As filed with the Securities and Exchange Commission on July 10, 2020

Registration Number 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

------------

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Amyris, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

2860

(Primary Standard Industrial Classification Code Number)

55-0856151

(IRS Employer Identification Number)

5885 Hollis Street, Suite 100

Emeryville, CA 94608

(510) 450-0761

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

John Melo

President and Chief Executive Officer

5885 Hollis Street, Suite 100

Emeryville, CA 94608

(510) 450-0761

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Please send copies of all correspondence to:

Gordon K. Davidson, Esq.

David Michaels, Esq.

Amanda L. Rose, Esq.

Fenwick & West LLP

801 California Street

Mountain View, California 94041

(650) 988-8500

Approximate date of commencement of proposed sale to the public: From time to time after the effectiveness of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer

|

Accelerated filer

|

|

Non-accelerated filer

|

Smaller reporting company

|

|

|

Emerging growth company

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities to be registered

|

Amount to be registered (1)

|

Proposed maximum offering price per unit (2)

|

Proposed maximum aggregate offering price (2)

|

Amount of registration fee

|

|

Common Stock, $0.0001 par value per share

|

65,166,658

|

$4.45

|

$289,991,628.10

|

$37,640.91

|

(1)Pursuant to Rule 416 under the Securities Act of 1933, this Registration Statement shall also cover any additional shares of common stock which become issuable by reason of any stock dividend, stock split or other similar transaction effected without the receipt of consideration that results in an increase in the number of outstanding shares of the registrant’s common stock.

(2)In accordance with Rule 457(c) under the Securities Act of 1933, the aggregate offering price of the registrant’s common stock is estimated solely for the purpose of calculating the registration fees due for this filing. For the initial filing of this Registration Statement, this estimate was based on the average of the high and low sales price of the registrant’s common stock reported by The Nasdaq Global Select Market on July 9, 2020.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PRELIMINARY PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PRELIMINARY PROSPECTUS IS NOT AN OFFER TO SELL NOR DOES IT SEEK AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION DATED JULY 10, 2020

PROSPECTUS

AMYRIS, INC.

65,166,658 Shares of Common Stock

This prospectus relates to the registration for potential offer and sale from time to time of up to 65,166,658 shares of our common stock, par value $0.0001 per share (the “Shares”), by the selling stockholders identified in the “Selling Stockholders” section of this prospectus. The shares of common stock registered hereunder consist of (i) outstanding shares of common stock issued to the selling stockholders pursuant to those certain Securities Purchase Agreements, dated June 1, 2020 and June 4, 2020, by and among the Company and the selling stockholders (the “Purchase Agreements”), and (ii) shares issuable to the selling stockholders upon conversion of shares of the Company’s Series E Convertible Preferred Stock, par value $0.0001 per share (the “Series E Preferred Stock”), issued to such selling stockholders pursuant to the Purchase Agreements and the Certificate of Designation of Preferences, Rights and Limitations of Series E Convertible Preferred Stock filed with the Secretary of State of Delaware on June 5, 2020 (the “Series E Certificate of Designation”). For more information regarding the Shares, see “Selling Stockholders” below.

The selling stockholders may sell the Shares directly to purchasers or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions. The selling stockholders may sell the Shares at any time at market prices prevailing at the time of sale or at privately negotiated prices. For more information regarding the selling stockholders and the sale of the Shares, see “Selling Stockholders” and “Plan of Distribution” below.

We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the Shares by the selling stockholders. We will pay the expenses incurred in registering the Shares, including legal and accounting fees.

Our common stock is traded on The Nasdaq Global Select Market under the symbol “AMRS.” On July 8, 2020, the closing price of our common stock was $4.62 per share.

Investing in our securities involves risks. See “Risk Factors” commencing on page 3. You should carefully read this prospectus, the documents incorporated herein, and, if applicable, any prospectus supplement subsequently filed with respect to this prospectus, before making any investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

i

|

|

|

1

|

|

|

3

|

|

|

6

|

|

|

6

|

|

|

7

|

|

|

14

|

|

|

17

|

|

|

20

|

|

|

22

|

|

|

22

|

|

|

22

|

|

|

22

|

INFORMATION CONTAINED IN THIS PROSPECTUS

Neither we nor the selling stockholders have authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus. Neither we nor the selling stockholders take any responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. This prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus, is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus, is delivered or securities are sold on a later date.

This prospectus may be supplemented from time to time by one or more prospectus supplements. Any such prospectus supplements may include additional information, such as additional risk factors or other special considerations applicable to us, our business or results of operations or our common stock, and may also update or change the information in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement.

For investors outside the United States, neither we nor the Selling Stockholder has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the U.S. Persons who come into possession of this prospectus and any free writing prospectus related to this offering in jurisdictions outside the U.S. are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

|

|

|

|

|

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and in the documents incorporated by reference herein. Because it is a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus and the documents incorporated by reference herein, including our consolidated financial statements and the related notes and the information set forth under the section “Risk Factors”. Some of the statements in this prospectus and the documents incorporated by reference herein constitute forward-looking statements that involve risks and uncertainties. See information set forth under the section “Forward-Looking Statements”. Except where the context requires otherwise, references in this prospectus to “Amyris,” “the Company,” “we,” “us” and “our” refer to Amyris, Inc., together with its consolidated subsidiaries, taken as a whole.

About This Prospectus

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “Commission”) to register 65,166,658 shares of our common stock (the “Shares”). The Shares registered hereunder consist of (i) outstanding shares of common stock issued to the selling stockholders pursuant to those certain Securities Purchase Agreements, dated June 1, 2020 and June 4, 2020, by and among the Company and the selling stockholders (the “Purchase Agreements”), and (ii) shares issuable to the selling stockholders upon conversion of shares of the Company’s Series E Convertible Preferred Stock, par value $0.0001 per share (the “Series E Preferred Stock”), issued to such selling stockholders pursuant to the Purchase Agreements and the Certificate of Designation of Preferences, Rights and Limitations of Series E Convertible Preferred Stock filed with the Secretary of State of Delaware on June 5, 2020 (the “Series E Certificate of Designation”). The Shares are being registered for resale or other disposition by the selling stockholders. We will not receive any proceeds from the sale or other disposition of the Shares registered hereunder, or interests therein.

About Amyris, Inc.

As a leading biotechnology company, we apply our technology platform to engineer, manufacture and sell high performance, natural, sustainably sourced products into the Clean Health & Beauty, and Flavor & Fragrance markets. Our proven technology platform enables us to rapidly engineer microbes and use them as catalysts to metabolize renewable, plant-sourced sugars into large volume, high-value ingredients. Our platform, combined with our proprietary fermentation process, replaces existing complex and expensive manufacturing processes. We have successfully used our technology to develop and produce nine distinct molecules at commercial volumes, leading to more than 17 commercial ingredients used by thousands of leading global brands.

We believe that synthetic biology represents a third industrial revolution, bringing together biology and engineering to generate new, more sustainable materials to meet the growing global demand for bio-based replacements for petroleum-based and traditional animal- or plant-derived ingredients. We continue to build demand for our current portfolio of products through an extensive sales network provided by our collaboration partners that represent leading companies for our target market sectors. We also have a small group of direct sales and distributors who support our Clean Beauty market and proprietary sweetener product, purecane. Via our partnership model, our partners invest in the development of each molecule to bring it from the lab to commercial-scale and use their extensive sales force to sell our ingredients and formulations to their customers as part of their core business. We capture long-term revenue both through the production and sale of the molecule to our partners and through royalty revenues from our partners' product sales to their customers.

We were founded in 2003 in the San Francisco Bay area by a group of scientists from the University of California, Berkeley. Our first major milestone came in 2005 when, through a grant from the Bill & Melinda Gates Foundation, we developed technology capable of creating microbial strains that produce artemisinic acid, a precursor of artemisinin, an effective anti-malarial drug. Building on our success with artemisinic acid, in 2007 we began applying our technology platform to develop, manufacture and sell sustainable alternatives to a broad range of markets. We focused our initial development efforts primarily on the production of Biofene®, our brand of renewable farnesene, a long-chain, branched hydrocarbon molecule that we manufacture through fermentation using engineered microbes. The commercialization of farnesene pushed us to create a more cost efficient, faster and accurate development process in the lab and to drive manufacturing costs down. This investment has enabled our technology platform to rapidly develop microbial strains and commercialize target molecules. In 2014, we began manufacturing additional molecules for the Flavor & Fragrance industry; in 2015 we began investing to expand our capabilities to other small molecule chemical classes beyond terpenes via our collaboration with the Defense Advanced Research Projects Agency (DARPA); and in 2016 we expanded into proteins.

|

|

|

|

|

|

We have invested over $700 million in infrastructure and technology to create microbes that produce molecules from sugar or other feedstocks at commercial-scale. This platform has been used to design, build, optimize and upscale strains producing nine distinct molecules at commercial volumes, leading to more than 17 commercial ingredients used by thousands of leading global brands. Our time to market for molecules has decreased from seven years to less than a year for our most recent molecule, mainly due to our ability to leverage the technology platform we have built.

Our technology platform has been in active use since 2007 and has been integrated with our commercial production since 2011, creating an organism development process that we believe makes us an industry leader in the successful scale-up and commercialization of biotech-produced ingredients. The key performance characteristics of our platform that we believe differentiate us include our proprietary computational tools, strain construction tools, screening and analytics tools, and advanced lab automation and data integration. Having this fully integrated with our large-scale manufacturing process and capability enables us to always engineer with the end specification and requirements guiding our technology. Our state-of-the-art infrastructure includes industry-leading strain engineering and lab automation located in Emeryville, California, pilot-scale production facilities in Emeryville, California and Campinas, Brazil, a demonstration-scale facility in Campinas, Brazil and a commercial-scale production facility in Leland, North Carolina, which is owned and operated by our Aprinnova joint venture to convert our Biofene into squalane and other final products.

We are able to use a wide variety of feedstocks for production, but have focused on accessing Brazilian sugarcane for our large-scale production because of its renewability, low cost and relative price stability. We have also successfully used other feedstocks such as sugar beets, corn dextrose, sweet sorghum and cellulosic sugars at various manufacturing facilities.

Several years ago, we made the strategic decision to transition our business model from collaborating and commercializing molecules in low margin commodity markets to higher margin specialty markets. We began the transition by first commercializing and supplying farnesene-derived squalane as a cosmetic ingredient sold to formulators and distributors. We also entered into collaboration and supply agreements for the development and commercialization of molecules within the Flavor & Fragrance and Clean Beauty markets where we utilize our strain generation technology to develop molecules that meet the customer’s rigorous specifications. During this transition, we solidified the business model of partnering with our customers to create sustainable, high performing, low-cost molecules that replace an ingredient in their supply chain, commercially scale and manufacture those molecules, and share in the profits earned by our customers once our customer sells its product into these specialty markets. These three steps constitute our grants and collaborations revenues, renewable product revenues, and royalty revenues.

During this transition, we solidified the business model of partnering with our customers to create sustainable, high performing, low-cost molecules that replace an ingredient in their supply chain, commercially scale and manufacture those molecules, and share in the profits earned by our customers once our customer sells its product into these specialty markets. These three steps constitute our grants and collaborations revenues, renewable product revenues, and royalty revenues.

Corporate Information

We were originally incorporated in California in 2003 under the name Amyris Biotechnologies, Inc. and then reincorporated in Delaware in 2010 and changed our name to Amyris, Inc. Our principal executive offices are located at 5885 Hollis Street, Suite 100, Emeryville, California 94608, and our telephone number is (510) 450-0761. Our common stock is listed on The Nasdaq Global Select Market under the symbol “AMRS.” Our website address is www.amyris.com. The information contained in or accessible through our website or contained on other websites is not a part of, and not incorporated into, this prospectus.

Amyris, the Amyris logo, Biofene, Biossance, Pipette, Purecane and No Compromise are trademarks or registered trademarks of Amyris, Inc or its subsidiaries. This report also contains trademarks and trade names of other businesses that are the property of their respective holders. Solely for convenience, the trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

|

RISK FACTORS

Investing in our common stock involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the risks and uncertainties described below, together with all of the other information set forth in this prospectus or incorporated herein by reference, including the consolidated financial statements and related notes, and the risks and uncertainties discussed under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019 and in Part II, Item 1A of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which are incorporated by reference herein in their entirety. If any of the risks described herein or therein actually occur, our business, financial condition and results of operations could suffer. In these circumstances, the market price of our common stock could decline and you may lose all or part of your investment in our common stock.

Additional risks and uncertainties beyond those set forth in this prospectus or in our reports filed with the Commission and not presently known to us or that we currently deem immaterial may also affect our operations. Any risks and uncertainties, whether set forth in this prospectus or in our reports filed with the Commission or otherwise, could cause our business, financial condition, results of operations and future prospects to be materially and adversely harmed. The trading price of our securities could decline due to any of these risks and uncertainties, and, as a result, you may lose all or part of your investment.

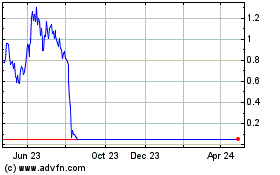

Our stock price may be volatile.

The market price of our common stock has been, and we expect it to continue to be, subject to significant volatility, and it has declined significantly from our initial public offering price. As of July 8, 2020, the reported closing price of our common stock on The Nasdaq Global Select Market (“Nasdaq”) was $4.62 per share. Market prices for securities of early stage companies have historically been particularly volatile. Such fluctuations could be in response to, among other things, the factors described in this “Risk Factors” section, or other factors, some of which are beyond our control, such as:

•fluctuations in our financial results or outlook or those of companies perceived to be similar to us;

•changes in estimates of our financial results or recommendations by securities analysts;

•changes in market valuations of similar companies;

•changes in the prices of commodities associated with our business such as sugar and petroleum or changes in the prices of commodities that some of our products may replace, such as oil and other petroleum sourced products;

•changes in our capital structure, such as future issuances of securities or the incurrence of debt;

•announcements by us or our competitors of significant contracts, acquisitions or strategic partnerships;

•regulatory developments in the United States, Brazil, and/or other foreign countries;

•litigation involving us, our general industry or both;

•additions or departures of key personnel;

•investors’ general perception of us; and

•changes in general economic, industry and market conditions.

Furthermore, stock markets have experienced price and volume fluctuations that have affected, and continue to affect, the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These broad market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rate changes and international currency fluctuations, may negatively affect the market price of our common stock.

In the past, many companies that have experienced volatility and sustained declines in the market price of their stock have become subject to securities class action and derivative action litigation. We were involved in two such lawsuits which were dismissed in 2014, were involved in five such lawsuits that were dismissed in September 2017, July 2018 and September 2018, respectively, were involved in two such lawsuits that were dismissed in October 2019 and December 2019, are currently involved in one such lawsuit, and we may be the target of this type of litigation in the future. Securities litigation

against us could result in substantial costs and divert our management’s attention from other business concerns, which could seriously harm our business.

The concentration of our capital stock ownership with insiders will limit the ability of other stockholders to influence corporate matters and presents risks related to the operations of our significant stockholders.

As of June 30, 2020, significant stockholders held an aggregate total of 48.7% of the Company's total common shares outstanding, as follows: Foris Ventures, LLC (Foris) (28.6%), FMR LLC (8.7%), DSM International B.V. (6.4%), and Vivo Capital LLC (Vivo) (5.0%). Furthermore, each of these parties holds some or a combination of convertible preferred stock, warrants and purchase rights, pursuant to which they may acquire additional shares of our common stock and thereby increase their ownership interest in our company. Additionally, Foris is indirectly owned by John Doerr, one of our current directors, and each of DSM and Vivo have the right to designate one or more directors to serve on our Board of Directors pursuant to agreements between us and such stockholders. This significant concentration of share ownership may adversely affect the trading price of our common stock because investors often perceive disadvantages in owning stock in companies with stockholders with significant interests. Also, these stockholders, acting together, may be able to control or significantly influence our management and affairs and matters requiring stockholder approval, including the election of directors and the approval of significant corporate transactions, such as mergers, consolidations or the sale of all or substantially all of our assets, and may not act in the best interests of our other stockholders. Consequently, this concentration of ownership may have the effect of delaying or preventing a change of control, or a change in our management or Board of Directors, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our company, even if such actions would benefit our other stockholders.

In addition, certain of our stockholders, including DSM International B.V., are also our commercial partners and have various rights in connection with their security ownership in us. These stockholders may have interests that are different from those of our other stockholders, including with respect to our company’s commercial transactions. While we have a related-party transactions policy that requires certain approvals of any transaction between our company and a significant stockholder or its affiliates, there can be no assurance that our significant stockholders will act in the best interests of our other stockholders, which could harm our results of operations and cause our stock price to decline.

The market price of our common stock could be negatively affected by future sales of our common stock.

If our existing stockholders, particularly our largest stockholders, our directors, their affiliates, or our executive officers, sell a substantial number of shares of our common stock in the public market, the market price of our common stock could decrease significantly. The perception in the public market that these stockholders might sell our common stock could also depress the market price of our common stock and could impair our future ability to obtain capital, especially through an offering of equity securities.

We have in place, or have agreed to file, registration statements for the resale of certain shares of our common stock held by, or issuable to, certain of our largest stockholders, including the registration statement of which this prospectus forms a part. All of our common stock sold pursuant to an offering covered by such registration statements will be freely transferable. In addition, shares of our common stock issued or issuable under our equity incentive plans have been registered on Form S-8 registration statements and may be freely sold in the public market upon issuance, except for shares held by affiliates who have certain restrictions on their ability to sell.

If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts may publish about us, our business, our market or our competitors. If any of the analysts who cover us change their recommendation regarding our stock adversely, or provide more favorable relative recommendations about our competitors, our stock price would likely decline. If any analyst who may cover us were to cease coverage of our company or fail to

regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

We do not expect to declare any dividends in the foreseeable future.

We do not anticipate declaring any cash dividends to holders of our common stock in the foreseeable future. In addition, certain of our equipment leases and credit facilities currently restrict our ability to pay dividends. Consequently, investors may need to rely on sales of their shares of our common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment. Investors seeking cash dividends should not purchase our common stock.

Anti-takeover provisions contained in our Certificate of Incorporation and Bylaws, as well as provisions of Delaware law, could impair a takeover attempt.

Our Certificate of Incorporation and Bylaws contain provisions that could delay or prevent a change in control of our company. These provisions could also make it more difficult for stockholders to nominate directors and take other corporate actions. These provisions include:

•a staggered Board of Directors;

•authorizing the Board of Directors to issue, without stockholder approval, preferred stock with rights senior to those of our common stock;

•authorizing the Board of Directors to amend our Bylaws, to increase the number of directors and to fill board vacancies until the end of the term of the applicable class of directors;

•prohibiting stockholder action by written consent;

•limiting the liability of, and providing indemnification to, our directors and officers;

•eliminating the ability of our stockholders to call special meetings; and

•requiring advance notification of stockholder nominations and proposals.

Section 203 of the Delaware General Corporation Law prohibits, subject to some exceptions, “business combinations” between a Delaware corporation and an “interested stockholder,” which is generally defined as a stockholder who becomes a beneficial owner of 15% or more of a Delaware corporation’s voting stock, for a three-year period following the date that the stockholder became an interested stockholder. We have agreed to opt out of Section 203 through our Certificate of Incorporation, but our Certificate of Incorporation contains substantially similar protections to our company and stockholders as those afforded under Section 203, except that we have agreed with Total that it and its affiliates will not be deemed to be “interested stockholders” under such protections.

These and other provisions in our Certificate of Incorporation and our Bylaws could discourage potential takeover attempts, reduce the price that investors are willing to pay in the future for shares of our common stock and result in the market price of our common stock being lower than it would be without these provisions.

FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and the other documents we have filed with the Commission that are incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties, including those discussed under the heading “Risk Factors” above, include our liquidity and ability to fund operating and capital expenses, potential delays or failures in development, production and commercialization of products, and our reliance on third parties.

All statements other than statements of historical fact are statements that could be deemed to be forward-looking statements, including any projections of financing needs, revenue, expenses, earnings or losses from operations, or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning product research, development and commercialization plans and timelines; any statements regarding expected production capacities, volumes and costs; any statements regarding anticipated benefits of our products and expectations for commercial relationships; any other statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. The words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “project,” “will be,” “will continue,” “will result,” “seek,” “could,” “may,” “might,” or any variations of such words or other words with similar meanings generally identify forward-looking statements.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. You should read this prospectus, any supplements to this prospectus and the documents that we incorporate by reference in this prospectus with the understanding that our actual future results may be materially different from what we expect.

The forward-looking statements in this prospectus and in any prospectus supplement or other document we have filed with the Commission and incorporated herein represent our views as of the date thereof. We anticipate that subsequent events and developments will cause our views to change. All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. However, while we may elect to update these forward-looking statements at some point in the future or to conform these statements to actual results or revised expectations, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this prospectus or such prospectus supplement or other document.

USE OF PROCEEDS

The proceeds from the sale of the Shares offered pursuant to this prospectus are solely for the accounts of the selling stockholders. Accordingly, we will not receive any of the proceeds from the sale of the Shares offered by this prospectus. See “Selling Stockholders” and “Plan of Distribution” below.

SELLING STOCKHOLDERS

The Shares being offered by the selling stockholders under this prospectus consist of (i) outstanding shares of common stock issued to the selling stockholders pursuant to the Purchase Agreements, and (ii) shares issuable to the selling stockholders upon conversion of shares of the Company’s Series E Preferred Stock issued to such selling stockholders pursuant to the Purchase Agreements and the Series E Certificate of Designation. The Shares are being registered for resale or other disposition by the selling stockholders. We will not receive any proceeds from the sale or other disposition of the Shares registered hereunder, or interests therein. Pursuant to the Purchase Agreements, we have agreed to file a registration statement with the Commission covering the resale of the Shares, and this registration statement has been filed pursuant to those agreements.

Series E Convertible Preferred Stock

The conversion and exercise terms of the Series E Preferred Stock are as follows:

Each share of Series E Preferred Stock (the “Preferred Shares”) has a stated value of $1,000 and is convertible into 333.33 shares of common stock. All Preferred Shares shall be automatically converted, without any further action by the holder, on the first trading day after the Company obtains Stockholder Approval (as defined below), which is being sought at the Company’s special meeting of stockholders to be held on August 14, 2020.

Unless and until converted into shares or our common stock in accordance with its terms, the Preferred Shares have no voting rights, other than as required by law or with respect to matters specifically affecting the Preferred Shares. The Preferred Shares entitle the holders thereof to (i) receive, if the Company declares or makes any dividend or other distribution of its assets to holders of shares of our common stock other than dividends in the form of common stock (a “Distribution”), payments on Preferred Shares equal to and in the same form as such Distribution actually paid on shares of our common stock when, as and if such Distribution are paid on shares of our common stock; and (ii) participate pari passu with the holders of our common stock in the net assets of the Company upon any liquidation, dissolution or winding-up of the Company, after the satisfaction in full of the debts of the Company and the payment of any liquidation preference owed to the holders of shares of capital stock of the Company ranking senior to the Series E Convertible Preferred Stock upon liquidation.

Pursuant to the Purchase Agreements, we agreed to obtain our stockholders’ approval for the issuance of shares of our common stock issuable upon conversion of the Series E Preferred Stock as is required by the applicable rules and regulations of the Nasdaq Stock Market, including Nasdaq Listing Standard Rule 5635(d) (the “Stockholder Approval”). We are seeking the Stockholder Approval at the special meeting of stockholders to be held on August 14, 2020.

Selling Stockholders

The table below lists the selling stockholders and other information regarding their beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations thereunder) of our common stock as of June 30, 2020. Under Section 13(d) of the Exchange Act, beneficial ownership generally includes voting or investment power with respect to securities, including any securities that grant the holder the right to acquire shares of common stock within 60 days of the date of determination. These shares are deemed to be outstanding for the purpose of computing the percentage ownership of the person holding those securities, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. The percentage ownership data is based on 204,618,423 shares of our common stock issued and outstanding as of June 30, 2020 (as reflected in the records of our stock transfer agent).

We have prepared the table below based on information furnished to us by or on behalf of the selling stockholders. The second column of the table lists the number of shares of common stock beneficially owned by the selling stockholders as of June 30, 2020. The third column of the table lists the shares of common stock issuable to the selling stockholders upon conversion of shares of the Company’s Series E Preferred Stock issued to such selling stockholders pursuant to the Purchase Agreements and the Series E Certificate of Designation. The fourth column of the table lists the shares of common stock

being offered under this prospectus by the selling stockholders or by those persons or entities to whom they transfer, donate, devise, pledge or distribute their Shares or by other successors in interest. The Shares may be sold pursuant to this prospectus or in privately negotiated transactions. See “Plan of Distribution.” Because the selling stockholders may sell all, some or none of their Shares in this offering and because there are currently no agreements, arrangements or undertakings with respect to the sale of any of the Shares, we cannot estimate the number of Shares the selling stockholders will sell under this prospectus. The fourth column of the table assumes the sale of all of the Shares offered by the selling stockholders pursuant to this prospectus.

The selling stockholders have not held any position or office or had any other material relationship with us or any of our predecessors or affiliates within the past three years, other than: (i) the acquisition and beneficial ownership of the Shares described in the tables below or other of our debt or equity securities, (ii) with respect to Foris Ventures, LLC, it is a greater than 20% stockholder of us and is affiliated with our director John Doerr, with respect to Perrara Ventures, LLC, it is affiliated with our director John Doerr, and (iv) with respect to Vivo Capital LLC (“Vivo”), director Frank Kung is a member of Vivo, which is an affiliate of each of Vivo Opportunity Fund, LP, Vivo Capital Fund IX, LP, Vivo Capital Fund VIII, LP and Vivo Capital Surplus Fund VIII, LP, and was designated to serve on our Board of Directors pursuant to the right of Vivo to designate one member of our Board of Directors under that certain Stockholder Agreement, dated August 3, 2017, between us, on the one hand, and Vivo Capital Fund VIII, L.P. and Vivo Capital Surplus Fund VIII, L.P., on the other hand.

Unless otherwise indicated in the footnotes below, we believe that the selling stockholders have sole voting and investment power with respect to all shares of our common stock beneficially owned by them. Since the date on which they provided us with the information below, the selling stockholders may have sold, transferred or otherwise disposed of some or all of their shares in transactions exempt from the registration requirements of the Securities Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Stockholder

|

|

|

Shares of Common Stock Beneficially Owned Prior to Offering (1)

|

|

Shares of Common Stock to be Issued Upon Conversion of the Series E Preferred Stock (1)

|

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus (2)

|

Shares of Common Stock Beneficially Owned After Offering (1)(2)

|

|

|

Foris Ventures, LLC(3)

|

|

|

67,268,358

|

31.5%

|

6,666,666

|

6,666,666

|

67,268,358

|

31.5%

|

|

Perrara Ventures, LLC (4)

|

|

|

-

|

-

|

3,333,333

|

3,333,333

|

-

|

-

|

|

Variable Insurance Products Fund III: Balanced Portfolio (5)

|

|

|

1,583,403

|

*

|

-

|

168,952

|

1,414,451

|

*

|

|

Fidelity Advisor Series I: Fidelity Advisor Balanced Fund (6)

|

|

|

1,360,547

|

*

|

-

|

148,235

|

1,212,312

|

*

|

|

Fidelity Puritan Trust: Fidelity Balanced Fund (7)

|

|

|

11,077,962

|

5.3%

|

-

|

1,182,813

|

9,895,149

|

4.8%

|

|

Vivo Opportunity Fund, L.P. (8)

|

|

|

2,473,280

|

1.2%

|

1,996,096

|

4,469,376

|

-

|

-

|

|

Vivo Capital Fund IX, L.P. (9)

|

|

|

551,884

|

*

|

445,406

|

997,290

|

-

|

-

|

|

Vivo Capital Fund VIII, L.P. (10)

|

|

|

9,058,383

|

4.4%

|

470,912

|

1,054,400

|

8,474,895

|

4.1%

|

|

Vivo Capital Surplus Fund VIII, L.P. (11)

|

|

|

1,250,773

|

*

|

65,028

|

145,601

|

1,170,200

|

*

|

|

Loyola Capital Partners, LP (12)

|

|

|

7,187,368

|

3.5%

|

312,630

|

699,998

|

6,800,000

|

3.3%

|

|

Farallon Capital Partners, L.P. (13)

|

|

|

753,524

|

*

|

608,144

|

1,361,668

|

-

|

-

|

|

Farallon Capital Institutional Partners, L.P. (13)

|

|

|

2,015,239

|

1.0%

|

1,626,427

|

3,641,666

|

-

|

-

|

|

Farallon Capital Institutional Partners II, L.P. (13)

|

|

|

490,667

|

*

|

396,000

|

886,667

|

-

|

-

|

|

Farallon Capital Institutional Partners III, L.P. (13)

|

|

|

175,238

|

*

|

141,430

|

316,668

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Four Crossings Institutional Partners V, L.P. (13)

|

|

|

315,429

|

*

|

254,570

|

569,999

|

-

|

-

|

|

Farallon Capital Offshore Investors II, L.P. (13)

|

|

|

2,803,810

|

1.4%

|

2,262,854

|

5,066,664

|

-

|

-

|

|

Farallon Capital F5 Master I, L.P. (13)

|

|

|

332,953

|

*

|

268,714

|

601,667

|

-

|

-

|

|

Farallon Capital (AM) Investors, L.P. (13)

|

|

|

122,667

|

*

|

99,000

|

221,667

|

-

|

-

|

|

Casdin Partners Master Fund, L.P. (14)

|

|

|

5,349,376

|

2.6%

|

4,317,290

|

9,666,666

|

-

|

-

|

|

AST Small-Cap Growth Opportunities Portfolio, a series of Advanced Series Trust (15)

|

|

|

327,657

|

*

|

265,927

|

593,584

|

-

|

-

|

|

Victory RS Small Cap Growth Fund, a series of Victory Portfolios (15)

|

|

|

2,447,976

|

1.2%

|

1,986,790

|

4,434,766

|

-

|

-

|

|

Victory RS Small Cap Equity Fund, a series of Victory Portfolios (15)

|

|

|

73,240

|

*

|

59,444

|

132,684

|

-

|

-

|

|

Victory RS Small Cap Growth Equity VIP Series, a series of Victory Variable Insurance Funds (15)

|

|

|

113,500

|

*

|

92,117

|

205,617

|

-

|

-

|

|

Victory RS Small Cap Growth Collective Fund, a series of Victory Capital International Collective Investment Trust (15)

|

|

|

239,996

|

*

|

194,780

|

434,776

|

-

|

-

|

|

JNL Multi- Manager Small Cap Growth Fund, a series of JNL Series Trust (15)

|

|

|

427,933

|

*

|

347,314

|

775,247

|

-

|

-

|

|

Japan Trustee Services Bank, Ltd. as Trustee for SMTB U.S. Small And Mid Cap Growth Concentrated Mother Fund (15)

|

|

|

3,964

|

*

|

3,217

|

7,181

|

-

|

-

|

|

The Master Trust Bank of Japan, Ltd. as Trustee for U.S. Small And Mid Cap Growth Concentrated M F (USD Denominated) (15)

|

|

|

45,712

|

*

|

37,100

|

82,812

|

-

|

-

|

|

RTW Master Fund, LTD. (16)

|

|

|

2,186,739

|

1.1%

|

1,258,737

|

2,818,385

|

-

|

-

|

|

RTW Innovation Master Fund, LTD. (16)

|

|

|

841,750

|

*

|

481,627

|

1,078,391

|

-

|

-

|

|

RTW Venture Fund Limited (16)

|

|

|

93,175

|

*

|

46,100

|

103,223

|

-

|

-

|

|

Perceptive Life Sciences Master Fund, Ltd. (17)

|

|

|

1,844,612

|

*

|

1,488,720

|

3,333,332

|

-

|

-

|

|

Nantahala Capital Partners II Limited Partnership(18)

|

|

|

331,546

|

*

|

267,579

|

599,125

|

-

|

-

|

|

Nantahala Capital Partners Limited Partnership(18)

|

|

|

121,547

|

*

|

98,097

|

219,644

|

-

|

-

|

|

Blackwell Partners LLC - Series A (18)

|

|

|

257,780

|

*

|

208,045

|

465,825

|

-

|

-

|

|

Silver Creek CS SAV, L.L.C. (18)

|

|

|

84,911

|

*

|

68,529

|

153,440

|

-

|

-

|

|

Nantahala Capital Partners SI, LP (18)

|

|

|

729,180

|

*

|

588,495

|

1,317,675

|

-

|

-

|

|

NCP QR LP (18)

|

|

|

135,187

|

*

|

109,105

|

244,292

|

-

|

-

|

|

Blue Water Life Science Master Fund, Ltd. (19)

|

|

|

1,448,867

|

*

|

863,457

|

1,933,332

|

378,992

|

*

|

|

Maven Investment Partners US Ltd – New York Branch (20)

|

|

|

737,845

|

*

|

595,487

|

1,333,332

|

-

|

-

|

|

Tamarack Global Healthcare Fund, LP (21)

|

|

|

1,173,633

|

*

|

-

|

1,173,633

|

-

|

-

|

|

Tamarack Global Healthcare Fund QP, LP (21)

|

|

|

159,700

|

*

|

-

|

159,700

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Koyote Trading LLC (22)

|

|

|

844,076

|

*

|

148,870

|

333,331

|

659,615

|

*

|

|

All other selling stockholders (23)

|

|

|

1,619,112

|

*

|

908,123

|

2,033,335

|

493,900

|

*

|

|

TOTAL

|

|

|

|

|

33,382,160

|

65,166,658

|

|

|

|

*

|

Represents beneficial ownership of less than one percent of the outstanding shares of our common stock.

|

|

|

|

|

|

|

|

(1)The shares of common stock beneficially owned prior to and after this offering exclude the number of shares of our common stock issuable to the selling stockholders upon conversion of shares of Series E Preferred Stock, subject to the Stockholder Approval. The number of shares of common stock to be issued upon conversion of the Series E Preferred Stock reflects the maximum number of shares to be issued to each selling stockholder in accordance with the Series E Certificate of Designation.

(2)We do not know when or in what amounts a selling stockholder may offer Shares for sale. The selling stockholders may not sell any or all of the Shares offered by this prospectus. Because the selling stockholders may offer all or some of the Shares pursuant to this offering and because there are currently no agreements, arrangements or undertakings with respect to the sale of any of the Shares, we cannot estimate the number of Shares that will be held by the selling stockholders after completion of this offering. However, for illustrative purposes of this table, we have assumed that, after completion of this offering, none of the Shares covered by this prospectus will be held by the selling stockholders.

(3)The shares of common stock beneficially owned prior to this offering include 8,778,230 shares of our common stock issuable upon exercise of certain rights to purchase common stock held by Foris Ventures, LLC (“Foris”) and also exclude 16,680,334 shares of our common stock issuable upon exercise by Foris of its option to convert all or any portion of the secured indebtedness outstanding under the Amended and Restated Loan and Security Agreement dated October 28, 2019, as further amended on June 1, 2020, into shares of our common stock, in accordance with Nasdaq Listing Standard Rule 5635(d), which conversion is subject to stockholder approval at our special meeting of stockholders scheduled to be held on August 14, 2020. Foris is indirectly owned by director John Doerr, who shares voting and investment control over the shares held by Foris. Barbara S. Hager, in her capacity as Manager of Foris may also be deemed to have investment discretion and voting power over the shares held by Foris. The address for Foris is 751 Laurel Street #717, San Carlos, California 94070.

(4)Perrara Ventures, LLC is indirectly owned by director John Doerr, who shares voting and investment control over the shares held by Perrara Ventures, LLC. Barbara S. Hager, in her capacity as Manager of Perrara Ventures, LLC may also be deemed to have investment discretion and voting power over the shares held by Perrara Ventures, LLC. The address for Perrara Ventures, LLC is 751 Laurel Street #717, San Carlos, California 94070.

(5)The shares of common stock beneficially owned prior to this offering include 381,451 shares of common stock issuable upon exercise of rights to purchase our common stock held by Variable Insurance Products Fund III: Balanced Portfolio, which is managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds advised by FMR Co, a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds' Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds' Boards of Trustees. The address for Variable Insurance Products Fund III: Balanced Portfolio is P.O. Box 35308, Newark, NJ 07101-8006.

(6)The shares of common stock beneficially owned prior to this offering include 320,612 shares of common stock issuable upon exercise of rights to purchase our common stock held by Fidelity Advisor Series I: Fidelity Advisor Balanced Fund, which is managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds advised by FMR Co, a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds' Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds' Boards of Trustees. The address for Fidelity Advisor Series I: Fidelity Advisor Balanced Fund is P.O. Box 35308, Newark, NJ 07101-8006.

(7)The shares of common stock beneficially owned prior to this offering include 2,782,258 shares of common stock issuable upon exercise of rights to purchase our common stock held by Fidelity Puritan Trust: Fidelity Balanced Fund, which is managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds' Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds' Boards of Trustees. The address for Fidelity Puritan Trust: Fidelity Balanced Fund is 333 South Wabash Ave, 32nd Floor, Chicago, Illinois 60604.

(8)Vivo Opportunity Fund, LLC is the general partner of Vivo Opportunity Fund, L.P. The voting members of Vivo Opportunity Fund, LLC are Dr. Albert Cha, Dr. Gaurav Aggarwal, Shan Fu, Dr. Frank Kung and Michael Chang, none of whom has individual voting or investment power with respect to the securities covered hereby. The address for Vivo Opportunity Fund, L.P. is 192 Lytton Avenue, Palo Alto, California 94301.

(9)Vivo Capital Fund IX, LLC is the general partner of Vivo Capital Fund IX, L.P. The voting members of Vivo Capital Fund IX, LLC are Dr. Frank Kung, Dr. Albert Cha, Dr. Edgar Engleman, Dr. Chen Yu and Shan Fu, none of whom has individual voting or investment power with respect to the securities covered hereby. The address for Vivo Capital Fund IX, LP is 192 Lytton Avenue, Palo Alto, California 94301.

(10)The shares of common stock beneficially owned prior to this offering include (i) 1,707,831 shares currently issuable to Vivo Capital Fund VIII, L.P. upon conversion of shares of our Series D Convertible Preferred Stock, which conversion is subject to a 9.99% beneficial ownership limitation, and (ii) 1,065,676 shares currently issuable to Vivo Capital Fund VIII, LP upon exercise of certain common stock purchase warrants, which exercise is subject to a 19.99% ownership limitation. Vivo Capital VIII, LLC is the general partner of Vivo Capital Fund VIII, L.P. The voting members of Vivo Capital VIII, LLC are Dr. Frank Kung, Dr. Albert Cha, Dr. Edgar Engleman, Dr. Chen Yu and Shan Fu, none of whom has individual voting or investment power with respect to the securities covered hereby. The address for Vivo Capital Fund VIII, L.P. is 192 Lytton Avenue, Palo Alto, California 94301.

(11)The shares of common stock beneficially owned prior to this offering include (i) 235,830 shares currently issuable to Vivo Capital Surplus Fund VIII, L.P. upon conversion of shares of our Series D Convertible Preferred Stock, which conversion is subject to a 9.99% beneficial ownership limitation, and (ii) 147,111 shares currently issuable to Vivo Capital Surplus Fund VIII, LP upon exercise of certain common stock purchase warrants, which exercise is subject to a 19.99% ownership limitation. Vivo Capital VIII, LLC is the general partner of Vivo Capital Surplus Fund VIII, L.P. The voting members of Vivo Capital VIII, LLC are Dr. Frank Kung, Dr. Albert Cha, Dr. Edgar Engleman, Dr. Chen Yu and Shan Fu, none of whom has individual voting or investment power with respect to the securities covered hereby. The address for Vivo Capital Fund VIII, L.P. is 192 Lytton Avenue, Palo Alto, California 94301.

(12)Robert J. Reynolds, in his capacity as General Partner of Loyola Capital Partners, LP., may be deemed to have investment discretion and voting power over the shares held by Loyola Capital Partners, LP. The address for Loyola Capital Partners, LP is c/o Loyola Capital Management LLC, 222 E. Wisconsin Ave. Suite 201. Lake Forest, IL 60045.

(13)Farallon Partners, L.L.C. (“FPLLC”), as the general partner of each of Farallon Capital Partners, L.P., Farallon Capital Institutional Partners, L.P., Farallon Capital Institutional Partners II, L.P., Farallon Capital Institutional Partners III, L.P., Farallon Capital Offshore Investors II, L.P. and Farallon Capital (AM) Investors, L.P., (collectively, the “FPLLC Entities”), may be deemed to beneficially own such shares of common stock held by or issuable to each of the FPLLC Entities. Farallon F5 (GP), L.L.C. (“F5MI GP”), as the general partner of Farallon Capital F5 Master I, L.P. (“F5MI”), may be deemed to beneficially own such shares of common stock held by or issuable to F5MI. Farallon Institutional (GP) V, L.L.C. (“FCIP V GP”), as the general partner of Four Crossings Institutional Partners V, L.P. (“FCIP V”), may be deemed to beneficially own such shares of common stock held by or issuable to FCIP V. Each of Philip D. Dreyfuss, Michael B. Fisch, Richard B. Fried, David T. Kim, Michael G. Linn, Rajiv A. Patel, Thomas G. Roberts, Jr., William Seybold, Andrew J. M. Spokes, John R. Warren and Mark C. Wehrly (collectively, the “Farallon Managing Members”), as a (i) managing member or senior managing member, as the case may be, of FPLLC or (ii) manager or senior manager, as the case may be, of F5MI GP and FCIP V GP, in each case with the power to exercise investment discretion, may be deemed to beneficially own such shares of common stock held by or issuable to the FCPLLC Entities, F5MI or FCIP V. Each of FPLLC, F5MI GP, FCIP V GP and the Farallon Managing Members disclaims beneficial ownership of any such shares of common stock. The address of each of the entities and individuals referenced in this footnote is c/o Farallon Capital Management, L.L.C., One Maritime Plaza, Suite 2100, San Francisco, CA 94111.

(14)The shares of common stock beneficially owned by Casdin Partners Master Fund, L.P. may be deemed to be indirectly beneficially owned by (i) Casdin Capital, LLC, the investment adviser to Casdin Partners Master Fund, L.P., (ii) Casdin Partners GP, LLC, the general partner of Casdin Partners Master Fund L.P., and (iii) Eli Casdin, the managing member of Casdin Capital, LLC and Casdin Partners GP, LLC. Each of Casdin Capital, LLC, Casdin Partners GP, LLC and Eli Casdin disclaims beneficial ownership of such securities except to the extent of their respective pecuniary interest therein. The address for Casdin Partners Master Fund, L.P. is 1350 Avenue of the Americas, Suite 2600, New York, NY 10019.

(15)Victory Capital Management Inc. (“Victory Capital”) serves as the investment adviser or investment sub-adviser to the selling stockholder. Victory Capital is an indirect wholly owned subsidiary of Victory Capital Holdings, Inc., a publicly traded company with its principal address at 15935 La Cantera Parkway, San Antonio, TX, 78256. By delegation from the selling stockholder and, as applicable, the selling stockholder’s Board of Trustees, Victory Capital has the power to dispose of the securities through its investment franchise, RS Investments Growth, and to vote the securities in accordance with its proxy voting policy through its proxy committee, which is composed of seven individuals. The address for the selling stockholders is c/o Victory Capital Management Inc., 4900 Tiedeman Road, 4th Floor, Brooklyn, OH 44144.

(16) Roderick Wong, in his capacity as Director of RTW Master Fund, Ltd. and RTW Innovation Master Fund, Ltd. and Managing Partner of the Investment Manager of RTW Venture Fund Limited (collectively, “RTW”), may be deemed to have investment discretion and voting power over the shares held by RTW. The address for RTW is C/O RTW Investments, LP, 40 10th Avenue, 7th Floor New York, NY 10014.

(17)Joseph Edelman, in his capacity as Chief Executive Officer of Perceptive Life Sciences Master Fund LTD may be deemed to have investment discretion and voting power over the shares held by Perceptive Life Sciences Master Fund LTD. The address for Perceptive Life Sciences Master Fund LTD is 51 Astor Place 10th floor, New York, NY 10003.

(18)Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholders as a General Partner or Investment Manager and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or Nantahala that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Exchange Act or any other purpose. Wilmot Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by Nantahala. The address for Nantahala is c/o Nantahala Capital Management, LLC, 130 Main St. 2nd Floor, New Canaan, CT 06840.

(19)Nathaniel T. Cornell, in his capacity as Managing Partner of Blue Water Life Science Master Fund, Ltd., may be deemed to have investment discretion and voting power over the shares held by Blue Water Life Science Master Fund, Ltd.. The address for Blue Water Life Science Master Fund, Ltd. is 60 East Sir Francis Drake Blvd., Suite 202, Larkspur, CA 94939.

(20) Anand K. Sharma may be deemed to have investment discretion and voting power over the shares held by Maven Investment Partners US Ltd – New York Branch. The address for Maven Investment Partners US Ltd – New York Branch is 675 Third Avenue, 15th Floor, New York, NY 10017.

(21)Justin Ferayorni, in his capacity as Chief Investment Officer of Tamarack Global Healthcare Fund, LP and Tamarack Global Healthcare Fund QP, LP (collectively, “Tamarack”) may be deemed to have investment discretion and voting power over the shares held by Tamarack. The address for Tamarack is 5050 Avenida Encinas, Suite 360, Carlsbad, CA 92008.

(22) The shares of common stock beneficially owned prior to this offering include 384,615 shares currently issuable to Koyote Trading, LLC upon exercise of certain common stock purchase warrants. Richard Schottenfeld, in his capacity as Manager of Koyote Trading, LLC, may be deemed to have investment discretion and voting power over the shares held by Koyote Trading, LLC. The address for Koyote Trading, LLC is 800 3rd Ave., Floor 10, New York, NY 10022.

(23)Includes other selling stockholders that collectively beneficially own less than one percent of our common stock.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of June 30, 2020, the number and percentage of outstanding shares of our common stock beneficially owned by:

•each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding shares of our common stock;

•each of our current directors;

•each of our named executive officers; and

•all current directors and executive officers, as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and generally includes any shares over which the individual or entity has sole or shared voting power or investment power. These rules also treat as outstanding all shares of capital stock that a person would receive upon the exercise of any option, warrant or right or through the conversion of a security held by that person that are immediately exercisable or convertible or exercisable or convertible within 60 days of the date as of which beneficial ownership is determined. These shares are deemed to be outstanding and beneficially owned by the person holding those options, warrants or rights or convertible securities for the purpose of computing the number of shares beneficially owned and the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. The information does not necessarily indicate beneficial ownership for any other purpose. Except as indicated in the footnotes to the below table and pursuant to applicable community property laws, to our knowledge the persons named in the table below have sole voting and investment power with respect to all shares of common stock attributed to them in the table.

Information with respect to beneficial ownership has been furnished to us by each director and named executive officer and certain stockholders, and derived from publicly-available SEC beneficial ownership reports on Forms 3 and 4 and Schedules 13D and 13G filed by covered beneficial owners of our common stock. Percentage ownership of our common stock in the table is based on 204,618,423 shares of our common stock outstanding on June 30, 2020 (as reflected in the records of our stock transfer agent). Except as otherwise set forth below, the address of the beneficial owner is c/o Amyris, Inc., 5885 Hollis Street, Suite 100, Emeryville, California 94608.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

|

|

Number of Shares

Beneficially Owned (#)

|

|

|

|

|

Percent

of Class (%)

|

|

|

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

Foris Ventures, LLC(1)…………………………………………………….

|

|

|

67,268,358

|

|

|

|

|

31.5%

|

|

|

|

|

FMR LLC(2) ………………………………………………………………

|

|

|

21,336,047

|

|

|

|

|

10.3%

|

|

|

|

|

DSM International B.V(3)………………………………………………...

|

|

|

27,001,551

|

|

|

|

|

12.4%

|

|

|

|

|

Vivo Capital LLC(4) ………………………………………….

|

|

|

13,337,920

|

|

|

|

|

6.4%

|

|

|

|

|

Directors and Named Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

John Melo(5) ………………………………………………………………

|

|

|

780,168

|

|

|

|

|

*

|

|

|

|

|

John Doerr(1)(6) ……………………………………………………….

|

|

|

67,565,870

|

|

|

|

|

31.7%

|

|

|

|

|

Geoffrey Duyk(7) ………………………………………………………….

|

|

|

18,498

|

|

|

|

|

*

|

|

|

|

|

Philip Eykerman(8) ……………………………………………………..

|

|

|

15,864

|

|

|

|

|

*

|

|

|

|

|

Christoph Goppelsroeder(9) ………………………………………………

|

|

|

-

|

|

|

|

|

*

|

|

|

|

|

Frank Kung(4)(10) …………………………………………………………..

|

|

|

13,347,068

|

|

|

|

|

6.4%

|

|

|

|

|

James McCann(11) ……………………………………………………

|

|

|

3,506

|

|

|

|

|

*

|

|

|

|

|

Steven Mills(12) ………………………………………………………

|

|

|

18,314

|

|

|

|

|

*

|

|

|

|

|

Carole Piwnica(13) ………………………………………………………

|

|

|

5,758,835

|

|

|

|

|

2.8%

|

|

|

|

|

Lisa Qi…………………………………………………………………..

|

|

|

-

|

|

|

|

|

*

|

|

|

|

|

Patrick Yang(14) …………………………………………………………

|

|

52,592

|

|

|

|

*

|

|

|

|

|

|

|

Eduardo Alvarez(15) ……………………………………………………

|

|

265,940

|

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|