JOHNSTOWN, Pa., Oct. 16 /PRNewswire-FirstCall/ -- AmeriServ

Financial, Inc. (NASDAQ:ASRV) reported third quarter 2007 net

income of $874,000 or $0.04 per diluted share. This represents an

increase of $231,000 or 35.9% over the third quarter 2006 net

income of $643,000 or $0.03 per diluted share. For the nine month

period ended September 30, 2007, the Company has earned $2.1

million or $0.10 per diluted share. This represents an increase of

$359,000 or 20.5% when compared to net income of $1.8 million or

$0.08 per diluted share for the first nine months of 2006. The

following table highlights the Company's financial performance for

both the three and nine month periods ended September 30, 2007 and

2006: Third Third Nine Months Nine Months Quarter Quarter Ended

Ended 2007 2006 September September 30, 2007 30, 2006 Net income

$874,000 $643,000 $2,110,000 $1,751,000 Diluted earnings per share

$ 0.04 $ 0.03 $ 0.10 $ 0.08 At September 30, 2007, ASRV had total

assets of $898 million and shareholders' equity of $88.5 million or

a book value of $3.99 per share. The Company's asset leverage ratio

remained strong at 10.44% at September 30, 2007. Allan R. Dennison,

President and Chief Executive Officer, commented on the 2007

results, "Our focus on executing our strategic plan has caused

AmeriServ Financial to report improved financial performance for

both the third quarter and first nine months of 2007. We are better

leveraging our expense base to generate increased non-interest

revenue as evidenced by the successful acquisition of West Chester

Capital Advisors earlier in 2007. Continued solid growth in both

loans and deposits has caused our net interest income to increase

for three consecutive quarters in 2007 after bottoming in the

fourth quarter of 2006. Our asset quality continues to be sound as

non-performing assets amounted to only 0.39% of total loans and our

loan loss reserve provided 289% coverage of non-performing assets

at September 30, 2007. The recent turmoil in the financial markets

that led to a reduction in interest rates positions AmeriServ

Financial for further net interest income improvement in the fourth

quarter." The Company's net interest income in the third quarter of

2007 decreased by $77,000 from the prior year's third quarter and

for the first nine months of 2007 decreased by $592,000 when

compared to the first nine months of 2006. The Company's net

interest margin is also down by six and 14 basis points,

respectively for the quarter and nine month periods ended September

30, 2007. The decline in both net interest income and net interest

margin resulted from the Company's cost of funds increasing at a

faster pace than the earning asset yield. This resulted from

deposit customer preference for higher yielding certificates of

deposit and money market accounts due to the inverted/flat yield

curve with short-term interest rates exceeding intermediate to

longer term rates for the majority of the past 18 months. As

mentioned earlier, on a quarterly basis the Company's net interest

margin has shown improvement and stability in 2007 increasing from

2.97% in the first quarter to 3.00% in the third quarter. This

helped to reverse a trend of four consecutive quarters of net

interest income and margin contraction experienced in 2006 where

the margin declined from 3.20% to a low of 2.93% in the fourth

quarter. The recent Federal Reserve reduction in short-term

interest rates and the return to a more positively sloped yield

curve positions the Company well for net interest income and margin

expansion in the fourth quarter of 2007. As a result of execution

of our community bank focused strategic plan, the Company did have

increased loans and deposits on our balance sheet in 2007. Since

year-end 2006, total loans have grown by $40 million or 6.8% to

$629.6 million while total deposits have increased by $22 million

or 3.0% to $763.8 million. The loan growth was most evident in the

commercial loan portfolio with particularly strong performance

during the third quarter of 2007. The deposit growth was caused by

increased certificates of deposit as customers have demonstrated a

preference for this product due to higher short-term interest

rates. The Company recorded a $150,000 provision for loan losses in

the third quarter of 2007 compared to no loan loss provision in the

third quarter of 2006. For the nine month period ended September

30, 2007, the provision for loan losses also amounted to $150,000

compared to a negative loan loss provision of $50,000 realized for

the same period in 2006. The Company did experience higher net

charge-offs in the third quarter of 2007 due almost entirely to the

$875,000 complete charge-off of a commercial loan that resulted

from fraud committed by the borrower. This caused net charge-offs

to average loans to total 0.61% in the third quarter of 2007

compared to 0.39% in the third quarter of 2006. For the nine month

period ended September 30, 2007, net charge-offs have amounted to

$1.1 million or 0.25% of total loans compared to net charge-offs of

$791,000 or 0.19% of total loans for the same nine month period in

2006. Non-performing assets totaled $2.5 million or only 0.39% of

total loans at September 30, 2007. This compares favorably to non-

performing assets of $3.0 million or 0.51% of total loans at

September 30, 2006. The allowance for loan losses provided 289%

coverage of non-performing assets at September 30, 2007 compared to

353% coverage at December 31, 2006, and 279% coverage at September

30, 2006. The allowance for loan losses as a percentage of total

loans amounted to 1.13% at September 30, 2007. Note also that the

Company has no exposure to sub-prime mortgage loans in either the

loan or investment portfolios. The Company's non-interest income in

the third quarter of 2007 increased by $775,000 from the prior

year's third quarter and for the first nine months of 2007

increased by $1.1 million when compared to the first nine months of

2006. The increase for both periods was due in part to the West

Chester Capital Advisors acquisition which closed in early March of

2007. This accretive acquisition provided $275,000 of investment

advisory fees in the third quarter of 2007 and $706,000 of fees for

the nine month period ended September 30, 2007. Trust fees also

increased by $74,000 for the third quarter 2007 and by $155,000 or

3.2% for the first nine months of 2007 due to continued successful

new business development efforts and an increased value for trust

assets. The fair market value of trust assets totaled $1.85 billion

at September 30, 2007. The Company also realized an increase on

gains realized on residential mortgage loan sales into the

secondary market that amounted to $90,000 for the third quarter of

2007 and $151,000 for the first nine months of 2007. These

increases reflect greater residential mortgage production from the

Company's primary market as this has been an area of emphasis in

the strategic plan. Finally, other income increased by $259,000 in

the third quarter and $51,000 for the first nine months of 2007 due

in part to a $69,000 gain realized on the sale of a closed branch

facility and a $120,000 gain realized on the sale of equipment

obtained from a lease financing arrangement. The Company also

benefited from increased fees associated with the higher

residential mortgage loan production. Total non-interest expense in

the third quarter of 2007 increased by $209,000 from the prior

year's third quarter but for the first nine months of 2007 declined

by $231,000 when compared to the first nine months of 2006. The

largest factor responsible for the quarterly increase was the

inclusion of $233,000 of non-interest expenses from West Chester

Capital Advisors; the largest component of which was reflected in

salaries and employee benefits. West Chester Capital Advisors has

contributed $568,000 in non-interest expenses for the nine month

period ended September 30, 2007. The overall reduction in expenses

for the nine month period reflects the Company's continuing focus

on containing and reducing non-interest expenses. The largest

expense reductions were experienced in equipment expense

($223,000), professional fees ($118,000), other expenses ($466,000)

and FDIC deposit insurance expense (103,000). This news release may

contain forward-looking statements that involve risks and

uncertainties, as defined in the Private Securities Litigation

Reform Act of 1995, including the risks detailed in the Company's

Annual Report and Form 10-K to the Securities and Exchange

Commission. Actual results may differ materially. NASDAQ: ASRV

SUPPLEMENTAL FINANCIAL PERFORMANCE DATA October 16, 2007 (In

thousands, except per share and ratio data) (All quarterly and 2007

data unaudited) 2007 1QTR 2QTR 3QTR YEAR TO DATE PERFORMANCE DATA

FOR THE PERIOD: Net income $428 $808 $874 $2,110 PERFORMANCE

PERCENTAGES (annualized): Return on average assets 0.20% 0.37%

0.39% 0.32% Return on average equity 2.05 3.79 4.00 3.30 Net

interest margin 2.97 3.01 3.00 3.00 Net charge-offs as a percentage

of average loans 0.06 0.07 0.61 0.25 Loan loss provision as a

percentage of average loans - - 0.10 0.03 Efficiency ratio 94.16

88.52 87.15 89.84 PER COMMON SHARE: Net income: Basic $0.02 $0.04

$0.04 $0.10 Average number of common shares outstanding 22,159

22,164 22,175 22,166 Diluted 0.02 0.04 0.04 0.10 Average number of

common shares outstanding 22,166 22,171 22,177 22,170 2006 1QTR

2QTR 3QTR YEAR TO DATE PERFORMANCE DATA FOR THE PERIOD: Net income

$540 $568 $643 $1,751 PERFORMANCE PERCENTAGES (annualized): Return

on average assets 0.25% 0.26% 0.29% 0.27% Return on average equity

2.59 2.71 3.00 2.77 Net interest margin 3.20 3.16 3.06 3.14 Net

charge-offs as a percentage of average loans 0.09 0.07 0.39 0.19

Loan loss provision as a percentage of average loans - (0.04) -

(0.01) Efficiency ratio 92.68 92.08 91.38 92.05 PER COMMON SHARE:

Net income: Basic $0.02 $0.03 $0.03 $0.08 Average number of common

shares outstanding 22,119 22,143 22,148 22,137 Diluted 0.02 0.03

0.03 0.08 Average number of common shares outstanding 22,127 22,153

22,156 22,145 AMERISERV FINANCIAL, INC. (In thousands, except per

share, statistical, and ratio data) (All quarterly and 2007 data

unaudited) 2007 1QTR 2QTR 3QTR PERFORMANCE DATA AT PERIOD END:

Assets $891,559 $876,160 $897,940 Investment securities 185,338

174,508 170,765 Loans 603,834 604,639 629,564 Allowance for loan

losses 8,010 7,911 7,119 Goodwill and core deposit intangibles

15,119 14,903 14,687 Deposits 768,947 762,902 763,771 FHLB

borrowings 15,170 4,258 23,482 Stockholders' equity 85,693 86,226

88,517 Trust assets - fair market value (B) 1,828,475 1,872,366

1,846,240 Non-performing assets 2,706 2,825 2,463 Asset leverage

ratio 10.23% 10.36% 10.44% PER COMMON SHARE: Book value (A) $3.87

$3.89 $3.99 Market value 4.79 4.40 3.33 Market price to book value

123.88% 113.12% 83.44% STATISTICAL DATA AT PERIOD END: Full-time

equivalent employees 375 376 358 Branch locations 21 21 20 Common

shares outstanding 22,161,445 22,167,235 22,180,650 2006 1QTR 2QTR

3QTR 4QTR PERFORMANCE DATA AT PERIOD END: Assets $876,393 $887,608

$882,837 $895,992 Investment securities 223,658 210,230 209,046

204,344 Loans 548,466 573,884 580,560 589,435 Allowance for loan

losses 9,026 8,874 8,302 8,092 Goodwill and core deposit

intangibles 12,031 11,815 11,599 11,382 Deposits 727,987 740,979

743,687 741,755 FHLB borrowings 45,223 43,031 31,949 50,037

Stockholders' equity 84,336 84,231 86,788 84,684 Trust assets -

fair market value (B) 1,669,525 1,679,634 1,702,210 1,778,652

Non-performing assets 4,193 4,625 2,978 2,292 Asset leverage ratio

10.36% 10.54% 10.52% 10.54% PER COMMON SHARE: Book value $3.81

$3.80 $3.92 $3.82 Market value 5.00 4.91 4.43 4.93 Market price to

book value 131.26% 129.09% 113.07% 128.98% STATISTICAL DATA AT

PERIOD END: Full-time equivalent employees 375 367 364 369 Branch

locations 22 22 21 21 Common shares outstanding 22,140,172

22,145,639 22,150,767 22,156,094 Note: (A) Other comprehensive

income had a negative impact of $0.22 on book value per share at

September 30, 2007. (B) Not recognized on the balance sheet

AMERISERV FINANCIAL, INC. CONSOLIDATED STATEMENT OF INCOME (In

thousands) (All quarterly and 2007 data unaudited) 2007 1QTR 2QTR

3QTR YEAR TO DATE INTEREST INCOME Interest and fees on loans

$10,061 $10,303 $10,591 $30,955 Total investment portfolio 2,114

2,005 1,863 5,982 Total Interest Income 12,175 12,308 12,454 36,937

INTEREST EXPENSE Deposits 5,699 5,931 5,994 17,624 All borrowings

521 364 438 1,323 Total Interest Expense 6,220 6,295 6,432 18,947

NET INTEREST INCOME 5,955 6,013 6,022 17,990 Provision for loan

losses - - 150 150 NET INTEREST INCOME AFTER PROVISION FOR LOAN

LOSSES 5,955 6,013 5,872 17,840 NON-INTEREST INCOME Trust fees

1,704 1,689 1,677 5,070 Net realized gains on loans held for sale

25 79 116 220 Service charges on deposit accounts 585 636 671 1,892

Investment advisory fees 102 329 275 706 Bank owned life insurance

258 265 479 1,002 Other income 559 594 804 1,957 Total Non-Interest

Income 3,233 3,592 4,022 10,847 NON-INTEREST EXPENSE Salaries and

employee benefits 4,885 4,930 4,813 14,628 Net occupancy expense

664 615 618 1,897 Equipment expense 546 564 466 1,576 Professional

fees 695 818 814 2,327 FDIC deposit insurance expense 22 22 22 66

Amortization of core deposit intangibles 216 216 216 648 Other

expenses 1,645 1,357 1,824 4,826 Total Non-Interest Expense 8,673

8,522 8,773 25,968 PRETAX INCOME 515 1,083 1,121 2,719 Income tax

expense 87 275 247 609 NET INCOME $428 $808 $874 $2,110 AMERISERV

FINANCIAL, INC. CONSOLIDATED STATEMENT OF INCOME (In thousands)

(All quarterly and 2007 data unaudited) 2006 1QTR 2QTR 3QTR YEAR TO

DATE INTEREST INCOME Interest and fees on loans $8,900 $9,155

$9,677 $27,732 Total investment portfolio 2,279 2,259 2,218 6,756

Total Interest Income 11,179 11,414 11,895 34,488 INTEREST EXPENSE

Deposits 4,026 4,563 5,143 13,732 All borrowings 861 660 653 2,174

Total Interest Expense 4,887 5,223 5,796 15,906 NET INTEREST INCOME

6,292 6,191 6,099 18,582 Provision for loan losses - (50) - (50)

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 6,292 6,241

6,099 18,632 NON-INTEREST INCOME Trust fees 1,641 1,671 1,603 4,915

Net realized gains on loans held for sale 23 20 26 69 Service

charges on deposit accounts 627 651 645 1,923 Bank owned life

insurance 256 260 428 944 Other income 695 666 545 1,906 Total

Non-Interest Income 3,242 3,268 3,247 9,757 NON-INTEREST EXPENSE

Salaries and employee benefits 4,815 4,612 4,600 14,027 Net

occupancy expense 655 591 573 1,819 Equipment expense 639 631 529

1,799 Professional fees 795 859 791 2,445 FDIC deposit insurance

expense 73 74 22 169 Amortization of core deposit intangibles 216

216 216 648 Other expenses 1,665 1,794 1,833 5,292 Total

Non-Interest Expense 8,858 8,777 8,564 26,199 PRETAX INCOME 676 732

782 2,190 Income tax expense 136 164 139 439 NET INCOME $540 $568

$643 $1,751 AMERISERV FINANCIAL, INC. AVERAGE BALANCE SHEET DATA

(In thousands) (All quarterly and 2007 data unaudited) Note: 2006

data appears before 2007. 2006 2007 NINE NINE 3QTR MONTHS 3QTR

MONTHS Interest earning assets: Loans and loans held for sale, net

of unearned income $572,077 $558,176 $612,424 $601,592 Deposits

with banks 698 669 616 525 Federal funds - - 2,249 3,009 Total

investment securities 215,759 225,066 176,474 187,398 Total

interest earning assets 788,534 783,911 791,763 792,524

Non-interest earning assets: Cash and due from banks 19,146 18,975

18,673 17,734 Premises and equipment 8,088 8,337 8,607 8,722 Other

assets 68,653 69,226 71,506 69,550 Allowance for loan losses

(8,739) (8,922) (7,808) (7,947) Total assets 875,682 871,527

882,741 880,583 Interest bearing liabilities: Interest bearing

deposits: Interest bearing demand 58,551 57,329 55,151 56,559

Savings 80,663 84,235 71,503 73,112 Money market 169,022 171,525

173,844 182,215 Other time 330,900 313,598 353,331 344,153 Total

interest bearing deposits 639,136 626,687 653,829 656,039

Borrowings: Federal funds purchased, securities sold under

agreements to repurchase, and other short-term borrowings 26,128

34,459 6,760 8,441 Advanced from Federal Home Loan Bank 962 972

5,499 3,607 Guaranteed junior subordinated deferrable interest

debentures 13,085 13,085 13,085 13,085 Total interest bearing

liabilities 679,311 675,203 679,173 681,172 Non-interest bearing

liabilities: Demand deposits 104,361 105,292 106,055 104,336 Other

liabilities 7,059 6,584 10,768 9,477 Stockholders' equity 84,951

84,448 86,745 85,598 Total liabilities and stockholders' equity

$875,682 $871,527 $882,741 $880,583 DATASOURCE: AmeriServ

Financial, Inc. CONTACT: Jeffrey A. Stopko, Senior Vice President

& Chief Financial Officer of AmeriServ Financial, Inc.,

+1-814-533-5310 Web site: http://www.ameriservfinancial.com/

Copyright

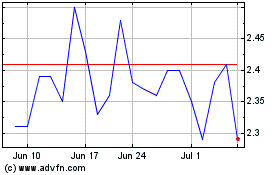

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Aug 2024 to Sep 2024

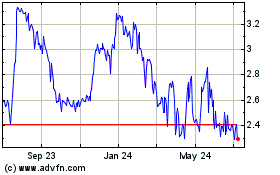

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Sep 2023 to Sep 2024