Current Report Filing (8-k)

September 27 2019 - 8:43AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of Earliest event Reported): September 23,

2019

AMERICAN

RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

|

Florida

(State

or other jurisdiction

of

incorporation)

|

000-55456

(Commission

File

Number)

|

46-3914127

(I.R.S.

Employer

Identification

No.)

|

9002

Technology Lane, Fishers Indiana, 46038

(Address

of principal executive offices)

(317)

855-9926

(Registrant’s

telephone number, including area code)

________________________________________________

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (See: General Instruction

A.2. below):

[

]

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

[

]

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act

(17CFR240.14a-12)

[

]

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17CFR240.14d-2(b))

[

]

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17CFR240.13e-4(c))

Item

1.01 Entry into a Material Definitive Agreement.

On

September 23, 2019, American Resources Corporation entered into a

binding agreement with Bear Branch Coal LLC, a Kentucky limited

liability company, Perry County Coal LLC, a Kentucky limited

liability company, Ray Coal LLC, a Kentucky limited liability

company, and Whitaker Coal LLC, a Kentucky limited liability

company (each a “Seller” and collectively,

“Sellers”). The agreement was entered into as part of

the bankruptcy proceedings of Cambrian Holding Company LLC,

(“Cambrian), and is subject to approval by the United States

Bankruptcy Court for the Eastern District of Kentucky (the

“Bankruptcy Court”) in the chapter 11 bankruptcy cases

of the Sellers, Case No. 19-51200(GRS), by entry of an order in

form and substance acceptable to Sellers and Buyer (the “Sale

Order). Under the agreement of the Sale Order, each Seller will

sell, transfer, assign, convey and deliver to American Resources

Corporation, effective as of the Closing, all assets, rights,

titles, permits, leases, contracts and interests of such Seller

free and clear of all liens, claims, interests and encumbrances, to

the fullest extent permitted by the Bankruptcy Court.

In

consideration for the purchased assets, the Buyer will assume the

Assumed Liabilities as described in Exhibit 99.1, attached hereto

and filed herewith, including the payment of all cure costs.

Additionally, the Buyer will assume all liabilities relating to the

transferred permits and the associated reclamation and post-mining

liabilities of the purchased assets totaling approximately

$10,000,000. The Buyer will also pay Sellers the amount $1.00 upon

closing.

Refer

to Exhibit 99.1 for full Sale Order details.

Item 9.01

Financial Statements and

Exhibits.

(d)

Exhibits

The

following exhibits are attached hereto and filed

herewith.

|

ExhibitNo.

|

|

Description

|

|

|

|

General

Assignment and Assumption Agreement and Bill of Sale

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

American Resources

Corporation

|

|

|

|

|

|

|

|

Date: September 27,

2019

|

By:

|

/s/ Mark C.

Jensen

|

|

|

|

|

Mark C.

Jensen

|

|

|

|

|

Chief Executive

Officer

|

|

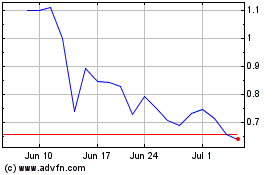

American Resources (NASDAQ:AREC)

Historical Stock Chart

From Mar 2024 to Apr 2024

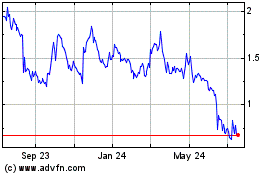

American Resources (NASDAQ:AREC)

Historical Stock Chart

From Apr 2023 to Apr 2024