Amended Current Report Filing (8-k/a)

June 04 2019 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K/A

Amendment

No. 1

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of Earliest event Reported): June 4, 2019

AMERICAN

RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

|

Florida

(State

or other jurisdiction

of

incorporation)

|

000-55456

(Commission

File

Number)

|

46-3914127

(I.R.S.

Employer

Identification

No.)

|

9002

Technology Lane, Fishers Indiana, 46038

(Address

of principal executive offices)

(317)

855-9926

(Registrant’s

telephone number, including area code)

________________________________________________

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (See: General Instruction

A.2. below):

[

]

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

[

]

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act

(17CFR240.14a-12)

[

]

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17CFR240.14d-2(b))

[

]

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17CFR240.13e-4(c))

Item

7.01 Regulation FD Disclosure.

American

Resources Corporation (the “Company”) will be

commencing a private offering (the “Offering”) of up to

3,500,000 units (“Units”), each Unit comprised of

$10.00 in principal amount of Senior Convertible Debentures due

2022 (the “Debentures”) convertible into the

Company’s Class A Common stock, par value $0.0001 per share

(the “Common Stock”), at an initial conversion price of

$6.00 per share of Common Stock and one warrant (the

“Warrants”) to purchase one share of Common Stock. Each

Warrant is exercisable for three years at an initial exercise price

equal to $8.00 per share. The Units are being offered without

registration under the Securities Act of 1933, as amended

(“Securities Act”), solely to persons who qualify as

accredited investors, as that term is defined in Rule 501 of

Regulation D under the Securities Act, in reliance upon the

exemption from registration provided by Section 4(a)(2) of the

Securities Act and Rule 506(c) of Regulation D promulgated

thereunder.

The

Company has retained Maxim Group, LLC to serve as its placement

agent for the Offering. The Company has agreed to pay the placement

agent a placement fee equal to 8% of the aggregate gross proceeds

raised in the Offering and warrants exercisable for a term of three

years to purchase 8% of the number of shares of common stock

included in the Units sold in the Offering at an exercise price of

$6.60 per share.

The

Offering may be increased by up to an additional $10,000,000 at the

mutual discretion of the Company and the placement agent. The

Offering will terminate on June 30, 2019, unless extended by the

Company and the placement agent.

The

initial closing of the Offering is conditioned, among other things,

on the Company’s acceptance of subscriptions for at least

$1,000,000 of Units.

Net

proceeds, if any, from the Offering will be used to complete

acquisitions, organic growth, equipment, refinance existing debt,

repaying the Permitted Indebtedness, and general working capital

purposes.

Attached

hereto as Exhibit 99.1 is the investor presentation that the

Company and the placement agent will be providing to potential

investors in connection with the Offering.

The

information contained in this Item 7.01 of this Current Report on

Form 8-K and in the accompanying exhibits shall not be incorporated

by reference into any filing of the Company under the Securities

Act or the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), whether made before or after the date

hereof, regardless of any general incorporation language in such

filing. The information in this report, including the exhibit

hereto, is being furnished and shall not be deemed to be

“filed” for purposes of Section 18 of the Exchange Act

or otherwise subject to the liabilities of that section or Sections

11 or 12(a)(2) of the Securities Act.

This

document is not an offer to sell nor a solicitation of an offer to

buy securities. Any offer or sale of securities will be made by

means of an offering memorandum containing detailed information

about the Company, management and the securities. In addition, no

offer, sale or solicitation is being made in any jurisdiction in

which such offer, sale or solicitation would be

prohibited.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits

The

following exhibits are attached hereto and filed

herewith.

|

Exhibit No.

|

|

Description

|

|

|

|

Investor

Presentation

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

American Resources

Corporation

|

|

|

|

|

|

|

|

Date: June 4,

2019

|

By:

|

/s/ Mark C.

Jensen

|

|

|

|

|

Mark C.

Jensen

|

|

|

|

|

Chief

Executive Officer

|

|

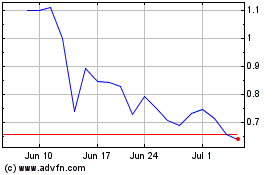

American Resources (NASDAQ:AREC)

Historical Stock Chart

From Mar 2024 to Apr 2024

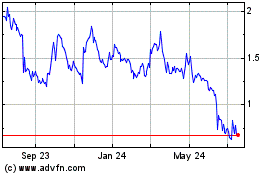

American Resources (NASDAQ:AREC)

Historical Stock Chart

From Apr 2023 to Apr 2024