Amedisys, Inc. (NASDAQ: AMED) today reported its financial results

for the three month period and year ended December 31, 2018.

Three Month Periods Ended December 31, 2018 and 2017

- Net service revenue increased $36.4 million to

$434.4 million compared to $398.0 million in 2017

(1).

- Net income attributable to Amedisys, Inc. of $27.5 million

compared to net loss attributable to Amedisys, Inc. of $3.8 million

in 2017.

- Net income attributable to Amedisys, Inc. per diluted share of

$0.84 per diluted share compared to net loss attributable to

Amedisys, Inc. of $0.11 in 2017.

Adjusted Quarterly Results*

- Adjusted EBITDA of $43.9 million compared to

$37.1 million in 2017.

- Adjusted net service revenue of $434.4 million compared to

$398.0 million in 2017.

- Adjusted net income attributable to Amedisys, Inc. of

$29.8 million compared to $19.4 million in 2017.

- Adjusted net income attributable to Amedisys, Inc. per diluted

share of $0.91 compared to $0.56 in 2017.

Years Ended December 31, 2018 and 2017

- Net service revenue increased $151.3 million to

$1,662.6 million compared to $1,511.3 million in 2017

(1).

- Net income attributable to Amedisys, Inc. of

$119.3 million compared to $30.3 million in 2017.

- Net income attributable to Amedisys, Inc. per diluted share of

$3.55 per diluted share compared to $0.88 in 2017.

Adjusted Year End Results*

- Adjusted EBITDA of $180.6 million compared to

$142.2 million in 2017.

- Adjusted net service revenue of $1,664.3 million compared

to $1,517.8 million in 2017.

- Adjusted net income attributable to Amedisys, Inc. of

$122.1 million compared to $75.9 million in 2017.

- Adjusted net income attributable to Amedisys, Inc. per diluted

share of $3.63 compared to $2.21 in 2017.

* See pages 12 and 13 for the definition and

reconciliations of non-GAAP financial measures to GAAP measures.

(1) Subsequent to our adoption of Accounting Standards Updates

2014-09 and 2015-14 on January 1, 2018, using the full

retrospective method, amounts previously classified as provision

for doubtful accounts are now classified as price concessions in

determining the transaction price of our net service revenue.

Paul B. Kusserow, President and Chief Executive Officer stated,

“Our fourth quarter results are a fitting cap to what has been by

all accounts an incredible year for Amedisys. In 2018, we

treated approximately 400,000 patients making more than

10 million visits across our three lines of business while

continuing to execute and make excellent progress on our strategic

pillars of clinical distinction, becoming the employer of choice,

operational efficiency and growth. Providing our clinically

distinct care to as many patients wherever they call home is, and

will always be, our first priority and to that point, our home

health and hospice quality measures continue to be at or near the

top of the industry. After a year of rebuilding, our home

health segment returned to growth and exceeded margin

expectations. Hospice continued its stellar performance with

another strong quarter and year of ADC growth and we continued to

grow our personal care platform, completing two acquisitions during

the year. Finally, thanks to our team of over 21,000 employees

for continuing to do all that you do to drive such impressive

results and provide such incredible care.”

2019 Guidance

- Net service revenue is anticipated to be in the range of $1.94

billion to $1.98 billion.

- Adjusted EBITDA is anticipated to be in the range of $205

million to $210 million.

- Adjusted diluted earnings per share is anticipated to be in the

range of $3.98 to $4.09 based on an estimated 33.1 million shares

outstanding.

This guidance excludes the effects of any future acquisitions,

if any are made.

We urge caution in considering the current trends and 2019

guidance disclosed in this press release. The home health and

hospice industry is highly competitive and subject to intensive

regulations, and trends are subject to numerous factors, risks, and

uncertainties, some of which are referenced in the cautionary

language below and others that are described more fully in our

reports filed with the Securities and Exchange Commission (“SEC”)

including our Annual Report on Form 10-K for the fiscal year ended

December 31, 2018, and subsequent Quarterly Reports on Form

10-Q, and current reports on Form 8-K which can be found on the

SEC’s internet website, http://www.sec.gov, and our internet

website, http://www.amedisys.com.

Earnings Call and Webcast Information

Amedisys will host a conference call on Thursday,

February 28, 2019, at 10:00 a.m. ET to discuss its fourth

quarter and year end results. To participate on the conference

call, please call before 10:00 a.m. ET to either (877) 524-8416

(Toll-Free) or (412) 902-1028 (Toll). A replay of the conference

call will be available through March 28, 2019 by dialing (877)

660-6853 (Toll-Free) or (201) 612-7415 (Toll) and entering

conference ID #13687280.

A live webcast of the call will be accessible through our

website on our Investor Relations section at the following web

address: http://investors.amedisys.com.

Non-GAAP Financial Measures

This press release includes reconciliations of the most

comparable financial measures calculated and presented in

accordance with accounting principles generally accepted in the

U.S. (“GAAP”) to non-GAAP financial measures. The non-GAAP

financial measures as defined under SEC rules are as follows:

(1) adjusted EBITDA, defined as net income (loss) attributable

to Amedisys, Inc. before provision for income taxes, net interest

expense and depreciation and amortization, excluding certain items;

(2) adjusted net service revenue, defined as net service

revenue excluding certain items; (3) adjusted net income

attributable to Amedisys, Inc., defined as net income (loss)

attributable to Amedisys, Inc. excluding certain items; and

(4) adjusted net income attributable to Amedisys, Inc. per

diluted share, defined as net income (loss) attributable to

Amedisys, Inc. common stockholders per diluted share excluding

certain items. Management believes that these non-GAAP financial

measures, when reviewed in conjunction with GAAP financial

measures, are useful gauges of our current performance and are also

included in internal management reporting. These non-GAAP financial

measures should be considered in addition to, and not more

meaningful than or as an alternative to the GAAP financial measures

presented in this earnings release and the company’s financial

statements. Non-GAAP measures as presented herein may not be

comparable to similarly titled measures reported by other companies

since not all companies calculate these non-GAAP measures

consistently.

Additional information

Amedisys, Inc. (the “Company”) is a leading healthcare at home

Company delivering personalized home health, hospice and personal

care. Amedisys is focused on delivering the care that is best for

our patients, whether that is home-based personal care; recovery

and rehabilitation after an operation or injury; care focused on

empowering them to manage a chronic disease; or hospice care at the

end of life. More than 3,000 hospitals and 65,000 physicians

nationwide have chosen Amedisys as a partner in post-acute care.

Founded in 1982, headquartered in Baton Rouge, LA with an executive

office in Nashville, TN, Amedisys is a publicly held company. With

more than 21,000 employees, in 472 care centers within 38 states

and the District of Columbia, Amedisys is dedicated to delivering

the highest quality of care to the doorsteps of more than 376,000

patients and clients in need every year. For more information about

the Company, please visit: www.amedisys.com.

We use our website as a channel of distribution for important

company information. Important information, including press

releases, investor presentations and financial information

regarding our company, is routinely posted on and accessible on the

Investor Relations subpage of our website, which is accessible by

clicking on the tab labeled “Investors” on our website home page.

Visitors to our website can also register to receive automatic

e-mail and other notifications alerting them when new information

is made available on the Investor Relations subpage of our

website.

Forward-Looking Statements

When included in this press release, words like “believes,”

“belief,” “expects,” “plans,” “anticipates,” “intends,” “projects,”

“estimates,” “may,” “might,” “would,” “should” and similar

expressions are intended to identify forward-looking statements as

defined by the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve a variety of risks and

uncertainties that could cause actual results to differ materially

from those described therein. These risks and uncertainties

include, but are not limited to the following: changes in Medicare

and other medical payment levels, our ability to open care centers,

acquire additional care centers and integrate and operate these

care centers effectively, changes in or our failure to comply with

existing federal and state laws or regulations or the inability to

comply with new government regulations on a timely basis,

competition in the healthcare industry, changes in the case mix of

patients and payment methodologies, changes in estimates and

judgments associated with critical accounting policies, our ability

to maintain or establish new patient referral sources, our ability

to consistently provide high-quality care, our ability to attract

and retain qualified personnel, changes in payments and covered

services by federal and state governments, future cost containment

initiatives undertaken by third-party payors, our access to

financing, our ability to meet debt service requirements and comply

with covenants in debt agreements, business disruptions due to

natural disasters or acts of terrorism, our ability to integrate,

manage and keep our information systems secure, our ability to

comply with requirements stipulated in our corporate integrity

agreement, our ability to realize the anticipated benefits of the

acquisition of Compassionate Care Hospice, and changes in law or

developments with respect to any litigation relating to the

Company, including various other matters, many of which are beyond

our control.

Because forward-looking statements are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified, you should not rely on any forward-looking statement as

a prediction of future events. We expressly disclaim any obligation

or undertaking and we do not intend to release publicly any updates

or changes in our expectations concerning the forward-looking

statements or any changes in events, conditions or circumstances

upon which any forward-looking statement may be based, except as

required by law.

|

Contact: |

Investor Contact: |

Media Contact: |

| |

Amedisys,

Inc. |

Amedisys,

Inc. |

| |

Nick

Muscato |

Kendra

Kimmons |

| |

Vice President,

Strategic Finance |

Vice President,

Marketing & Communications |

| |

(855)

259-2046 |

(225)

299-3720 |

| |

IR@amedisys.com |

kendra.kimmons@amedisys.com |

AMEDISYS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

|

|

For the Three-Month

Period Ended December 31 |

|

|

For the Year Ended

December 31 |

| |

|

|

| |

|

|

| |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

| Net service revenue |

$ |

434,378 |

|

|

$ |

397,961 |

|

|

$ |

1,662,578 |

|

|

$ |

1,511,272 |

|

| Cost of service, excluding

depreciation and amortization |

|

262,251 |

|

|

|

239,238 |

|

|

|

992,863 |

|

|

|

903,377 |

|

| General and administrative

expenses: |

|

|

|

|

| Salaries and

benefits |

|

84,309 |

|

|

|

79,406 |

|

|

|

316,522 |

|

|

|

305,938 |

|

| Non-cash

compensation |

|

5,234 |

|

|

|

4,507 |

|

|

|

17,887 |

|

|

|

16,295 |

|

| Other |

|

42,778 |

|

|

|

39,757 |

|

|

|

166,897 |

|

|

|

159,980 |

|

| Depreciation and

amortization |

|

3,379 |

|

|

|

3,984 |

|

|

|

13,261 |

|

|

|

17,123 |

|

| Asset impairment

charge |

|

— |

|

|

|

1,323 |

|

|

|

— |

|

|

|

1,323 |

|

| Securities

Class Action Lawsuit settlement, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28,712 |

|

| Operating expenses |

|

397,951 |

|

|

|

368,215 |

|

|

|

1,507,430 |

|

|

|

1,432,748 |

|

| Operating income |

|

36,427 |

|

|

|

29,746 |

|

|

|

155,148 |

|

|

|

78,524 |

|

| Other income

(expense): |

|

|

|

|

| Interest

income |

|

15 |

|

|

|

54 |

|

|

|

278 |

|

|

|

158 |

|

| Interest

expense |

|

(1,536 |

) |

|

|

(1,431 |

) |

|

|

(7,370 |

) |

|

|

(5,031 |

) |

| Equity in

earnings from equity method investments |

|

1,231 |

|

|

|

232 |

|

|

|

7,692 |

|

|

|

3,381 |

|

|

Miscellaneous, net |

|

458 |

|

|

|

487 |

|

|

|

3,240 |

|

|

|

3,769 |

|

| Total other

income (expense), net |

|

168 |

|

|

|

(658 |

) |

|

|

3,840 |

|

|

|

2,277 |

|

| Income before income

taxes |

|

36,595 |

|

|

|

29,088 |

|

|

|

158,988 |

|

|

|

80,801 |

|

| Income tax expense |

|

(8,875 |

) |

|

|

(32,794 |

) |

|

|

(38,859 |

) |

|

|

(50,118 |

) |

| Net income (loss) |

|

27,720 |

|

|

|

(3,706 |

) |

|

|

120,129 |

|

|

|

30,683 |

|

| Net income attributable to

noncontrolling interests |

|

(259 |

) |

|

|

(142 |

) |

|

|

(783 |

) |

|

|

(382 |

) |

| Net income (loss)

attributable to Amedisys, Inc. |

$ |

27,461 |

|

|

$ |

(3,848 |

) |

|

$ |

119,346 |

|

|

$ |

30,301 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common

share: |

|

|

|

|

| Net income

(loss) attributable to Amedisys, Inc. common stockholders |

$ |

0.86 |

|

|

$ |

(0.11 |

) |

|

$ |

3.64 |

|

|

$ |

0.90 |

|

| Weighted

average shares outstanding |

|

31,916 |

|

|

|

33,898 |

|

|

|

32,791 |

|

|

|

33,704 |

|

| Diluted earnings per

common share: |

|

|

|

|

| Net income

(loss) attributable to Amedisys, Inc. common stockholders |

$ |

0.84 |

|

|

$ |

(0.11 |

) |

|

$ |

3.55 |

|

|

$ |

0.88 |

|

| Weighted

average shares outstanding |

|

32,805 |

|

|

|

33,898 |

|

|

|

33,609 |

|

|

|

34,304 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMEDISYS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Amounts in

thousands, except share data)

|

|

As of December 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

ASSETS |

|

|

| Current assets: |

|

|

| Cash and

cash equivalents |

$ |

20,229 |

|

|

$ |

86,363 |

|

| Patient

accounts receivable |

|

188,972 |

|

|

|

201,196 |

|

| Prepaid

expenses |

|

7,568 |

|

|

|

7,329 |

|

| Other

current assets |

|

7,349 |

|

|

|

16,268 |

|

| Total

current assets |

|

224,118 |

|

|

|

311,156 |

|

| Property and equipment,

net of accumulated depreciation of $95,472 and $146,814 |

|

29,449 |

|

|

|

31,122 |

|

| Goodwill |

|

329,480 |

|

|

|

319,949 |

|

| Intangible assets, net of

accumulated amortization of $33,050 and $30,610 |

|

44,132 |

|

|

|

46,061 |

|

| Deferred income taxes |

|

35,794 |

|

|

|

56,064 |

|

| Other assets |

|

54,145 |

|

|

|

49,130 |

|

| Total

assets |

$ |

717,118 |

|

|

$ |

813,482 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

| Current liabilities: |

|

|

| Accounts

payable |

$ |

28,531 |

|

|

$ |

25,384 |

|

| Payroll and

employee benefits |

|

92,858 |

|

|

|

89,936 |

|

| Accrued

expenses |

|

99,475 |

|

|

|

89,104 |

|

| Current

portion of long-term obligations |

|

1,612 |

|

|

|

10,638 |

|

| Total

current liabilities |

|

222,476 |

|

|

|

215,062 |

|

| Long-term obligations,

less current portion |

|

5,775 |

|

|

|

78,203 |

|

| Other long-term

obligations |

|

6,234 |

|

|

|

3,791 |

|

| Total

liabilities |

|

234,485 |

|

|

|

297,056 |

|

| |

|

|

|

|

|

|

|

| Equity: |

|

|

| Preferred

stock, $0.001 par value, 5,000,000 shares authorized; none issued

or outstanding |

|

— |

|

|

|

— |

|

| Common

stock, $0.001 par value, 60,000,000 shares authorized; 36,252,280

and 35,747,134 shares issued; and 31,973,505 and 33,964,767 shares

outstanding |

|

36 |

|

|

|

35 |

|

| Additional

paid-in capital |

|

603,666 |

|

|

|

568,780 |

|

| Treasury

stock at cost 4,278,775 and 1,782,367 shares of common stock |

|

(241,685 |

) |

|

|

(53,713 |

) |

| Accumulated

other comprehensive income |

|

15 |

|

|

|

15 |

|

| Retained

earnings |

|

119,550 |

|

|

|

204 |

|

| Total

Amedisys, Inc. stockholders’ equity |

|

481,582 |

|

|

|

515,321 |

|

|

Noncontrolling interests |

|

1,051 |

|

|

|

1,105 |

|

| Total

equity |

|

482,633 |

|

|

|

516,426 |

|

| Total

liabilities and equity |

$ |

717,118 |

|

|

$ |

813,482 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

AMEDISYS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS AND DAYS REVENUE

OUTSTANDING (Amounts in thousands, except

statistical information)

|

|

For the Three-Month

Period Ended December 31 |

|

|

For the Year

Ended December 31 |

| |

|

|

| |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

| Cash Flows from

Operating Activities: |

|

|

|

|

| Net income (loss) |

$ |

27,720 |

|

|

$ |

(3,706 |

) |

|

$ |

120,129 |

|

|

$ |

30,683 |

|

| Adjustments to reconcile

net income (loss) to net cash provided by operating

activities: |

|

|

|

|

| Depreciation

and amortization |

|

3,379 |

|

|

|

3,984 |

|

|

|

13,261 |

|

|

|

17,123 |

|

| Non-cash

compensation |

|

5,234 |

|

|

|

4,507 |

|

|

|

17,887 |

|

|

|

16,295 |

|

| 401(k)

employer match |

|

2,042 |

|

|

|

2,207 |

|

|

|

8,976 |

|

|

|

8,754 |

|

| (Gain) loss

on disposal of property and equipment |

|

(24 |

) |

|

|

22 |

|

|

|

714 |

|

|

|

— |

|

| Deferred

income taxes |

|

5,355 |

|

|

|

34,950 |

|

|

|

20,271 |

|

|

|

52,178 |

|

| Equity in

earnings from equity method investments |

|

(1,231 |

) |

|

|

(232 |

) |

|

|

(7,692 |

) |

|

|

(3,381 |

) |

| Amortization

of deferred debt issuance costs/debt discount |

|

201 |

|

|

|

180 |

|

|

|

797 |

|

|

|

735 |

|

| Return on

equity investment |

|

1,785 |

|

|

|

665 |

|

|

|

6,158 |

|

|

|

5,321 |

|

| Asset

impairment charge |

|

— |

|

|

|

1,323 |

|

|

|

— |

|

|

|

1,323 |

|

| Changes in operating

assets and liabilities, net of impact of acquisitions: |

|

|

|

|

| Patient

accounts receivable |

|

6,058 |

|

|

|

(23,826 |

) |

|

|

12,224 |

|

|

|

(34,672 |

) |

| Other

current assets |

|

8,711 |

|

|

|

956 |

|

|

|

8,679 |

|

|

|

(4,940 |

) |

| Other

assets |

|

2,221 |

|

|

|

(547 |

) |

|

|

2,947 |

|

|

|

(12,749 |

) |

| Accounts

payable |

|

3,835 |

|

|

|

2,587 |

|

|

|

3,165 |

|

|

|

(2,843 |

) |

| Accrued

expenses |

|

(1,234 |

) |

|

|

9,259 |

|

|

|

13,524 |

|

|

|

31,843 |

|

| Other

long-term obligations |

|

(19 |

) |

|

|

(140 |

) |

|

|

2,443 |

|

|

|

61 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by

operating activities |

|

64,033 |

|

|

|

32,189 |

|

|

|

223,483 |

|

|

|

105,731 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows from

Investing Activities: |

|

|

|

|

| Proceeds from sale of

deferred compensation plan assets |

|

152 |

|

|

|

— |

|

|

|

715 |

|

|

|

622 |

|

| Proceeds from the sale of

property and equipment |

|

3 |

|

|

|

131 |

|

|

|

54 |

|

|

|

249 |

|

| Purchases of property and

equipment |

|

(874 |

) |

|

|

(1,633 |

) |

|

|

(6,558 |

) |

|

|

(10,707 |

) |

| Investments in equity

method investees |

|

(3,667 |

) |

|

|

(40 |

) |

|

|

(7,144 |

) |

|

|

(476 |

) |

| Acquisitions of

businesses, net of cash acquired |

|

(5,186 |

) |

|

|

(9,587 |

) |

|

|

(9,260 |

) |

|

|

(33,715 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing

activities |

|

(9,572 |

) |

|

|

(11,129 |

) |

|

|

(22,193 |

) |

|

|

(44,027 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows from

Financing Activities: |

|

|

|

|

| Proceeds from issuance of

stock upon exercise of stock options |

|

3,204 |

|

|

|

340 |

|

|

|

5,953 |

|

|

|

4,554 |

|

| Proceeds from issuance of

stock to employee stock purchase plan |

|

642 |

|

|

|

584 |

|

|

|

2,429 |

|

|

|

2,382 |

|

| Shares withheld upon stock

vesting |

|

(1,149 |

) |

|

|

(485 |

) |

|

|

(6,570 |

) |

|

|

(6,939 |

) |

| Non-controlling interest

distribution |

|

(560 |

) |

|

|

— |

|

|

|

(1,090 |

) |

|

|

(216 |

) |

| Proceeds from borrowings

under revolving line of credit |

|

10,500 |

|

|

|

— |

|

|

|

138,000 |

|

|

|

— |

|

| Repayments of borrowings

under revolving line of credit |

|

(60,500 |

) |

|

|

— |

|

|

|

(130,500 |

) |

|

|

— |

|

| Principal payments of

long-term obligations |

|

(379 |

) |

|

|

(1,250 |

) |

|

|

(91,450 |

) |

|

|

(5,319 |

) |

| Debt issuance costs |

|

— |

|

|

|

— |

|

|

|

(2,433 |

) |

|

|

— |

|

| Purchase of company

stock |

|

— |

|

|

|

— |

|

|

|

(181,402 |

) |

|

|

— |

|

| Repurchase of

noncontrolling interest |

|

— |

|

|

|

— |

|

|

|

(361 |

) |

|

|

— |

|

| Net cash used in financing

activities |

|

(48,242 |

) |

|

|

(811 |

) |

|

|

(267,424 |

) |

|

|

(5,538 |

) |

| Net increase (decrease) in

cash and cash equivalents |

|

6,219 |

|

|

|

20,249 |

|

|

|

(66,134 |

) |

|

|

56,166 |

|

| Cash and cash equivalents

at beginning of period |

|

14,010 |

|

|

|

66,114 |

|

|

|

86,363 |

|

|

|

30,197 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents

at end of period |

$ |

20,229 |

|

|

$ |

86,363 |

|

|

$ |

20,229 |

|

|

$ |

86,363 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

Disclosures of Cash Flow Information: |

|

|

|

|

| Cash paid for

interest |

$ |

533 |

|

|

$ |

509 |

|

|

$ |

3,522 |

|

|

$ |

2,697 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash paid for income

taxes, net of refunds received |

$ |

3,261 |

|

|

$ |

— |

|

|

$ |

14,278 |

|

|

$ |

315 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

Disclosures of Non-Cash Financing Activities: |

|

|

|

|

| Note payable issued for

software licenses |

$ |

— |

|

|

$ |

— |

|

|

$ |

418 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital leases |

$ |

929 |

|

|

$ |

— |

|

|

$ |

2,936 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Days revenue outstanding

(1) |

|

38.0 |

|

|

|

44.0 |

|

|

|

38.0 |

|

|

|

44.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Our calculation of days revenue outstanding at

December 31, 2018 and 2017 is derived by dividing our ending

patient accounts receivable by our average daily patient revenue

for the three month periods ended December 31, 2018 and 2017,

respectively.

AMEDISYS, INC. AND SUBSIDIARIES

SEGMENT INFORMATION (Amounts in millions,

except statistical information)

(Unaudited)

Segment Information - Home Health

|

|

For the Three-

Month Period

Ended December 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

Financial Information

(in millions): |

|

|

| Medicare |

$ |

211.5 |

|

|

$ |

205.0 |

|

| Non-Medicare |

|

92.5 |

|

|

|

76.9 |

|

| |

|

|

|

|

|

|

|

| Net service

revenue |

|

304.0 |

|

|

|

281.9 |

|

| Cost of service |

|

189.4 |

|

|

|

174.9 |

|

| |

|

|

|

|

|

|

|

| Gross margin |

|

114.6 |

|

|

|

107.0 |

|

| Asset impairment

charge |

|

— |

|

|

|

1.3 |

|

| Other operating

expenses |

|

72.2 |

|

|

|

71.3 |

|

| |

|

|

|

|

|

|

|

| Operating income |

$ |

42.4 |

|

|

$ |

34.4 |

|

| |

|

|

|

|

|

|

|

| Same Store Growth

(1): |

|

|

| Medicare revenue |

|

3 |

% |

|

|

2 |

% |

| Non-Medicare revenue |

|

20 |

% |

|

|

24 |

% |

| Total admissions |

|

6 |

% |

|

|

3 |

% |

| Total volume (2) |

|

6 |

% |

|

|

7 |

% |

| Total Episodic admissions

(3) |

|

5 |

% |

|

|

2 |

% |

| Total Episodic volume

(4) |

|

5 |

% |

|

|

5 |

% |

| Key Statistical

Data - Total (5): |

|

|

|

Medicare: |

|

|

| Admissions |

|

47,864 |

|

|

|

46,421 |

|

| Recertifications |

|

28,555 |

|

|

|

27,896 |

|

| |

|

|

|

|

|

|

|

| Total volume |

|

76,419 |

|

|

|

74,317 |

|

| Completed episodes |

|

75,497 |

|

|

|

73,037 |

|

| Visits |

|

1,328,025 |

|

|

|

1,273,435 |

|

| Average revenue per

completed episode (6) |

$ |

2,891 |

|

|

$ |

2,858 |

|

| Visits per completed

episode (7) |

|

17.7 |

|

|

|

17.6 |

|

|

Non-Medicare: |

|

|

| Admissions |

|

30,092 |

|

|

|

27,421 |

|

| Recertifications |

|

14,874 |

|

|

|

12,415 |

|

| |

|

|

|

|

|

|

|

| Total volume |

|

44,966 |

|

|

|

39,836 |

|

| Visits |

|

722,677 |

|

|

|

619,745 |

|

| Total

(5): |

|

|

| Visiting Clinician Cost

per Visit |

$ |

84.27 |

|

|

$ |

83.88 |

|

| Clinical Manager Cost per

Visit |

|

8.09 |

|

|

|

8.49 |

|

| |

|

|

|

|

|

|

|

| Total Cost per Visit |

$ |

92.36 |

|

|

$ |

92.37 |

|

| Visits |

|

2,050,702 |

|

|

|

1,893,180 |

|

|

|

For the Year

Ended December 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

Financial Information

(in millions): |

|

|

| Medicare |

$ |

830.8 |

|

|

$ |

793.3 |

|

| Non-Medicare |

|

343.7 |

|

|

|

290.6 |

|

| Net service

revenue |

|

1,174.5 |

|

|

|

1,083.9 |

|

| Cost of service |

|

722.1 |

|

|

|

670.9 |

|

| Gross margin |

|

452.4 |

|

|

|

413.0 |

|

| Asset impairment

charge |

|

— |

|

|

|

1.3 |

|

| Other operating

expenses |

|

279.8 |

|

|

|

281.9 |

|

| Operating income |

$ |

172.6 |

|

|

$ |

129.8 |

|

| |

|

|

|

|

|

|

|

| Same Store Growth

(1): |

|

|

| Medicare revenue |

|

6 |

% |

|

|

(4 |

%) |

| Non-Medicare revenue |

|

18 |

% |

|

|

17 |

% |

| Total admissions |

|

5 |

% |

|

|

2 |

% |

| Total volume (2) |

|

7 |

% |

|

|

4 |

% |

| Total Episodic admissions

(3) |

|

4 |

% |

|

|

1 |

% |

| Total Episodic volume

(4) |

|

5 |

% |

|

|

3 |

% |

| Key Statistical

Data - Total (5): |

|

|

|

Medicare: |

|

|

| Admissions |

|

190,748 |

|

|

|

190,132 |

|

| Recertifications |

|

112,773 |

|

|

|

106,774 |

|

| Total volume |

|

303,521 |

|

|

|

296,906 |

|

| Completed episodes |

|

296,223 |

|

|

|

290,227 |

|

| Visits |

|

5,261,315 |

|

|

|

5,067,436 |

|

| Average revenue per

completed episode (6) |

$ |

2,854 |

|

|

$ |

2,823 |

|

| Visits per completed

episode (7) |

|

17.6 |

|

|

|

17.3 |

|

|

Non-Medicare: |

|

|

| Admissions |

|

118,577 |

|

|

|

107,665 |

|

| |

|

|

|

|

|

|

|

| Recertifications |

|

55,736 |

|

|

|

46,364 |

|

| Total volume |

|

174,313 |

|

|

|

154,029 |

|

| Visits |

|

2,772,339 |

|

|

|

2,347,363 |

|

| Total

(5): |

|

|

| Visiting Clinician Cost

per Visit |

$ |

81.88 |

|

|

$ |

82.04 |

|

| Clinical Manager Cost per

Visit |

|

8.01 |

|

|

|

8.44 |

|

| Total Cost per Visit |

$ |

89.89 |

|

|

$ |

90.48 |

|

| Visits |

|

8,033,654 |

|

|

|

7,414,799 |

|

(1) Same store information

represents the percent increase (decrease) in our Medicare,

Non-Medicare, Total and Episodic revenue, admissions or volume for

the period as a percent of the Medicare, Non-Medicare, Total and

Episodic revenue, admissions or volume of the prior period.

(2) Total volume includes all

admissions and recertifications. (3)

Total Episodic admissions includes admissions for Medicare and

Non-Medicare payors that bill on a 60-day episode of care basis.

(4) Total Episodic volume includes

admissions and recertifications for Medicare and Non-Medicare

payors that bill on a 60-day episode of care basis.

(5) Total includes acquisitions.

(6) Average Medicare revenue per

completed episode is the average Medicare revenue earned for each

Medicare completed episode of care.

(7) Medicare visits per completed

episode are the home health Medicare visits on completed episodes

divided by the home health Medicare episodes completed during the

period.

Segment Information - Hospice

|

|

For the Three-

Month Period

Ended December 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

Financial Information

(in millions): |

|

|

| Medicare |

$ |

103.5 |

|

|

$ |

92.7 |

|

| Non-Medicare |

|

5.3 |

|

|

|

5.2 |

|

| Net service

revenue |

|

108.8 |

|

|

|

97.9 |

|

| Cost of service |

|

56.8 |

|

|

|

50.6 |

|

| Gross margin |

|

52.0 |

|

|

|

47.3 |

|

| Other operating

expenses |

|

23.2 |

|

|

|

20.8 |

|

| Operating income |

$ |

28.8 |

|

|

$ |

26.5 |

|

| |

|

|

|

|

|

|

|

| Same Store Growth

(1): |

|

|

| Medicare revenue |

|

11 |

% |

|

|

14 |

% |

| Non-Medicare revenue |

|

5 |

% |

|

|

131 |

% |

| Hospice admissions |

|

12 |

% |

|

|

8 |

% |

| Average daily census |

|

9 |

% |

|

|

12 |

% |

| Key Statistical

Data - Total (2): |

|

|

| Hospice admissions |

|

7,152 |

|

|

|

6,371 |

|

| Average daily census |

|

7,809 |

|

|

|

7,162 |

|

| Revenue per day, net |

$ |

151.46 |

|

|

$ |

148.62 |

|

| Cost of service per

day |

$ |

79.02 |

|

|

$ |

76.81 |

|

| Average discharge length

of stay |

|

103 |

|

|

|

96 |

|

|

|

For the Year

Ended December 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

Financial Information

(in millions): |

|

|

| Medicare |

$ |

390.2 |

|

|

$ |

350.7 |

|

| Non-Medicare |

|

20.7 |

|

|

|

17.1 |

|

| Net service

revenue |

|

410.9 |

|

|

|

367.8 |

|

| Cost of service |

|

212.0 |

|

|

|

187.5 |

|

| Gross margin |

|

198.9 |

|

|

|

180.3 |

|

| Other operating

expenses |

|

85.7 |

|

|

|

77.5 |

|

| Operating income |

$ |

113.2 |

|

|

$ |

102.8 |

|

| |

|

|

|

|

|

|

|

| Same Store Growth

(1): |

|

|

| Medicare revenue |

|

11 |

% |

|

|

17 |

% |

| Non-Medicare revenue |

|

21 |

% |

|

|

20 |

% |

| Hospice admissions |

|

8 |

% |

|

|

11 |

% |

| Average daily census |

|

11 |

% |

|

|

15 |

% |

| Key Statistical

Data - Total (2): |

|

|

| Hospice admissions |

|

27,596 |

|

|

|

25,381 |

|

| Average daily census |

|

7,588 |

|

|

|

6,820 |

|

| Revenue per day, net |

$ |

148.36 |

|

|

$ |

147.75 |

|

| Cost of service per

day |

$ |

76.53 |

|

|

$ |

75.31 |

|

| Average discharge length

of stay |

|

100 |

|

|

|

93 |

|

(1) Same store information

represents the percent increase (decrease) in our Medicare and

Non-Medicare revenue, Hospice admissions or average daily census

for the period as a percent of the Medicare and Non-Medicare

revenue, Hospice admissions or average daily census of the prior

period. (2) Total includes

acquisitions.

Segment Information - Personal Care

|

|

For the Three-

Month Period

Ended December 31, |

| |

2018 |

|

2017 |

|

Financial Information

(in millions): |

|

|

| Medicare |

$ |

— |

|

$ |

— |

| Non-Medicare |

|

21.6 |

|

|

18.1 |

| |

|

|

|

|

|

|

|

|

|

| Net service

revenue |

|

21.6 |

|

|

18.1 |

| Cost of service |

|

16.1 |

|

|

13.7 |

|

|

|

|

| Gross margin |

|

5.5 |

|

|

4.4 |

| Other operating

expenses |

|

3.4 |

|

|

3.1 |

|

|

|

|

| Operating income |

$ |

2.1 |

|

$ |

1.3 |

|

|

|

|

| Key Statistical

Data: |

|

|

| Billable hours |

|

890,696 |

|

|

782,140 |

| Clients served |

|

13,054 |

|

|

12,646 |

| Shifts |

|

406,119 |

|

|

365,360 |

| Revenue per hour |

$ |

24.24 |

|

$ |

23.07 |

| Revenue per shift |

$ |

53.16 |

|

$ |

49.39 |

| Hours per shift |

|

2.2 |

|

|

2.1 |

| |

|

|

|

For the Year

Ended December 31, |

|

|

2018 |

|

2017 |

|

Financial Information (in

millions): |

|

|

| Medicare |

$ |

— |

|

$ |

— |

| Non-Medicare |

|

77.2 |

|

|

59.6 |

|

|

|

|

| Net service

revenue |

|

77.2 |

|

|

59.6 |

| Cost of service |

|

58.8 |

|

|

45.0 |

|

|

|

|

| Gross margin |

|

18.4 |

|

|

14.6 |

| Other operating

expenses |

|

13.1 |

|

|

9.7 |

|

|

|

|

| Operating income |

$ |

5.3 |

|

$ |

4.9 |

|

|

|

|

| Key Statistical

Data: |

|

|

| Billable hours |

|

3,248,304 |

|

|

2,604,794 |

| Clients served |

|

17,981 |

|

|

16,774 |

| Shifts |

|

1,468,541 |

|

|

1,195,511 |

| Revenue per hour |

$ |

23.75 |

|

$ |

22.86 |

| Revenue per shift |

$ |

52.54 |

|

$ |

49.80 |

| Hours per shift |

|

2.2 |

|

|

2.2 |

| |

|

|

|

|

|

Segment Information - Corporate

|

|

For the Three- Month Period

Ended December 31, |

| |

2018 |

|

2017 |

|

Financial Information

(in millions): |

|

|

| Other operating

expenses |

$ |

35.0 |

|

$ |

29.6 |

| Depreciation and

amortization |

|

1.9 |

|

|

2.9 |

| |

|

|

|

|

|

| Total operating

expenses |

$ |

36.9 |

|

$ |

32.5 |

| |

|

|

|

|

|

| |

|

|

|

For the Year

Ended December 31, |

|

|

2018 |

|

2017 |

|

Financial Information (in

millions): |

|

|

| Other operating

expenses |

$ |

127.6 |

|

$ |

117.8 |

| Depreciation and

amortization |

|

8.4 |

|

|

12.5 |

| |

|

|

|

|

|

| Total operating expenses

before Securities Class Action Lawsuit settlement, net |

|

136.0 |

|

|

130.3 |

| Securities

Class Action Lawsuit settlement, net |

|

— |

|

|

28.7 |

| Total operating

expenses |

$ |

136.0 |

|

$ |

159.0 |

|

|

|

|

AMEDISYS, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP

MEASURES (Amounts in thousands)

(Unaudited)

Adjusted Earnings Before Interest, Taxes, Depreciation

and Amortization (“Adjusted EBITDA”):

|

|

For the Three-

Month Period

Ended December 31, |

|

|

For the Year Ended

December 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| Net income (loss)

attributable to Amedisys, Inc. |

$ |

27,461 |

|

|

$ |

(3,848 |

) |

|

$ |

119,346 |

|

|

$ |

30,301 |

|

| Add: |

|

|

|

|

| Income tax

expense |

|

8,875 |

|

|

|

32,794 |

|

|

|

38,859 |

|

|

|

50,118 |

|

| Interest

expense, net |

|

1,521 |

|

|

|

1,377 |

|

|

|

7,092 |

|

|

|

4,873 |

|

| Depreciation

and amortization |

|

3,379 |

|

|

|

3,984 |

|

|

|

13,261 |

|

|

|

17,123 |

|

| Certain

items (1) |

|

3,124 |

|

|

|

24,414 |

|

|

|

3,739 |

|

|

|

61,429 |

|

| Interest

component of certain items (1) |

|

(451 |

) |

|

|

(168 |

) |

|

|

(1,731 |

) |

|

|

(263 |

) |

| Tax

component of certain items (1) |

|

— |

|

|

|

(21,424 |

) |

|

|

— |

|

|

|

( 21,424 |

) |

| Adjusted EBITDA (2)

(6) |

$ |

43,909 |

|

|

$ |

37,129 |

|

|

$ |

180,566 |

|

|

$ |

142,157 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Service Revenue

Reconciliation:

|

|

For the Three-

Month Period

Ended December 31, |

|

|

For the Year Ended

December 31, |

| |

2018 |

|

2017 |

|

|

2018 |

|

2017 |

| Net service revenue |

$ |

434,378 |

|

$ |

397,961 |

|

$ |

1,662,578 |

|

$ |

1,511,272 |

| Add: |

|

|

|

|

| Certain

items (1) |

|

— |

|

|

— |

|

|

1,687 |

|

|

6,506 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net service

revenue (3) (6) |

$ |

434,378 |

|

$ |

397,961 |

|

$ |

1,664,265 |

|

$ |

1,517,778 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income Attributable to Amedisys, Inc

Reconciliation:

|

|

For the Three-

Month Period

Ended December 31, |

|

|

For the Year Ended

December 31, |

| |

|

2018 |

|

|

2017 |

|

|

|

2018 |

|

|

2017 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to Amedisys, Inc. |

$ |

27,461 |

|

$ |

(3,848 |

) |

|

$ |

119,346 |

|

$ |

30,301 |

| Add: |

|

|

|

|

| Certain

items (1) |

|

2,312 |

|

|

23,233 |

|

|

|

2,767 |

|

|

45,627 |

| Adjusted net income

attributable to Amedisys, Inc. (4) (6) |

$ |

29,773 |

|

$ |

19,385 |

|

|

$ |

122,113 |

|

$ |

75,928 |

|

|

|

|

|

|

Adjusted Net Income Attributable to Amedisys, Inc. per

Diluted Share:

|

|

For the Three-

Month Period

Ended December 31, |

|

|

For the Year Ended

December 31, |

| |

|

2018 |

|

|

2017 |

|

|

|

2018 |

|

|

2017 |

| Net income (loss)

attributable to Amedisys, Inc. common stockholders per diluted

share |

$ |

0.84 |

|

$ |

(0.11 |

) |

|

$ |

3.55 |

|

$ |

0.88 |

| Add: |

|

|

|

|

| Certain

items (1) |

|

0.07 |

|

|

0.67 |

|

|

|

0.08 |

|

|

1.33 |

| Adjusted net income

attributable to Amedisys, Inc. common stockholders per

diluted share (5) (6) |

$ |

0.91 |

|

$ |

0.56 |

|

|

$ |

3.63 |

|

$ |

2.21 |

|

|

|

|

|

|

(1) The following details the

certain items for the three month periods and years ended

December 31, 2018 and 2017:

Certain Items:

|

|

For the Three-Month Period

Ended December 31, 2018 |

|

For the Year Ended

December 31, 2018 |

|

|

(Income) Expense |

|

(Income) Expense |

|

Certain Items Impacting Net Service

Revenue: |

|

|

| Florida self-audit

(pre-acquisition) |

$ |

— |

|

|

$ |

1,687 |

|

| Certain Items

Impacting Operating Expenses: |

|

|

| Acquisition costs |

|

1,025 |

|

|

|

2,757 |

|

| Legal fees -

non-routine |

|

56 |

|

|

|

1,465 |

|

| Indemnity receivable

adjustment |

|

2,143 |

|

|

|

2,143 |

|

| Certain Items

Impacting Total Other Income (Expense): |

|

|

| Legal settlements |

|

— |

|

|

|

(1,437 |

) |

| Miscellaneous, other

(income) expense, net |

|

(100 |

) |

|

|

(2,876 |

) |

| Total |

$ |

3,124 |

|

|

$ |

3,739 |

|

| Net of tax |

$ |

2,312 |

|

|

$ |

2,767 |

|

| Diluted EPS |

$ |

0.07 |

|

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three-Month Period

Ended December 31, 2017 |

|

For the Year Ended

December 31, 2017 |

|

|

(Income) Expense |

|

(Income) Expense |

|

Certain Items Impacting Net Service

Revenue: |

|

|

| Florida ZPIC audit |

$ |

— |

|

$ |

6,506 |

|

| Certain Items

Impacting Operating Expenses: |

|

|

| Acquisition costs |

|

48 |

|

|

1,025 |

|

| Legal fees -

non-routine |

|

358 |

|

|

1,768 |

|

| Securities

Class Action Lawsuit settlement, net |

|

— |

|

|

28,712 |

|

| Restructuring

activity |

|

648 |

|

|

2,318 |

|

| Data center

relocation |

|

— |

|

|

940 |

|

| Asset impairment |

|

1,323 |

|

|

1,323 |

|

| Certain Items

Impacting Total Other Income (Expense): |

|

|

| Legal settlements |

|

— |

|

|

(2,014 |

) |

| Miscellaneous, other

(income) expense, net |

|

613 |

|

|

(573 |

) |

| Certain Items

Impacting Income Tax Expense: |

|

|

| Remeasurement of deferred

tax assets and liabilities |

|

21,424 |

|

|

21,424 |

|

| Total |

$ |

24,414 |

|

$ |

61,429 |

|

| Net of tax |

$ |

23,233 |

|

$ |

45,627 |

|

| Diluted EPS |

$ |

0.67 |

|

$ |

1.33 |

|

|

|

|

|

(2) Adjusted EBITDA is defined as

net income (loss) attributable to Amedisys, Inc. before provision

for income taxes, net interest expense and depreciation and

amortization, excluding certain items as described in footnote 1.

(3) Adjusted net service revenue is

defined as net service revenue plus certain items as described in

footnote 1. (4) Adjusted net income

attributable to Amedisys, Inc. is defined as net income (loss)

attributable to Amedisys, Inc. calculated in accordance with GAAP

excluding certain items as described in footnote 1.

(5) Adjusted net income attributable

to Amedisys, Inc. common stockholders per diluted share is defined

as diluted income (loss) per share calculated in accordance with

GAAP excluding the earnings per share effect of certain items as

described in footnote 1. (6) Adjusted

EBITDA, adjusted net service revenue, adjusted net income

attributable to Amedisys, Inc. and adjusted net income attributable

to Amedisys, Inc. common stockholders per diluted share should not

be considered as an alternative to, or more meaningful than, income

before income taxes or other measures calculated in accordance with

GAAP. These calculations may not be comparable to a similarly

titled measure reported by other companies, since not all companies

calculate these non-GAAP financial measures in the same manner.

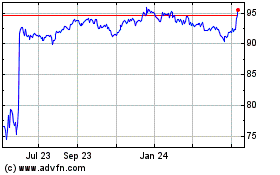

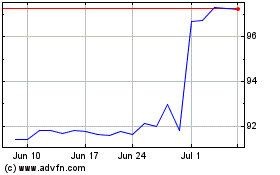

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2023 to Apr 2024