U.S. Sales Force Increased to 400 Sales

Professionals for 2019 Following Unprecedented Positive Results of

Vascepa® Cardiovascular Outcomes Study Presented in November

2018

Amarin Corporation plc (NASDAQ:AMRN), today provided a business

update, including a preliminary estimate of 2018 revenue results

and 2019 revenue and spending guidance. Amarin plans to discuss

these results and expectations with investors in connection with

the 37th Annual J.P. Morgan Healthcare Conference in San Francisco,

California, at which Amarin will be presenting.

Preliminary (unaudited) 2018

Financial Results

Record Revenue Levels: Net

total revenue for 2018 are estimated to have reached between $224

and $228 million, including estimated net total revenue of $72 to

$76 million in Q4 2018. Both the full year and Q4 2018 results

represent record revenue levels for Amarin. These results, which

are subject to audit, represent increases of approximately $43 to

$47 million (approximately 24% to 26%) over full year 2017 results.

Both full year and Q4 2018 net total revenue consist predominantly

of U.S. sales driven by increased prescriptions for Vascepa®

(icosapent ethyl) capsules (less than $1 million in estimated

ex-U.S. derived net revenue in 2018). Wholesaler inventory levels

of Vascepa were within normal industry ranges at the end of

2018.

Current Assets: Amarin ended

2018 with approximately $249 million in cash, approximately $72

million in net accounts receivable and approximately $56 million in

inventory.

No Debt, Except Remaining Balance of

Royalty-Bearing Instrument: Amarin ended 2018 with no debt

except the remaining balance on its royalty-bearing instrument

which is repaid at a rate of 10% of Vascepa revenues; aggregate

repayment of less than $90 million remains until this royalty-like

obligation is fully extinguished.

2019 Financial and Operational

Guidance

In November 2018, results of the REDUCE-ITTM

cardiovascular outcomes study of Vascepa were presented and

published1. These unprecedented placebo-controlled results were

headlined by achieving the study’s primary endpoint with a 25%

reduction in major adverse cardiovascular events and a number

needed to treat of 21, as well as achieving multiple prespecified

secondary endpoints, including a 20% reduction in

cardiovascular-related death. In connection with these results, the

company expressed its priorities as follows:

- Aggressively grow U.S. revenues through promotion and education

of healthcare professionals;

- Pursue label expansion for Vascepa through a supplemental new

drug application (sNDA) to the FDA in the U.S. seeking a label

which reflects the cardioprotective effects of Vascepa demonstrated

in the REDUCE-IT study;

- Leverage data from the sNDA through third-party relationships

to expand Vascepa regulatory approvals and sales internationally;

and

- Operate in a cost-effective, opportunistic manner.

Preliminary feedback from physicians, payers and

other healthcare professionals regarding REDUCE-IT results have

been broadly positive. The New England Journal of Medicine on

December 26, 2018 designated the REDUCE-IT study as a top story of

2018 in the NEJM Journal Watch Cardiology section. Similarly, the

American College of Cardiology included REDUCE-IT results in its

top 10 list for 2018.

While such initial feedback is encouraging, the

REDUCE-IT results remain new and unknown in detail to most

healthcare professionals and payers. Also unknown in detail by most

healthcare professionals and payers are the failures of

prior-generation therapies to demonstrate cardiovascular benefit

and the important differentiation of Vascepa from these other

products. While the potential need for Vascepa is estimated to be

millions of patients, and while Vascepa is the first therapy for

its targeted population to demonstrate positive results in a

robust, globally-conducted cardiovascular outcomes study, Vascepa

is creating a new paradigm in preventative cardiovascular care.

Significant advancement in preventative cardiovascular care has

been infrequent. Statin therapy, the standard of care for treating

cholesterol related cardiovascular risk, was introduced

approximately three decades ago and grew tremendously over many

years. There is no historical revenue analog for a cardiovascular

drug that is directly comparable to the current market dynamic in

which Vascepa operates with its status as an increasingly

recognized preferred add-on to statin therapy in select patients

and its favorable efficacy, safety and cost profile. However, usage

rates of new drugs for chronic needs have shown more pronounced

growth following label expansion than following positive outcomes

study results. This is likely due in part to expanded consumer

promotion and greater payer acceptance following label expansion;

recent examples include Repatha® and Jardiance®, neither of which

are competitors to Vascepa, nor is Vascepa seeking to replace

statin therapy. Rather, Vascepa is seeking to address

cardiovascular risk not fully addressed by other available

therapies.

2019 Revenue Guidance: While we

are optimistic that Vascepa will reach billions of dollars in

revenues, history of other therapies for chronic conditions

suggests that growth occurs over many years. Forecasting Vascepa

revenues at this early stage is difficult as feedback from

physicians and payers remains preliminary and the timing of an

expanded U.S. label for Vascepa is not yet known. Fortunately,

managed care coverage for Vascepa is already generally good. While

such coverage may improve further following label expansion, we do

not expect Vascepa coverage by most payers to change dramatically

in 2019 compared to current coverage. Amarin begins 2019

anticipating that its 2019 net total revenue will increase by more

than 50% over 2018 results to approximately $350 million, mostly

from sales of Vascepa in the U.S.

Vascepa Label Expansion: Amarin

anticipates submitting a sNDA in the U.S. seeking an expanded

indication for Vascepa before the end of Q1 2019. Assuming a

standard 10-month review by the FDA, an expanded label for Vascepa

is not currently expected to impact 2019 Vascepa revenue levels.

After the sNDA is submitted, Amarin will seek clarification as to

whether priority review by the FDA is possible for this important

submission. The dataset from Vascepa, representing greater than

35,000 patient years of study, is large. Additionally, the list of

prespecified endpoints which the company intends to evaluate in

support of the sNDA is extensive. As a result, submission of the

sNDA is not anticipated until late in Q1 2019.

Inventory Purchases: Because

the rate of Vascepa revenue growth is difficult to predict,

including potentially significantly varied timing regarding FDA

review of the sNDA, Amarin intends to purchase inventory during

2019 at a rate which could support at least twice the 2019 net

total revenue guidance described above. Such purchases do not

change Amarin’s revenue guidance. Rather, they prepare Amarin for a

situation in which actual revenue turns out to be significantly

higher than the guidance described above. One of the important

features of Vascepa is the product’s stability achieved through the

expert manufacturing of its fragile single-active ingredient. This

stability achievement presents limited financial risk of

over-purchasing Vascepa inventory as the product has demonstrated

stability supporting approved commercial expiry dating through four

years. The incremental cost of this inventory build is anticipated

to be between $50 and $75 million in 2019.

Quarterly Variability and Other

Considerations: As of the end of 2018, Amarin had promoted

REDUCE-IT published results, subject to various off-label related

disclosures and disclaimers, to approximately 25,000 of its

targeted 50,000 physicians. However, most of these 25,000

physicians have thus far met with Amarin sales reps only once since

the results were published in The New England Journal of Medicine

in November (see investor relations section of Amarin’s website for

link to this publication and discussion of frequently asked

investor questions regarding REDUCE-IT results). As Amarin

discussed when Vascepa was initially launched for its currently

approved niche indication as a treatment for adult patients with

very high triglyceride levels (TG >500 mg/dL), data from

promotion of other products by other companies suggests that target

audiences often need to see data multiple times (e.g. 5 – 7 times)

before usage patterns are significantly changed. Accordingly, while

we believe that a small portion of the increase in Q4 2018 revenues

reflects REDUCE-IT results, we anticipate that most of the upside

from these unprecedented clinical trial results will be realized in

the future. It is encouraging and important to note that

cardiologists who, while fewer in number, appear to be embracing

REDUCE-IT results rapidly. As a result, beginning in January we

increased the number of cardiologists to be targeted by our sales

representatives.

Amarin has increased its sales force to 400

sales representatives, up from 150 for most of 2018. More than 90%

of these sales representatives are now well trained and will be

meeting with healthcare professionals this week. The remainder,

fewer than 40 sales representatives, are scheduled to complete

their training and begin Vascepa promotion within two weeks. This

rapid hiring and training of these new sales representatives, which

more than doubles Amarin’s sales force, completed over a period of

approximately three months is an example of Amarin’s

execution-oriented approach. By the end of March 2019, we

anticipate that nearly all our 50,000 physician targets will be

called upon at least once regarding REDUCE-IT results with most of

these targets called upon two to three times.

Patients who are good candidates for Vascepa

tend to visit their physicians once, sometimes twice, a year. As a

result, similar to the experience of other therapies for treating

chronic conditions, we do not anticipate prescription rates for

Vascepa to spike upwardly immediately. Also, for context, note that

we do not anticipate broadly expanding consumer promotion of

Vascepa until the label for Vascepa is expanded. At that time, we

will also evaluate whether 400 sales representatives are sufficient

to support the multi-billion dollar potential of this important new

cardiovascular therapy.

While Amarin anticipates that net total revenue

will increase in each quarter of 2019 compared to the corresponding

quarter of 2018, at this time the company is not providing

quantified revenue guidance by quarter. The company anticipates

continued industry-wide seasonality regarding prescription growth

with, for example, Q1 impacted by headwinds caused by annual

beginning of the year deductibles under insurance plans for some

patients. This dynamic has historically caused some patients to

ration the number of prescriptions they fill until they satisfy

their deductibles and can better afford all of their prescriptions.

This beginning of the year challenge is not specific to Vascepa but

has historically most significantly impacted therapies such as

Vascepa which address chronic, asymptomatic medical conditions. In

addition, while 400 sales representatives giving Vascepa top

promotion priority is anticipated to grow revenues, Amarin, as

previously described, did not renew its agreement with its prior

co-promotion partner beyond the December 31, 2018 expiration date

of the co-promotion agreement. That partner was primarily promoting

Vascepa in a second position by its sales representatives. All

Amarin sales representatives will be promoting Vascepa in the first

and only position. A short adjustment period is expected between

the impact of ceasing the sales calls under that co-promotion

agreement and Amarin’s new sales representatives becoming fully

productive.

Spending: Currently, Amarin

anticipates operating expenses for 2019 to increase $25 to $50

million over 2018 levels. Included in these amounts are increased

costs associated with Vascepa promotion partially offset by

elimination of expenses associated with the company’s prior

co-promotion partner, expense which is estimated to have exceeded

$40 million in 2018, and modestly lower R&D expenses as the

REDUCE-IT trial is complete. R&D expenses, while lower than

2018, are anticipated to remain relatively high to support the sNDA

submission, to support multiple potential additional publications

of REDUCE-IT results, to support partners with respect to

international submissions for Vascepa and to evaluate future

product opportunities on Amarin’s own and in collaboration with its

development partner, Mochida. Total R&D expenses for 2019 are

anticipated to be approximately $40 million and likely highest in

the first half of 2019. These expense estimates assume that Vascepa

label expansion is approved following an anticipated 10-month FDA

review cycle. In the event that the label is expanded earlier than

expected or product revenue grows faster than expected, selling,

general & administrative (SG&A) expenses may be higher than

reflected in this operating expense guidance.

International: Internationally,

Amarin currently has three partners for commercialization of

Vascepa in select geographies and intends to consider potential

additional partners to commercialize Vascepa in other parts of the

world. In the Middle East, Amarin’s partner Biologix, in

2018, received approval for Vascepa in two countries, Lebanon and

the United Arab Emirates, with additional approvals in the region

requested. In Greater China, Amarin’s partner Eddingpharm began

enrolling patients in a clinical study for Vascepa, with the

intention of making Vascepa the first approved prescription drug of

its type in Mainland China and other markets in that region. In

Canada, Amarin and its newest partner HLS Therapeutics are hopeful

that REDUCE-IT results will support efforts to gain regulatory

approval to commercialize Vascepa although, similar to the pathway

in the U.S., the REDUCE-IT data package is still being prepared and

regulatory submission in Canada cannot be made until after that

data package is ready for submission in the U.S. With respect to

commercialization partners for Vascepa in other geographies, Amarin

intends to continue to be receptive to inquiries from qualified

companies. However, in the near-term, Amarin’s priority is the U.S.

sNDA submission and label expansion approval.

Comment from Amarin's President

and CEO

“We enter 2019 with great confidence that

Vascepa will lead to improved cardiovascular care for millions of

at-risk patients,” commented John F. Thero, president and chief

executive officer. He continued, “2018 was a landmark year for

Amarin as an unprecedented positive outcomes result from the use of

Vascepa was demonstrated in the REDUCE-IT study and, prior to

presenting REDUCE-IT results, we achieved record product revenues

from Vascepa. With the support of our investors, we are well

financed and positioned to increase Vascepa promotion. Amarin’s

dedicated team of employees and collaborators give me confidence

that we will successfully pursue Vascepa label expansion while

further accelerating Vascepa revenue growth in the U.S. and

advancing Vascepa internationally.”

Amarin will provide further details regarding

its 2018 results and plans to provide further outlook for 2019 in

connection with the company's annual report on Form 10-K when

issued near the end of February 2019.

About Amarin

Amarin Corporation plc. is a rapidly growing,

innovative pharmaceutical company focused on developing

therapeutics to improve cardiovascular health. Amarin’s product

development program leverages its extensive experience in

polyunsaturated fatty acids and lipid science. Vascepa® (icosapent

ethyl) is Amarin's first FDA-approved drug and is available by

prescription in the United States, Lebanon and the United Arab

Emirates. Amarin’s commercial partners are pursuing additional

regulatory approvals for Vascepa in Canada, China and the Middle

East. For more information about Amarin, visit

www.amarincorp.com.

About Cardiovascular

Disease

Worldwide, cardiovascular disease (CVD) remains

the #1 killer of men and women. In the United States CVD leads to

one in every three deaths – one death approximately every 38

seconds – with annual treatment cost in excess of $500 billion.2,

3

Multiple primary and secondary

prevention trials have shown a significant reduction of 25% to

35% in the risk of cardiovascular

events with statin therapy, leaving significant

persistent residual risk despite the achievement of target LDL-C

levels.4

Beyond the cardiovascular risk associated with

LDL-C, genetic, epidemiologic, clinical and real-world data suggest

that patients with elevated triglycerides (TG) (fats in the blood),

and TG-rich lipoproteins, are at increased risk for cardiovascular

disease. 5, 6, 7, 8

About VASCEPA® (icosapent ethyl)

Capsules

Vascepa® (icosapent ethyl) capsules are a

single-molecule prescription product consisting of the omega-3 acid

commonly known as EPA in ethyl-ester form. Vascepa is not fish oil,

but is derived from fish through a stringent and complex

FDA-regulated manufacturing process designed to effectively

eliminate impurities and isolate and protect the single molecule

active ingredient from degradation. Vascepa, known in scientific

literature as AMR101, has been designated a new chemical entity by

the FDA. Amarin has been issued multiple patents internationally

based on the unique clinical profile of Vascepa, including the

drug’s ability to lower triglyceride levels in relevant patient

populations without raising LDL-cholesterol levels.

Indication and Usage Based on Current

FDA-Approved Label (not including REDUCE-IT results)

- Vascepa (icosapent ethyl) is

indicated as an adjunct to diet to reduce triglyceride (TG) levels

in adult patients with severe (≥500 mg/dL)

hypertriglyceridemia.

- The effect of Vascepa on the risk

for pancreatitis and cardiovascular mortality and morbidity in

patients with severe hypertriglyceridemia has not been

determined.

Important Safety Information for Vascepa Based

on Current FDA-Approved Label (not including REDUCE-IT results)

(Includes Data from Two 12-Week Studies (n=622) (MARINE and ANCHOR)

of Patients with Triglycerides Values of 200 to 2000 mg/dL)

- Vascepa is contraindicated in

patients with known hypersensitivity (e.g., anaphylactic reaction)

to Vascepa or any of its components.

- In patients with hepatic

impairment, monitor ALT and AST levels periodically during

therapy.

- Use with caution in patients with

known hypersensitivity to fish and/or shellfish.

- The most common reported adverse

reaction (incidence >2% and greater than placebo) was arthralgia

(2.3% for Vascepa, 1.0% for placebo). There was no reported adverse

reaction >3% and greater than placebo.

- Adverse events and product

complaints may be reported by calling 1-855-VASCEPA or the FDA at

1-800-FDA-1088.

- Patients receiving treatment

with Vascepa and other drugs affecting coagulation (e.g.,

anti-platelet agents) should be monitored periodically.

- Patients should be advised to

swallow Vascepa capsules whole; not to break open, crush, dissolve,

or chew Vascepa.

FULL VASCEPA PRESCRIBING INFORMATION CAN BE

FOUND AT WWW.VASCEPA.COM.

Vascepa has been approved for use by the United

States Food and Drug Administration (FDA) as an adjunct to diet to

reduce triglyceride levels in adult patients with severe (≥500

mg/dL) hypertriglyceridemia. Nothing in this press release should

be construed as promoting the use of Vascepa in any indication that

has not been approved by the FDA.

Forward-Looking Statements

This press release contains forward-looking

statements, including expectations regarding planned regulatory

filings and the nature of FDA’s review and related timing thereof;

expectations regarding regulatory approvals outside the United

States; expectations that REDUCE-IT results could lead to a new

treatment paradigm in the patient population studied; expectations

concerning the extent and timing of any increase in usage rates

following the announcement of the REDUCE-IT results; expectations

regarding sales force expansion and medical education and marketing

initiatives expected in 2019 and beyond; expectations concerning

revenue and prescriptions growth, operating and R&D expenses,

inventory purchases and other financial metrics; expectations

concerning quarterly variability and general market trends; and

expectations regarding international and insurance coverage

expansion. These forward-looking statements are not promises or

guarantees and involve substantial risks and uncertainties. In

addition, Amarin's ability to effectively commercialize Vascepa

will depend in part on its ability to continue to effectively

finance its business, efforts of third parties, its ability to

create market demand for Vascepa through education, marketing and

sales activities, to achieve market acceptance of Vascepa, to

receive adequate levels of reimbursement from third-party payers,

to develop and maintain a consistent source of commercial supply at

a competitive price, to comply with legal and regulatory

requirements in connection with the sale and promotion of Vascepa

and to maintain patent protection for Vascepa. Among the factors

that could cause actual results to differ materially from those

described or projected herein include the following: uncertainties

associated generally with research and development, clinical trials

and related regulatory approvals; the risk that sales may not meet

expectations and related cost may increase beyond expectations; the

risk that patents may not be upheld in patent litigation and

applications may not result in issued patents sufficient to protect

the Vascepa franchise. A further list and description of these

risks, uncertainties and other risks associated with an investment

in Amarin can be found in Amarin's filings with the U.S. Securities

and Exchange Commission, including its most recent quarterly report

on Form 10-Q. Existing and prospective investors are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date hereof. Amarin undertakes no obligation

to update or revise the information contained in this press

release, whether as a result of new information, future events or

circumstances or otherwise.

Availability of Other Information About

Amarin

Investors and others should note that Amarin

communicates with its investors and the public using the company

website (http://www.amarincorp.com/), the investor relations

website (http://investor.amarincorp.com/), including but not

limited to investor presentations and investor FAQs, Securities and

Exchange Commission filings, press releases, public conference

calls and webcasts. The information that Amarin posts on these

channels and websites could be deemed to be material information.

As a result, Amarin encourages investors, the media, and others

interested in Amarin to review the information that is posted on

these channels, including the investor relations website, on a

regular basis. This list of channels may be updated from time to

time on Amarin’s investor relations website and may include social

media channels. The contents of Amarin’s website or these channels,

or any other website that may be accessed from its website or these

channels, shall not be deemed incorporated by reference in any

filing under the Securities Act of 1933.

References

1 Bhatt DL, Steg PG, Miller M, Brinton EA,

Jacobson TA, Ketchum SB, Doyle RT, Juliano RA, Jiao L, Granowitz C,

Tardif JC, Ballantyne CM. Cardiovascular Risk Reduction with

Icosapent Ethyl for Hypertriglyceridemia. N Engl J Med

2019;380:11-22.2 American Heart Association. 2018. Disease

and Stroke Statistics-2018 Update.3 American Heart Association.

2017. Cardiovascular disease: A costly burden for America

projections through 2035.4 Ganda OP, Bhatt DL, Mason RP, et al.

Unmet need for adjunctive dyslipidemia therapy in

hypertriglyceridemia management. J Am Coll Cardiol.

2018;72(3):330-343.5 Budoff M. Triglycerides and triglyceride-rich

lipoproteins in the causal pathway of cardiovascular disease. Am J

Cardiol. 2016;118:138-145.6 Toth PP, Granowitz C, Hull M, et al.

High triglycerides are associated with increased cardiovascular

events, medical costs, and resource use: A real-world

administrative claims analysis of statin-treated patients with high

residual cardiovascular risk. J Am Heart Assoc.

2018;7(15):e008740.7 Nordestgaard BG. Triglyceride-rich

lipoproteins and atherosclerotic cardiovascular disease - New

insights from epidemiology, genetics, and biology. Circ Res.

2016;118:547-563.8 Nordestgaard BG, Varbo A. Triglycerides and

cardiovascular disease. Lancet. 2014;384:626–635.

Amarin Contact Information

Investor Relations:Elisabeth SchwartzInvestor

Relations and Corporate CommunicationsAmarin Corporation

plcIn U.S.: +1 (908) 719-1315investor.relations@amarincorp.com

(investor inquiries)PR@amarincorp.com (media inquiries)

Lee M. Stern Trout Group In U.S.: +1

(646) 378-2992lstern@troutgroup.com

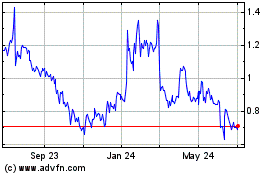

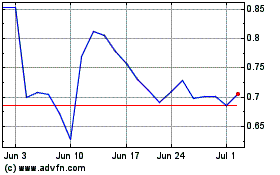

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024