American National Bankshares Inc. and HomeTown Bankshares Corporation Announce Regulatory Approvals for Proposed Merger

March 07 2019 - 4:05PM

American National Bankshares Inc. (NASDAQ: AMNB – “American”)

headquartered in Danville, Va., and HomeTown Bankshares

Corporation, (NASDAQ: HMTA - "HomeTown"), headquartered in Roanoke,

Va., today jointly announced the receipt of regulatory approvals

from the Office of the Comptroller of the Currency, the Federal

Reserve Bank of Richmond, and the Virginia State Corporation

Commission to move forward with the proposed merger of HomeTown

with and into American. The proposed merger remains subject to

shareholder approval and special shareholder meetings for both

companies are set for March 19, 2019.

“We are pleased to have received all required regulatory

approvals. We look forward to receiving shareholder approvals and

plan to close the merger effective April 1st,” said Jeffrey V.

Haley, President and Chief Executive Officer of American.

About American

American National Bankshares Inc. is a multi-state bank holding

company with total assets of approximately $1.9 billion.

Headquartered in Danville, Va., American is the parent company of

American National Bank and Trust Company (“American National

Bank”). American National Bank is a community bank serving southern

and central Virginia and north central North Carolina with 24

banking offices and two loan production offices. American National

Bank also manages an additional $769 million of trust,

investment and brokerage assets in its Trust and Investment

Services Division. Additional information about American and

American National Bank is available at www.amnb.com.

Shares of American are traded on the Nasdaq Global Select Market

under the symbol "AMNB."

About HomeTown

HomeTown Bankshares Corporation is the parent company of

HomeTown Bank, which officially opened for business on November 14,

2005. HomeTown Bank offers a full range of banking services

to small and medium-size businesses, real estate investors and

developers, private investors, professionals and individuals.

HomeTown Bank serves three markets including the Roanoke Valley,

the New River Valley and Smith Mountain Lake through six branches,

seven ATMs, HomeTown Mortgage and HomeTown Investments. A

high level of responsive and personal service coupled with local

decision-making is the hallmark of its banking strategy. For more

information, please visit www.hometownbank.com.

Shares of HomeTown are traded on the Nasdaq Capital Market under

the symbol "HMTA."

Additional Information About the Merger and Where to

Find It

In connection with the proposed merger, American has filed with

the Securities and Exchange Commission (the “SEC”) a registration

statement on Form S-4 to register the shares of American common

stock to be issued to the shareholders of HomeTown. The

registration statement includes a joint proxy statement/prospectus,

which was first mailed to the shareholders of American and HomeTown

on or about February 13, 2019. In addition, each of American and

HomeTown may file other relevant documents concerning the proposed

merger with the SEC.

WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION

STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS

INCLUDED WITHIN THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT

DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE

PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT AMERICAN, HOMETOWN AND THE PROPOSED TRANSACTION. Investors

and security holders may obtain free copies of these documents

through the website maintained by the SEC at www.sec.gov. Free

copies of the joint proxy statement/prospectus also may be obtained

by directing a request by telephone or mail to American National

Bankshares Inc., 628 Main Street, Danville, Virginia 24541,

Attention: Investor Relations (telephone: (434) 792-5111) or

HomeTown Bankshares Corporation, 202 South Jefferson Street,

Roanoke, Virginia 24011, Attention: Investor Relations (telephone:

(540) 345-6000) or by accessing American’s website at www.amnb.com

under “Investors – Financial Documents – Documents/Filings” or

HomeTown’s website at www.hometownbank.com under “Investors –

Investor Relations – SEC Filings.” The information on American’s

and HomeTown’s websites is not, and shall not be deemed to be, a

part of this release or incorporated into other filings either

company makes with the SEC.

American, HomeTown and their respective directors, executive

officers and members of management may be deemed to be participants

in the solicitation of proxies from the shareholders of American

and HomeTown in connection with the merger. Information about the

directors and executive officers of American is set forth in the

proxy statement for American’s 2018 annual meeting of shareholders

filed with the SEC on April 12, 2018. Information about the

directors and executive officers of HomeTown is set forth in the

proxy statement for HomeTown’s 2018 annual meeting of shareholders

filed with the SEC on April 5, 2018. Additional information

regarding the interests of these participants and other persons who

may be deemed participants in the merger may be obtained by reading

the joint proxy statement/prospectus.

Caution Regarding Forward-Looking

Statements

Statements made in this release, other than those concerning

historical financial information, may be considered forward-looking

statements, which speak only as of the date of this release and are

based on current expectations and involve a number of assumptions.

These include statements as to the anticipated benefits of the

merger, including future financial and operating results, cost

savings and enhanced revenues that may be realized from the merger

as well as other statements of expectations regarding the merger

and any other statements regarding future results or expectations.

Each of American and HomeTown intends such forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 and is including this statement for

purposes of these safe harbor provisions. The companies’ respective

abilities to predict results, or the actual effect of future plans

or strategies, is inherently uncertain. Factors that could have a

material effect on the operations and future prospects of each of

American and HomeTown and the resulting company, include but are

not limited to: (1) the businesses of American and/or HomeTown

may not be integrated successfully or such integration may be more

difficult, time-consuming or costly than expected;

(2) expected revenue synergies and cost savings from the

merger may not be fully realized or realized within the expected

timeframe; (3) revenues following the merger may be lower than

expected; (4) customer and employee relationships and business

operations may be disrupted by the merger; (5) the ability to

obtain the required shareholder approvals and the ability to

complete the merger on the expected timeframe may be more

difficult, time-consuming or costly than expected; (6) changes

in interest rates, general economic conditions, legislation and

regulation, and monetary and fiscal policies of the U.S.

government, including policies of the U.S. Treasury, Office of the

Comptroller of the Currency and the Board of Governors of the

Federal Reserve System; (7) the quality and composition of the loan

and securities portfolios, demand for loan products, deposit flows,

competition, and demand for financial services in the companies’

respective market areas; (8) the implementation of new

technologies, and the ability to develop and maintain secure and

reliable electronic systems; (9) accounting principles, policies,

and guidelines; and (10) other risk factors detailed from time

to time in filings made by American and HomeTown with the SEC.

American and HomeTown undertake no obligation to update or clarify

these forward-looking statements, whether as a result of new

information, future events or otherwise.

This release shall not constitute an offer to sell or the

solicitation of an offer to buy securities in any jurisdiction in

which such solicitation would be unlawful.

For more information, contact:

Jeffrey V. Haley

Susan K. StillPresident & Chief Executive

Officer

President & Chief Executive OfficerAmerican National Bankshares

Inc.

HomeTown Bankshares Corporation haleyj@amnb.com

sstill@HomeTownBankVa.com434.773.2259

540.278.1705

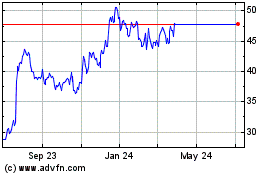

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From Apr 2023 to Apr 2024