Altair Announces Proposed Offering of Convertible Senior Notes

June 04 2019 - 4:28PM

Altair Engineering Inc. (Nasdaq: ALTR) (“Altair”) today announced

that it intends to offer, subject to market and other conditions,

$175 million aggregate principal amount of convertible senior

notes due 2024 (the “Notes”) in an underwritten offering registered

with the Securities and Exchange Commission (the “SEC”). The

Notes will be convertible into cash and/or shares of Altair’s Class

A common stock at Altair’s election. The interest rate, conversion

price and other terms of the Notes are to be determined upon

pricing of the offering. In addition, Altair expects to grant the

underwriters a 30-day option to purchase up to an additional 15% of

the Notes offered.

J.P. Morgan Securities LLC, Goldman Sachs & Co. LLC and RBC

Capital Markets, LLC will act as joint bookrunners for the

offering.

Altair intends to use a portion of the net proceeds received

from the offering to repay outstanding indebtedness under its

$150.0 million revolving credit facility, which was approximately

$14.8 million as of March 31, 2019. Altair intends to use the

remaining net proceeds for acquisitions of, or investments in,

technologies, solutions or businesses that complement Altair’s

business and other general corporate purposes, including

working capital, developing and building an addition adjacent to

Altair’s corporate headquarters facilities and related real estate

development matters, sales and marketing activities, general and

administrative matters and capital expenditures. Altair does not

have any agreements or binding commitments for any such

acquisitions or investments at this time.

An effective registration statement relating to the securities

was filed with the SEC on June 4, 2019. The offering of these

securities will be made only by means of a prospectus supplement,

any free writing prospectus that Altair may authorize in connection

therewith, and the accompanying prospectus. Copies of the

preliminary prospectus supplement and the accompanying prospectus

may be obtained by contacting J.P. Morgan Securities LLC c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, by telephone: (866) 803-9204 or email:

prospectus-eq_fi@jpmchase.com, Goldman Sachs & Co. LLC,

Attention: Prospectus Department, 200 West Street, New York,

NY 10282, by telephone at (866) 471-2526, or by emailing

prospectus-ny@ny.email.gs.com or RBC Capital Markets, LLC,

Attention: Equity Syndicate, 200 Vesey Street, 8th Floor, New York,

NY 10281; telephone: (877) 822-4089.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the securities, nor shall

there be any sale of the securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

the registration or qualification under the securities laws of any

such state or jurisdiction.

About AltairAltair is a global technology

company that provides software and cloud solutions in the areas of

product development, high-performance computing and data

intelligence. Altair enables organizations across broad

industry segments to compete more effectively in a connected world

while creating a more sustainable future.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements relating to Altair’s expectations regarding the

completion, timing and size of the proposed public offering, and

its expectations with respect to the use of proceeds from the

offering and granting the underwriters an option to purchase

additional Notes. These forward-looking statements are made as of

the date of this release and are based on current expectations,

estimates, forecasts and projections as well as the beliefs and

assumptions of management. Words such as “may,” “can,”

“anticipate,” “assume,” “should,” “indicate,” “would,” “believe,”

“contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,”

“point to,” “project,” “predict,” “could,” “intend,” “target,”

“potential”, the negative and plural of these words and other

similar words and expressions of the future. Forward-looking

statements are subject to a number of risks and uncertainties, many

of which involve factors or circumstances that are beyond Altair’s

control. Altair’s actual results could differ materially from those

stated or implied in forward-looking statements due to a number of

factors, including but not limited to, risks detailed in the

section entitled “Risk Factors” in Altair’s Annual Report on Form

10-K for the year ended December 31, 2018, and in the preliminary

prospectus related to the proposed offering filed with

the Securities and Exchange Commission. Past performance is

not necessarily indicative of future results. The forward-looking

statements included in this press release represent Altair’s views

as of the date of this press release. Altair anticipates that

subsequent events and developments may cause its views to change.

Altair undertakes no intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events, changes in Altair’s expectations or

otherwise. These forward-looking statements should not be relied

upon as representing Altair’s views as of any date subsequent to

the date of this press release.

Investor and Media Relations Dave Simon Altair

248-614-2400 ext. 332 ir@altair.com

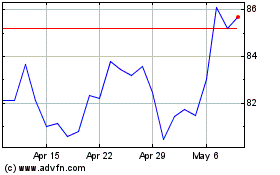

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Apr 2023 to Apr 2024