sale of the shares to Lincoln Park.

We have agreed to indemnify

Lincoln Park and certain other persons against certain liabilities in connection with the offering of shares of common stock offered

hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute amounts required

to be paid in respect of such liabilities.

Lincoln Park represented

to us that at no time prior to the date of the Purchase Agreement has Lincoln Park or its agents, representatives or affiliates

engaged in or effected, in any manner whatsoever, directly or indirectly, any short sale (as such term is defined in Rule 200 of

Regulation SHO of the Exchange Act) of our Common Stock or any hedging transaction. Lincoln Park agreed that during the term of

the Purchase Agreement, it, its agents, representatives or affiliates will not enter into or effect, directly or indirectly, any

of the foregoing transactions.

We have advised Lincoln

Park that it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M

precludes Lincoln Park, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from

bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution

until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price

of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares

offered by this prospectus supplement.

Nevada Agency and Transfer

Company is transfer agent and registrar for the Common Stock. Our common stock is listed on The Nasdaq Capital Market under the

symbol “AVXL”.

LEGAL MATTERS

The validity of the securities offered

by this prospectus has been passed upon for us by Snell & Wilmer, L.L.P., Reno, Nevada.

EXPERTS

The financial statements as of September

30, 2019 and 2018 and for each of the two years in the period ended

September 30, 2019 and management’s assessment of the effectiveness of internal control over financial reporting as of September

30, 2019 incorporated by reference in this Prospectus have been so incorporated in reliance on the reports of BDO USA, LLP, an

independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts

in auditing and accounting. BDO’s report on the effectiveness of internal controls over financial reporting expresses an

adverse opinion on the effectiveness of the Company’s internal control over financial reporting as of September 30, 2019.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports and other information

with the SEC under the Exchange Act. You may read and copy any reports, statements or other information filed by us at the SEC’s

public reference room at 100 F Street, N.E., Washington, D.C. 20549. Our filings with the SEC are also available to the public

from commercial document retrieval services and at the SEC’s website at www.sec.gov.

We make available free of charge on our internet website

at www.anavex.com our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any

amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to,

the SEC. Information contained on our website is not incorporated by reference into this prospectus supplement and you should not

consider such information as part of this prospectus supplement.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus certain information that we file with the SEC, which means that we can disclose important

information to you by referring you to other documents separately filed by us with the SEC that contain such information. The information

we incorporate by reference is considered to be part of this prospectus and information we later file with the SEC will automatically

update and supersede the information in this prospectus. The following documents filed by us with the SEC pursuant to Section 13(a)

of the Exchange Act and any of our future filings under Sections 13(a), 13(c), 14 or 15 (d) of the Exchange Act, except for

information furnished under Item 2.02 or 7.01 of Current Report on Form 8-K, or exhibits related thereto, made before the termination

of the offering are incorporated by reference herein:

|

|

(1)

|

our Annual Report on Form 10-K for the fiscal year ended September 30, 2019, filed with the SEC on December 16, 2019;

|

|

|

(2)

|

our Quarterly Report on Form 10-Q for the period ended December 31, 2019, filed on February 6,

2020;

|

|

|

(3)

|

our Current Report on Form 8-K filed on April 8, 2020;

|

|

|

(4)

|

our Definitive Proxy Statement on Schedule 14A filed on February 20, 2020; and

|

|

|

(5)

|

the description of our Common Stock contained in the Registration Statement on Form 8-A (File No.

001-37606) filed with the SEC on October 23, 2015.

|

Any statement contained herein or

in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for

the purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which

also is or is deemed to be incorporated by reference herein modifies or replaces such statement. Any such statement so modified

or superseded shall not be deemed to constitute a part of this prospectus, except as so modified or superseded.

We will provide to each person, including

any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated

by reference in the prospectus contained in the registration statement but not delivered with the prospectus, other than an exhibit

to these filings unless we have specifically incorporated that exhibit by reference into the filing, upon written or oral request

and at no cost to the requester. Requests should be made by writing or telephoning us at the following address:

Anavex Life Sciences Corp.

51 West 52nd Street, 7th Floor

New York, NY 10019-6163

(844) 689-3939

PROSPECTUS

Anavex Life Sciences Corp.

$250,000,000 of Common Stock

and Warrants

Anavex Life Sciences Corp., a Nevada corporation

(“us”, “we”, “our”, “Anavex” or the “Company”)

may offer and sell from time to time, in one or more series or issuances and on terms that we will determine at the time of the

offering, shares of our common stock, par value $0.001 per share (“Common Stock“) and warrants (“Warrants”)

described in this prospectus, up to an aggregate amount of $250,000,000.

This prospectus provides you with a general

description of the securities offered. Each time we offer and sell securities, we will file a prospectus supplement to this prospectus

that contains specific information about the offering and, if applicable, the amounts, prices and terms of the securities. Such

supplements may also add, update or change information contained in this prospectus. You should carefully read this prospectus

and the applicable prospectus supplement before you invest in any of our securities. This prospectus may not be used to consummate

sales of securities unless accompanied by a prospectus supplement.

We may offer and sell the securities described

in this prospectus and any prospectus supplement directly to our stockholders or to other purchasers or through agents on our behalf

or through underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale of any

of these securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable

fees, commission or discounts.

Our Common Stock is currently quoted on

the Nasdaq Capital Market under the symbol “AVXL”. On July 2, 2019, the last reported sale price of our Common Stock

was $3.90 per share.

Investing in our securities

involves a high degree of risk. See the section entitled “Risk Factors” on page 11 of this prospectus and in the

documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for

certain risks and uncertainties you should consider.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is dated July 15, 2019.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus of Anavex Life Sciences

Corp., a Nevada corporation (collectively with all of its subsidiaries, the “Company”, “Anavex”, or “we”,

“us”, or “our”) is a part of a registration statement on Form S-3 that we filed with the Securities and

Exchange Commission (“SEC”) utilizing a “shelf” registration process. Under this shelf registration process,

we may, from time to time, sell the securities described in this prospectus in one or more offerings up to a total dollar amount

of $250,000,000 as described in this prospectus.

The registration statement of which this

prospectus is a part provides additional information about us and the securities offered under this prospectus. The registration

statement, including the exhibits and the documents incorporated herein by reference, can be read on the SEC website or at the

SEC offices mentioned under the heading “Prospectus Summary - Where You Can Find More Information.”

We will provide a prospectus supplement

containing specific information about the amounts, prices and terms of the securities for a particular offering. The prospectus

supplement may add, update or change information in this prospectus. If the information in the prospectus is inconsistent with

a prospectus supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus

and, if applicable, any prospectus supplement. See “Prospectus Summary — Where You Can Find More Information”

for more information.

You should rely only on the information

contained or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other person

to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not making offers to sell or solicitations to buy the securities in any jurisdiction in which an offer or solicitation

is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is

unlawful to make an offer or solicitation. You should not assume that the information in this prospectus or any prospectus supplement,

as well as the information we file or previously filed with the SEC that we incorporate by reference in this prospectus or any

prospectus supplement, is accurate as of any date other than the date of such document. Our business, financial condition, results

of operations and prospects may have changed since those dates.

PROSPECTUS

SUMMARY

The items in the following summary

are described in more detail later in this prospectus. This summary does not contain all of the information you should consider.

Before investing in our securities, you should read the entire prospectus carefully, including the “Risk Factors” beginning

on page 11 and the financial statements incorporated by reference.

Our Current Business

Anavex Life Sciences Corp. is a clinical

stage biopharmaceutical company engaged in the development of differentiated therapeutics by applying precision medicine to central

nervous system (“CNS”) diseases with high unmet need. We analyze genomic data from clinical studies to identify biomarkers,

which select patients that will receive the therapeutic benefit for the treatment of neurodegenerative and neurodevelopmental diseases.

Our lead compound, ANAVEX®2-73,

is being developed to treat Alzheimer’s disease, Parkinson’s disease and potentially other central nervous system diseases,

including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder caused by mutations in the X-linked

gene, methyl-CpG-binding protein 2 (“MECP2”).

Our total portfolio currently consists

of five programs. To prioritize the allocation of our resources, we designate certain programs as core programs and others as seed

programs, and we currently have two core programs and three seed programs. Our core programs are at various stages of clinical

and preclinical development, in neurodegenerative and neurodevelopmental diseases.

We have a portfolio of compounds varying

in sigma-1 receptor (S1R) binding activities. The SIGMAR1 gene encodes the S1R protein, which is an intracellular chaperone protein

with important roles in cellular communication. S1R is also involved in transcriptional regulation at the nuclear envelope and

restores homeostasis and stimulates recovery of cell function when activated. In order to validate the ability of our compounds

to activate quantitatively the S1R, we performed in collaboration with Stanford University a quantitative Positron Emission Tomography

(PET) imaging scan in mice, which demonstrated a dose-dependent ANAVEX®2-73 target engagement or receptor occupancy

(RO) with S1R in the brain.

Cellular Homeostasis

Many diseases are possibly directly caused

by chronic homeostatic imbalances or cellular stress of brain cells. In pediatric diseases like Rett syndrome or infantile spasms,

the chronic cellular stress is possibly caused by the presence of a constant genetic mutation. In neurodegenerative diseases, such

as Alzheimer’s and Parkinson’s diseases, chronic cellular stress is possibly caused by age-correlated buildup of cellular

insult and hence chronic cellular stress. Specifically, defects in homeostasis of protein or ribonucleic acid (“RNA”)

lead to the death of neurons and dysfunction of the nervous system. The spreading of protein aggregates resulting in a proteinopathy,

a characteristic finding in Alzheimer’s and Parkinson’s diseases that results from disorders of protein synthesis,

trafficking, folding, processing or degradation in cells. The clearance of macromolecules in the brain is particularly susceptible

to imbalances that result in aggregation and degeneration in nerve cells. For example, Alzheimer’s disease pathology is characterized

by the presence of amyloid plaques, neurofibrillary tangles, which are aggregates of hyperphosphorylated Tau protein that are a

marker of other diseases known as tauopathies as well as inflammation of microglia. With the SIGMAR1 activation through SIGMAR1

agonists like ANAVEX®2-73, our approach is to restore cellular balance, i.e. homeostasis. Therapies that correct

defects in cellular homeostasis might have the potential to halt or delay neurodevelopmental and neurodegenerative disease progression.

ANAVEX®2-73-specific Biomarkers

A full genomic analysis of Alzheimer’s

disease (AD) patients treated with ANAVEX®2-73 resulted in the identification of actionable genetic variants. A

significant impact of the genomic biomarkers SIGMAR1, the direct target of ANAVEX®2-73 and COMT, a gene involved

in memory function, on the drug response level was identified, leading to an early ANAVEX®2-73-specific biomarker

hypothesis. It is expected that excluding patients with these two identified biomarker variants (approximately 10%-20% of

the population) in prospective studies would identify approximately 80%-90% patients that would display clinically significant

improved functional and cognitive scores. The consistency between the identified DNA and RNA data related to ANAVEX®2-73,

which are considered independent of AD pathology, as well as multiple endpoints and time-points, provides support for precision

medicine clinical development of ANAVEX®2-73 by using genetic biomarkers identified within the study population

itself to target patients who are most likely to respond to ANAVEX®2-73 treatment in AD as well as indications like

Parkinson’s disease dementia (PDD) or Rett syndrome (RTT) in which ANAVEX®2-73 is currently studied or planned

to be studied.

Clinical Studies Overview

In November 2016, we completed a Phase

2a clinical trial, consisting of PART A and PART B, which lasted a total of 57 weeks, for ANAVEX®2-73 in mild-to-moderate

Alzheimer’s patients. This open-label randomized trial met both primary and secondary endpoints and was designed to assess

the safety and exploratory efficacy of ANAVEX®2-73 in 32 patients. ANAVEX®2-73 targets sigma-1 and

muscarinic receptors, which have been shown in preclinical studies to reduce stress levels in the brain believed to restore cellular

homeostasis and to reverse the pathological hallmarks observed in Alzheimer’s disease. In October 2017, we presented positive

pharmacokinetic (PK) and pharmacodynamic (PD) data from the Phase 2a study, which established a concentration-effect relationship

between ANAVEX®2-73 and study measurements. These measures obtained from all patients who participated in the entire

57 weeks include exploratory cognitive and functional scores as well as biomarker signals of brain activity. Additionally, the

study appears to show that ANAVEX®2-73 activity is enhanced by its active metabolite (ANAVEX19-144), which also

targets the sigma-1 receptor and has a half-life approximately twice as long as the parent molecule.

In March 2016, we received approval from